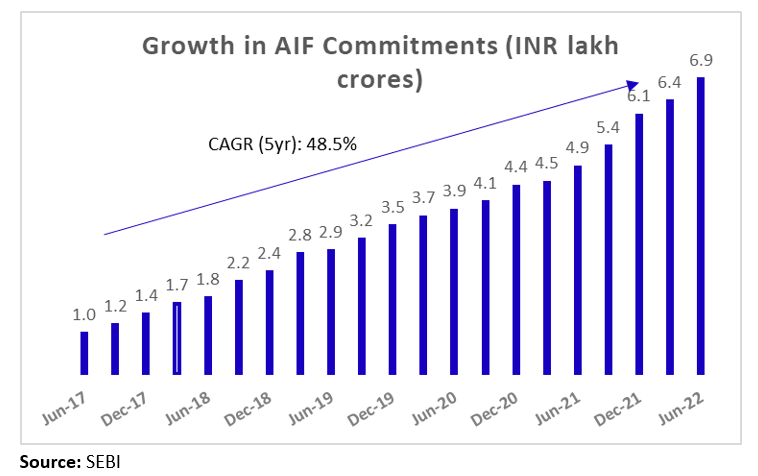

India’s AIF industry has come a long way since its inception a decade ago. What is striking about the industry is its pace of growth. The commitments raised, which denotes amount clients are willing to invest in AIFs, are expected to surpass INR 7 lakh crores within a decade in the Sep 2022 quarter. However, the mutual fund industry, which currently sits with an average AUM of ~INR 40 lakh crores (as of Nov 2022), achieved an AUM of the same level over four decades in mid-2009, after the first scheme (US-64 by UTI) was launched in 1964.

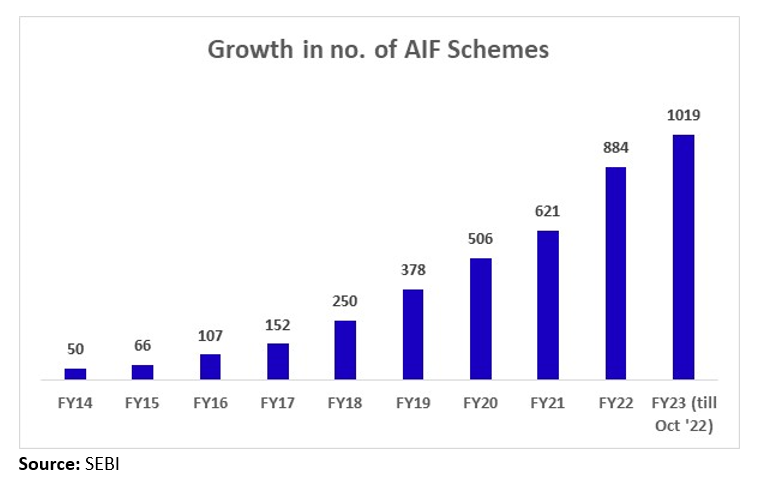

Due to increasing awareness and recognition of AIFs as a preferred alternative investment vehicle, the growth in the number of schemes was phenomenal with new entrants and demand for new schemes. In less than three years, the number of schemes more than doubled from 506 in FY20 to 1019 in FY23 (till Oct ’22).

The major factor that is driving the growth in AIFs is their low correlation to public markets, regulatory support, and their ability to provide a diversified investment portfolio, mitigating the risk profile of investors. Hence, high net-worth individuals (HNIs) and family offices are increasingly preferring AIFs instead of limiting themselves to asset classes like traditional equity and bonds to diversify risk in their portfolio. Higher volatility in the market for traditional investments due to economic consequences of Covid-19, geo-political tensions, and surging inflation have been a major concern. Given these issues, AIFs fit well into the criteria with higher risk-adjusted returns and inflation hedging.

