“The one instrument that has relative political autonomy is monetary policy.” – Mohamed El-Erian

Executive Summary

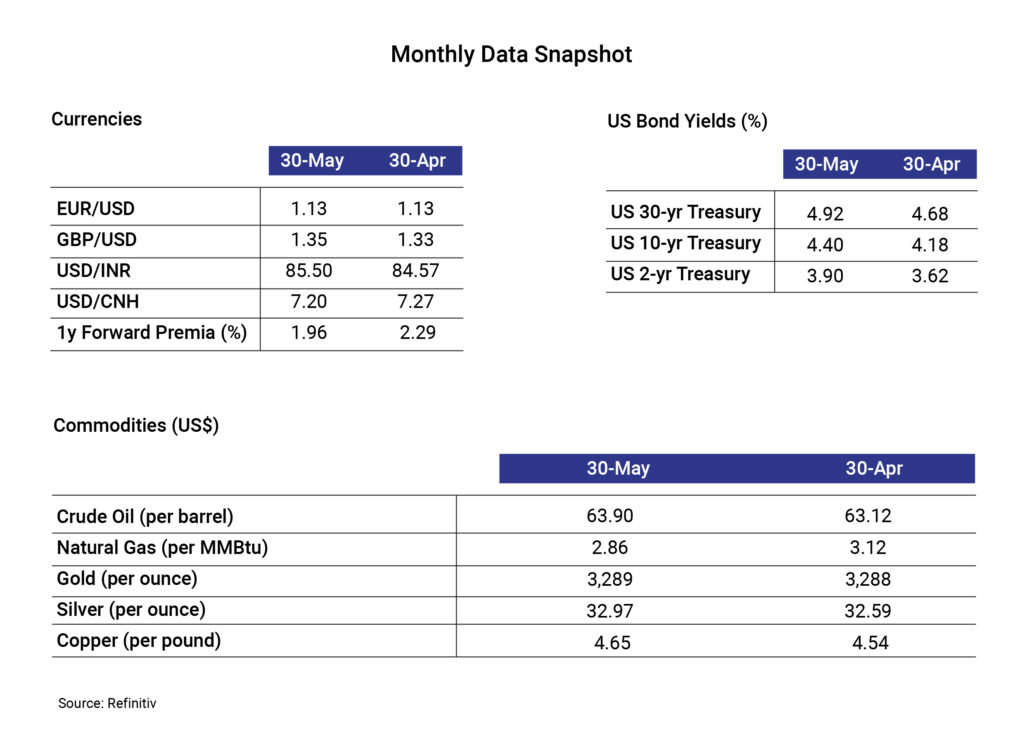

The US Federal Reserve kept rates on hold and indicated that the central bank would likely be reactive instead of pre-emptive in the current uncertain environment. The US Fed’s statement noted the strength in economic activity, however, with rising stagflation risk. President Trump’s policies will continue to take centre stage and the impact of the same will likely determine the Fed’s next move. Meanwhile, the longer-end US treasury continued its weakness in May with yields rising on the back of the ‘Big Beautiful Bill’, with the US 30-year treasury breaching 5%, before a modest recovery. Moody’s also stripped the US of its pristine AAA sovereign rating citing fiscal concerns. In addition to tariffs flip flop, the focus is shifting to US fiscal policy with markets attaching significant term premiums seen in higher longer-end yields. Fading US exceptionalism, fiscal concerns, asset re-allocation, and tariff uncertainty – all of them are supporting softer USD and higher US yields. Barring sharp negative economic shocks, the US Fed will also not be in a hurry to act. Uncertainty continues to weigh on markets for now.

On the domestic front, geo-political tensions dominated the earlier part of the month with volatility in local currency assets. Markets regained their calm once the tensions eased, with rates rallying and currency moderating. Data-wise, inflation continued to moderate, strengthening the case for a deeper rate-cut cycle. Liquidity conditions continued to ease with additional Open Market Operations by the central bank. The Q4GDP growth came in better than expectations while domestic concerns remain due to headwinds from trade disruptions and global slowdown. On the currency front, INR benefits from an overall weaker USD. However, we believe the central bank will likely buffer up its reserves, which they spent since the peak in September-October last year (US$100 billion as per market estimates to defend INR).

