“It is a curious fact that although all booms are alike, all are different.” — Edwin Lefevre

Domestic Updates

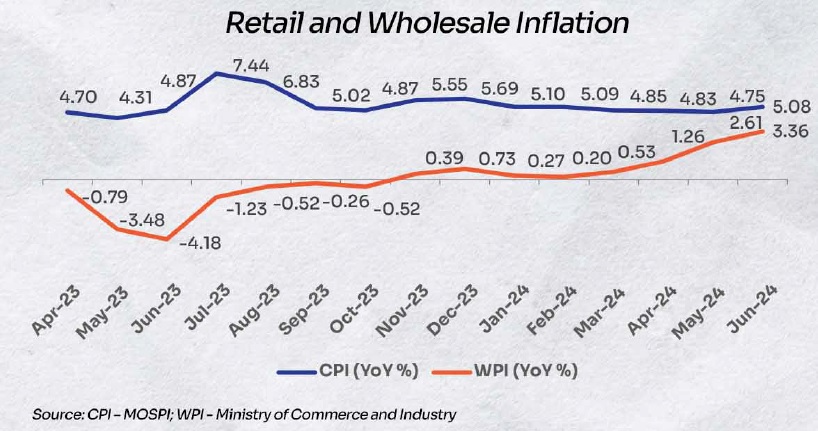

India’s retail inflation moves further away from RBI’s median target

- The retail inflation in India accelerated for the first time in 5 months to 5.08% YoY in June from the 12-month low of 4.75% in May due to a rise in food prices, which account for nearly 50% of the CPI basket. Food inflation rose to 9.55% in June from 8.69% in May and 4.55% in June 2023. However, the headline inflation remained within the RBI’s tolerance band of 2 to 6% but moved further away from the median target of 4% which is critical for a rate cut decision this year. Rural inflation rose to 5.67% 5.34% in May while urban inflation softened to 4.39% from 4.21% in May.

Wholesale inflation continues to accelerate

- The wholesale inflation jumped to a 16-month high of 3.36% YoY in June from 2.61% in May led by a rise in prices of food articles, manufacture of food products, crude petroleum & natural gas, mineral oils, and other manufacturing. Inflation in food articles rose to 8.68% from 7.4% in May while inflation in manufactured products increased to 1.43% from 0.78% in May.

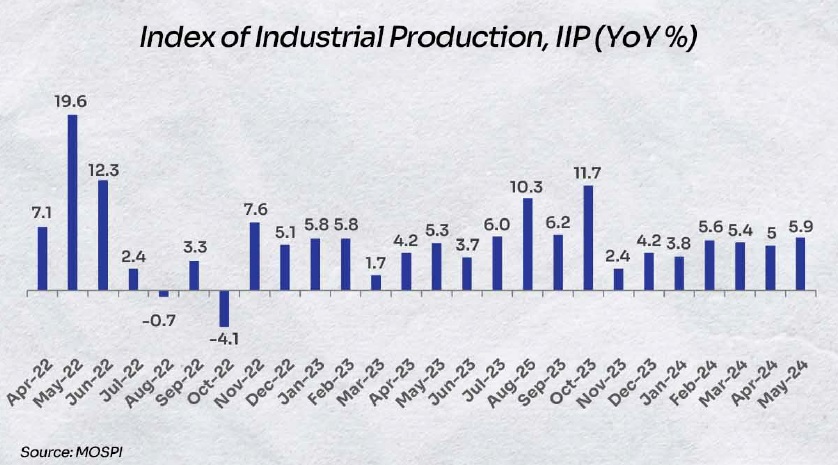

India’s industrial output growth jumps to 7-month high

- The growth in India’s industrial output, as measured by the Index of Industrial Production (IIP), increased to a 7-month high of 5.9% in May from 5% in April. Compared to April, growth in mining decelerated to 6.6% from 6.8%, manufacturing accelerated to 4.6% from 3.9%, and electricity accelerated to 13.7% from 10.2%.

