The venture capital (VC) funding, provided to emerging enterprises in return for an equity stake, seems to have entered the winter. Things have started going downhill lately due to adverse macroeconomic scenarios led by geopolitical tensions, low anticipated growth, and rising interest rates amid multi-year high inflation. Many VC firms have reportedly asked their portfolio companies to cut costs and revise budgets and projections to adapt to the funding winter. Some firms even believe the situation is worse than the first wave of Covid when ultra-loose monetary policies adopted by central banks and expansionary fiscal policies by governments supported the market.

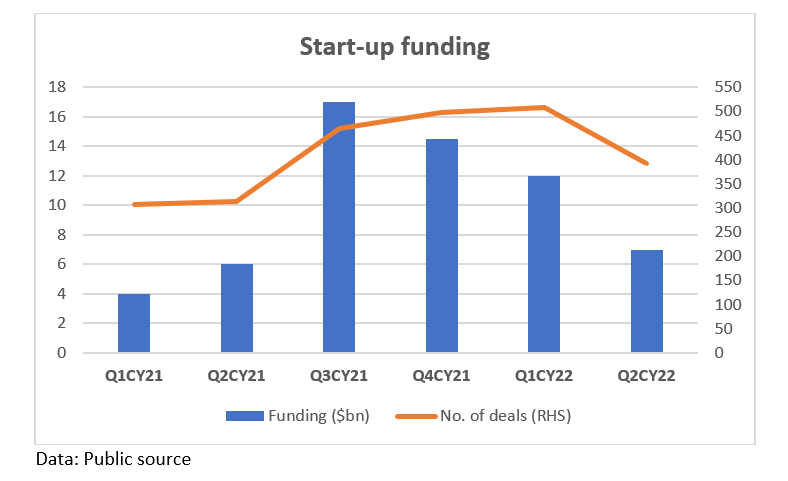

The chilling effect on the VC funding has set in from the third quarter of CY21 as evident in the chart below —

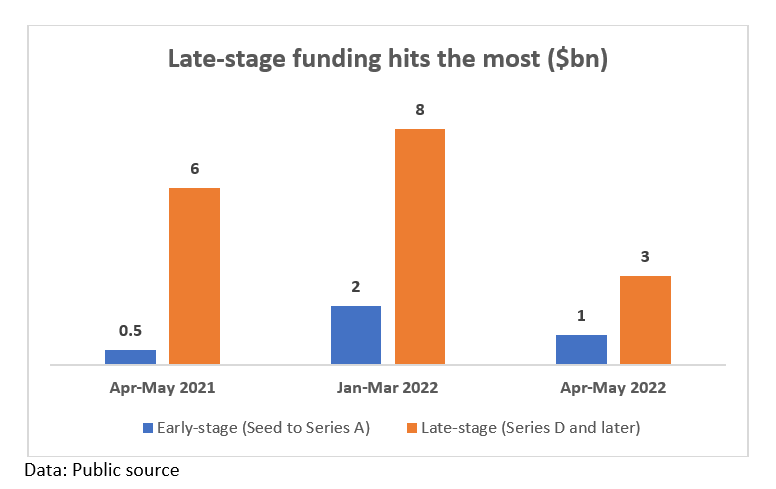

If we examine the nature of the decline in VC funding in the recent past, we see that late-stage funding has hit the most while early-stage funding has more or less retained the momentum. This is because the crossover funds, which invest in both publicly traded and privately held companies, comprise a significant part of late & growth stage deals and turned their back from making new large bets in the private market.

The rise in Venture Debt

As VC funding is drying up, emerging enterprises and start-ups are increasingly shifting towards non-equity-based funding, in other words, debt. Talking about debt, it could be available from banks, however, that is an option mired with difficulties such as placing collaterals or pledging shares against the loan. Moreover, bank loans tend to be standardised with repayment schedules not matching the underlying cash flows generated by the entity’s business. In such a situation, Venture Debt (VD) becomes an alternative, however again, that is an option, whose terms are not entirely based on debt and include an equity component.

VD is a type of loan offered to early-stage, high-growth companies, which are already backed by VC firms. The VD deals are structured to include an equity component, aka “equity kicker”, which is there in the form of warrants, preference shares, rights, or options. Equity kickers serve to sweeten the deal and provide returns over and above the fixed income portion of the deal.

