“In the last few years, we have traversed one of the most difficult periods in the history of the Indian economy and, perhaps, in the global economy…It was a period of relentless turbulence and jolts, and as a country we can derive satisfaction that the Indian economy has just not navigated this period of trials successfully but has emerged stronger.” — Shaktikanta Das, Former RBI Governor

Executive Summary

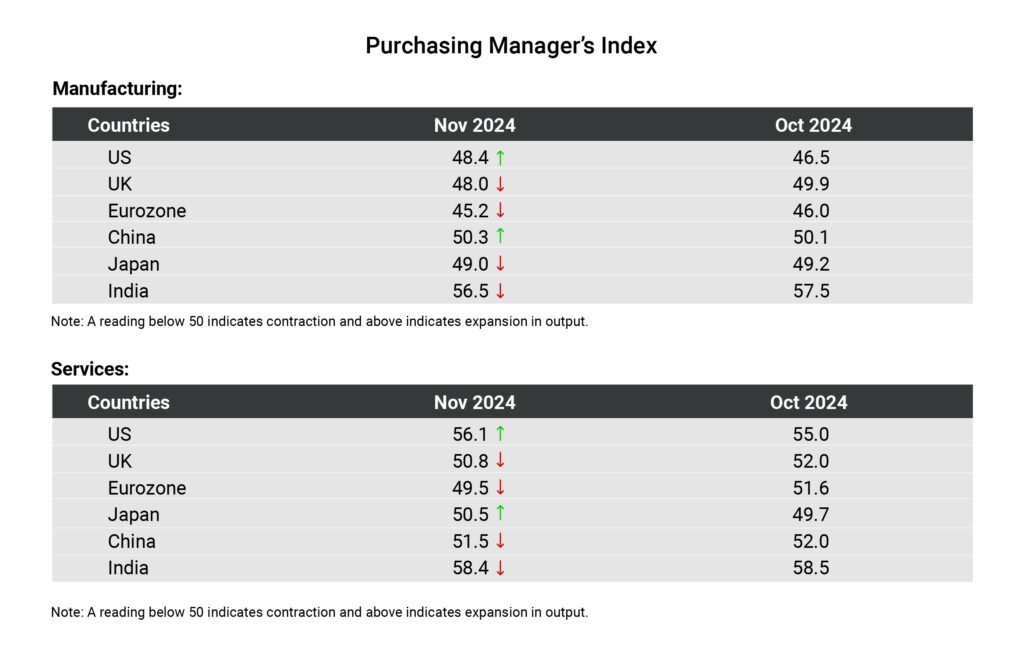

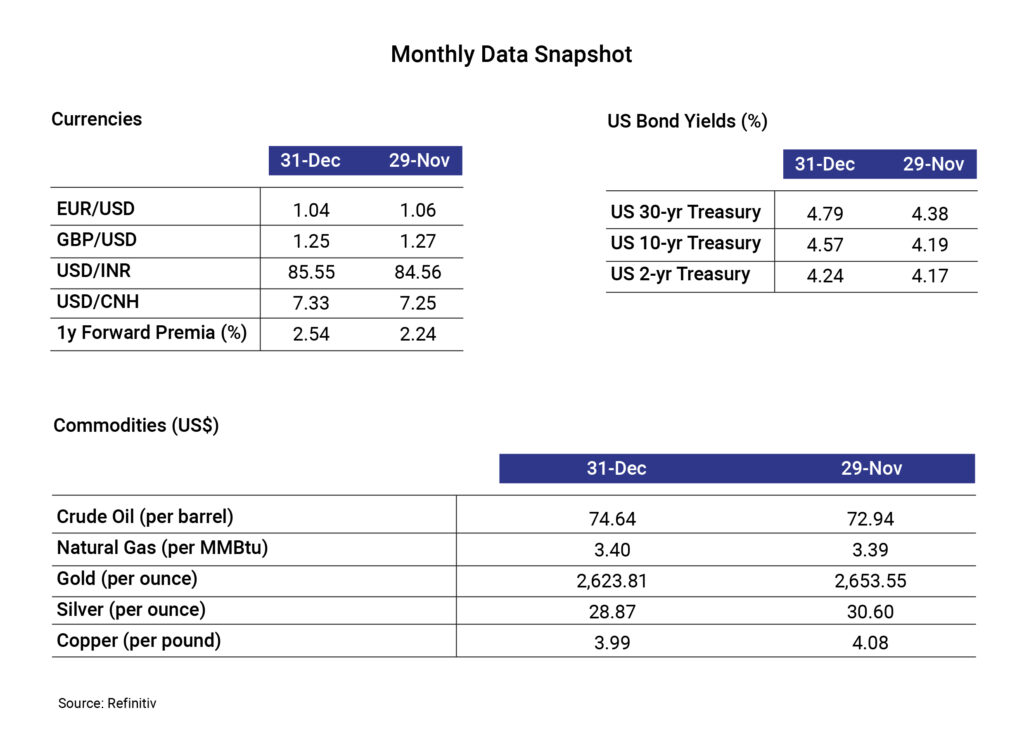

The US Fed delivered a hawkish 25 basis points (bps) cut this month, with the median dot plot rising by 50 bps for both 2025 and 2026, implying Fed members see lower rate cuts in the next two years. Chairman Powell’s tone was also hawkish during the press conference, with statements like “we are significantly closer to neutral” while saying that they would be cautious about further cuts. However, he also simultaneously noted that the policy is still sufficiently restrictive. Markets reacted with a steeper rate curve and stronger dollar index, with emerging market economies facing depreciation pressures as well. All eyes are on Trump resuming office this month, with markets anticipating tariff actions very soon. Uncertainty around policies will keep markets on edge and volatility is likely to continue. Elsewhere, the European Central Bank cut benchmark rates by another 25 bps while Japan maintained the status quo. With the slower rate cut expectations in the US in 2025 amidst a relatively stronger economy, interest rate differentials along with Trump’s expected policy measures will continue to favour stronger dollar trade.

