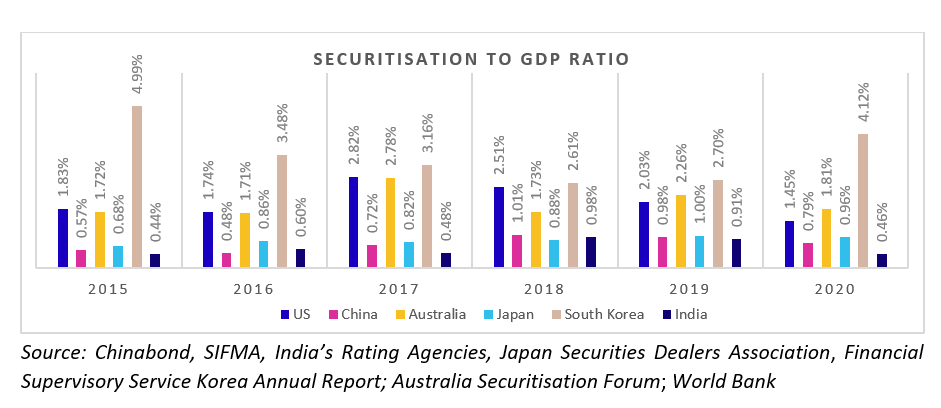

Despite the rapid growth, India’s securitisation market is under-penetrated compared to other developed markets. As evident in the chart, securitisation volumes at $12 billion comprised only 0.46% of GDP in India versus $304 billion or 1.45% of GDP in the US in 2020. It highlights the significant opportunity in the securitisation market.

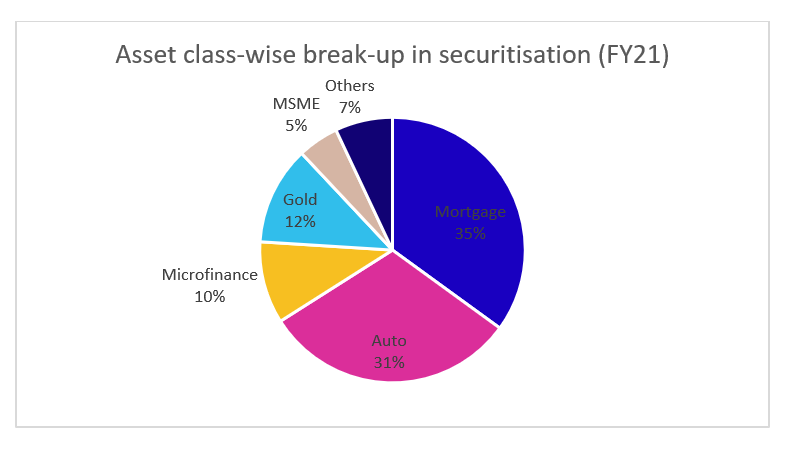

In terms of asset class, the following chart depicts the break-up in India’s securitisation market.

We are yet to see how far the new securitisation guidelines bridge the market gap. Till date, the investor’s participation in the market has remained limited primarily to banks (to meet private sector lending) and mutual funds to some extent. Foreign Portfolio Investors, FPI have remained virtually non-existent in asset securitisation transactions.

FPIs low participation in the market directly via PTCs has been mainly caused by 3 factors —

- Complexities in obtaining & submitting documents like PAN Card due to data privacy and other concerns; filing income tax.

- on income arising from such investments.

- Absence of any fund focusing on securitization pools that could (a) benefit from the inherent diversification of investing in multiple pools and (b) address the difficulty in hedging forex risk due to unpredictable cashflows of MBS/ABS by pooling cash flows & stabilizing investor payouts.

The growth has also been inhibited by Indian asset managers’ reluctance to design products for offshore investors due to following factors —

- Higher set up cost in running pooling vehicles in offshore jurisdictions like Mauritius, Singapore.

- Higher chances of tax litigation while claiming treaty benefits.

- Difficulty in accessing leverage/borrowing.

- Poor access to regulators in foreign jurisdictions.

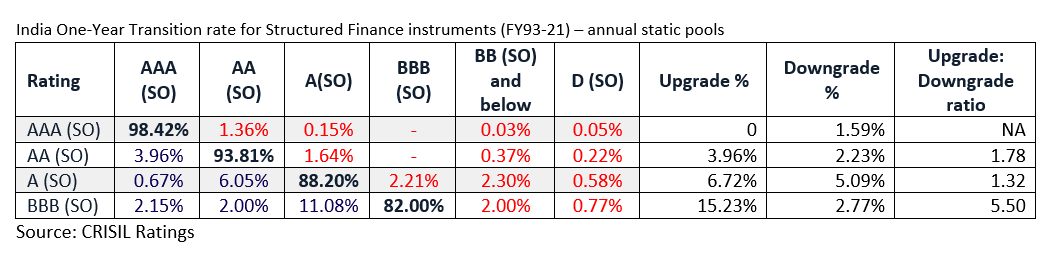

However, there is room for healthy growth as the Indian retail securitisation pools have performed well through the past decade steering through several crises. About 56% of structured finance ratings, which include issue years for asset backed securities and mortgage backed securities spanning over 29 years, were rated “CRISIL AAA (SO)”. These ratings were highly stable as over 98% of them remained unchanged on average.