VD can be done by dedicated VD funds. The factors which make VD favourable are

- It can be offered to companies that may not be cash flow positive yet

- It can be provided to companies without existing collateral

- It does not require a valuation to be set for the business

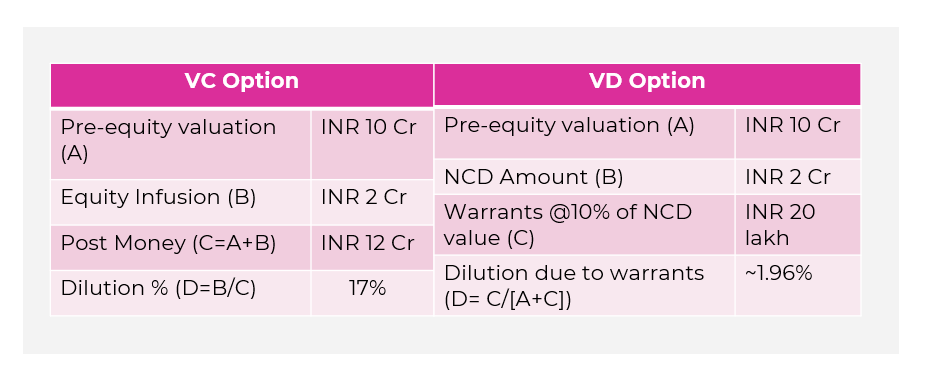

- It gives way to less dilution for existing shareholders compared to VC funding as explained below

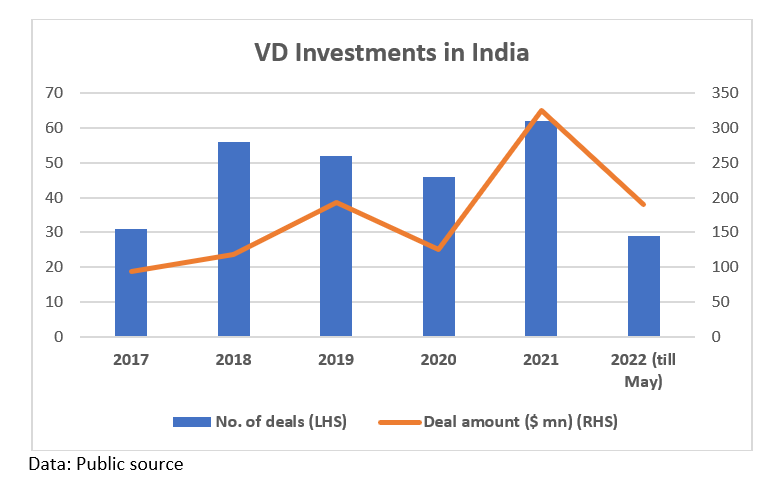

With gradual awareness, VD funding picked up in India over the last 5-6 years and has become a popular route for emerging enterprises to raise capital without diluting equity. The first VD that entered India was SVB India Finance, which started lending in 2008 and rebranded as Innoven Capital in 2015 when Temasek Holdings acquired the firm from Silicon Valley Bank. Since then, the VD market has been dominated by players like Trifecta Capital, Alteria Capital, and Stride Ventures apart from Innoven.

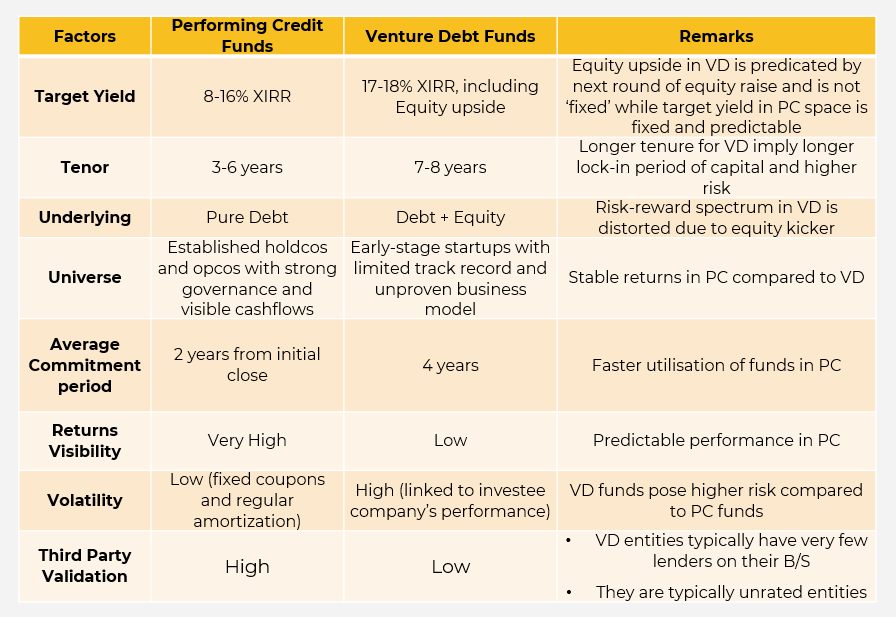

Despite a gain in momentum, VD investments still account for ~2% of the size of VC investments in India, a share which is ~20% in the US. A venture debt deal runs for 2-3 years whereas a VD fund has a life of 7-8 years allowing them to recycle capital at a much higher pace.

