The logistics sector is crucial to the Indian economy and its development. It is valued at ~US$200-250 billion and employs over 2 crore people, making it one of the largest employers in the country (Economic Survey 2021). Freight forwarding (FF) is an integral part of the segment and forms an essential part of the supply chain specializing in transporting products between two places unlike a typical third-party logistics provider (or 3PL) that provides value-added services like packaging, documentation, warehousing, etc., to manage entire logistics needs for their clients.

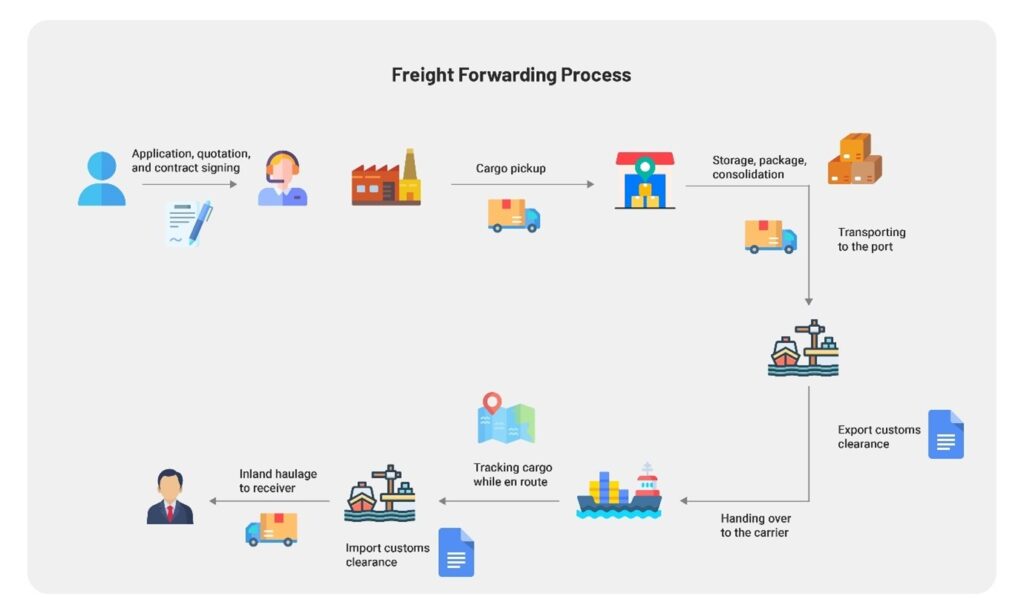

For instance, an FF agent will move the cargo from the manufacturing plant (supplier’s factory/ warehouse) to a shipping port by truck and again from the destination port to the client’s facility/warehouse by the same/another mode of transportation. They offer different modes of shipment, viz. road, rail, ship, and air, be it a single mode or multimodal for a shipment.

In the entire process of shipment, the FF entity deals with several intermediaries like shipping lines, customs agencies, port authorities, etc., to execute the shipment. It’s a manpower-oriented process and need people with long presence in the industry. As a result, the fees charged by the FF entity factor in manpower and tracking costs along with other charges for the shipment.

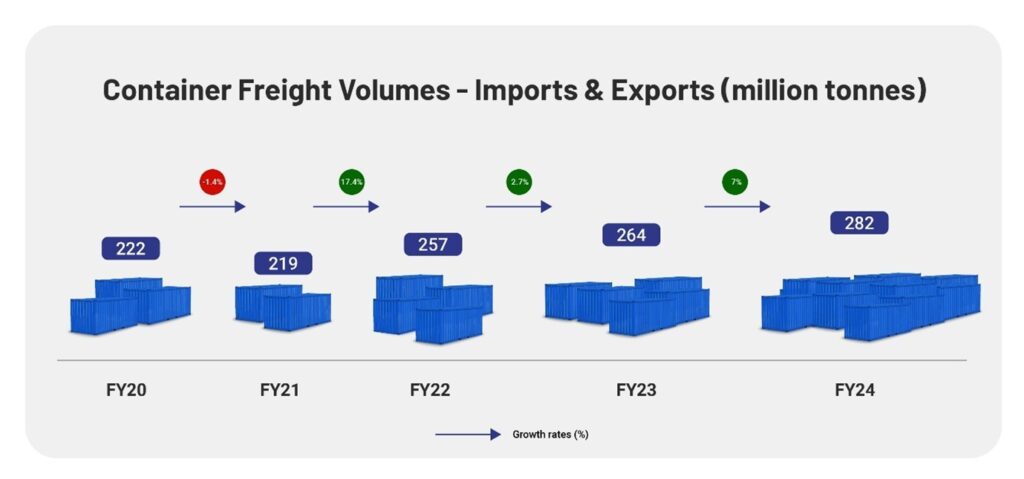

The growth in the FF sector is a function of exports and imports from India. In FY24, imports constituted 61% of the gross merchandise trade and exports 39%. As a result, the container traffic is inclined towards imports than exports. However, as the Indian government is working towards expanding its export portfolio over its import portfolio beyond traditional sectors, the ratio is expected to reverse in the future.

