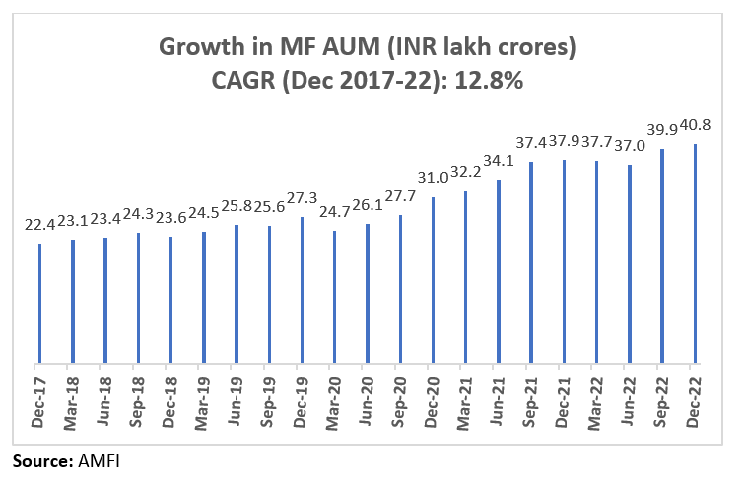

The growth of India’s alternative investment funds industry has been phenomenal over the past few years. The industry’s commitments raised, which denotes the amount clients are willing to invest in AIFs, clocked a 5-year CAGR of ~50% to ~INR 7 lakh crores as of Jun 2022. However, the mutual fund industry, which sits with an average AUM of ~INR 41 lakh crores (as on Dec 2022), achieved an AUM of the same level over four decades in mid-2009, after the first scheme (US-64 by UTI) was launched in 1964.

Over the last five years, the growth in the AIF industry has been super steady without any dent even at the onset of Covid-19 unlike mutual funds.

Within the AIF segment, Category II constitutes more than 80% of industry commitments. As of Jun 2022, Cat II commitments jumped ~44% y-o-y to ~INR 5.6 lakh crores. Among other categories, Cat I commitments rose ~27% to ~INR 58,000 crores and Cat III commitments grew ~47% to ~INR 74,500 crores as of June 2022.

What are the catalysts for growth?

The major factor that is driving the growth in alternative investment funds is their low correlation to public markets. Hence, high net-worth individuals (HNIs) and family offices are increasingly preferring AIFs over other asset classes like traditional equity and bonds.

Economic uncertainties led by Covid, and geo-political tensions have added a lot of volatility to the market, higher valuations in the listed space have been a major concern, while inflation hedging is a must. Given these issues, alternative investment funds fit well into the criteria with higher risk-adjusted returns.

Among other factors that led AIFs to gain traction include the regulatory mandate to ensure sponsors’ “skin in the game” as mentioned in Part I. The investments in the funds are managed by a team of seasoned finance professionals and a competent investment committee with the ability to underwrite risk and ensure consistently higher returns.

The robust growth in Cat II AIFs is attributed to their ability to provide a diversified investment portfolio, mitigating the risk profile of investors. Foreign Portfolio Investors (FPIs) have been increasingly taking the AIF route to make debt investments as stringent RBI rules for debt investments by offshore investors do not apply to the route. For instance, as per 2020 circular by RBI, short-term investments by an FPI were limited to 30% of total investment in corporate bonds. Credit AIFs are able to provide flexibility to offshore investors to participate in private debt issuances and generate additional alpha through strategic asset allocation.

What advantages do AIFs gain over other vehicles to capture the Performing Credit opportunity?

When we spoke about the asymmetry in the debt market, we mentioned huge opportunities in the Performing Credit space comprising of issuers largely in the unlisted universe. Alternative investment funds seem to be perfectly fit the criteria in addressing the space.

In 2020, the Securities and Exchange Board of India (SEBI) issued new norms in a circular that placed several limitations for debt investments by mutual funds. It has restricted mutual funds from investing in unlisted debt instruments such as the unlisted commercial papers (CPs), which are short-term debt securities issued by corporates for up to one year. It has allowed mutual funds to invest in unlisted non-convertible debentures (NCDs), used for raising long-term capital, provided the instruments have a simple structure and the exposure to them does not exceed 10% of the scheme’s portfolio. The circular also reduced the exposure to unrated debt from 25% to only 5% of the net assets of a mutual fund scheme.

In contrast, debt AIFs, under Cat II, are allowed to invest in both listed and unlisted investee companies. They are also not subject to restrictions such as sectoral exposure caps or sticking to one class of investments.

Due to the absence of small/retail investors in the space, liberal regulations for AIFs help them stand apart from other vehicles like mutual funds to capture the Performing Credit opportunity.

(Note: The article has been updated to reflect the latest available data for AIF and MF.)

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.