Retail inflation drops to its lowest in nearly 6 years, food price-led downward trajectory may continue

India’s retail inflation, which is measured by the consumer price index (CPI) slipped further by 18 basis points month-on-month (MoM) to 3.16% YoY in April 2025, the lowest since July 2019. This can be attributed to a sharp MoM decline of 91 basis points in food inflation to 1.78%, which is the lowest since October 2021. However, core inflation, which excludes volatile food and energy prices, remained unchanged at 4.1% compared to the previous month. The fall in food inflation is driven by subdued food prices of vegetables, pulses, fruits, meat and fish. With this, the retail inflation stayed within the RBI’s medium-term target for three straight months.

The wholesale inflation fell to its lowest level in 13 months to 0.85% in April 2025 due to softening food inflation. It was lower than market estimates of 1.4% and 1.19% in April 2024. All three major segments of WPI – primary articles, fuel & power, and manufactured products – witnessed a moderation in inflation. Inflation for primary articles contracted to 1.44% in April for the first time in nearly two years primarily due to crude oil and natural gas inflation that fell to a 22-month low of 15.55% in April. Inflation in manufactured products, which accounts for over 60% of the overall basket, slowed to 2.62% in April from 3.07% in March. The fuel and power category witnessed a deflation of 2.18% in April against an inflation of 0.2% in March driven by a decline in prices of LPG, petrol, and diesel.

The deceleration in inflation is expected to provide RBI the needed comfort to continue with the rate cut cycle, with another 25-bps cut in FY26 being likely. Since the beginning of this calendar year, the central bank reduced the repo rate by 100 bps to 5.5% with a larger-than-expected cut of 50 basis points in June. The downside potential in India’s inflation trajectory remains strong due to lower global oil prices (with an expected pass-through) and an anticipated normal monsoon and higher foodgrain production, along with a favourable base. The rate cut cycle could get even deeper if the domestic economy experiences a slowdown below RBI’s growth projections for the year (6.5%).

