“Interest rates are to asset prices what gravity is to the apple” – Warren Buffett

Executive Summary

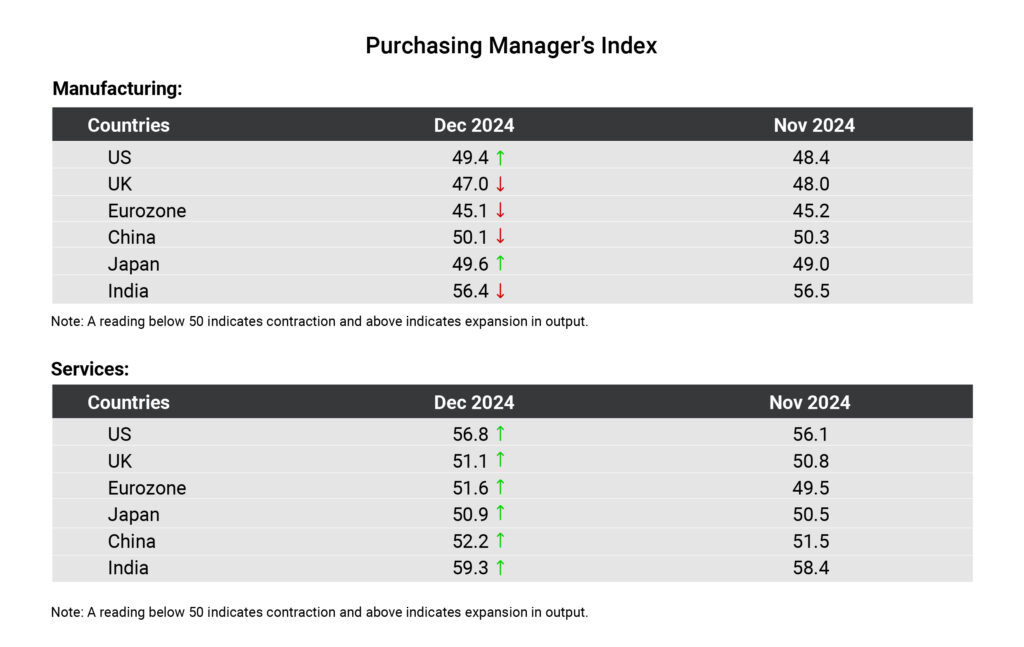

The year 2025 had a volatile start with President Trump’s inauguration and tariffs in play. While tariffs weren’t levied on the first day as widely anticipated, they did eventually find their way through the month, though not by the same magnitude as part of his poll promises. Meanwhile, the US Fed stayed the course in the first meeting of the year, keeping rates unchanged. However, the central bank’s tone was perceived to be marginally on the hawkish side. The CPI reading was comforting for markets with headline in line with expectations and core CPI a tad softer. Treasuries rallied across the curve on the back of this from intra-month highs, and the dollar index also showed marginal retracement. Elsewhere, the European Central Bank (ECB) continued its rate cut path while the Indonesian Central Bank surprised with a cut with a focus on growth and Japan hiked. With uncertainty around US policies, markets will likely remain volatile in the near future.