Union Budget: A fine balance between growth, employment, capital investment, & fiscal consolidation

- The Centre retained the capital expenditures target at INR 11.11 lakh crore for FY25, which is the same as the Interim Budget presented in February this year. This reflected a 2x rise in spending on infrastructure over the past three years to generate demand and create more jobs across the economy. As a percentage of GDP, long-term capex rose from 1.7% in FY20 to 3.4% in FY25. The fiscal deficit target has been cut to 4.9% of GDP in FY25 from 5.1% of GDP in the Interim Budget. Consequently, the estimate for gross borrowing has been reduced to INR 14.01 lakh crore from INR 14.13 lakh crore in the Interim Budget while the net borrowing estimate stands at INR 11.63 lakh crore for the year. The Centre kept the target for nominal GDP (measured at current prices) growth unchanged at 10.5% in the Union Budget compared with the Interim Budget. On the other hand, the real GDP growth target has been pegged at 6.5-7% for FY25, as per the Economic Survey 2023-24, presented before the Union Budget.

India’s poverty ratio declines significantly

- The National Council of Applied Economic Research (NCAER), one of the nation’s oldest economic policy research think tank, indicated in a research paper that the poverty ratio in India declined significantly to 8.5% in 2022-24 from 21.2% in 2011-12. The paper revealed that the poverty ratio in rural areas fell more compared to the same in urban areas. In rural areas it fell from 24.8% in 2011-12 to 8.6% now and in urban areas it decreased from 13.4% to 8.4% in the same period.

India’s trade deficit swells as imports are up more

- India’s trade deficit widened to US$20.98 billion in June from US$19.19 billion in the same month last year, as per the Commerce Ministry. This happened as imports increased 5% YoY to US$56.18 billion due to the rise in inbound shipments of crude oil, pulses, and electronic goods. Merchandise exports rose by 2.6% y-o-y to US$35.2 billion. The Commerce Ministry is focusing on 6 major sectors (engineering, textiles and apparel, electronics, pharmaceutical, chemicals and plastics, and agriculture) and 20 countries to boost exports.

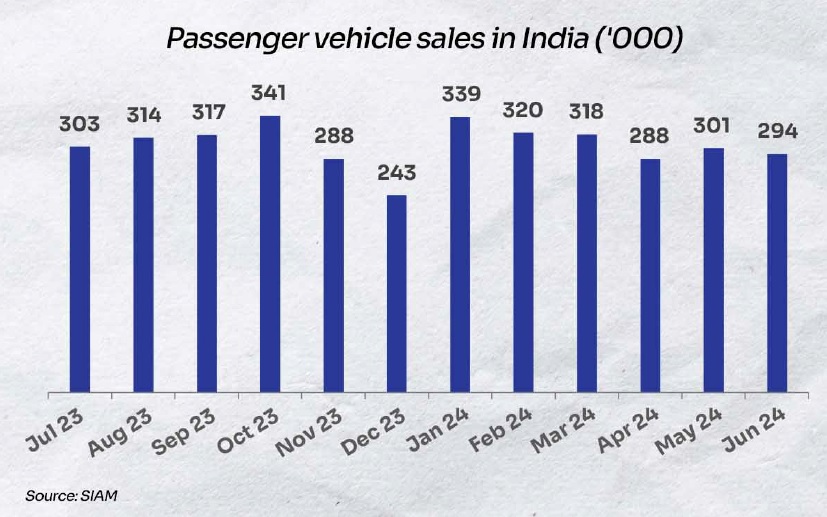

Growth in passenger vehicle sales accelerate

- Passenger vehicle sales stood at 294,133 in June 2024, reflecting a 5% growth that is higher than 4.3% a month ago. As per the Society of Indian Automobile Manufacturers (SIAM), the sector is expected to perform well in the near term due to favourable monsoon and the festive season.