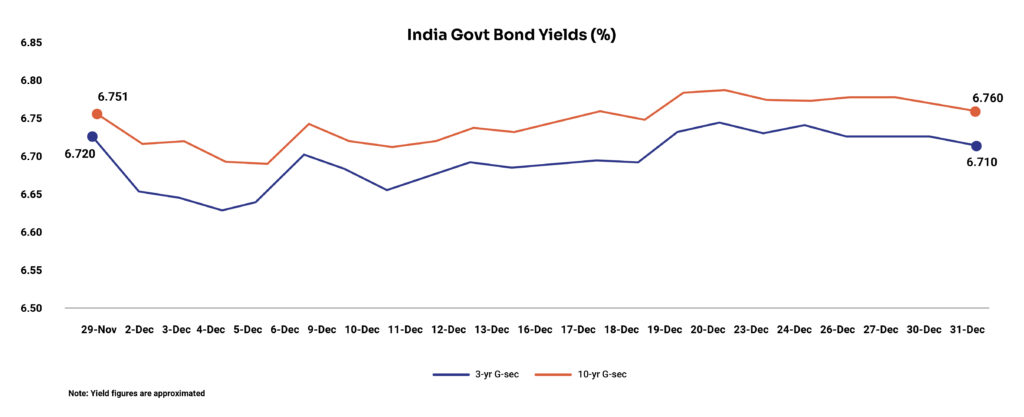

On the domestic front, RBI MPC kept rates on hold with a 4-2 vote and maintained a Neutral stance. The MPC acknowledged the tightening liquidity conditions and cut the CRR rate by 50 bps to 4% to infuse INR 1.16 lakh crore liquidity into the banking system. MPC minutes showed increasing concerns about growth and with the regime change, markets are now expecting rate cuts starting February. On the forex front, INR saw depreciation pressures, largely on the back of a stronger dollar with most Asian currencies facing the heat. The central bank continued to smoothen the move. The forex reserves are down about 10% from the peak US$705 billion, a majority of which was spent to smoothen INR depreciation. Despite the drawdown, the currency buffer still remains strong and will help the central bank in containing volatility.

Domestic Updates

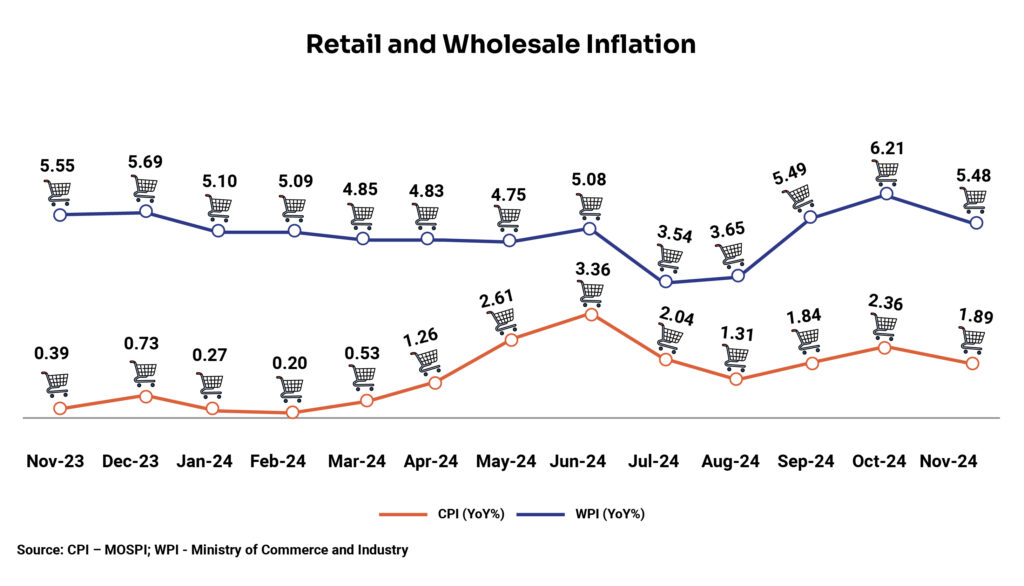

India’s retail inflation moderates closer to RBI’s upper band, wholesale inflation shrinks

The retail inflation in India, measured as a change in the Consumer Price Index (CPI), eased to a 3-month low of 5.48% YoY in November, returning to the RBI`s target band of 2-6% from 6.21% YoY in October 2024. The softening is attributed to food inflation, which accounts for ~40% of the overall basket and fell to a 3-month low of 9.04% YoY in November from 10.87% YoY in October. The significant decline in vegetable inflation from 42.18% YoY in October to 29.33% YoY in November mainly contributed to the declaration of food inflation.

Inflation based on the wholesale price index (WPI) slightly dropped to 1.89% YoY in November from a 3-month high of 2.36% in October. Inflation for primary articles softened to 5.49% in November from 8.09% in October, while inflation for the manufacturing segment further increased to 2% in November from 1.5% in October.

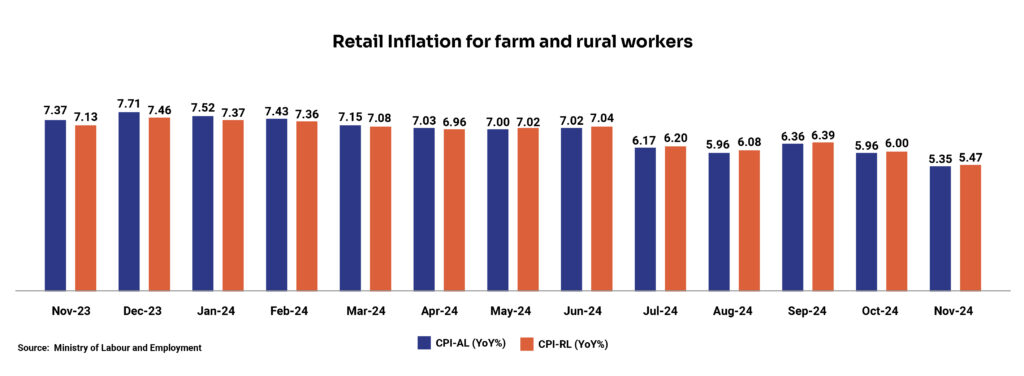

Meanwhile, retail inflation for farm and rural workers dipped to 5.35% YoY and 5.47% in November 2024, respectively, from 5.96% YoY and 6.00% in the previous month.