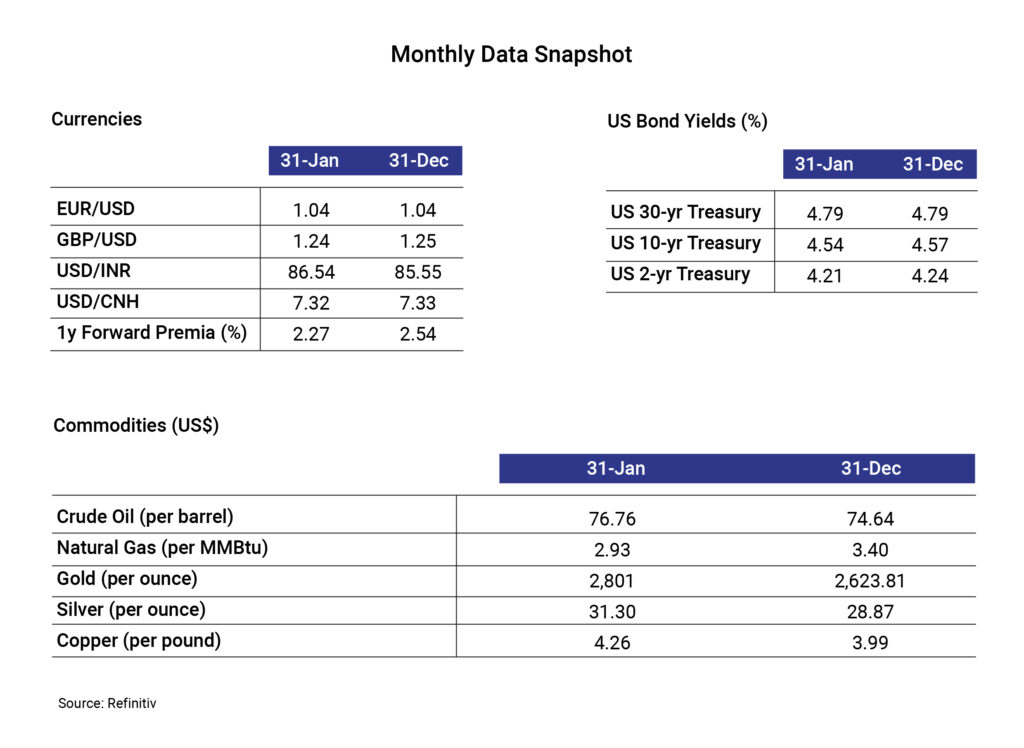

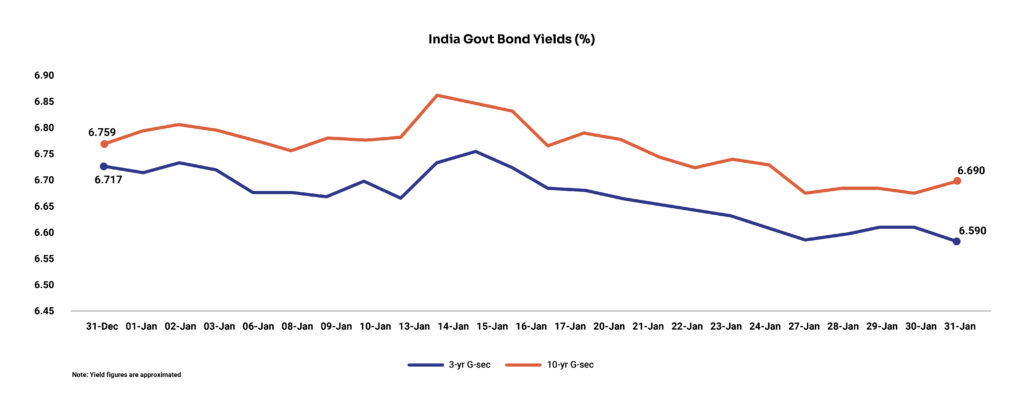

On the domestic front, the Reserve Bank of India (RBI) came up with measures to ease the system liquidity deficit, including Open Market Operations, FX Swaps, and VRR auctions. The consumer price inflation (CPI) moderated, while Index of Industrial Production (IIP) data came in stronger, with improvements across segments. On the currency side, strong depreciation pressures on INR were noted after an extended period of calm earlier in 2024, stemming from stronger USD, weaker balance of payments (BoP), with stress on capital account balance on the back of non-stop foreign portfolio investors (FPI) withdrawals from the equity segment. A large part of the pressure on the currency is on account of the stronger USD, with INR finally catching up to its emerging market peers. The new RBI regime also seems to be more comfortable with some volatility in the currency pair as opposed to the previous regime which kept the pair in a tight range with a weaker BoP position and continued strength in the dollar index.

Domestic Updates

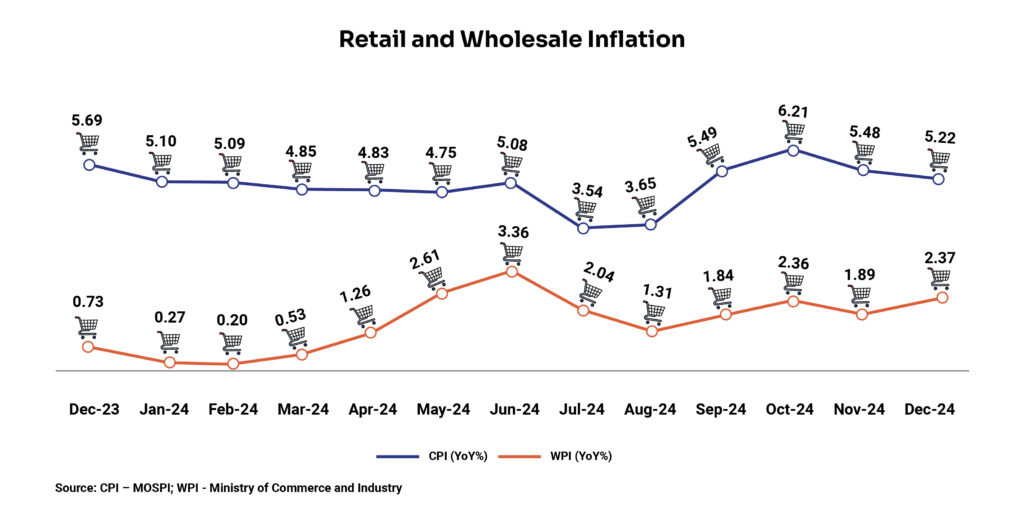

India’s retail inflation abates to 4-month low, wholesale inflation rises

The retail inflation in India, measured as a change in the Consumer Price Index (CPI), moderated to a 4-month low of 5.22% YoY in December from 5.48% YoY in November. This is attributable to food inflation that declined to a 4-month low of 8.39% YoY in December from 9.04% YoY in November. Vegetable inflation, that contributes significantly to the food inflation, also fell to 26.56% in December from 29.33% YoY in November.

Inflation based on the wholesale price index (WPI) rose to a 6-month high of 2.37% YoY in December from 1.89% YoY in November. The rise is attributed to higher inflation for primary articles (which includes food articles, non-food articles, and minerals) to 6.02% in December from 5.49% in November, while inflation for the manufacturing segment edged up 2.14% in December from 2% in November.

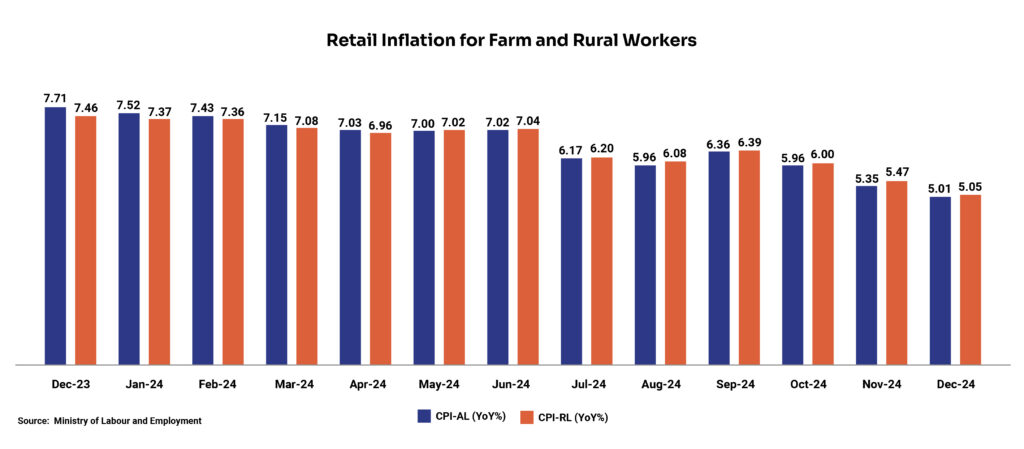

Meanwhile, retail inflation for farm and rural workers softened further to 5.01% YoY and 5.05% in December, respectively, from 5.35% YoY and 5.47% in the previous month.

