“Lending firms using the Account Aggregator (AA) framework facilitated loans worth INR 42,300 crore during the period of September 2021 to March 2024.” – Sahamati

What is the Account Aggregator framework?

Account aggregation or financial data aggregation is a technique used in the financial services industry involving the collection, gathering, and synthesis of information in one place from multiple financial accounts, such as loan accounts, savings and current accounts, credit cards, investment accounts like mutual funds and demat accounts, public provident fund, income tax returns, as well as supplementary business or consumer accounts in e-commerce, food or cab aggregators. The data collection, assembling, and sharing are enabled via open application programming interface (API) connections.

The inception of the Account Aggregator framework in India dates back to 2016 when the Reserve Bank of India held joint consultations at the Financial Stability and Development Council (FSDC) with representation from RBI, SEBI, IRDAI, and PFRDA and released the Master Guidelines for the framework. That’s how a new class of NBFCs known as Account Aggregators (AA) was conceptualized. In 2021, the AA ecosystem saw the light of day with eight large private sector banks joining it.

Who are the stakeholder entities?

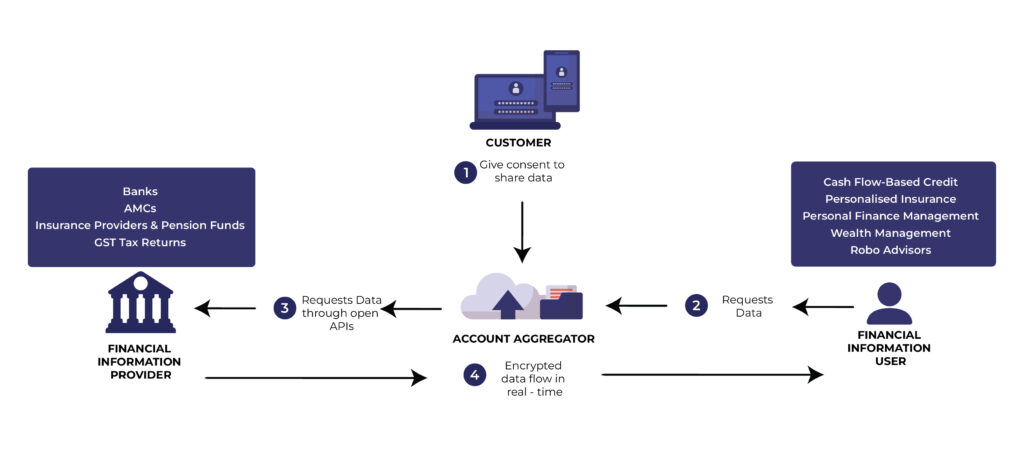

The stakeholders in the AA ecosystem are as follows:

- Financial Information Providers (FIPs): FIPs are regulated financial entities such as banks, NBFCs, insurance, and asset management companies, depositories, etc., who store citizens’ data by the virtue of holding their accounts and share the data with citizens’ consent. For example, when you secure a loan, your bank can act as the FIP by sharing your data with the lending bank or NBFC. As of August 2024, the number of FIPs stands at 163.