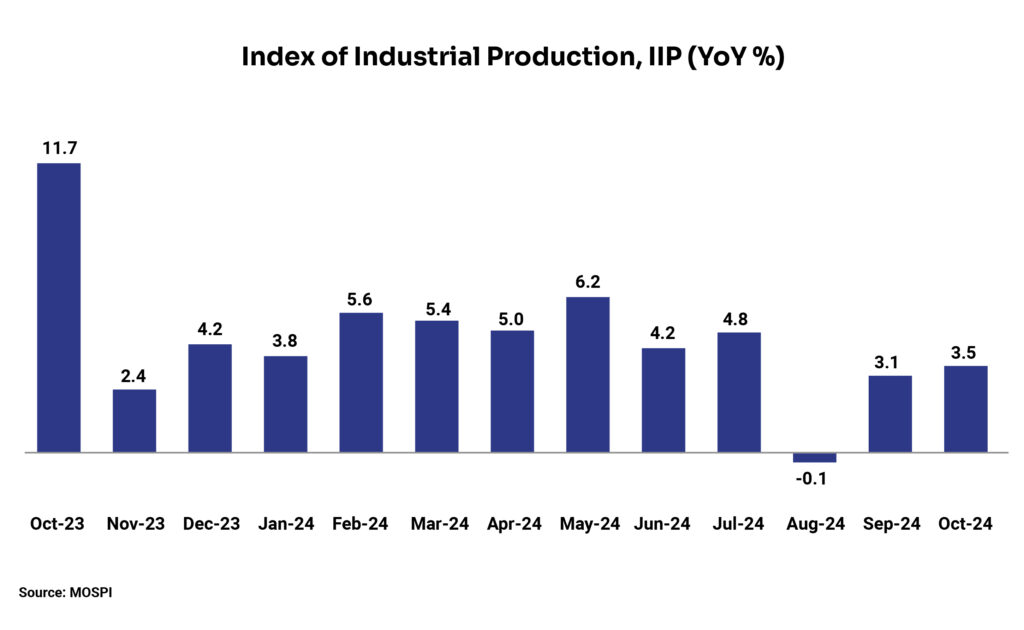

India’s industrial output rises led by manufacturing

India’s industrial output, as measured by the Index of Industrial Production (IIP), edged up to 3.5% in October from 3.1% in September. This increase was driven by the manufacturing sector output, which grew by 4.1% in October compared to 3.9% in September. The other core industries output, including mining and electricity, witnessed a moderate growth of 0.9% and 2%, respectively.

RBI MPC maintains status quo, cuts CRR

The Reserve Bank of India (RBI) kept the repo rate unchanged at 6.5% in its 5th bi-monthly monetary policy committee (MPC) meeting of FY25 with a 4:2 majority. With this, the benchmark rate has been kept unchanged for the 11th straight meeting. The MPC maintained its policy stance at ‘Neutral’, which allows flexibility to track the progress of inflation and growth and take appropriate actions when necessary.

The cash reserve ratio (CRR) was cut by 50 bps to 4% in response to ongoing liquidity stress in the banking system. The CRR reduction is expected to release INR 1.16 lakh crore into the banking system in 2 tranches and support credit growth and economic activity.