Performing Credit – white space in the Indian debt market

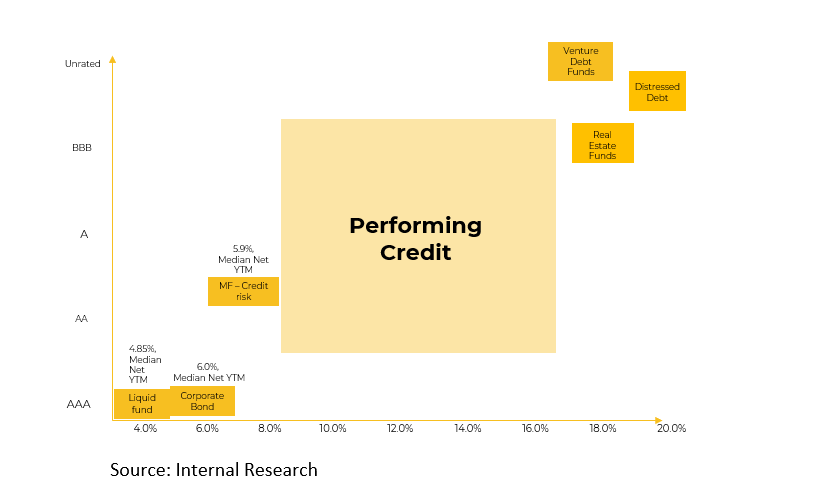

As we move away from AAA to AA rated bonds down to BBB rated companies, a lucrative opportunity for investors exists in a white space, known as the Performing Credit (PC), that exists between mutual funds and distressed debt funds & others at the two extremes. To better understand the depth and coverage of the market let’s see how the market players are positioned given their yield and ratings.

The range of up to 8% is mostly covered by mutual funds. The portfolios operating in this range are disproportionately skewed towards safety due to risk parameters set by SEBI and low liquidity risk on account of being open-ended vehicles. At the other extreme, there are Venture, Distressed Debt, and Real Estate funds operating in the above-16% yield range.

Profitability

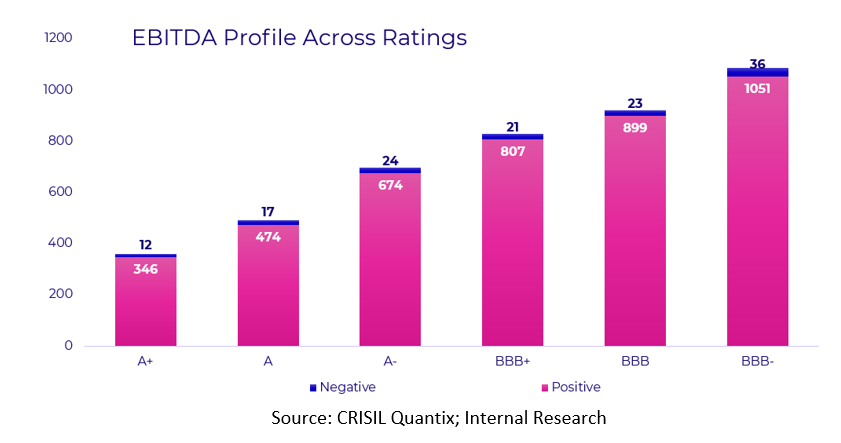

PC space consists of papers issued by rated and stable companies which are undiscovered and yield high risk-adjusted returns. These are the companies that are operating mature and established business models with steady cash flows. Over and above, as the below chart suggests, over 90% of these companies in any rating bracket are EBITDA positive (in FY21).