Market Structure and Competition

Freight Forwarding sector is a part of the highly fragmented logistics industry with a presence of more than 2000 small and medium size players across the country. Currently, the unorganized players occupy ~90% of the logistics industry with organized players accounting for the rest.

However, the maturity and exponential growth in the industry depends highly on the shift from unorganized to organized sector with demand for value added services on the rise, digital transformation, and fast adoption of modern technologies in the segment. Few large players in the segment include players like DHL Global, Allcargo Gati, CH Robinson, DB Schenker, Kuehne Nagel, Expeditors, together accounting for less than 10-15% of the market.

The competitive edge in the industry depends on the type of business model players are adopting. It usually requires more than just the infrastructure.

Traditional model: Here, players usually track data on paper or in a limited digitized form and mostly rely on established processes and systems. They manage orders, transport and delivery manually or with legacy systems.

Digital model: The deviation from a traditional model to the digital model is marked by underlying processes of booking and managing freight. Digital FF entities use advanced technologies like the Internet of Things (IoT), GPS enabled real-time tracking, automation, blockchain, cloud computing, big data analysis, and artificial intelligence to coordinate and control shipment activities like carrier sourcing, vetting, tracking documentation, pricing, etc. Such technologies empower FF and their clients to stay informed about the exact location and status of their cargo, overall providing efficient and seamless solutions.

Challenges – Cost Factors

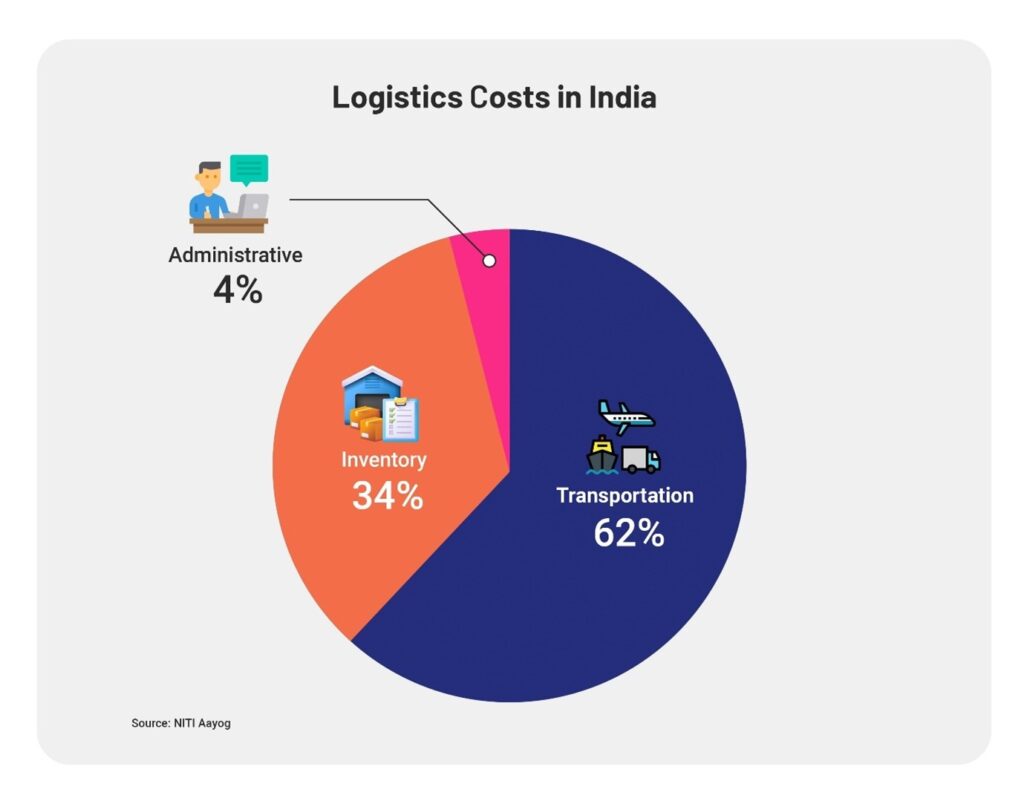

Logistics costs in India account for 13-14% of GDP compared to the average of 8-11% witnessed in major economies. The higher cost is attributed to inefficiencies in infrastructure, skewed modal share, and obsolete technologies. It is estimated that the final stage of the delivery process costs nearly 40% of the overall logistic cost.