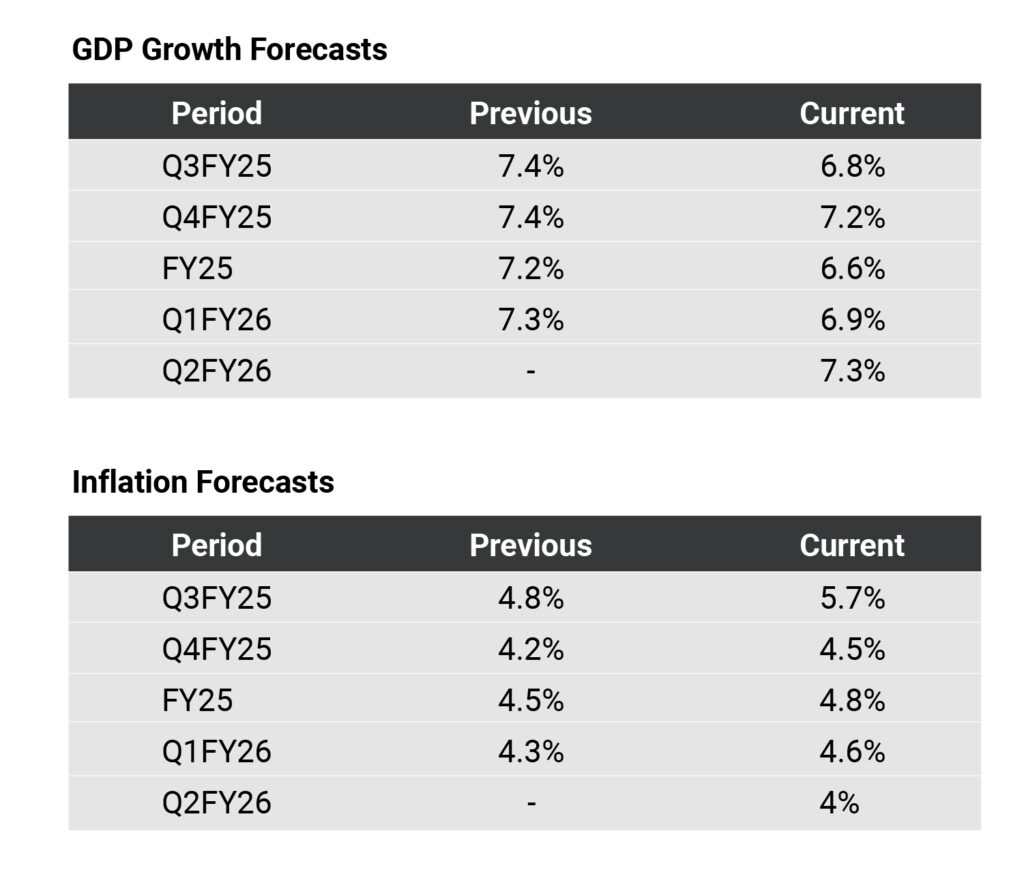

Following are the revisions in GDP growth and Inflation forecasts announced by the MPC:

RBI enhances limit for collateral free loan for farmers

In another move, the RBI has enhanced the collateral-free loan limit for farmers from INR 1.6 lakh to INR 2 lakh, effective January 1, 2025, in an effort to support small and marginal farmers amid rising input costs. As per RBI directives, banks across the country are asked to waive collateral and margin requirements for agricultural and allied activity loans up to INR 2 lakh per borrower.

Indian household debt surge, RBI FSR

According to the RBI’s Financial Stability Report (FSR), the debt of Indian households increased to 42.9% of GDP (at current market prices) in the second quarter of 2024 from 42.7% of GDP in the first quarter of 2024. However, as per RBI, it indicates a positive trend as the surge is primarily driven by an increase in the number of borrowers rather than a rise in average indebtedness per individual. As of March 2024, borrowing by individuals accounted for 91% of total household financial liabilities. Three main factors are identified for household borrowing: Consumption (personal loans, credit card debt, and loans for consumer durables), asset creation, and productive activities.

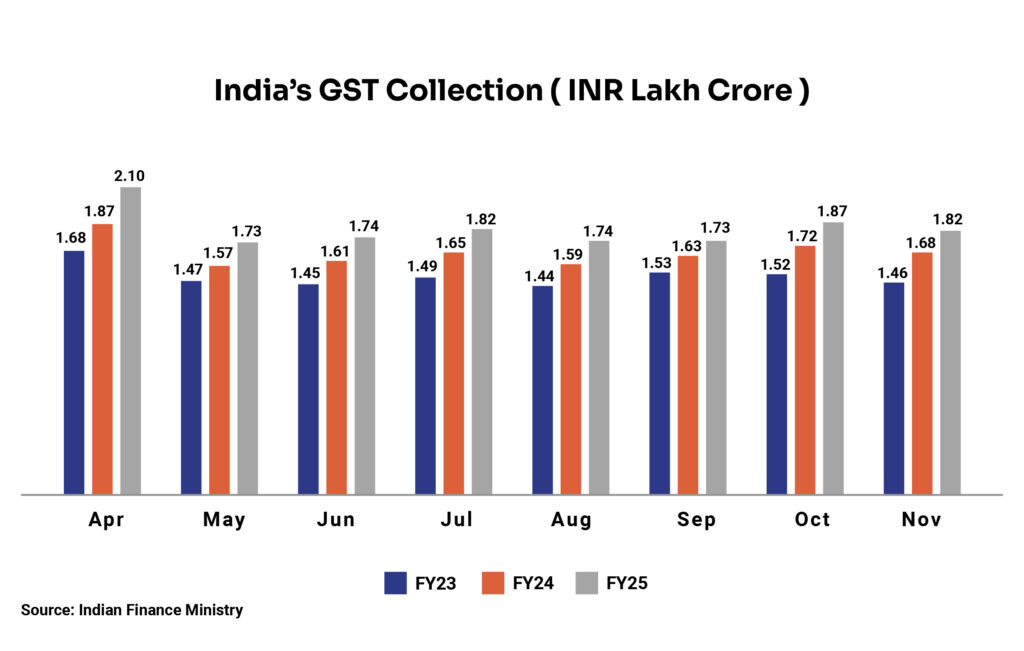

GST collections grew substantially

India’s GST collection grew 8.5% YoY to INR 1.82 lakh crore in November 2024. Among the states, Maharashtra had the top collection (INR 29,948 crore) followed by Karnataka (INR 13,722 crore), Gujarat (INR 12,192 crore), Tamil Nadu (INR 11,096 crore), and Haryana (INR 9,900 crore). For the April-November period, tax collections increased by 9.3% YoY to INR 14.57 lakh crore in FY25.

Finance Ministry of India, ADB projects India’s FY25 GDP growth at 6.5%

The Asian Development Bank (ADB) has revised India’s GDP growth forecast lower to 6.5% from its previous estimate of 7% due to lower-than-anticipated growth in private investment and housing demand. As per the multilateral development bank, changes in US trade, fiscal, and immigration policies could adversely impact growth and inflation in developing Asia and the Pacific.

The Finance Ministry of India in their Monthly Economic Review has projected economic growth at 6.5% in FY25 after a decline in growth from 6.7% in the April-June quarter to 5.4% in the July-September quarter, driven by gains in agricultural and industrial activities. The ministry’s outlook is also based on a favourable demand outlook in rural and urban areas in the initial months of H2FY25.

The Organisation for Economic Co-operation and Development (OECD) upgraded its growth forecast to 6.8% from its earlier estimate of 6.6% due to growth in investments and recovery in the agricultural sector.