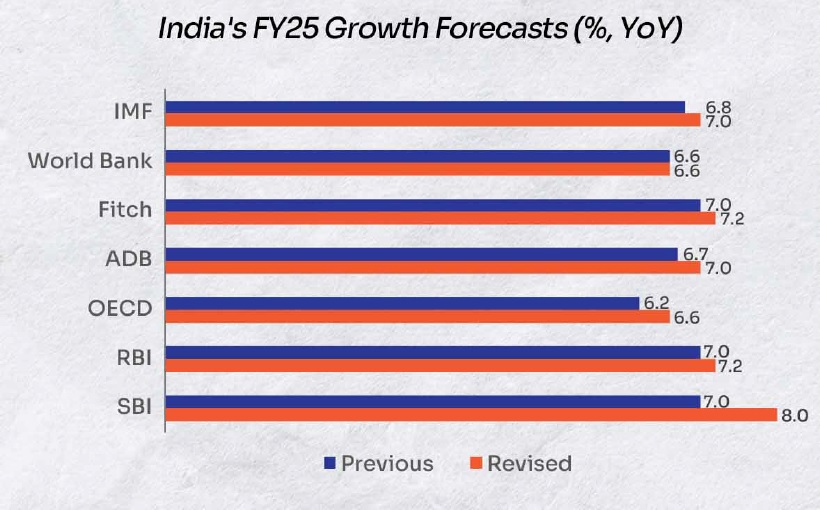

How India’s FY25 Growth Projections looks

- The International Monetary Fund (IMF) revised India’s GDP growth forecast for FY25 upwards by 20 basis points to 7% due to a perceived rise in private consumption, mainly in rural areas. However, the UN-based agency expects the growth to decelerate to 6.5% in FY26.

Global Updates

Roundups

Monetary policies

- The Bank of Canada cut its target for the overnight rate by 25 basis points (bps) to 4.5% and kept the Bank Rate at 4.75% and the deposit rate at 4.5%. The central bank expects inflation to ease gradually despite being still above the central bank targets in advanced economies. In Canada, the bank noticed an increase in excess supply in the economy due to population growth and faster growth in output. However, household spending has been weaker. Also, the labour market is slackening as unemployment rose to 6.4%. The central bank projected a GDP growth of 1.2% in 2024, 2.1% in 2025, and 2.4% in 2026. Consumer price inflation softened to 2.7% in June and the bank noticed broad inflationary pressures to be easing.

- The People’s Bank of China unexpectedly cut its one-year policy loan rate, known as the medium-term lending facility (MLF), by 20 bps to 2.3%. The magnitude of the cut is the highest since the initiation of the first wave of COVID-19 (April 2020) which is no doubt to support the sluggish economy of China. It followed the reduction of the 7-day reserve repo rate by 10 bps.

GDP growth

- The UK economy grew 0.4% on a MoM basis in May beating forecasts of a 0.2% rise and after stalling in April. The service sector increased 0.3% and was the biggest contributor to growth. Industrial output rose 0.2%, rebounding from a 0.9% drop in April. Housing construction grew at the fastest pace in nearly a year.