The retail inflation for industrial workers (IW), measured by the CPI-IW, fell to 3.88% in November from 4.41% in October.

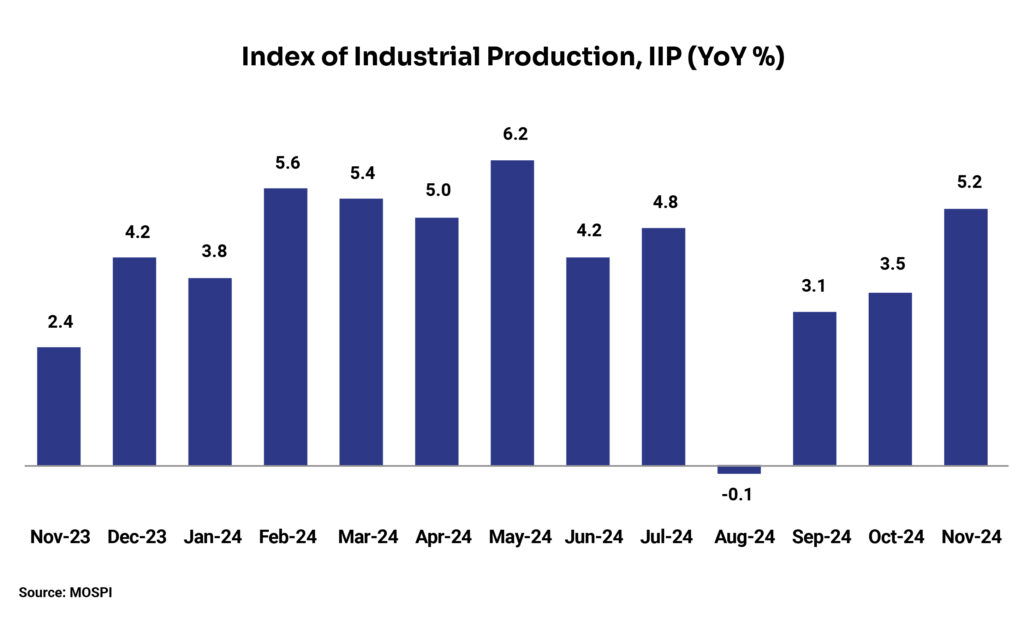

India’s industrial output growth accelerates to a 6-month high

India’s industrial output, as measured by the Index of Industrial Production (IIP), rose to a 6-month high of 5.2% in November from 3.5% in October. All three sectors in the IIP basket Manufacturing, Mining and Electricity contributed towards this growth. Manufacturing sector output grew 5.8%, while mining, and electricity output witnessed a growth of 1.9% and 4.4% respectively in November.

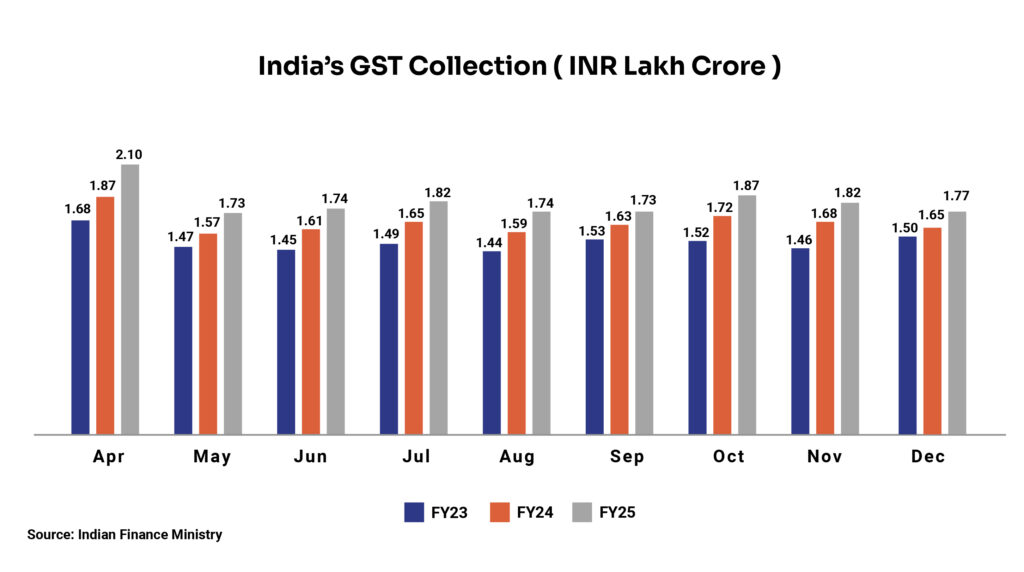

Centre’s GST collections shrink

India’s GST collections in December declined to a 3-month low of INR 1.77 lakh crore but increased 7.3% YoY. Among the states, Maharashtra recorded the highest collection (INR 29,260 crore) followed by Karnataka (INR 12,526 crore), Tamil Nadu (INR 10,956 crore), Gujarat (INR 10,279 crore), and Haryana (INR 10,403 crore). Net GST collections grew by 3.3% to INR 1.54 lakh crore in December 2024 from INR 1.49 lakh crore in December 2023.

