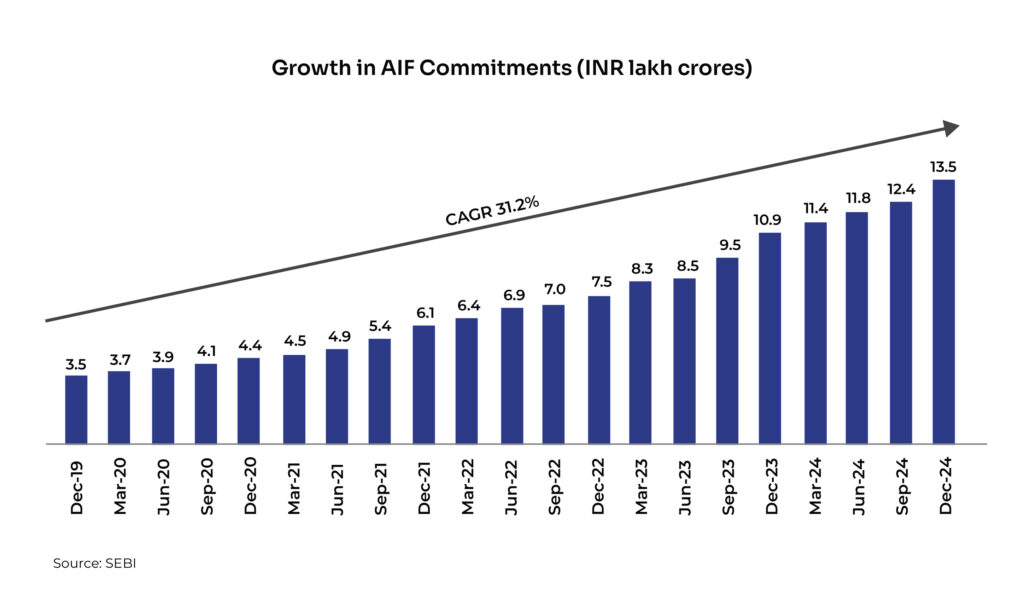

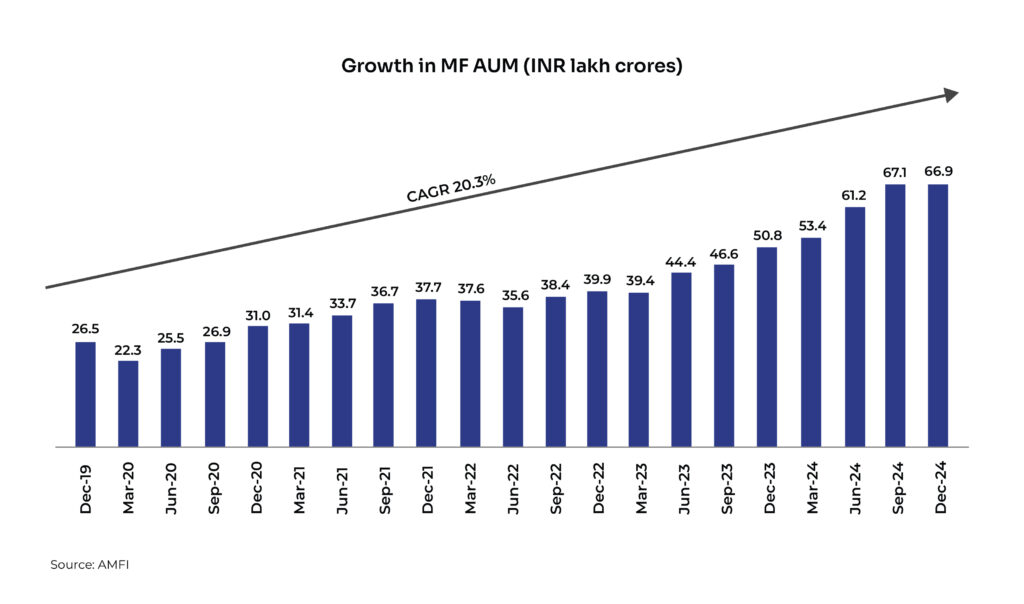

The growth of India’s alternative investment funds industry has been phenomenal over the past few years. The industry’s commitments raised, which denotes the amount clients are willing to invest in AIFs, clocked a 5-year CAGR of ~31% to ~INR 13.5 lakh crores as of Dec 2024. However, the mutual fund industry, which sits with an average AUM of ~INR 67 lakh crores (as on Dec 2024), achieved an AUM of the same level over four decades in mid-2009, after the first scheme (US-64 by UTI) was launched in 1964.

Over the last five years, the growth in the AIF industry has been super steady without any dent even during Covid-19, unlike mutual funds.

Within the AIF segment, Category II constitutes ~80% of industry commitments. As of Dec 2024, Cat II commitments jumped ~14% y-o-y to ~INR 10 lakh crore. Among other categories, Cat I commitments rose ~15% to ~INR 84,862 crore and Cat III commitments grew ~70% to ~INR 2 lakh crore as of Dec 2024.

What are the catalysts for growth?

The major factor that is driving the growth in alternative investment funds is their low correlation to public markets. Hence, high net-worth individuals (HNIs) and family offices are increasingly preferring AIFs over other asset classes like traditional equity and bonds.

Economic uncertainties led by black swan events and geo-political tensions add a lot of volatility to the market, while inflation hedging is a must. Given these issues, alternative investment funds fit well into the criteria with higher risk-adjusted returns.

Among other factors that led AIFs to gain traction include the regulatory mandate to ensure sponsors’ “skin in the game”. The investments in the funds are managed by a team of seasoned finance professionals with local expertise and a competent investment committee with the ability to underwrite risk and ensure consistently higher returns.

AIFs have continued to exhibit secular growth with the majority of the incremental funds raised in the Category II and Category III AIFs. While Category III investments are predominantly concentrated in listed equities, the growth in Category II funds has been contributed by the Private Credit segment with debt investments contributing to 40% of the segment.

While banks continued to prioritise lending to retail and large corporate borrowers, mid-market corporates continue to prefer debt investments from Private Credit AIFs due to the tailored solutions being offered. From an investor standpoint, these AIFs have seen increased acceptance from domestic investors driven by tax parity with debt mutual funds and improved visibility on return outperformance.

Disclaimer: The information provided in this article is for general informational purposes only and is not an investment, financial, legal or tax advice. While every effort has been made to ensure the accuracy and reliability of the content, the author or publisher does not guarantee the completeness, accuracy, or timeliness of the information. Readers are advised to verify any information before making decisions based on it. The opinions expressed are solely those of the author and do not necessarily reflect the views or opinions of any organization or entity mentioned.