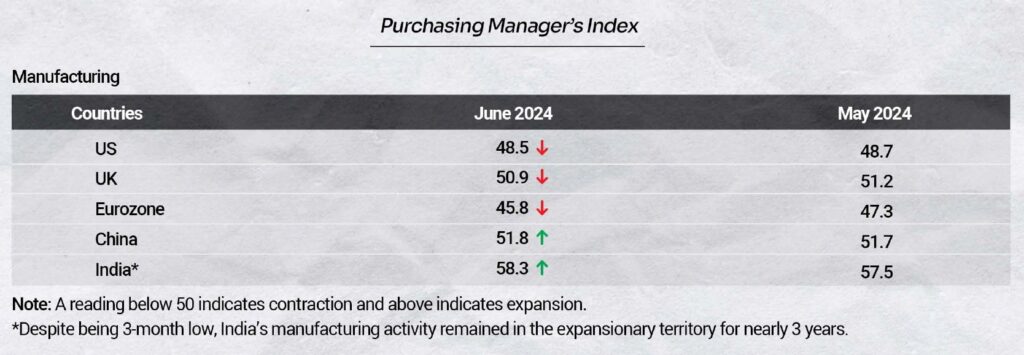

- China’s GDP grew 4.7% YoY in the second quarter of CY2024, missing expectations of a 5.1% growth. It indicated a slowdown as the GDP grew 5.3% YoY in the first quarter of the year. The sluggish growth is attributed to a persistent property downturn, weak domestic demand, falling yuan, and trade frictions with the West.

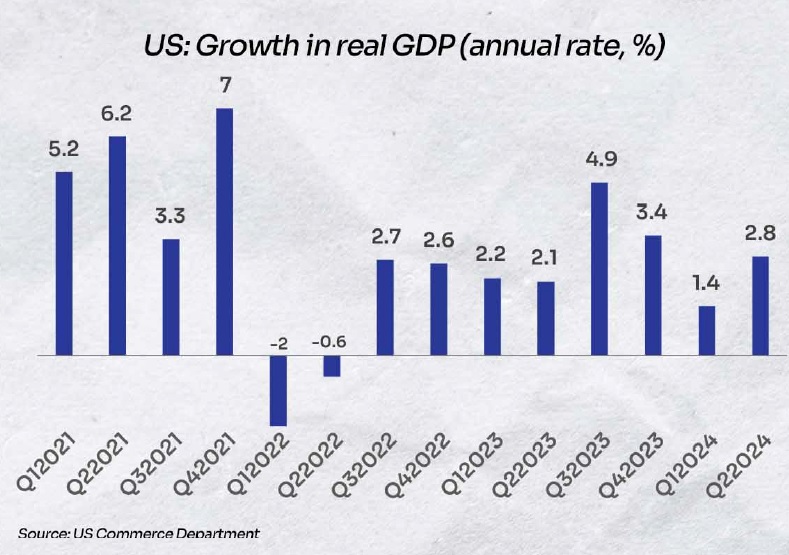

- The US economy showed improvements as the GDP expanded at an annualized rate of 2.8% in April-June 2024 versus 1.4% in the previous quarter. It came in above the consensus estimates of a growth of 2%. The growth is led by personal spending, except for housing due to high interest rates. Personal consumption expenditure, which accounts for ~70% of GDP, grew 2.3%, up 0.8 percentage points from the prior quarter.

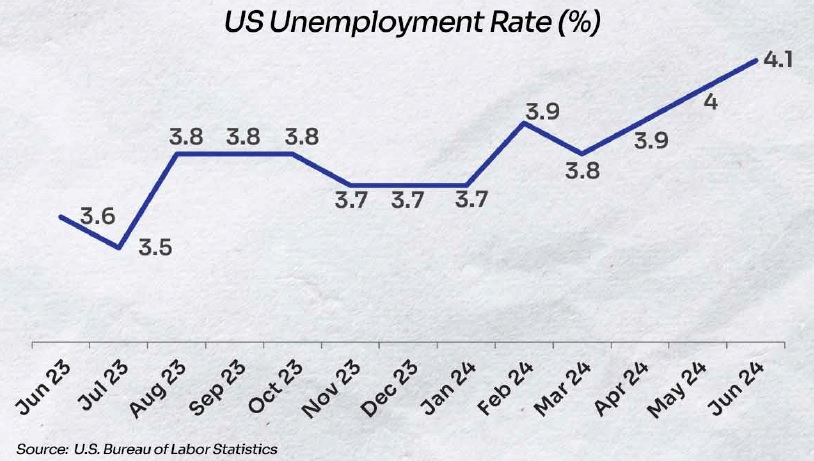

Unemployment data

- The unemployment rate in the US increased to the highest level since November 2021 at 4.1% in June compared with 4% in May. Nonfarm payrolls rose by 206,000 in June compared to 218,000 in May (revised lower). Taking the moderation in inflation into account, the data could push the US Fed to consider rate cuts later this year.