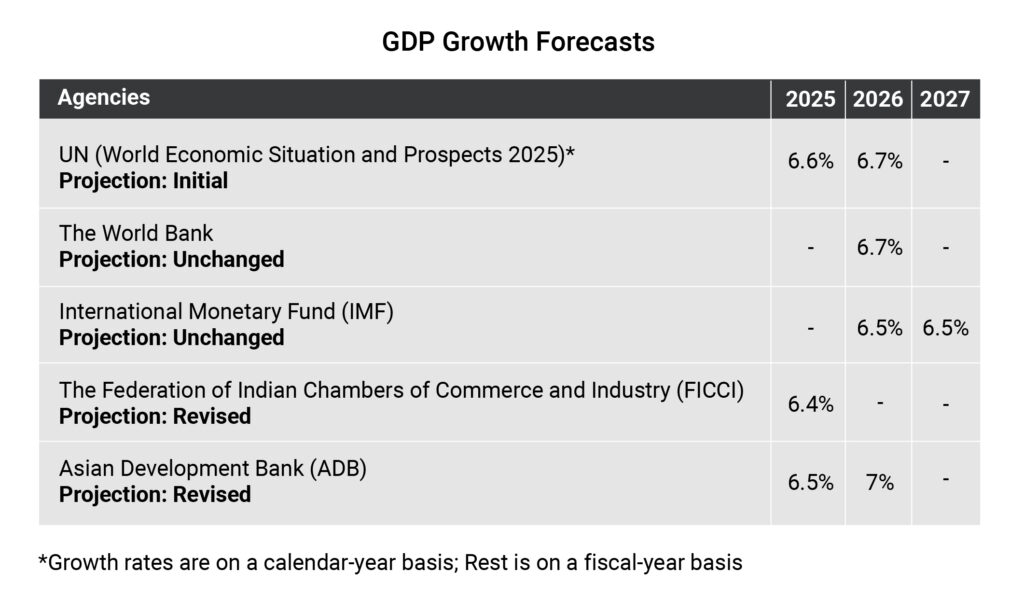

NSO expects slowdown in India’s GDP growth

Indian economy is estimated to grow at 6.4% in FY25, significantly lower than 8.2% in FY24 as per the first advance estimate by the National Statistics Office (NSO) and Ministry of Statistics & Programme Implementation (MoSPI). The expected slowdown in the economy could be attributed to stagnation in investments and moderation in manufacturing. This estimate is lower than the RBI`s projection of 6.6% for FY25. Despite the 7-quarter low GDP growth of 5.4% in the July-September quarter, the government expects agricultural and industrial growth to pick up along with an increase in rural demand to achieve the targeted growth by FY25.

Unified Pension Scheme – an improvement over existing National Pension System

The central government of India has launched a Unified Pension Scheme (UPS) for central government employees covered under the National Pension System (NPS) effective from April 1, 2025. The employees have an option to choose UPS or stay with the existing NPS, however, once they opt for UPS, they won’t be able to switch back. UPS is designed to provide financial stability to government employees after their retirement with a guaranteed pension and an inflation cover.

No GST on penalties imposed by banks and NBFCs

The Central Board of Indirect Taxes and Customs (CBIC) stated that non-compliance charges levied by banks and NBFCs are to prevent breaches and not compensation against the loss. Hence, penal charges imposed by banks and NBFCs on non-compliance by borrowers fall outside the scope of taxable services and will not be taxed at 18% GST.

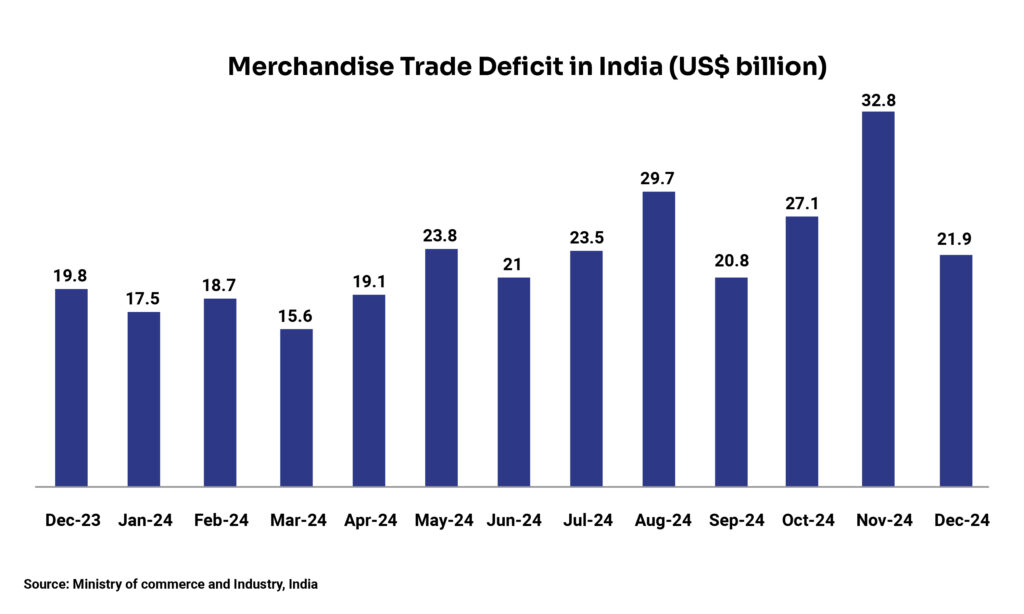

India’s trade deficit abates

India’s merchandise trade deficit narrowed to a 3-month low of US$21.9 billion in December 2024 from US$32.8 billion in November driven by ~50% drop in gold imports. Merchandise exports contracted by 1% YoY to US$38.01 billion while imports grew 4.9% YoY to US$59.95 billion. In April-December 2024, imports rose 5.1% YoY while exports grew 1.6%.

