Over the recent years and particularly after Covid-19 investors, corporates and stakeholders globally have started realizing that Environmental Social and Governance (ESG) practices have a significant impact on financial performance and enable better access to capital and business opportunities. As per a study by American investment research firm Morgan Stanley Capital International (MSCI) on global and emerging corporates over 2015-19, companies that are rated higher by ESG scores are found to have lesser exposure to systematic risks (which are risks inherent in the entire market affecting all industries) compared to ones with low ESG-ratings.

The accelerating embrace of ESG practices globally is changing the way businesses perceive and report on sustainability. Thus, in a rapidly evolving ESG landscape, developing an understanding of ESG parameters has become crucial to today’s corporate management and investors alike.

What is ESG?

ESG is primarily a risk assessment and mitigation tool that provides a framework for evaluating an organisation’s environmental, social, and governance performance beyond traditional financial performance indicators. ESG performance of a company is complementary to its bottom line, contributing to the creation of long-term stakeholder value while being responsible towards society.

The three interconnected dimensions E, S, and G are explained as follows:

Setting on the path to a net-zero future, climate-related risk disclosures have gained momentum. This has led to global market players’ adoption of formal ESG reporting frameworks and standards such as Global Reporting Initiatives (GRI), Sustainability Accounting Standard Boards (SASB), Task Force for Climate-related Disclosures (TFCD), Carbon Disclosure Project (CDP), EU Sustainable Finance Disclosure Regulation (SFDR), and Integrated Reporting.

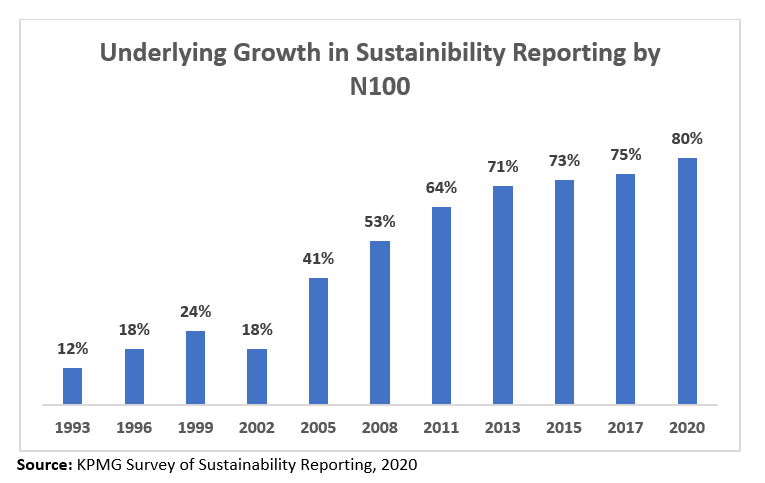

At the onset, the adoption of these frameworks was primarily done by the larger listed entities globally. As per the KPMG Survey of Sustainability Reporting, 80 out of the top 100 companies by revenue in 52 countries, aka N100, reported on sustainability in 2020, showing an improvement of 5% since the last survey in 2017. The below chart depicts the increasing trend in the adoption of sustainability reporting by N100 companies:

Where is India in this equation?

With the changing global dynamics of how business is done and the advent and active adoption of ESG practices in the West, India began its own journey when SEBI mandated the top 100 listed entities to report on ESG by introducing Business Responsibility Report (BRR) in 2012. In 2021, SEBI replaced the existing BRR with a more robust Business Responsibility and Sustainability Report (BRSR). The core aim of BRSR is to empower all the stakeholders of the capital markets with the non-financial information of an organization through ESG reporting. It will be applicable to the top 1,000 listed entities by market cap and contain disclosures related to:

- ESG risks and opportunities

- Sustainability-related goals, targets, and performance

- Environmental impact covering aspects including resource usage, emissions, waste management, etc, and

- Social impact covering the workforce, value chain, communities, and consumers.

Similar to the BRR, the BRSR framework is also based on the nine core principles of the National Guidelines on Responsible Business Conduct. However, unlike BRR where disclosures were limited to Yes / No responses to a questionnaire, BRSR expands itself into both qualitative and quantitative ESG data for each of the nine principles drawing references from international reporting frameworks such as GRI, SASB, CDP, TCFD, and EU SFDR. BRSR has been made mandatory from FY23.

Though BRSR doesn’t pertain to unlisted companies at this point, the need of the hour demands that they start crafting their ESG strategies into their businesses as well to tap new opportunities to access global capital more favourably. The shift will further be primed by a pared-down Lite version of the BRSR framework that SEBI is currently consulting on for the unlisted companies of India to eventually bring them up the curve.

As the financial sector solves for today and plans for tomorrow and beyond in the face of uncertainty, it is imperative for the sector to develop resilience and response to risk management. Hence, robust governance on one hand and social and environmental aspects on the other hand hold equal prominence for businesses to flourish and benefit the people and the planet. The financial services sector needs to lead the way in driving the transition to a sustainable economy.

Vivriti’s ongoing ESG journey

As a purpose-led organization, Vivriti Group’s prime motto has been to deepen the debt markets for mid-market enterprises by solving a multitude of issues including information asymmetry, structuring, risk perception, and liquidity. Vivriti’s efforts are deeply mission-driven, to equalise access to debt and build capital market access for mid-market enterprises that are critical for India’s progress and sustainability.

To enable access to deep pools of capital from international and domestic capital markets, Vivriti has invested in ESG risk measurement, as well as impact assessment of its portfolios. Vivriti has also followed a proactive approach to ESG risk mitigation, through active engagement with its portfolio companies. Further, Vivriti has invested significantly in its own ESG framework – in key social aspects such as diversity, gender equality, inclusion, and employee well-being, as well as in becoming a net-zero organisation. Keeping up with our commitment towards a sustainable future, we have come up with our first sustainability report – Sustainability at Scale. The report highlights Vivriti’s ESG initiatives during FY22, its commitment to responsible investing, and its contribution to India’s growth story by aligning the business objectives with the UN Sustainable Development Goals 2030.

Engaging in sustainable practices and meeting the ESG criteria is the need of the hour today. The new equation is turning ESG theory into action and driving sustainable outcomes from meaningful change to the measurable value. Extending the theory around ESG, our next posts will focus on ESG in the unlisted segment, and materiality for debt investors including challenges and noise around ESG, throwing more light on greenwashing.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.