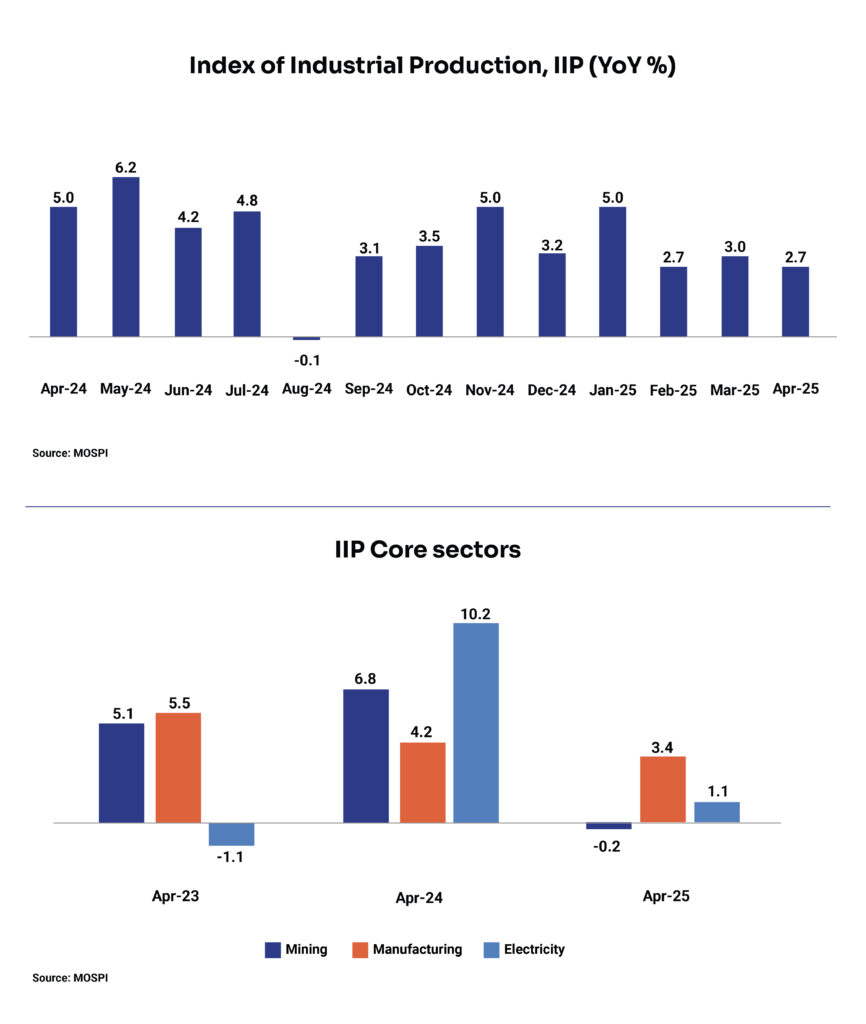

Industrial output growth at 8-month low, mining and electricity sectors slow down

The growth in India’s industrial output, which is measured by the Index of Industrial Production (IIP), fell to an 8-month low of 2.7% YoY in April 2025 from an upwardly revised 3.9% in March 2025. This decline is attributed to the deceleration in mining and electricity sector growth. Mining sector output shrank 0.2% YoY, the lowest since August 2024, while the electricity sector output growth slowed to 1.1% YoY considering the early start of monsoons. This happened despite the 3-month high growth in the manufacturing sector, the largest in the IIP core sectors, to 3.4% YoY in April 2025. Within the sector, 16 of 23 industry groups showed positive growth in April 2025.

By use-based classification, capital goods reported the strongest growth of 20.3% YoY, which was an 18-month high, followed by consumer durables (6.4%), intermediate goods (4.1%), and construction goods (4%). Consumer non-durable goods remained in the negative territory with a 1.7% fall in output, indicating weakness in private consumption. While external headwinds remain a concern, domestic demand led by government spending, favourable rural outlook, and low energy prices is expected to boost domestic growth.