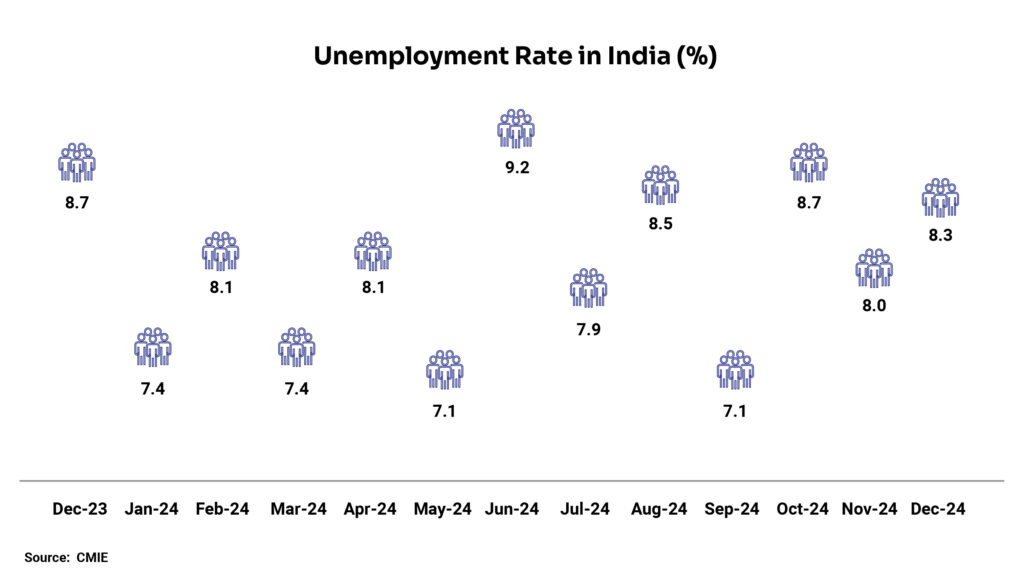

India’s unemployment rate worsens but not unusual for December

The unemployment rate in India increased to 8.3% in December from 8% in November, according to the survey by the Centre for Monitoring Indian Economy (CMIE). The rise is not unusual as unemployment rises every December due to a lean period. However, the rate in December 2024 is lower compared to December 2023. Moreover, urban unemployment has decreased to 6.4% in Q2 FY25 from 6.6% in Q2 FY24 while both the Labour Force Participation Rate (LFPR) and Worker-to-Population Ratio (WPR) have increased during this time, as per the 2023-24 annual Periodic Labour Force Survey (PLFS) report.

India’s forex reserves spike

India’s foreign exchange reserves increased to US$629.55 billion as of 24th January following a 7-week decline, as the rupee strengthened by 0.5% due to forex market interventions by the Reserve Bank of India. The surge in reserves by US$5.5 billion during the week marks the highest in the last 4 months. The primary contributor towards this growth is the foreign currency assets (FCAs) that grew US$4.7 billion to US$$537.89 billion in the period. Moreover, in the reported week, gold reserves went up by US$704 million to US$69.65 billion, as per RBI data.

India’s direct tax collection surges in FY25

During the April 1, 2024 — January 12, 2025, India’s net direct tax collection grew 16% to INR 16.9 lakh crore, according to the latest data from the Central Board of Direct Taxes. The gross direct tax collections were up by 20% to INR 20.64 lakh crore from INR 17.21 lakh crore. Corporate tax collection stood at INR 7.7 lakh crore in the same period, while Securities Transaction Tax (STT) collection, a component of direct tax, stood at INR 44,500 crore (75% growth YoY).