Huge room for growth

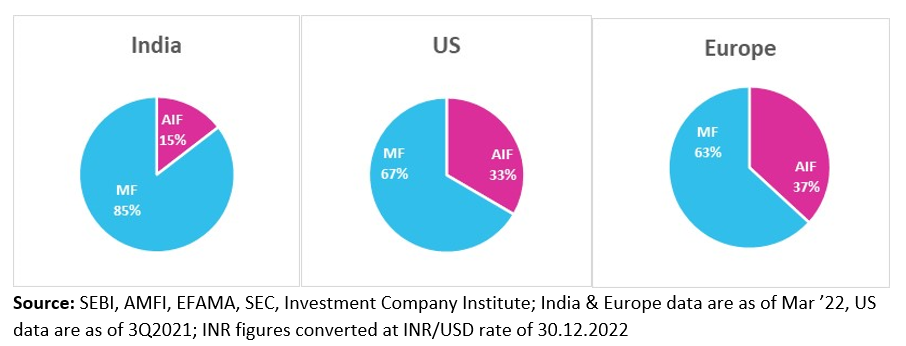

Despite the rapid growth in the number of schemes and commitments, the AIF industry is yet to mature to a much larger size given the lesser restrictions it enjoys with respect to investment in the unlisted universe compared to mutual funds and the risk-return spectrum it offers. Its potential to grow can be gauged from its share in the overall asset size of pooled investment vehicles in the country, which is much smaller than what it is in other developed countries.

As evident from the charts, AIFs in developed regions like the US and Europe account for ~30% to ~40% of the asset size of pooled investment vehicles, whereas in India it is only about 15%!

The engines of growth

(i) HNI base

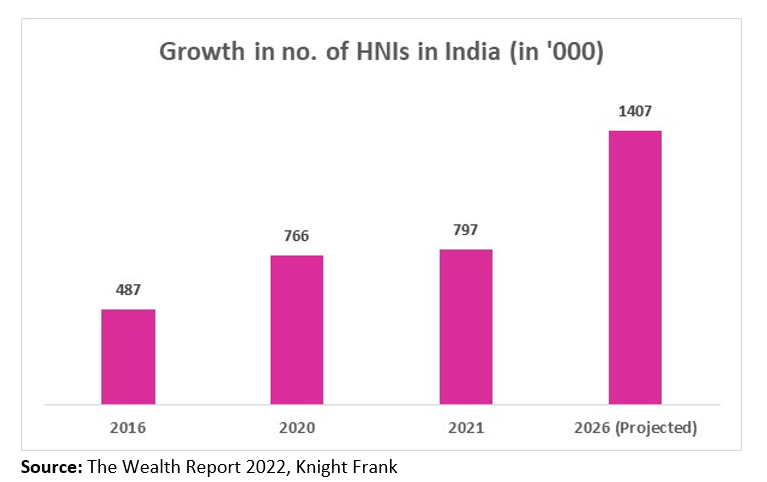

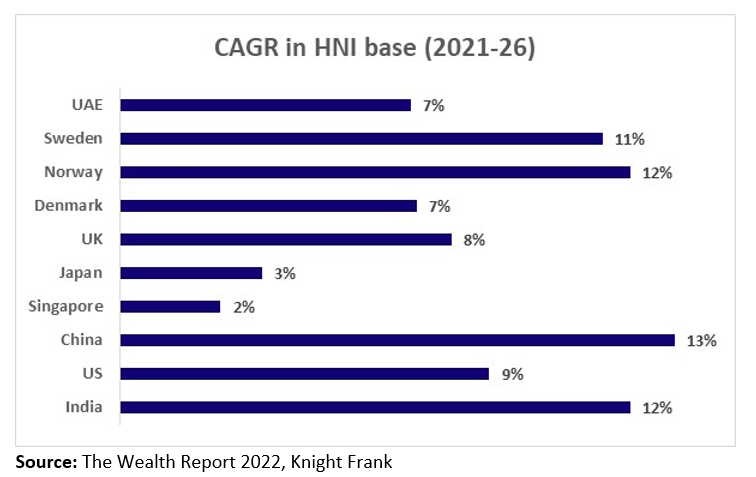

Is there inherent strength to support the growth potential of AIFs in India? There is indeed a significant pool of wealthy individuals who all can be the target group to tap the underpenetrated market. As per a recent report, the number of high net-worth individuals (HNIs), with a net worth of over US$1 million, is expected to nearly double from ~0.8 million in 2021 to ~1.4 million in 2026.