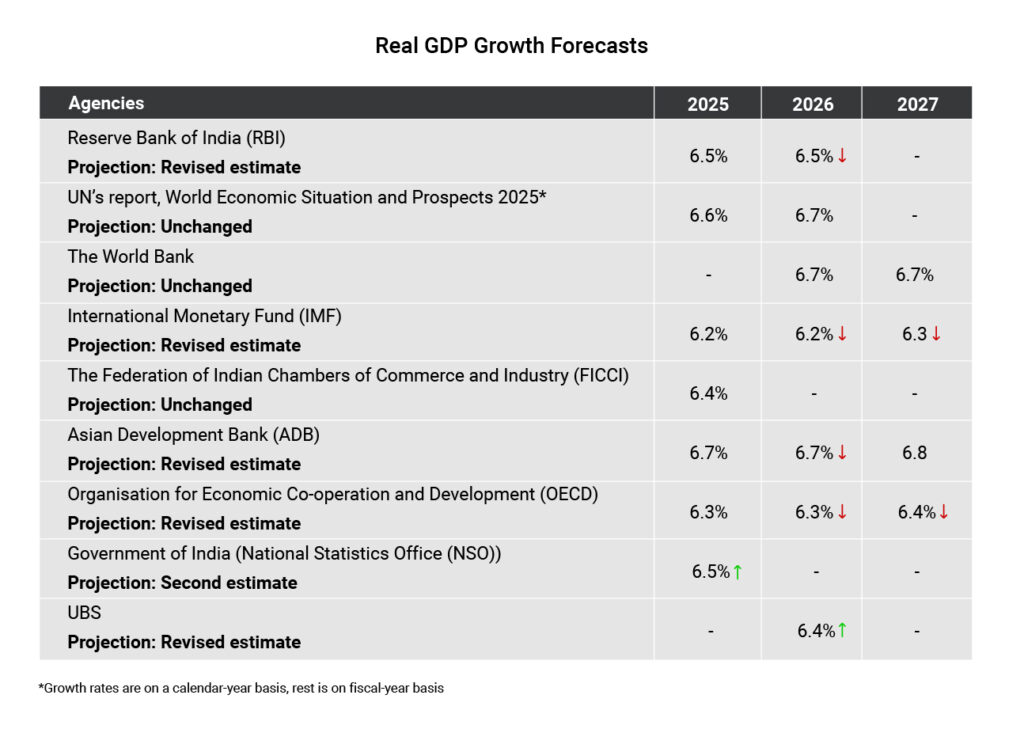

India’s Q4 Growth Suprises, FY26 outlook remains positive

India’s real GDP growth in Q4FY25 came in at 7.4% YoY, surpassing the market estimates by 40 basis points as well as the previous quarter’s growth of 6.4%. The 5-quarter-high growth is attributed to higher agriculture output led by foodgrain production and acceleration in industrial activity led by manufacturing, construction, and mining activities even though private consumption demand has slowed down due to weak urban demand.

The higher-than-expected Q4 growth led to an expected growth of 6.5% YoY for FY25, which is not overwhelming though as it decelerated to a 4-year low. The slowdown is attributable to lower growth in Industrial (5.9% in FY25 vs. 10.8% in FY24) and Services (7.2% in FY25 vs. 9% in FY24) activities. The agriculture sector was the shining star in the year with growth accelerating to 4.6% in FY25 from 2.7% in FY24 due to record Kharif production, favourable monsoon, and improved rural demand.

Going forward, the GDP growth is expected to be positively driven by a recovery in urban demand led by tax cuts and sustained low inflation level, buoyant rural demand on the back of above-normal monsoon and higher foodgrain production, lower crude prices, and continued monetary easing by the central bank (at least an additional 25 bps cut after June meeting). However, geopolitical tensions and a fall in demand for India’s exports due to a slowdown in the US economy will be concerns affecting the growth in the current fiscal year.

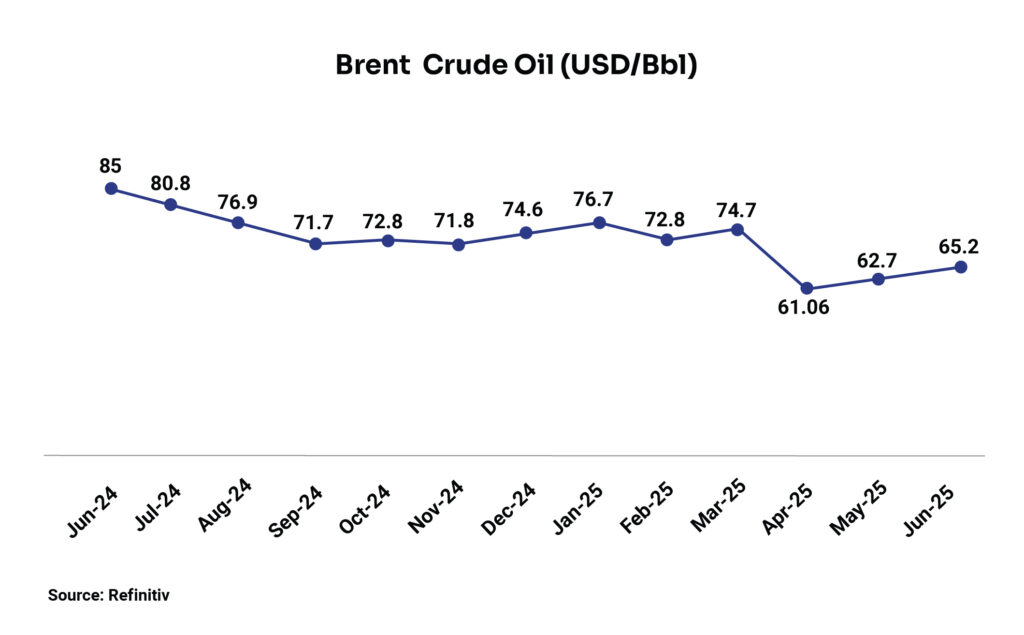

Global crude oil market falters, further dips are likely

Global crude oil prices (Brent) declined ~21% from the January peak of ~US$82/barrel to ~US$65/bbl on June 5th. This is the first time in nearly four years that crude oil prices have dipped below US$70 owing to several factors. However, the downward trajectory is expected to continue!