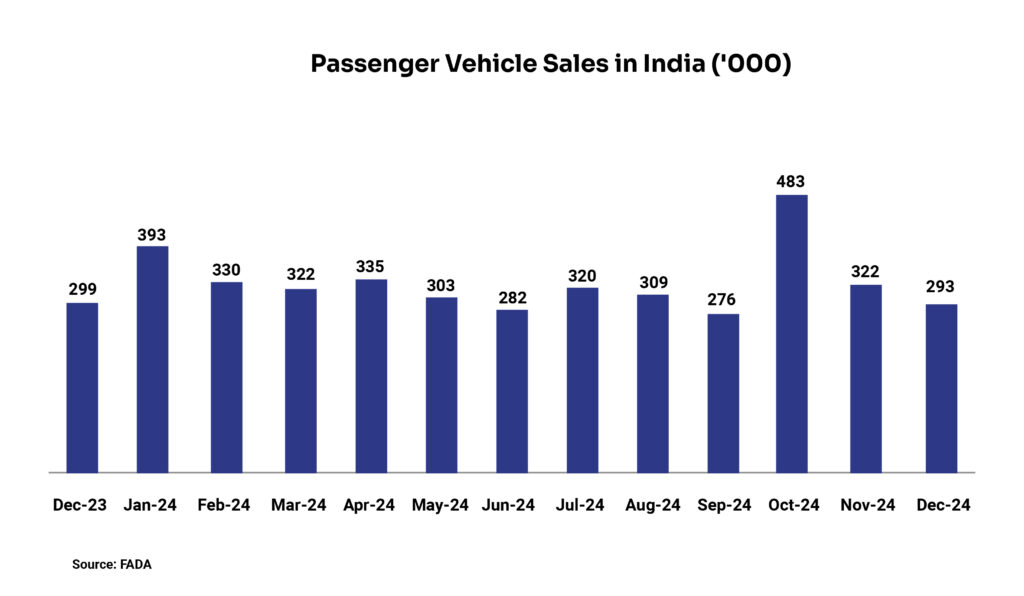

Passenger vehicle sales declines

Total passenger vehicle sales in India fell 2% YoY to 293,465 units in December 2024 from 321,943 units in November, as per the data from the Federation of Automobile Dealers Association (FADA). The decline is attributed to limited launches and deferment of purchases by buyers to January. All other categories witnessed a slowdown – 2-wheeler sales declined 17.6% YoY, 3-wheeler fell 4.5%, and commercial vehicles decreased 5.2%, except the tractor segment which registered a growth of 25.7% YoY.

Global Update Roundups

Monetary Policies

- US: The US Federal Reserve held its key interest rates steady pausing its rate-cutting cycle after three consecutive reductions in 2024. The overnight borrowing rate is kept unchanged in a range between 4.25%-4.5%, which is in line with expectations. In the post-meeting comment, the Fed justified the stance with an optimistic view on the labour market while avoiding the key reference of inflation progressing towards the central bank’s 2% goal. The Fed Chair Jerome Powell said, “We feel like we don’t need to be in a hurry to make any adjustments,” adding that decisions will remain data-driven.

- Euro zone: The European Central Bank (ECB) cut its key interest rate by 25 bps to 2.75%, in line with the expectations, amid an uncertain economic outlook. This marks the fourth consecutive cut to the eurozone deposit rate in a unanimous decision. In its press release, ECB said, “The disinflation process is well on track. Inflation has continued to develop broadly in line with the staff projections and is set to return to the governing council’s 2% medium-term target in the course of this year”.

- Japan: The Bank of Japan (BoJ) raised its key short-term interest rate by 25 bps to 0.5%. The hike is in line with expectations but took the rate to the highest level in 17 years. This was the 3rd rate hike by the central bank after ending the negative interest rate regime in March 2024. The move is led by momentum in wage hikes and steady progress in inflation.

- Canada: The Bank of Canada cut its benchmark interest rates by 25 bps to 3%, which was in line with expectations. With this, the cumulative reduction was 200 bps since the start of the rate cut cycle in June 2024. This happens as the central bank saw inflation converging to the 2% target in recent months, a trend that is expected to continue for the next 2 years.

- Indonesia: The Bank of Indonesia cut its benchmark interest rates by 25 bps to 5.75% in an unexpected move as it defied market expectations of a pause. The decision is backed by central bank’s commitment to control inflation in the target range of 2.5±1% for 2025 and 2026, stabilizing the domestic currency, and supporting economic growth amid global uncertainty.

GDP growth

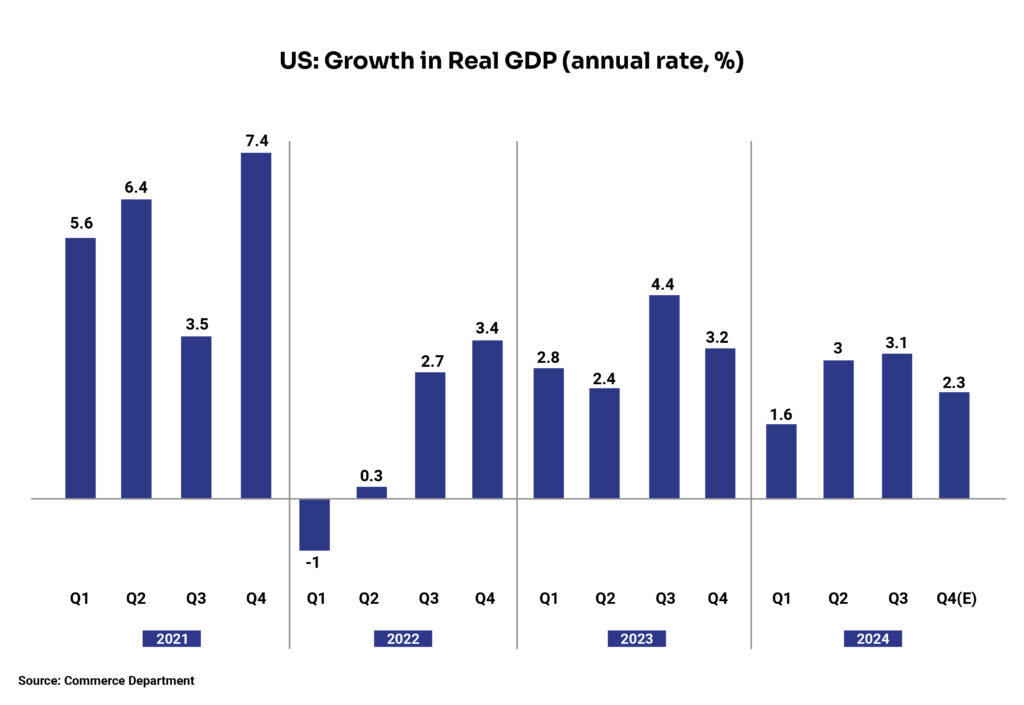

- US: The economic growth decelerated to an annualised rate of 2.3% in the fourth calendar quarter of 2024, down from the previous quarter’s growth of 3.1% and 2.6%, the advance estimate of the Bureau of Economic Analysis. While consumer spending increased for both goods (6.6% vs 5.6%) and services (3.1% vs 2.8%), there was a contraction in both exports (-0.8% vs 9.6%) and imports (-0.8% vs 10.7%). Government expenditure also had a sluggish growth of 2.5% vs 5.1% in the previous quarter.