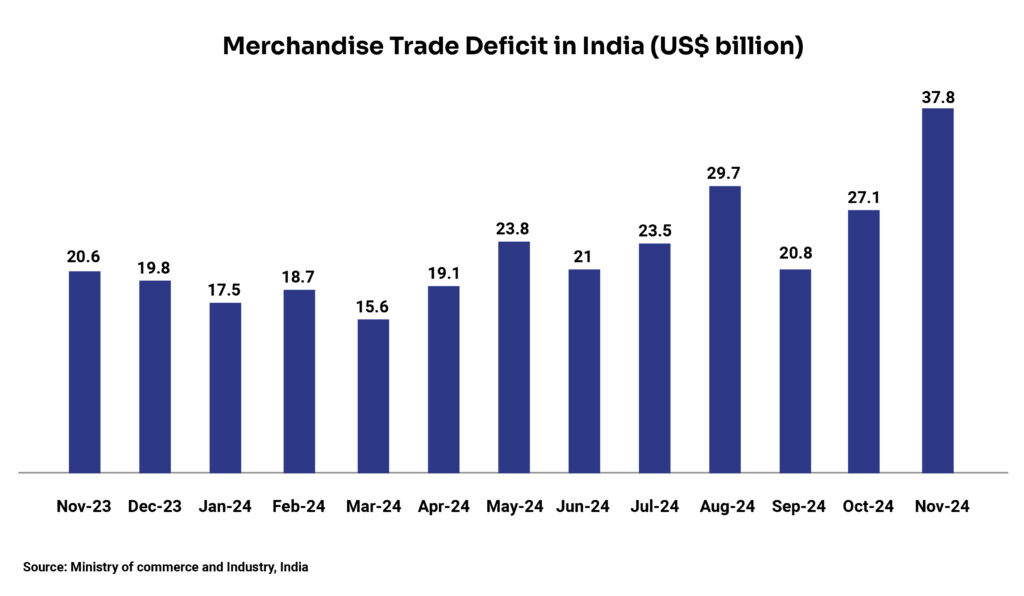

India’s trade deficit reaches record high

India’s merchandise trade deficit rose to an all-time high of US$37.8 billion in November widening sharply from US$20.6 billion in November 2023. This was driven by a contraction in merchandise exports by 4.8% YoY to US$32.11 billion and a 27% YoY rise in imports to US$69.95 billion, which is an all-time high.

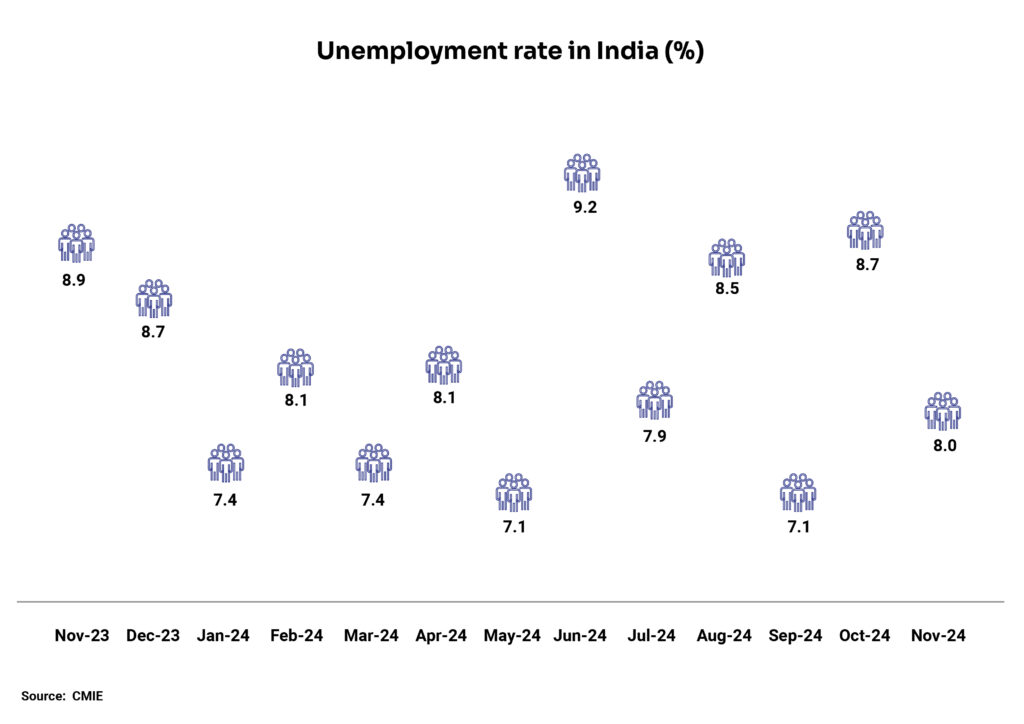

India’s unemployment rate abates

The unemployment rate in India fell from 8.7% in October to 8% in November, according to the survey by the Centre for Monitoring Indian Economy (CMIE). The labour force participation rate (LPR), which is measured as a percentage of the working-age population, fell from 41.2% in October to 40.8% in November suggesting that fewer people were actively looking for a job.

India’s forex reserves continue to decline

India’s foreign exchange reserves dropped by US$4.1 billion to a 3-month low of US$640.28 billion as of December 27. The major contributor to this decline is US$4.6 billion decline in Foreign Currency Assets (FCAs) to US$551.92 billion. This reduction in reserves is attributed to RBI’s efforts aimed at stabilising the depreciation of the Rupee.