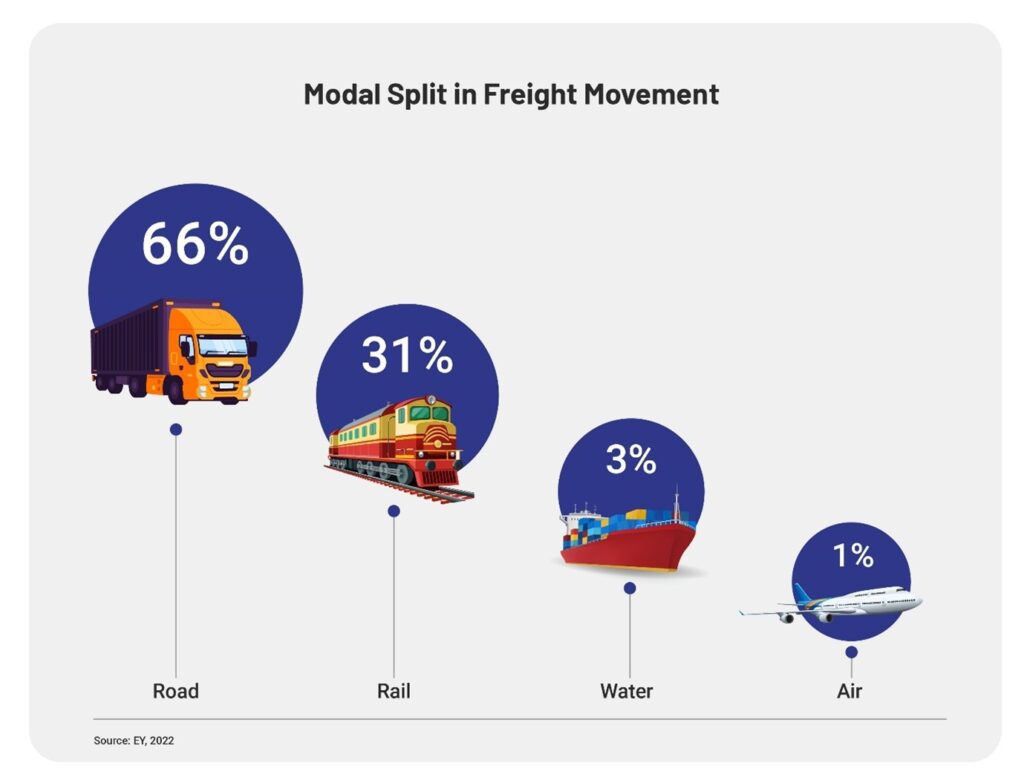

Currently, India’s freight movement is heavily skewed toward road transportation unlike major economies. The skewed modal share resulted in higher spending on freight forwarding as cost of road transport (INR 2.5 per tonne/km) is significantly higher compared to other modes such as rail (INR 1.35 per tonne /km) and water (INR 1.1 per tonne /km) (KPMG, Oct 2022).

Some of the steps to mitigate the cost issues include:

- A shift in the modal share of the sector by executing the long-haul transport via rail. Low-to-medium value non-bulk products can also be transported via rail and/or intermodal transport.

- Optimize vehicle use and productivity via effective routing and loading.

- Improve fuel efficiency by discarding old vehicles and shifting to electric vehicles or alternate fuels.

These apart, the Government of India (GoI) has taken multiple logistics specific initiatives to mitigate the issue. It plans to cut logistics costs from 13-14% of GDP to 8-10% of GDP by 2030. As per estimates, a 10% cut in indirect logistics cost can lead to 5-8% rise in exports as saving on logistics would bring down commodity prices making India more competitive in global markets.

The ranking of India (among 160 countries) in the Logistic Performance Index (LPI) by the World Bank improved from 54 in 2014 to 38 in 2023. The improvement is largely driven by GoI initiatives like GatiShakti (for multi-modal connectivity), National Logistics Policy (to upgrade the logistics infrastructure), Bharatmala (improving road networks), Sagarmala (for shipping and maritime), UDAN (regional airport development program), Dedicated Freight Corridors (improving rail freight network), etc., aimed at making India’s logistic infrastructure more agile, integrated and green.