If we compare the CAGR of India’s HNI base with other countries, we found that it exceeds or is equivalent to some of the top economies across the world.

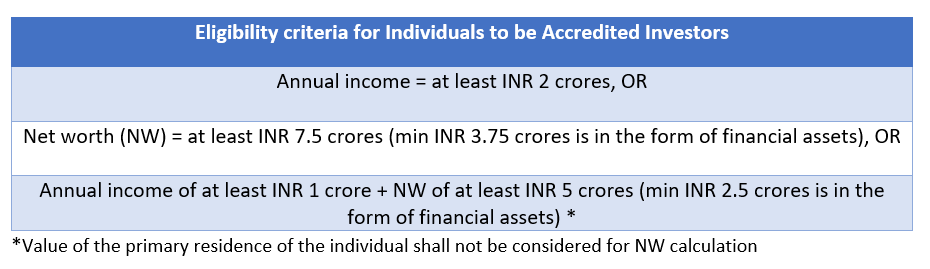

(ii) Accreditation

The Accreditation Investors framework, initiated by SEBI in 2021, holds the key to the paradigm shift in the AIF industry. This is primarily because the market watchdog has allowed Accreditation Investors under the framework to invest with ticket sizes that are lower than the stipulated minimum amount of INR 1 crore. The premise of the framework is based on a class of investors, who are equipped with good knowledge about the risk and returns of financial products, have the ability to make informed decisions about their investments, and meet certain income eligibility criteria.

Certificates for Accredited Investors would be provided by Accreditation Agencies, which can be subsidiaries of stock exchanges or depositories (National Securities Depository Limited or Central Depository Services Limited) or any other institution that meets the eligibility criteria.

The relaxed criteria in minimum investment will be able to unlock the potential of the AIF industry by enabling investors to enter the market who were previously backing off due to higher ticket sizes. The widening of the investor base, for instance, can be gauged from that of the size of the market for Portfolio Management Services (PMS), which requires a minimum investment of INR 50 lakhs per investor.

The investor base of PMS was ~1.4 lakh as of Oct 2022. Hence, given the fact that there could be 15,000 to 20,000 unique investors across all AIFs registered with SEBI, and considering the PMS base, we are looking at growth in the AIF base, which is 7-9x the current size for the near term.

(iii) Digitisation

Some mutual funds have a fully digitised onboarding process which allows seamless transaction processing with minimal Turnaround Time (TAT). Given the potential growth of AIFs due to the inclusion of smaller ticket size investors with an Accredited Investor framework, there is a need for digitising the onboarding process for AIFs.

We suggest Accreditation Agencies to consider building a digital infrastructure for AIFs for the onboarding process that would

- Reduce TAT to issue Accredited Investor certificate to the minimum, and

- Remove any back and forth between investors and Accreditation Agencies by providing a standardised format of the NW certificate.

(iv) Listing of fund units

The development of a secondary market for AIFs is essential to ensure liquidity in the AIF industry. As per Section 14 of SEBI’s AIF regulations, units of close-ended AIFs may be listed on a stock exchange subject to a minimum tradable lot of INR 1 crore, after the final close of the scheme. However, we are not aware of any AIFs listing their units till date.

The listing of AIF units would

- Ensure liquidity by allowing investors an easy exit opportunity (subject to KYC) due to dematerialisation and enabling price discovery in a demand-supply mechanism.

- Create a more enabling environment for Pension Funds, which are more inclined to investing in listed securities according to PFRDA guidelines, to invest in AIF units.

In this regard, clear operational guidelines should also be established by the regulator with respect to standardisation of contribution agreements, handling of fractionalised units, tradable lot sizes for Accredited Investors, and involvement of merchant bankers in the listing process.

The article has been covered in ET Prime on January 20, 2023. You can read it in the below mentioned link

Thinking beyond traditional investments: here’s what could revolutionise AIFs

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.