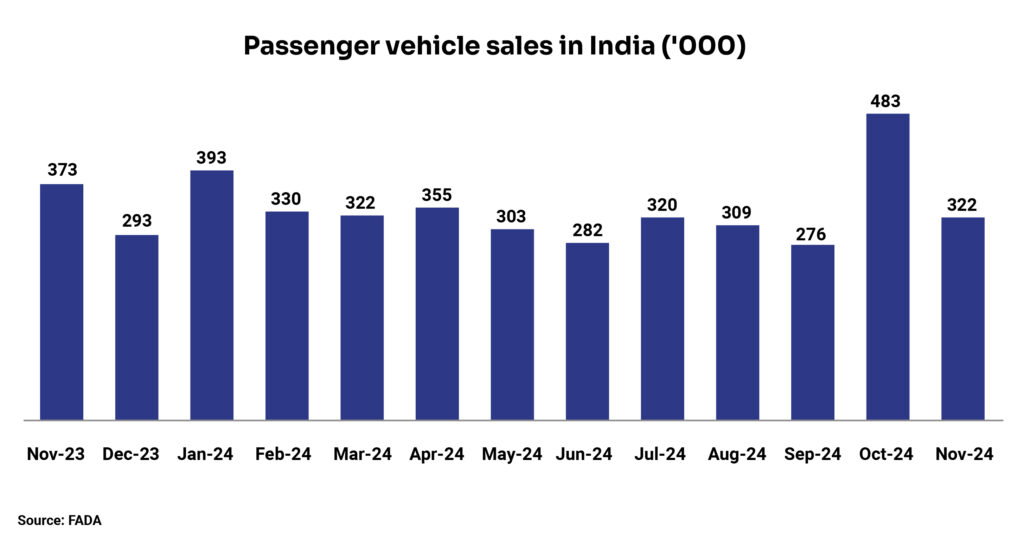

Passenger vehicle sales nosedive

Total passenger vehicle sales in India decreased ~14% YoY to 321,943 units in November from 483,159 units in October, as per the data from the Federation of Automobile Dealers Association (FADA). The auto dealers attribute the decline to the shift of festive demand to October, weak market sentiment, and limited new launches. However, 2-wheeler sales grew 15.8% YoY due to rural demand and year-end offers while 3-wheeler sales witnessed a comparatively modest growth of 4.2% YoY in November.

Global Update Roundups

Monetary policies

- US: The US Federal Reserve cut the benchmark interest rate by a quarter percentage point, as expected while cautioning about additional cuts in 2025 that will depend on the progress in lowering stubbornly high inflation. The overnight borrowing rate has been reduced to a target range of 4.25%-4.5%, which is back to the level of December 2022. The dot plot matrix suggested that there could be only two more cuts in 2025. Over the longer term, the Federal Open Market Committee (FOMC) sees the “neutral” funds rate at 3%. The FOMC raised its GDP growth forecast for full-year 2024 by half a percentage point to 2.5%. However, the FOMC officials expect GDP growth to decelerate to 1.8% in the long term. Expectations for headline and core inflation were pegged at 2.4% and 2.8%, respectively, slightly higher than September estimates and above the Fed’s 2% target. The projection for the unemployment rate is lowered to 4.2% for 2024.

- ECB: The European Central Bank (ECB) lowered the three key interest rates — deposit facility, the main refinancing operations, and the marginal lending facility — by 25 bps to 3%, 3.15%, and 3.4%, respectively, with effect from 18 December 2024. The rate cut, the fourth one in 2024, is based on the revised outlook on inflation trajectory and its dynamics as well as the strength of monetary policy transmission. Headline inflation averaged 2.4% in 2024 and is expected to be 2.1% in 2025, 1.9% in 2026, and 2.1% in 2027. The ECB expects inflation to settle near the Governing Council’s 2% medium-term target on a sustained basis. Secondly, financial conditions are easing with the gradual transmission of rate cuts making debt cheaper for firms and households. However, the transmission is yet to run its full course making the debt market still tight.

- UK: The Bank of England’s Monetary Policy Committee (MPC) kept the benchmark bank rate unchanged at 4.75% in its December meeting in a majority vote of 6:3. This happens as the MPC adopts a medium-term outlook with a forward-looking approach to achieve the 2% inflation target on a sustainable basis. Since the previous meeting, the 12-month consumer price inflation rose to 2.6% in November from 1.7% in September, mainly driven by stronger inflation in core goods and food.

- China: The People’s Bank of China kept the one-year medium-term lending facility (MLF) rate steady at 2% as it aims to stabilize the domestic currency that has come under pressure following Donald Trump’s victory. The offshore yuan has lost more than 2% since the U.S. presidential election on November 5 and roughly 3.3% against the USD since Sep 24 when Beijing started the initial round of stimulus announcements.

- Japan: The Bank of Japan kept its benchmark interest rate unchanged at 0.25% in order to take more time to assess the impact of financial and foreign exchange markets on Japan’s economy. The decision was based on a majority decision vote of 8:1. “In particular, with firms’ behaviour shifting more toward raising wages and prices recently, exchange rate developments are, compared to the past, more likely to affect prices,” the bank added.