Freight Rates

In the freight forwarding process, suppliers and customers have different FF agents. The type of quote for the FF service depends on which agent handles the shipment. If the supplier’s FF agent is handling the entire shipment, then it quotes the Cost, insurance, and freight (CIF) rate to the customer. On the other hand, if the customer’s agent handles the job, it procures the shipment at the Freight on Board (FOB) rate offered by the supplier while the former pays the FF fee to his own agent. Customers may compare the CIF and FOB rates and select the one which is cheaper. However, the cost is not the sole factor in selecting the rate but other factors such as what services are covered, additional fees, customs duties and taxes, insurance, etc.

The FF agents usually secure contracts with two to three shipping lines for each trade lane. The shipping lines quote rates (Tier 1, 2, and Spot rates) to FF agents based on the freight volume. For higher volume commitments, they quote Tier 1 rates that are 20-30% cheaper than spot rates.

Trend in freight rates

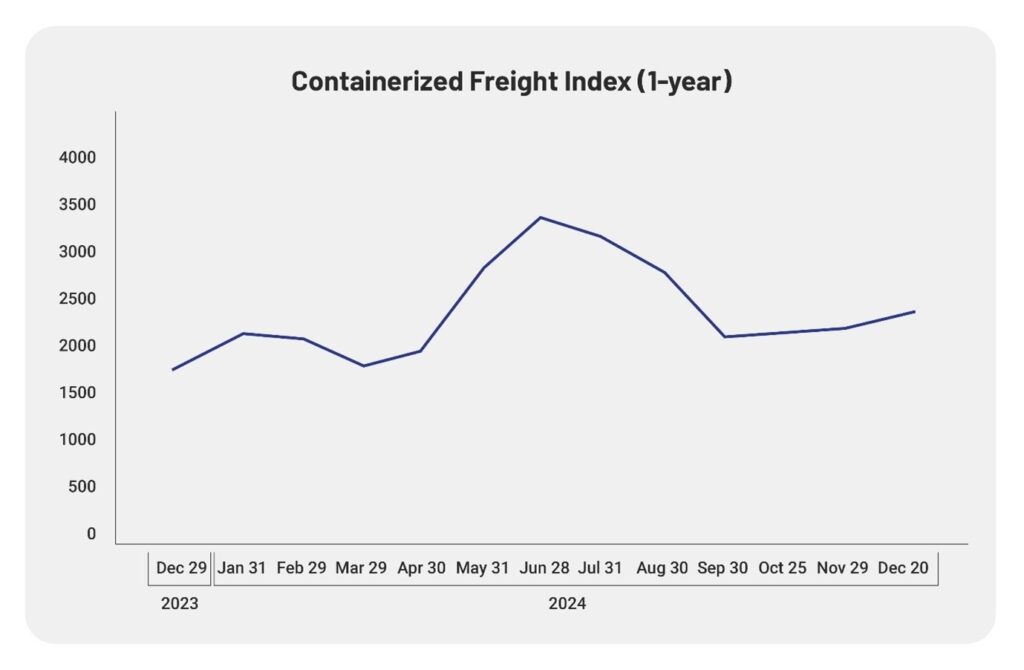

Historically, freight rates have been volatile as maritime trade is susceptible to several external factors like geopolitical incidents, crude prices, maritime accidents (like Egypt’s Suez Canal blockage in 2021), and other factors.

Freight rates shot up following the global financial crisis in 2008-10 and subsequently normalized from 2013-19 onwards before escalating sharply in the wake of the pandemic. In the last 2 years, rates started spiking again after an interim fall following the Red Sea crisis and the attack on vessels on the Suez Canal (which handles ~30% of container traffic worldwide).

The Containerized Freight Index, which tracks the cost of shipping containers on major trade lanes, reached an all-time high in January 2022.

In general, most of the volatility in freight rates is passed on to the customers. However, the absolute margins of FF agents are affected when there is a fall in freight rates.

Outlook

The demand for FF services is positively impacted by more and more large enterprises focusing on their core business activities and choosing to outsource supply chain distribution to intermediaries. The next leg of growth is expected to be driven by FF companies adopting new-age digital models and digitization aimed at addressing the inefficiency in business processes. Further, expansion of the e-commerce sector and GoI initiatives are expected to further support the growth.

As per the World Trade Organization, global merchandise trade volume is expected to rise 2.6% in 2024 and 3.3% in 2025. Industry experts believe the Indian FF market will grow at an annual rate of 5-6% during 2024-2029 while the entire freight and logistics market will grow at an annual rate of 9-10% in the same period.

Disclaimer:

The views provided in this article are of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.