Global Economic Updates

Central bank policy actions

- The US Federal Open Market Committee unanimously held on to the 22-year high federal funds rate in a target range of 5.25%-5.5% for the second time in a row after following a spate of 11 rate hikes since March 2022 (including four in 2023) to combat inflation. This happens as the US economy showed strength and the labour market remains tight, despite the string of rate hikes.

- The Bank of Japan (BOJ) allowed more flexibility in its yield curve control as it retained the target level of its 10-year government bond yield at 0% but loosened the ‘upper bound’ to fluctuate to 1%. In its July meeting, BOJ committed to let yields fluctuate in the range of +/- 0.5 percentage points from its 0% target level. BOJ also raised the inflation forecast due to the prolonged effects of pass-through cost hikes, led by an increase in crude oil and import prices. The consumer price inflation forecast is raised from 2.5% to 2.8% for fiscal 2023; 1.9% to 2.8% for fiscal 2024; and 1.6% to 1.7% for fiscal 2025.

- The Bank of England kept its benchmark interest rates unchanged at the 15-year high level of 5.25% for the second time in a row expecting inflation to slide further to ~4.5% in 2023 before continuing to dip further in 2024. UK’s inflation came in at 6.7% in September which is well above the long-term target of 2% but it fell considerably from the peak of 11.1% reported in October 2022.

- The People’s Bank of China kept the benchmark lending rates – 1-year loan prime rate (LPR) and 5-year LPR unchanged at 3.45% and 4.20%, respectively, on the expected line. In China, new and outstanding loans are based on a 1-year LPR, and mortgage pricing is influenced by the 5-year LPR. The economic recovery of the world’s second-largest economy remains patchy calling for more monetary easing. However, such easing could put further downside pressure on the weakening yuan.

- Indonesian central bank, Bank Indonesia (BI) also kept the benchmark 7-day reverse repo rate unchanged at 6%, as expected, to support the domestic currency rupiah amid global uncertainties. The country’s inflation rose from 2.28% in September to 2.56% in October, but it remained within BI’s target range of 2%-4% for the year.

Inflation readings

- Consumer Price Inflation (CPI) in the US dipped to 3.2% YoY in October from September’s reading of 3.7% and came in below the consensus of 3.3%. The core CPI, which excludes the impact of food and energy prices, went up 4% YoY, which is below the consensus estimate of 4.1%. Food prices were up 3.3% YoY.

- CPI in the Eurozone declined to 2.9% YoY in October from 4.3% in September. The reading came in below the consensus estimates of 3.1%. The core inflation slowed to 4.2% YoY in October from 4.5% in September. Energy prices fell 11.1% compared to 4.6% in September. Inflation readings were the lowest in Belgium (-1.7%) and the Netherlands (-1%) and the highest in Slovakia (7.8%) and Slovenia (6.6%).

- CPI in the UK declined from 6.7% YoY in September to a 2-year low of 4.6% YoY in October due to the steep rise in energy costs in the comparable month a year ago. Core CPI, which strips out volatile food, energy, alcohol, and tobacco prices, declined from 6.1% in September to 5.7% in October.

- CPI in Canada declined from 3.8% in September to 3.1% in October and was in line with the consensus estimate. The main reason for the decline is the fall in gasoline prices by 7.8% YoY in October. Excluding gasoline prices, inflation came in at 3.6% in the month.

- CPI in China was -0.2% YoY in October versus flat YoY in September. Economists expected a deflation of 0.1% in the month. Producer prices declined as well by 2.6% YoY pointing to sluggish demand in the economy.

- Germany’s producer price index declined 11% YoY in October after September’s fall of 14.7% YoY, continuing the fourth consecutive month of deflationary pressures, mainly driven by energy and metal prices. The fall is also attributed to inflated commodity prices due to the Russia-Ukraine conflict in October last year, since when they started declining, partly driven by energy price caps across Europe.

Other economic indicators

- The US labour market showed signs of loosening as the job additions decelerated from 297,000 in September to 150,000 in October, missing the consensus estimate of a 170,000 rise. The slowdown is attributed to United Auto Workers strikes leading to a net loss of jobs in the manufacturing sector.

- Manufacturing activity in the US showed contraction for the 12th consecutive month in October following a 28-month period of growth. The ISM Manufacturing purchasing managers’ index (PMI) dipped to 46.7 in the month from the 10-month high of 49 in September (both below the threshold of 50 for expansion). The new orders Index remained in contraction territory as it came 3.7 points lower than the reading in September.

- China’s manufacturing activity surprisingly contracted in October after showing signs of nascent recovery lately. The manufacturing PMI dipped to 49.5 in October from 50.2 in September and missed the consensus estimate of 50.2. The Chinese policymakers announced a slew of measures (including interest rate cuts and fiscal stimulus) to support the economy. Given the recent data, analysts believe more support may be needed to reach the government’s annual growth target of ~5%.