- China: The GDP growth accelerated to 5.4% YoY in Q4 2024 from 4.6% in Q3 2024, surpassing market estimates of 5%. This has been the strongest annual growth in 1.5 years driven by a series of measures implemented by the government since September to boost economic recovery. In December, exports grew double digits as businesses rushed to complete their shipment in anticipation of high tariffs under the Trump administration, while imports increased to a 27-month high.

IMF’s global growth prediction remains steady

The International Monetary Fund (IMF) kept their global growth projection for both FY25 and FY26 steady at 3.3% compared to their October 2024 World Economic Outlook (WEO) forecast. The estimate is lower than the historical (2000–19) average of 3.7%. The prediction for 2025 remained unchanged as the upward revision in US GDP offset the downward revision in other major economies. IMF expects global headline inflation to slow down to 4.2% in 2025 and 3.5% in 2026, due to faster disinflation with easing of supply-side pressures and restrictive monetary policies.

Unemployment

- US: Unemployment rate in the US eased to 4.1% in December 2024 from 4.2% in the previous month and came in below the market expectations of 4.2%. The number of unemployed individuals decreased to 6.8 million in December from 7.1 million in the previous month. The labour force participation rate was steady at 62.5% in the month.

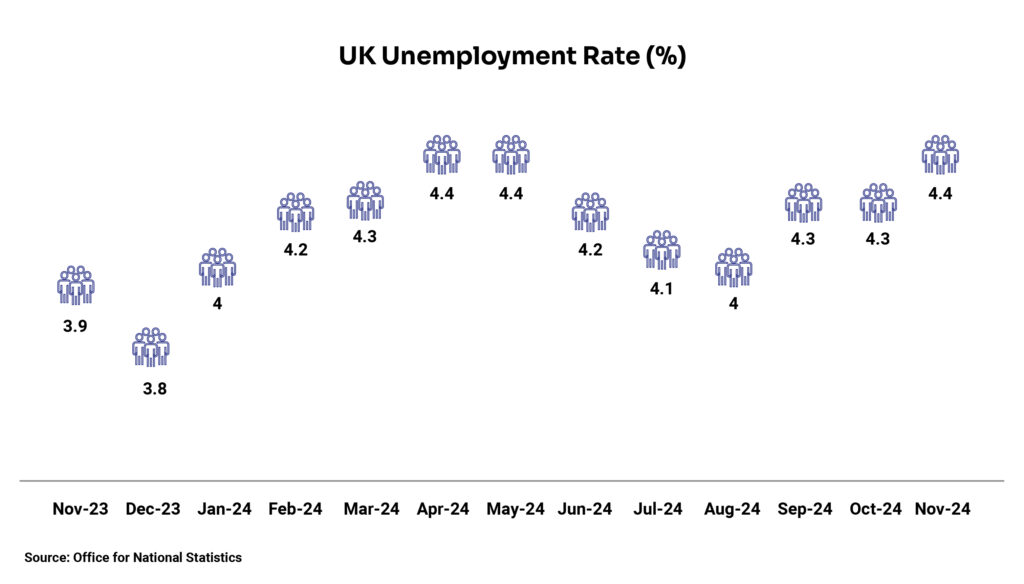

- UK: The unemployment rate inched up to 4.4% in November from 4.3% in October and came in above the market estimate of 4.3%. This is the highest unemployment rate for three months as the number of individuals that were unemployed for up to 12 months increased to 1.77 million in November. On the other hand, employed individuals grew by 35,000 to 33.78 million driven by growth in full-time employment and self-employed workers.

- Canada: The unemployment rate in Canada eased to 6.7% in December from the record high of 6.8% in November, defying the consensus estimates of 6.9%. The number of unemployed population declined by 24,200 to 1,492,100 while the joblessness among youth rose (+17,600 to 462,200) in December. The labour force participation rate remained unchanged at a 4-month high of 65.1%.

- China: The unemployment rate in China increased to a 3-month high of 5.1% in December 2024 from market estimates and November’s reading of 5%. The jobless rate for local registered residents rose 0.1 percentage points (pp) to 5.3%, non-local registrants to 4.6%, and non-local agricultural registrants to 4.5%.

- Japan: The unemployment rate softened to 2.4% in December 2024 compared to the market consensus and November’s readings of 2.5%. The number of unemployed individuals stood at 1.7 million in December. The non-seasonally adjusted labour force participation rate increased to 63.4% in December 2024 from 62.8% in December 2023. The jobs-to-applications ratio was steady at 1.25 in the month under study.

- Euro: The unemployment rate in the Euro Area edged up to 6.3% in December (in line with market forecast) from a record low of 6.2% in November. The number of unemployed increased by 96,000 MoM to 10.8 million.