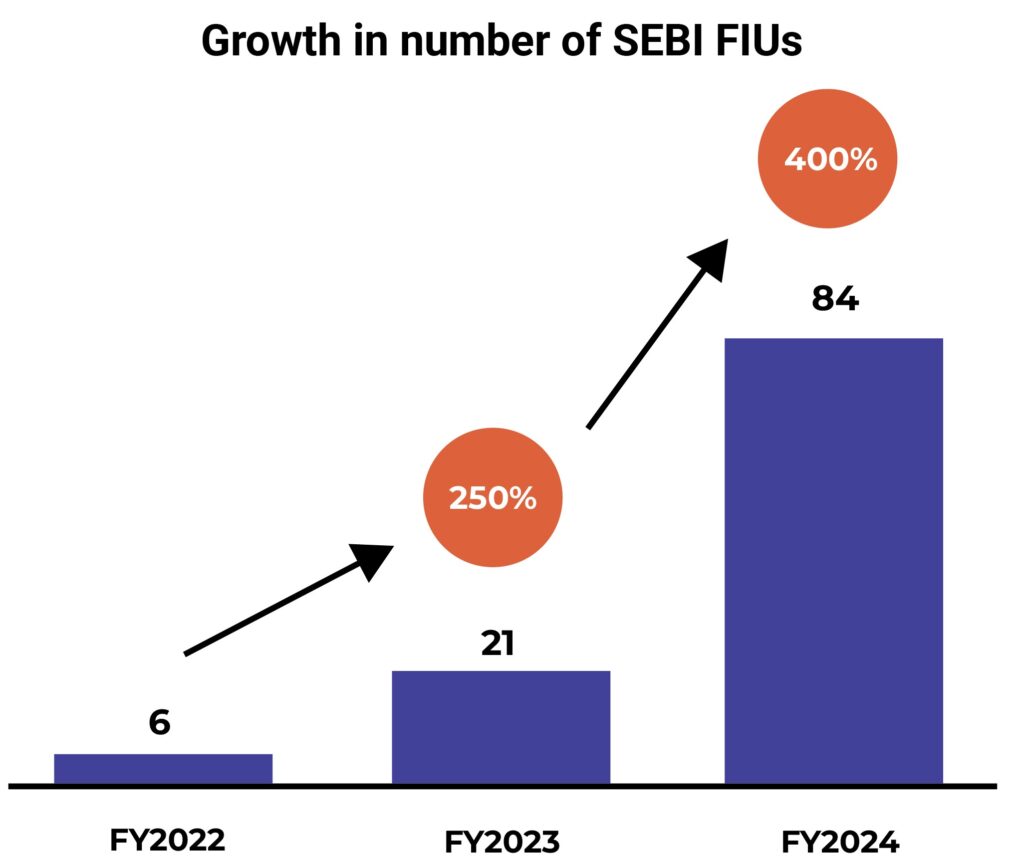

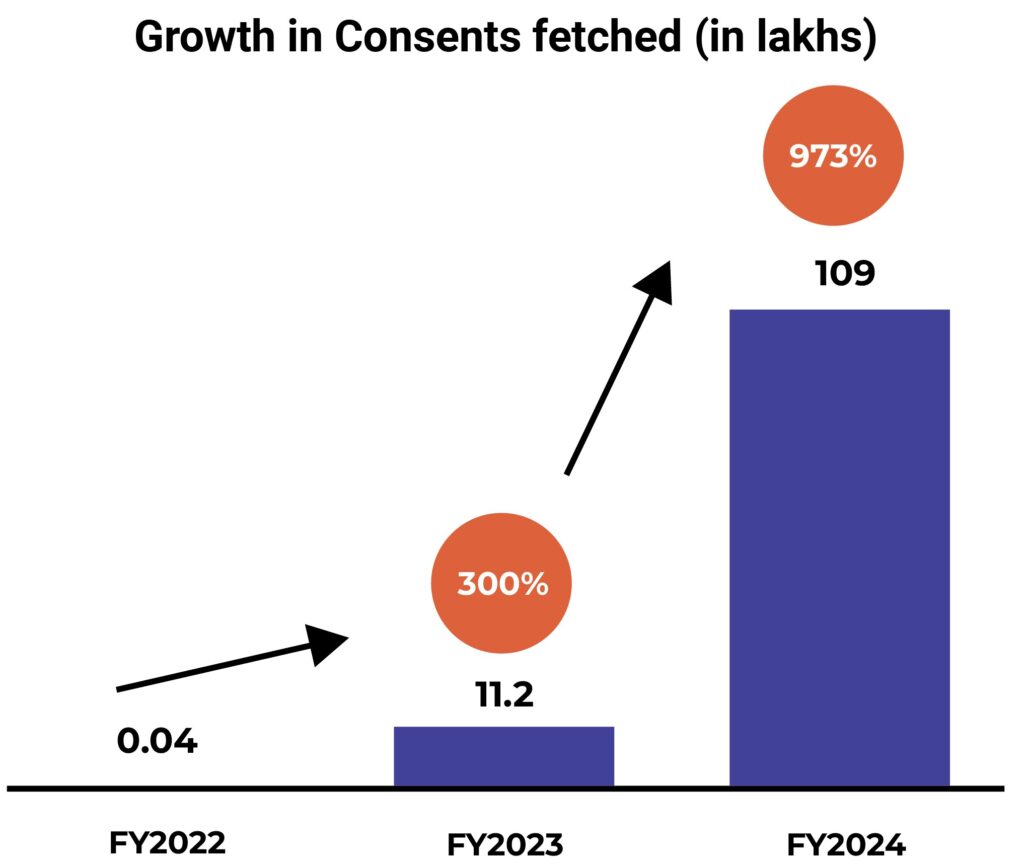

- Financial Information Users (FIUs): FIUs are regulated financial entities like banks NBFCs, and others who use citizens’ available data with FIPs to provide them services. They solicit consent from a user by providing details of the data to be captured through an AA identifier. Since the launch of the AA framework in 2021, SEBI-regulated entities have been the early adopters. In FY24, the number of SEBI-registered FIUs recorded an exponential rise while the usage from SEBI FIUs saw growth as reflected in the number of consents taken.

- Account aggregators (AAs): AAs are NBFCs licensed by RBI to enable the sharing of structured financial data from FIPs to FIUs while retaining a record of the consent provided. In other words, they operate as consent managers for citizens. As of now, there are 15 licensed AAs in India.

How does the AA framework operate?

The AA framework empowers citizens by enabling them to share data only with their explicit consent captured in an electronic consent framework. The data can be shared in a digital format on a real-time basis, directly from the existing FIPs of the citizens to the potential FIUs of the citizens.

What are the benefits?

- AAs help financial institutions access tamper-proof and machine-readable data. It enables reliable, convenient, and secure data-sharing driving down the transaction costs for the lenders.

- AAs can improve the quantum and the quality of the loan portfolio of the lenders through efficiency gains.

- AAs are poised to serve ‘thin file’ customers, expanding the total addressable market for lenders and strengthening financial inclusion. It can help financial institutions serve underserved customers and MSMEs better.

Way ahead

Currently, a customer needs to sign up with multiple Account Aggregators to complete transactions. This increases operational efforts for institutions as they need to access customer data from various sources by integrating with each data provider. To significantly reduce this operational burden, AAs plans to introduce interoperability, eliminating the need for individuals to open accounts with multiple aggregators, which in turn, will allow banks, NBFCs, and other financial institutions to exchange customer data seamlessly.

Sahamati, an industry body within the Account Aggregator ecosystem, is running a pilot program to test interoperability. If interoperability kicks in, customers’ financial data can be accessed across different financial institutions even if those institutions are linked to different aggregators, once a customer has given consent through any AA.

Disclaimer:

The views provided in this blog are of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.