The above table indicates the migration of transaction ratings, from one rating category to another – both upgrades and downgrades.

The performance stands even better when we compare the downgrade of domestic AAA (SO) structured finance ratings for one year which is at 1.59% versus 2.32% for S&P AA- and 3.33% for S&P A-rated securitisation pools.

- This indicates that domestic AAA-rated securitisation pools compare with Fitch AA- and A-rated ABS

- As a comparison, India’s international rating is Fitch BBB-

The performance of the retail securitisation pools also withstood the recent COVID crisis with rating upgrades significantly outweighing downgrades, and no ABS witnessing a payment default.

GIFT City: Unlocking global pools of capital into securitisation by AIFs

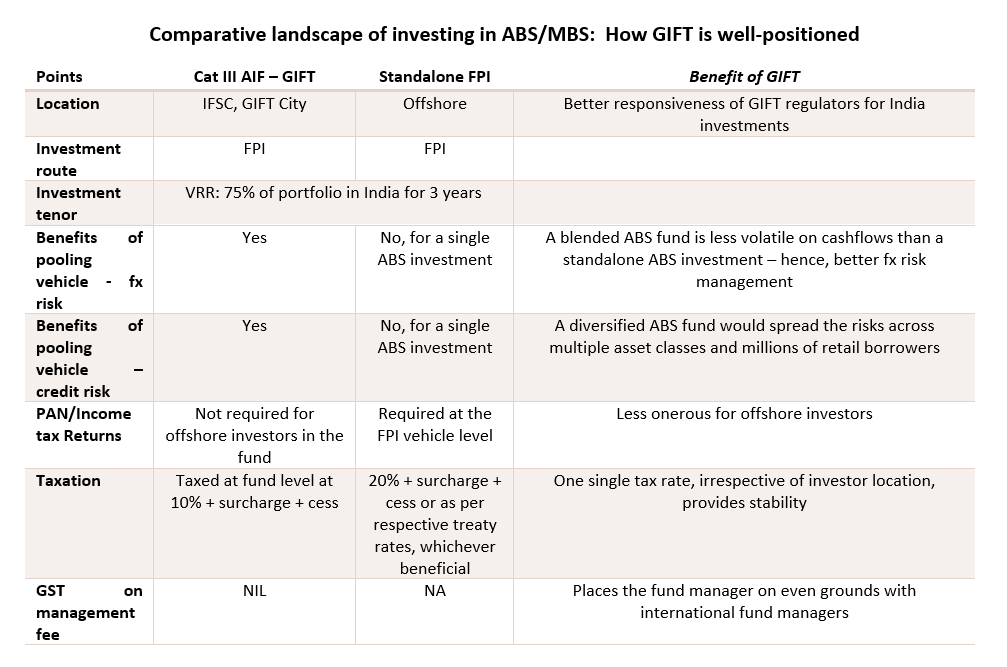

India’s 1st International Financial Services Centre (IFSC), GIFT City solves the above issues and scores over other pooling jurisdictions like Mauritius, Singapore. IFSC was set up to undertake financial services transactions that are currently carried outside Indian soil by overseas financial institutions and foreign subsidiaries of Indian financial institutions. It doesn’t require investors to comply with India’s foreign exchange regime while investing in businesses within IFSC. Special tax incentives have also been provided to units located within the IFSC to incentivize offshore investments.

In IFSC, all categories of AIFs, Cat I, Cat II, and Cat III, can be set up, governed by AIF Regulations of the Securities and Exchange Board of India (SEBI). AIFs within IFSC has been granted special dispensations to provide them with higher operational flexibility.

FPIs are encouraged to invest in securitisation products based in GIFT City due to following reasons:

- No PAN card or return filing required under the Income Tax Act for the non-resident investors (awaited for Cat III AIFs).

- Exemption from tax on any income received from the Category III AIF or on transfer of its units.

- Cat III AIFs could (a) lower credit risk through better diversification, and (b) remove difficulties in hedging forex risk as the asset manager can combine a basket of many securitisation pools in a way that could stabilise cash flows.

An asset manager benefits in the following ways while setting up a Cat III AIF in GIFT City:

- Enjoy 100% corporate tax exemption for 10 consecutive years out of a block of 15 years.

- Exemption from MAT.

- No GST on management fees.

- No restriction/cap on investment in a single investee company.

- Ability to enhance returns by taking leverage at the fund level.

- Lower set up cost due to lower operating expenses.

- No need to claim treaty benefits, and hence no litigation risk.

- Access to regulator is better in GIFT than in foreign jurisdictions.

To conclude, the Indian securitisation market looks to be well on track for exponential growth given the favorable regulatory climate and the potential of higher participation from overseas investors/HNIs via AIFs due to the presence of India’s first IFSC.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.