Inflation readings

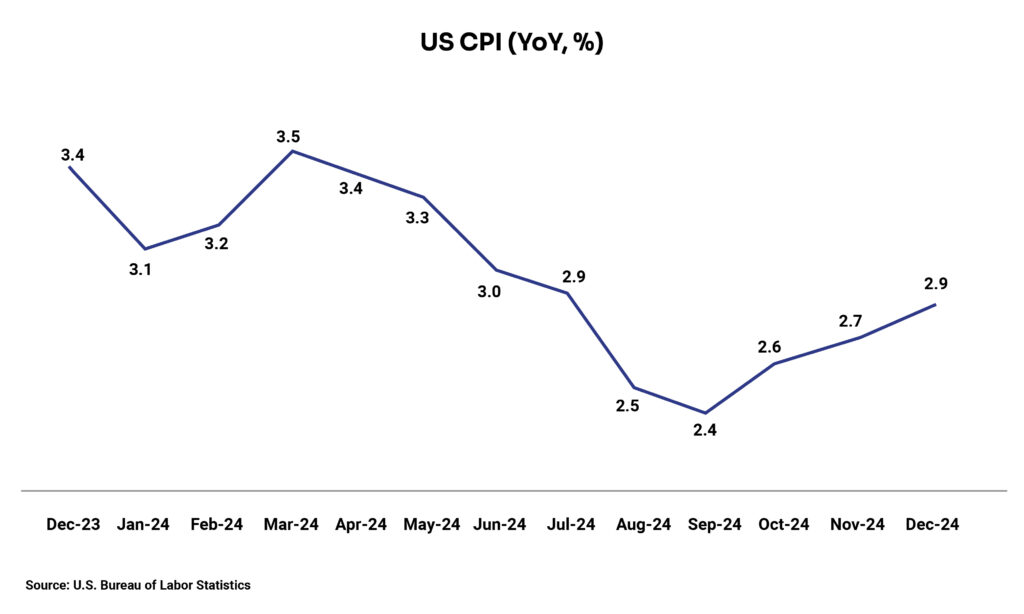

- US: Consumer price inflation in the US accelerated for the third consecutive month to 2.9% YoY in December from 2.7% in November. The inflation was in line with market expectations. The rise is attributable to low base effects owing to a lesser decline in energy costs (-0.5% vs -3.2% in November) and acceleration in inflation for food (2.5% vs 2.4%), transportation (7.3% vs 7.1%), and lesser fall in prices of new vehicles (-0.4% vs -0.7%).

- Eurozone: The inflation rate in the Euro Area rose to a 5-month high of 2.4% YoY in December from 2.2% in November in line with both market expectations and preliminary estimates but decelerated from 2.9% in December 2023. Segment-wise contributors to inflation are services (4% in December vs 3.9% in November) and processed food, alcohol, and tobacco (2.9% vs 2.8%) which was offset by unprocessed food (1.6% vs 2.3%). Core inflation, which excludes prices for energy, food, alcohol & tobacco remained the same at 2.7%.

- UK: The inflation rate in the UK unexpectedly moderated to 2.5% YoY in December from 2.6% in November, below the consensus estimates of 2.6%. The downward pressure majorly came from restaurants and hotels, recreation and communication, services, transport, and air fares. On the other hand, upward pressure on inflation mostly came from motor fuels, and housing and utilities. Inflation for food and non-alcoholic beverages remained unchanged.

- China: China’s consumer inflation rate edged down to 0.1% YoY in December from 0.2% in November in line with the market estimates. This marked the lowest level since March 2024. The decline in food prices after rising consequently for the past 4 months is attributed to the fall in inflation.

- Japan: The annual inflation rate in Japan escalated to 3.6% YoY in December, the highest reading since January 2023, from 2.9% in November. This hike was majorly driven by food prices (6.4% vs 4.8% in November) with vegetables and fresh food being the main contributor. Additional upward pressure came from electricity prices (18.7% vs 9.9%) and gas cost (5.6% vs 3.5%) as the subsidies have been discontinued since May.

Consumer confidence

- US: The consumer confidence fell to a 4-month low of 104.1 in January 2025 from a revised 109.5 in December and came in lower than the forecast of 105.7. This decline is fuelled by pessimism on current and future business conditions. Moreover, consumers are feeling less optimism on labour market and employment.

- Japan: Japan’s consumer confidence index marginally dropped to 35.2 in January 2025 from 36.2 in the previous month, below market expectations of 36.6. This is the lowest reading since September 2023. All sentiment indicators witnessed a decline – overall livelihood (32.2 vs 34.1), income growth (39.9 vs 40.2), employment (41.0 vs 41.2), and willingness to buy durable goods (27.5 vs 29.4).

- UK: The GfK consumer confidence index in the UK fell by 5 points to -22 in January 2025, marking its lowest reading since November 2023. The decline is a sign of growing economic concerns as all the measures such as Personal Financial Situation in the last 12 months and the next 12 months, General Economic Situation in the last 12 months and the next 12 months, and Major Purchase Index that make up the Overall Index Score dropped compared to previous month. The government`s decision to raise taxes also impacted the reading.

- Euro: The consumer confidence in the Euro Area rose by 0.3 points to -14.2 in January 2025, in line with the initial estimates. While the consumer confidence and their intention to make major purchases remained unchanged, their expectations from the economy improved marginally.

Balance of Trade

- China: China’s trade surplus surged to US$104.84 billion in December from US$97.44 billion in November, surpassing expectations of US$99.80 billion. It’s the largest trade surplus reported since February 2024. Exports jumped 10.7% YoY, surpassing the estimate of 7.3% in anticipation of tariffs from the upcoming US administration. Imports also rose unexpectedly by 1% YoY in December recovering from a 3.9% fall in November.

- UK: The UK’s trade deficit dropped to £4.76 billion in November from an upwardly revised £5.01 billion in October. Imports grew 0.6% MoM to a 5-month high of £72.79 billion, while exports grew 1% to a 4-month high of £68.03 billion.

- Japan: Japan reported a trade surplus rose of JPY 130.94 billion in December compared to a deficit of JPY 110.3 billion in November, beating the forecast of a JPY 55 billion deficit. It’s the first trade surplus reported since June 2024 driven by an increase in exports compared to imports. Exports rose to a record high of JPY 9,910.60 billion, while imports increased to a 5-month high of JPY 9,779.67 billion.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.