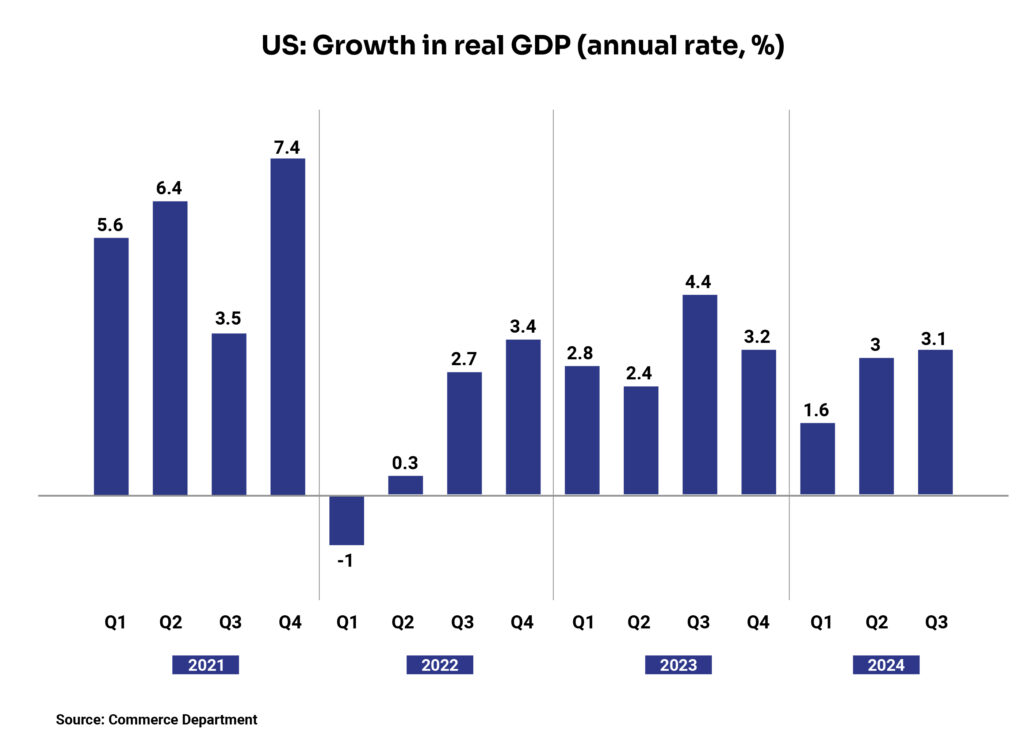

GDP growth

- US: The GDP grew at an annualized rate of 3.1% in Q3CY24, surpassing the second estimate of 2.8% growth and the previous quarter growth of 3% growth recorded. The growth is driven by an acceleration in the pace of personal spending growth (3.7% vs 3.5% in the second estimate) driven by a robust increase in consumption of goods (5.6%) and spending on services (2.8%).

- Japan: The growth in the economy decelerated to 1.2% YoY in Q3CY24 from 2.2% in Q2. However, the growth was higher than the consensus estimates of 0.9%. The sluggish growth is attributable to moderation in capex due to rising interest rates and softer government spending.

- Euro Area: The GDP growth accelerated to 0.4% on a seasonally adjusted QoQ basis in Q3CY24 from 0.2% in Q2 and to 0.9% in Q3 from 0.5% rise in Q2 on an annual basis, marking the strongest growth since Q1CY23. The uptick was driven by a boost in private consumption (0.7% in Q3 vs no growth in Q2) aided by softer price pressure and a rebound in fixed investment (2% in Q3 vs -2.4% in Q2)

- UK: The pace of growth in the British UK economy quickened to 0.9% YoY in Q3CY24 from 0.7% YoY in Q2CY24, marking the highest growth since Q1CY23. The improvement is led by household spending and gross fixed capital formation partially offset by a slower than expected rise in government spending.

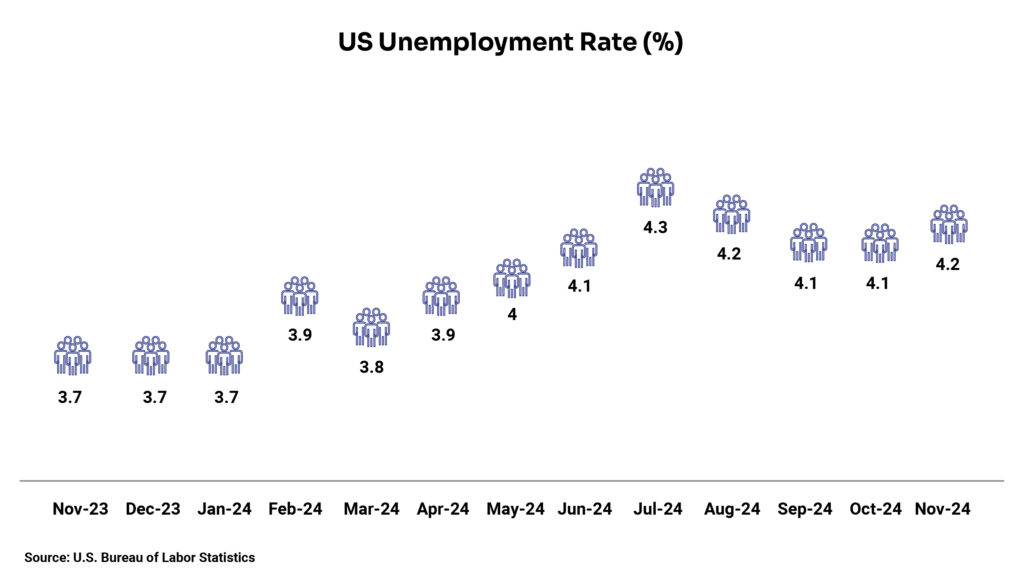

Unemployment

- US: The unemployment rate inched up to 4.2% in November from 4.1% in October and 3.7% in November 2023. The number of unemployed individuals stood at 7.1 million in the month, up from 6.3 million a year earlier. The labour force participation rate, which indicates the percentage of working-age individuals who are employed or actively looking for work, declined to 62.5% in the month.

- Canada: The unemployment rate in Canada rose to the highest level since September 2021 at 6.8% in November from 6.5% in October and surpassed the market consensus of 6.6%. In absolute terms, the number of unemployed increased substantially by 87,300 to 1,516,300 in the month as joblessness rose among the youth, the core aged population, and the older population. The labour force participation rate rose to a 3-month high of 65.1%.

- China: Unemployment in China remained unchanged at 5%, which is a 5-month low, meeting market expectations. The jobless rate for local registered residents rose 0.1 percentage points (pp) to 5.2%, non-local registrants to 4.6%, and non-local agricultural registrants to 4.4%.

- Japan: Japan’s unemployment rate was 2.5% in November 2024, remaining steady for the second consecutive month. The non-seasonally adjusted labour force participation rate increased to 63.5% in November from 63.1% in November 2023. The jobs-to-applications ratio remained at its highest level in 6 months at 1.25 for the second consecutive month.

- Euro: The unemployment rate remain unchanged at 6.3% in November for the second consecutive month. The number of unemployed decreased by 39,000 MoM and 333,000 YoY to 10.8 million.

