In Part I and Part II, we have discussed ESG risk & opportunities and explained the enormous power and responsibility the financial sector holds in terms of funding and transitioning towards sustainability. Taking this forward, we would focus more on the different ESG risk integration strategies and how Vivriti Group as an organization has redefined the due diligence of its portfolio companies to include impact & sustainability.

The real equation is turning ESG theory into action. Today it not only matters how the business is performing financially but also how it operates and what it stands for. So, the real question is how to make a purpose-driven investment decision. And what are the factors that directly impact how a company operates?

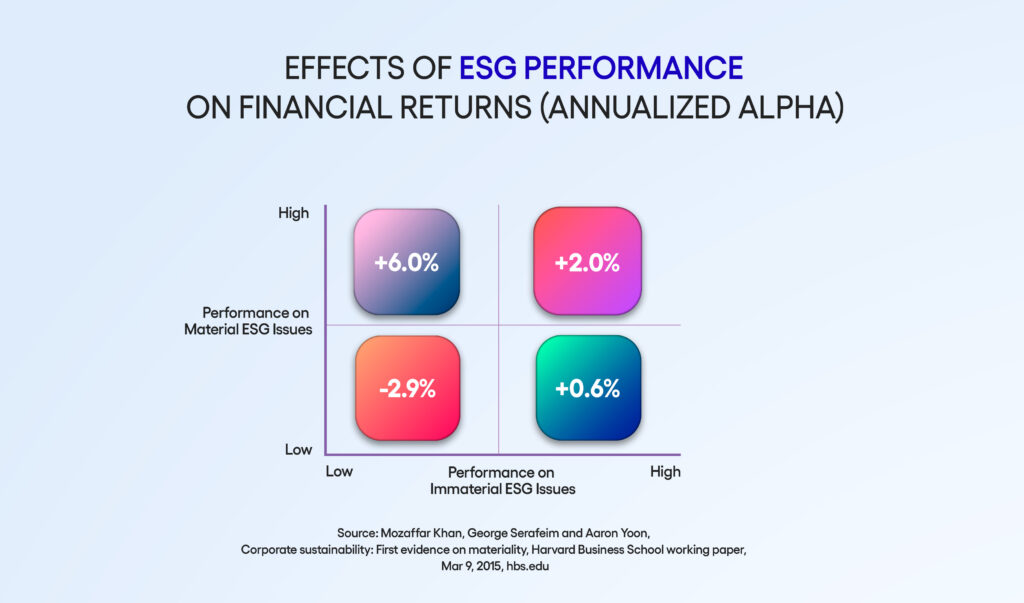

According to research conducted by George Serafeim, professor of business administration at the Harvard Business School, businesses are most successful financially and in terms of ESG when combined efforts are made to focus only on factors that directly impact how a company operates—referred to as material ESG factors. For example, for a sole proprietor having a small online jewellery trading business with 10 employees, data security would be a material ESG issue because the business handles user data while its labour practices would be considered immaterial at its current start-up stage.

ESG metrics can be extremely useful to investors for purpose-driven decision-making. Due to the lack of official standards yet on how to incorporate ESG factors into decision-making, one tries to choose from the below investment strategies which align best with his sustainability goals and existing risk integration frameworks.

At Vivriti, we started with the goal of constructing a values-aligned portfolio (Negative exclusionary screening/ Positive best-in-class screening, and Portfolio tilts). The organisation has taken a step forward to include and integrate ESG risk assessment in its existing risk framework.

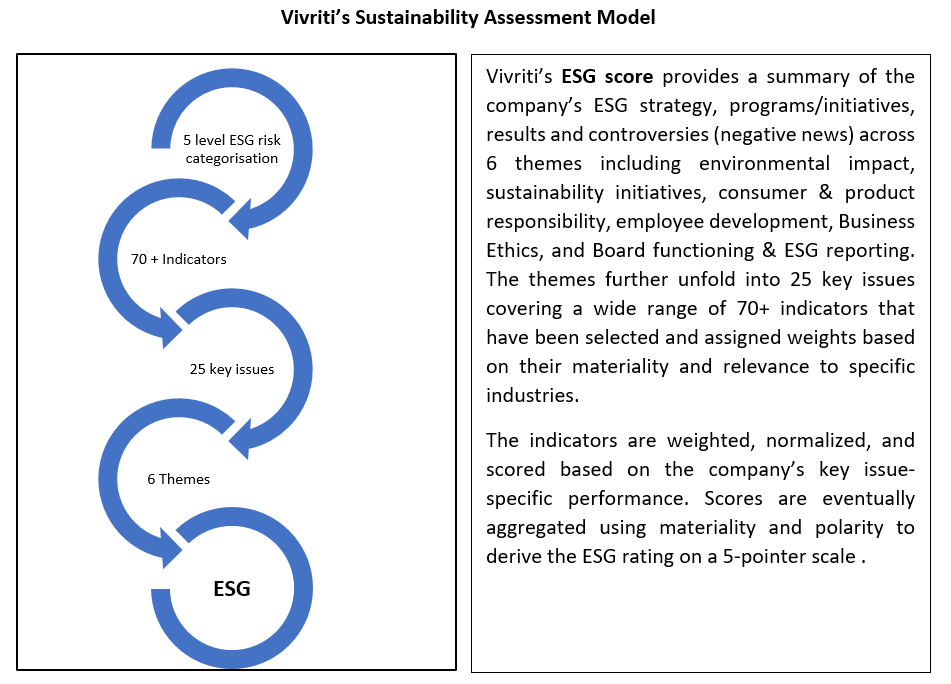

Vivriti has developed its in-house Sustainability Assessment Model across 37 sectors assessing all its borrowers and originators on their environment, social, and governance parameters and identifying the ESG risks and opportunities. The taxonomy of which is based on global frameworks such as Global Reporting Initiative (GRI) standards, Task Force on Climate-Related Financial Disclosures (TFCD), and Indian ESG/ Sustainability reporting standards such as Business Responsibility Report (BRR)/ Business Responsibility and Sustainability Reporting (BRSR).

The on-field due diligence carried out by the ESG analyst alongside business and credit analysts reinstalls the importance of sustainability in the final decision-making. The observations and assessments are translated into a report that also includes an action plan & a stewardship engagement plan to mitigate the ESG risks. The stewardship centers around four principal parameters – talent, society & environment, corporate governance, innovation & customer trends.

The transition to the integrated framework could be time-consuming but it is definitely a foot forward in our sustainability journey. One might wonder how Vivriti’s portfolio companies have reacted to the ESG due diligence. Well, curiosity is the fuel for discovery, inquiry, and learning. It has been reassuring to discover how smaller companies are willing to incorporate ESG practices in their business activities as they recognise the long-term rewards both financially and for the greater good; it is the direction that is lacking!

Sustainability is a collective journey and Vivriti believes in charting the course along with its business partners.

Disclaimer: The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.