- The unemployment rate in the UK remained unchanged at 4.4% in May compared to the previous month and met market estimates. It is the highest reading since September 2021 as the number of unemployed individuals rose by 88,000 to 1.53 million, driven by those unemployed for up to 6 months.

Inflation readings

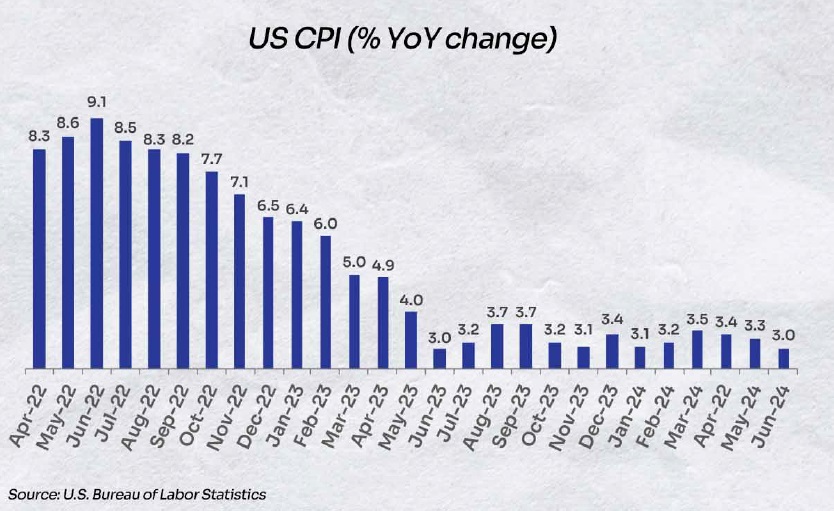

- US: Consumer price inflation softened for the 3rd straight month to 3% YoY in June, marking the lowest reading since June 2023. It came in below the market estimates of 3.1%. The downward trajectory in inflation is attributed to a slowdown in housing prices. Other factors contributing to inflation include groceries, used cars, and gas which have either remained steady or declined. Shelter prices rose 0.2%, which is the smallest rise since August 2021.

Eurozone: Consumer price inflation eased to 2.5% YoY in June compared to 2.6% in May. The core inflation, which excludes volatile food and energy prices, was stable at 2.9% in June. Energy prices cooled off from a rise of 0.3% in May to 0.2% in June. Food inflation dipped to a 3-year low of 1.6% in June versus 1.9% in the prior month. Countries with lowest inflation include Finland (0.5%), Italy (0.9%), and Lithuania (1.0%) and the ones with the highest inflation are Belgium (5.4%), Romania (5.3%), Spain and Hungary (both 3.6%).

China: Annual inflation rate went down to 0.2% in June from 0.3% in the prior two months. It came in below consensus estimates of 0.4%. Factors that contributed to weaker inflation include food prices (-2.1% YoY), which recorded a steeper than expected fall, and non-food prices (0.8% YoY) like vehicles, household appliances, etc.

UK: Annual inflation remained steady at the central bank target of 2% in June, holding at 2021-lows, but came in above the consensus of 1.9%. A decline in clothing and footwear prices along with a sharp drop in food and drink inflation maintained the inflation at a lower level.

Japan: The annual inflation remained steady at 2.8% for the second straight month in June 2024. However, it remained at its highest level since February. The elevated level of inflation is attributed to electricity (13.4% vs 14.7% in May), gas (2.4% vs -2.5%), food (3.6% vs 4.1%), housing (0.6% vs 0.6%), transport (2.5% vs 2.3%), furniture & household utensils (3.7% vs 2.9%), clothes (2.2% vs 2.2%), healthcare (1.4% vs 1.1%), culture (5.6% vs 5.2%), communication (1.3% vs 0.4%), and miscellaneous (1.1% vs 1.2%).

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.