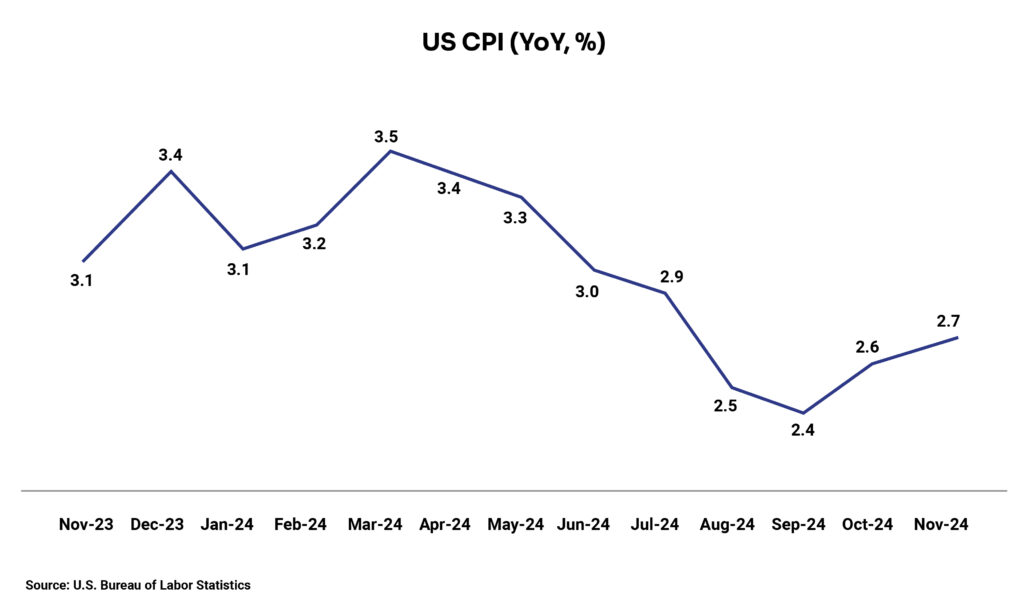

Inflation readings

- US: The inflation rate accelerated for the second month to 2.7% YoY in November 2024 from 2.6% in October. The persistent rise in wages leading to higher consumer spending is one of the main contributing factors to the rise in inflation. The core inflation, which excludes volatile food and energy costs, rose 3.3% YoY, the same as in the previous month. Over the past three months, the core CPI averaged 3.7% at an annualized rate. Segment-wise, food, energy, medical care, and recreation indices increased during the month.

- Eurozone: The inflation rate accelerated to 2.2% YoY in November from 2% in October but decelerated from 2.4% in November 2023. Segment-wise, the largest contributors to inflation are services (+1.74 pp), food, alcohol & tobacco (+0.53 pp), non-energy industrial goods (+0.17 pp), and energy (-0.19 pp).

- UK: The inflation rate in the UK accelerated for the second month to 2.6% in November from 2.3% in October, moving further beyond the central bank’s target (2%) but meeting the consensus estimates. It’s the highest inflation recorded in 8 months led by a faster pace of price rises of recreation and culture (3.6% vs 3% in October), housing and utilities (3% vs 2.9%), and food and non-alcoholic beverages (2% vs 1.9%).

- China: China’s inflation slowed to 0.2% YoY in November from 0.3% in October, marking it the lowest level since June and the consensus estimates of 0.5%. The fall in inflation is attributed to a slowdown in food prices at 0.1% YoY. Non-food inflation bounced to 0% after two months of YoY deflation.

- Japan: The inflation rate rose to the highest level since October 2023 at 2.9% YoY in November. It rose from 2.3% in October led by a steep rise in food prices (4.8% vs 3.5% in October). Also, it was led by an acceleration in prices of electricity (9.9% vs 4.0%) and gas prices (5.6% vs 3.5%) due to the absence of energy subsidies since May.

Consumer confidence

- US: The consumer confidence index fell to 104.7 in December from an upwardly revised 112.8 in November reflecting pessimism on current business conditions. This decline is further fuelled by negative sentiments on labour market, particularly on job opportunities. Moreover, consumers were also less optimistic about the future business conditions.

- Japan: The Japan’s consumer confidence index dropped to 36.2 in December from 36.4 in November, below the market forecast of 36.6. This was driven by a marginal decline in sentiment to buy durable goods (29.4 vs. 29.9 in November) and a weaker outlook on overall livelihood (34.1 vs. 34.3), partially offset by higher optimism about employment (41.2 vs. 41.0) and steady confidence in income growth (at 40.2).

- UK: The GfK Consumer Confidence Index in the UK shows a minor improvement of 1 point from -18 in November to -17 in December, showing growth momentum for the second month in a row. However, the consumer sentiment on the UK`s economic outlook is still gloomy.

- Euro: The consumer confidence fell 0.8 points to -14.5 in December from -13.7 in November, below the market expectations of -14. This marked the lowest reading since April 2024.

Balance of Trade

- US: In November 2024, the trade deficit broadened to US$78.2 billion from US$73.6 billion in October (revised). Exports increased 2.7%, reaching a new high of US$273.4 billion, driven by vehicle sales, and sale of crude oils and petroleum products, among others. Imports grew 3.4% to US$351.6 billion in November driven by the purchase of semiconductors, food, beverages, crude oil, and gold, among others.

- China: China’s trade surplus grew 40% to US$97.44 billion in November 2024 from US$69.45 billion in November 2023, surpassing the forecast of US$95 billion. Exports surged 6.7% YoY, below the estimate of 8.5% and slowing from October’s increase of 12.7% as manufacturers placed orders in advance in anticipation of higher tariffs from the US. Imports fell 3.9% YoY, falling further from 2.3% in October due to slower domestic demand.

- UK: The UK’s trade deficit rose 7.5% to £3.72 billion in October from £3.46 billion in September. Imports grew 1.3% MoM to £72.60 billion, while exports grew 1.0% to £68.88 billion.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.