Demand side concerns due to a potential slowdown in the US, China, and global growth led to the primary fall in prices. The Organisation for Economic Cooperation and Development (OECD) recently lowered its global economic growth outlook from 3.3% in 2024 to 2.9% in 2025 and the next year, with the slowdown expected to be heavily concentrated in the US, Canada, Mexico and China. What added fuel to the fire was the Organization of the Petroleum Exporting Countries Plus (OPEC+) move on May 3 to a collective output hike of 4,11,000 barrels per day (bpd) from June. The oil cartel decided to raise production for the third month in a row leading to further dips in crude prices. OPEC+ steadily reversed nearly half of the 2.2 million bpd “voluntary” output cuts announced by eight of its members in 2023, which was meant to raise global oil prices. It is highly likely that the full 2.2 million bpd cut will be materialised by October 2025. The International Energy Agency (IEA) predicted oil demand to grow by a meagre 0.73% adding to the pain of an oversupplied market.

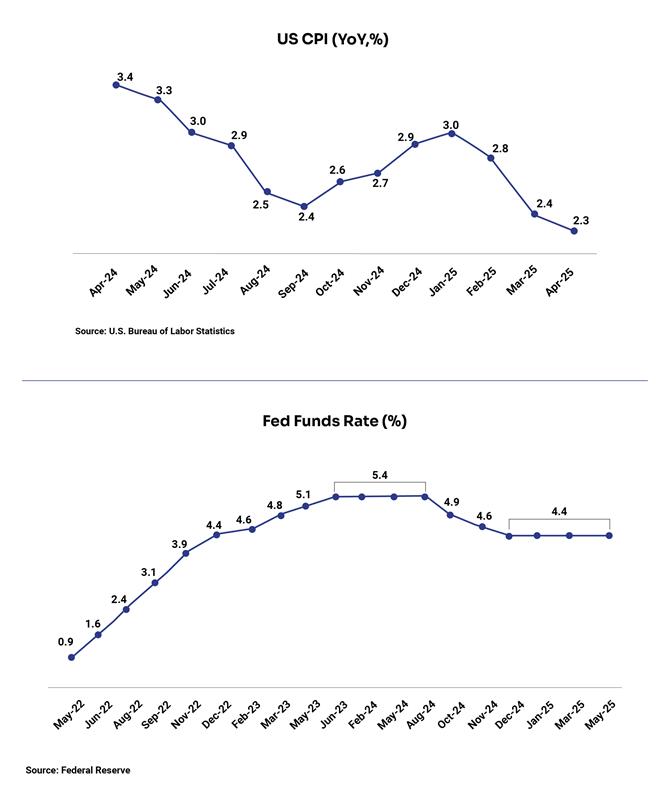

US inflation falls to its lowest level in over 4 years

Consumer price inflation in the US dropped to 2.3% in April 2025 from 2.4% in March, which is the smallest annual increase since February 2021. The consumer price index rose 0.2% in April on a seasonally adjusted basis below the market forecast of a 0.3% increase. The prices for gasoline and fuel oil fell sharply (-11.8% and -9.6% MoM, respectively) leading to a 3.7% decline in the energy index, which continued its declining trajectory. The other factor contributing to the slowdown in inflation was the food index, which fell 2.8% MoM primarily driven by a 12.7% decrease in egg prices.

The US Federal Reserve held the repo rate steady in its last meeting citing upside inflation risks. The US Fed kept the federal funds rate unchanged at 4.25%-4.5%, extending its pause in rate cuts since January. Hence, despite falling inflation, the US Fed is unlikely to cut rates in the near term due to concerns about tariff-led inflation.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.