- The service sector activity in China remained stable as depicted by the Caixin General Service PMI which rose to 50.4 in October from a 9-month low of 50.2 in September. With this, services activity in the country grew for the 10th straight month. Foreign sales increased due to the removal of travel restrictions attracting more tourists while employment stabilized.

- Germany, Europe’s largest economy, contracted as the GDP fell 0.3% YoY in the third quarter of 2023, after remaining unchanged in the prior quarter. High inflation continues to erode consumers’ purchasing power. Economists expect the contraction to continue.

- Euro zone economy contracted 0.1% QoQ in the third quarter of 2023, which is worse than market forecasts of no change. France, Spain, and Belgium reported an expansion in GDP in the quarter (0.1%, 0.3%, 0.5%, respectively), which was more than offset by contraction in Germany, nil growth in Italy, and declines in Austria, Portugal, Ireland, Estonia, and Lithuania.

- Saudi Arabia and Russia reaffirmed oil supply cuts of more than 1 million barrels a day through the end of 2023. This happens as the oil major nations want to ensure trading of global crude prices with an upside bias amid a weak demand outlook. Saudi Arabia has slashed daily output by 1 million barrels, while Russia has curbed exports by 300,000 barrels, on top of earlier cuts made with fellow OPEC+ nations.

Domestic Economic Updates

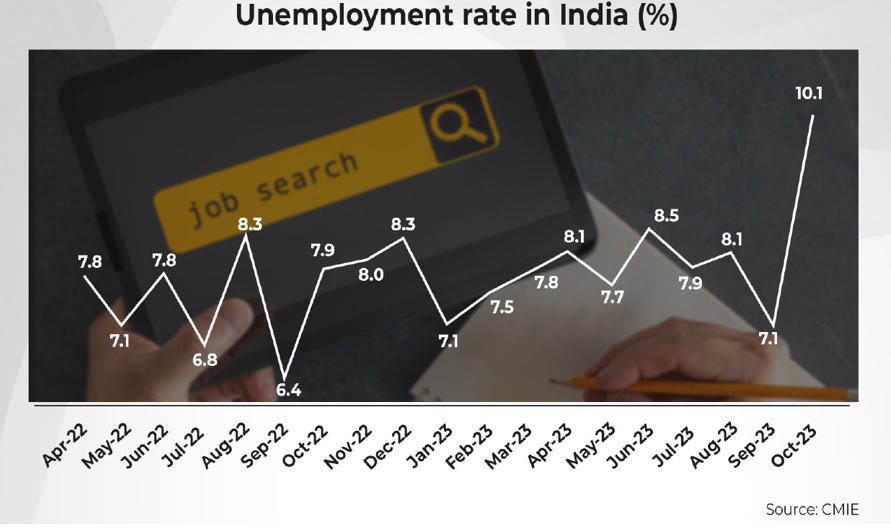

- India’s unemployment rate rose to a more than 2-year high at 10.05% in October from 7.1% in September, survey data by private research firm CMIE revealed. The rise was mainly driven by joblessness in rural India. Unemployment in rural areas surged from 6.2% to 10.8% and in urban areas eased marginally to 8.4% in October.

- The index of eight core industries rose by 8.1% YoY in September 2023 driven by growth in 7 out of 8 core sectors, viz., coal, steel, electricity, natural gas, refinery products, cement, and fertilisers. However, the growth reflected a declaration from 12.5% in August to a 4-month low in September. Crude oil sector output dipped marginally by 0.4% YoY in the month.