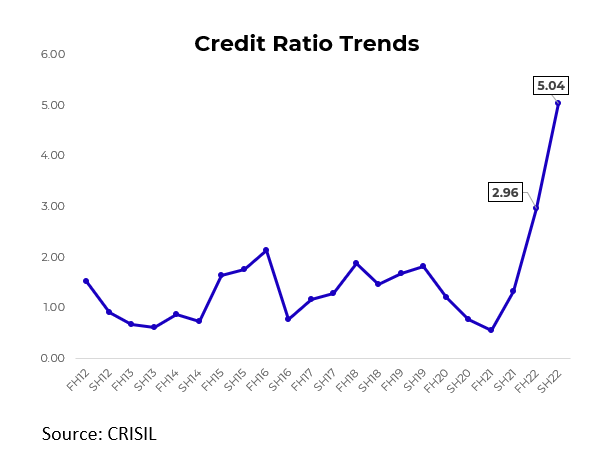

Further, the overall credit performance of the rated universe, including the Performing Credit space, has been improving since FY21 as depicted in the trend in Credit Ratio (upgrades to downgrades) below —

The above chart indicates that the credit ratio improved to over 5x in the second half of FY22 compared to under 3x in the first half of FY22.

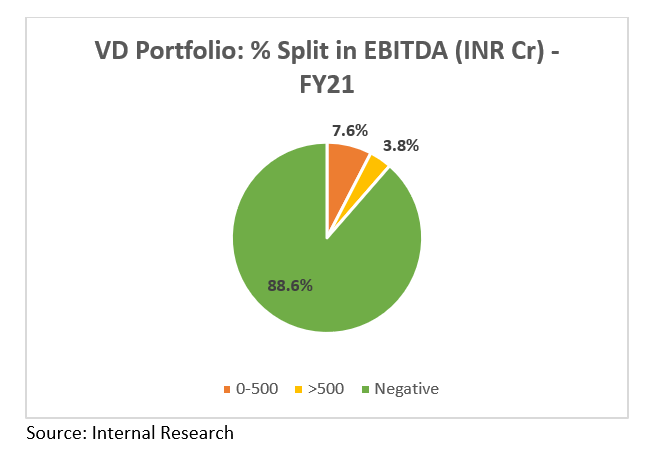

However, when we analysed ~80 VD investee portfolio companies we found that they are largely EBITDA negative with limited ability to throw cashflows.

Asset quality

The VD portfolio comprises companies that are typically unrated unlike the companies in the PC space. This could make the asset quality in the VD universe inferior, although VD investors have lately been considering the underlying business model, path to profitability, positive unit metrics, and longer runways for evaluating their investment decisions.

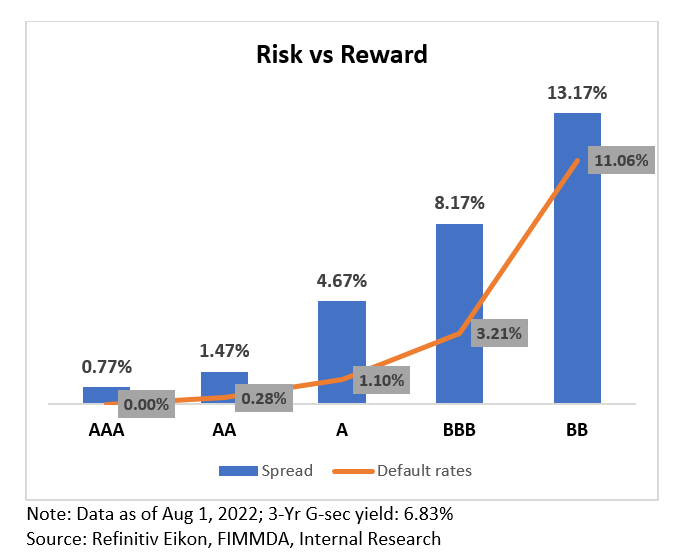

The asset quality in the PC space can be evaluated by plotting default rates across the rating scale and comparing them with respective yield spreads over 3-year G-sec.

The above chart depicts that the premium of return over risk till BBB, which is the space including PC investee companies, increased disproportionately. However, if the VD companies are ever rated, they would possibly lie in the BB and below bracket since they have unproven business models, lower vintage, mostly negative EBITDA, implying a higher risk on even principal repayments.

Apart from the asset quality, investors in VD funds need to look at the pricing of future rounds of VC investment, which determines the upside potential to overall returns. VD funds fundamentally rely on VCs to price the investee companies fairly, which enhances the value of the equity kicker. If they are not, the value of the equity kicker gets affected thereby affecting the overall returns from the fund. However, the returns from funds in the PC space are predictable as they are entirely dependent on returns from debt instruments making the risk-return spectrum not as distorted as VD funds.

Note:Excerpts from this article have been published on the 12th of Sep 2022 edition of LiveMint. To read it, please click here

Disclaimer:The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.