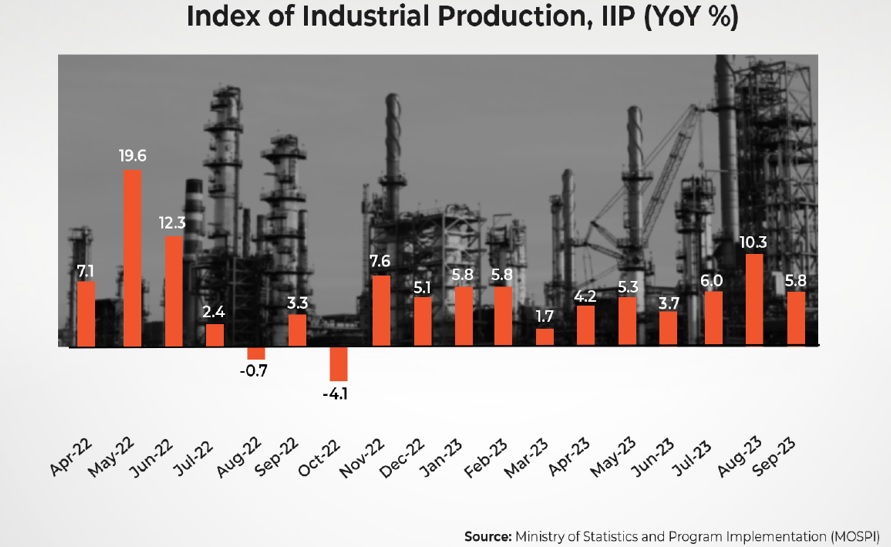

- The growth in India’s industrial production slipped from a 14-month high of 10.3% YoY in August to a 3-month low of 5.8% YoY in September due to the base effect and a deceleration in the growth of manufacturing output (accounts for 77.6% of the weight of the Index of Industrial Production) to 4.5% YoY in September from 9.3% YoY in August, electricity output to 9.9% YoY from 15.3% YoY in August, and mining sector output to 11.5% YoY from 12.3% YoY in August.

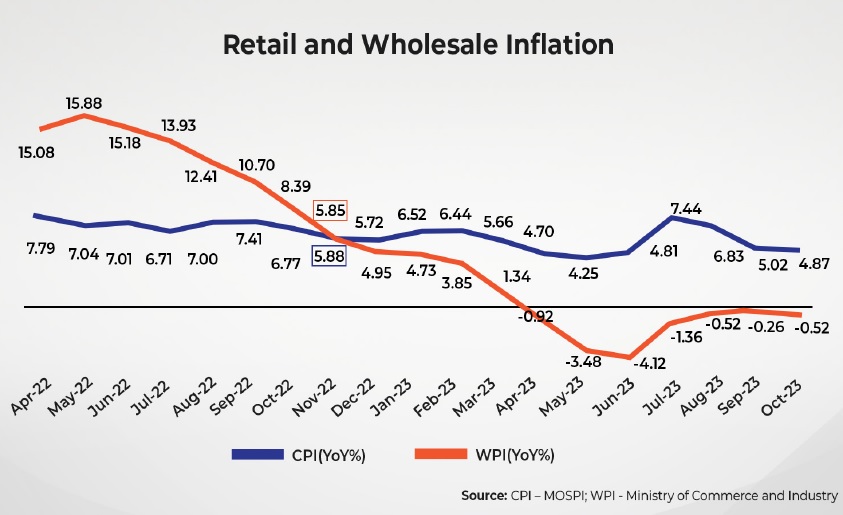

- India’s CPI softened further to a 4-month low of 4.87% YoY in October from 5.02% in the prior month due to moderation in food prices. With this, the retail inflation was recorded within the Reserve Bank of India’s tolerance band of 4-6% for the second consecutive month. Food inflation, which accounts for ~50% of the overall consumer price basket, rose 6.61% YoY in October versus 6.56% in September. Meanwhile, the country’s wholesale prices remained in the deflationary zone for the 7th consecutive month at -0.52% in October due to favourable base and easing of commodity prices. The items that witnessed a fall in prices include chemicals and chemical products, electricity, textiles, basic metals, food products, paper and paper products, etc.

- The retail inflation for agricultural labourers (AL) and rural labourers (RL) came in at 7.08% YoY and 6.92% YoY in October, which is higher than 6.70% and 6.55%, respectively in September due to higher prices of certain food items like rice, wheat atta, pulses, vegetables, milk, onion, chillies (green), spices, etc. The food inflation for AL and RL was 8.42% and 8.18% in October versus 8.06% and 7.73%, respectively, in September.

- India’s merchandise exports increased for the second time in FY24 and rose 6.2% to US$33.6 billion in October led by low base and higher non-oil exports while imports jumped 12.3% YoY to a record high of US$65.03 billion due to higher gold imports on the back of festive demand. With this, India’s merchandise trade deficit widened to an all-time high of US$31.46 billion, surpassing the previous record of US$29.23 billion in September 2022.

- Total Foreign direct investment (FDI), which includes equity capital of unincorporated bodies, reinvest earnings and other capital, decreased 15.5% YoY to US$32.9 billion during the first half of FY24 (April-September 2023), as per the data released by the Department for Promotion of Industry and Internal Trade (DPIIT). FDI equity inflows declined 24% to US$20.5 billion in the period with the same decreasing from major countries like Singapore, Mauritius, the US, the UK, and the UAE and increasing from countries like the Netherlands, Japan, and Germany. Despite the decline, Singapore emerged as the top investor with US$5.22 billion of FDI during the first half of FY24. State-wise, Maharashtra attracted the highest inflow of US$7.95 billion during the period, compared with US$8 billion in the same period a year ago.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.