“My gut tells me that uncertainty for the path of the economy is extremely elevated.” – Jerome Powell, US Fed Chair

Executive Summary

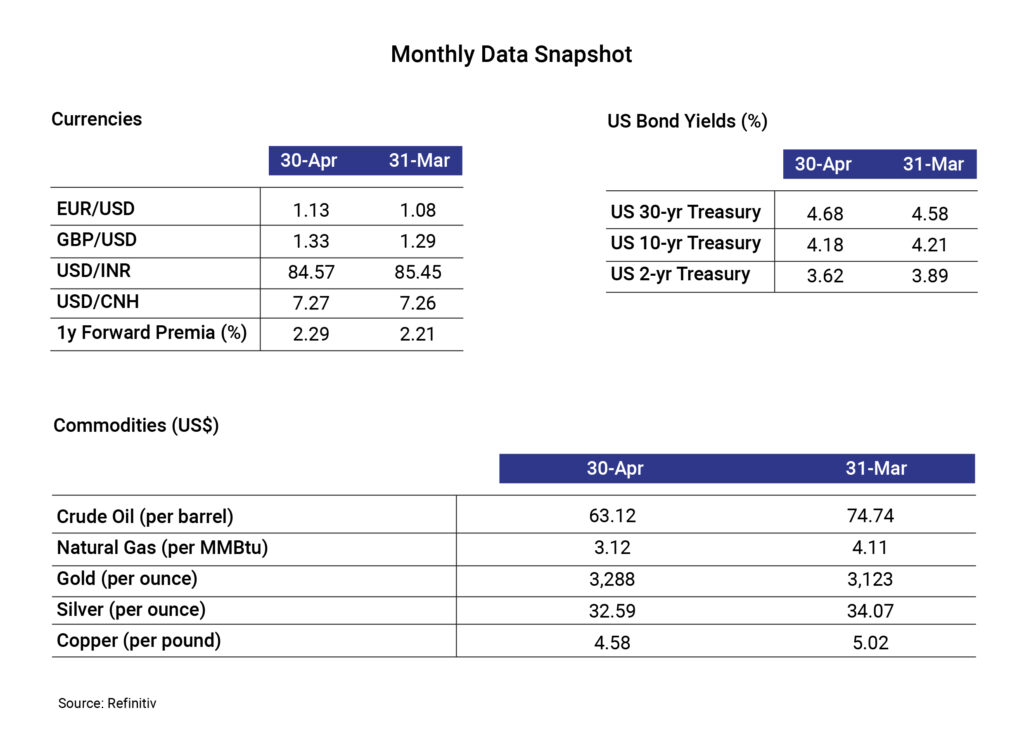

Tariffs dominated the month with liberation day tariffs turning out to be more severe than market anticipation. This triggered a strong risk off market reaction. Typical risk-off moves are associated with a stronger dollar and softer US yields, but this time it was different with fading US exceptionalism theme dominating market sentiments, strong sell-off in longer tenor US treasury yields, and a weaker dollar. The eventual pause on tariffs saw some normalcy return to the market with risk assets rallying. However, the chain of events has shaken investor confidence about US supremacy, depicted by a sharp rally in gold this year (almost 30% YTD), and US treasuries and the dollar losing value. Markets will likely continue to watch the tariff space as it progresses towards the pause deadline.

On the domestic front, the central bank followed up with another unanimous rate cut in April with the underlying dovish tone. In addition to the cuts, the series of liquidity infusion operations into the banking system led to a sharp rally in the rate curve. INR also appreciated against the dollar on the chatter of large inward flows. Market positioning of USD-INR was also long, which exacerbated the move as market participants stopped out. However, a recent chain of events with respect to geo-political tensions poses a risk to domestic markets and the space will be watched closely for escalations. So far, the sell-off is contained across asset classes domestically. We expect RBI to intervene whenever necessary to stem any sharp currency depreciation pressures.

Retail inflation falls to near 6-year low, more repo rate cuts are likely

India’s retail inflation declined marginally by 27 basis points (bps) on a month-on-month (MoM) basis to 3.34% in March, which is the lowest point in nearly 6 years. Although marginal on a MoM basis, the fall is much more pronounced (287 bps) when compared to the 2024 peak. The lower inflation is largely attributed to the decline in food inflation led by falling prices of vegetables, eggs, pulses, spices, and meat and fish. In the food basket, the deceleration in vegetable prices have been more intense as they went up by 42% YoY in October 2024 and dropped to a 21-month low of -7% YoY in March 2025.

The drop in food inflation also led the producer’s prices or wholesale inflation to decline to a 4-month low of 2.05% in March. Wholesale food prices eased from 2.38% in February to 2.05% in March driven by decline in vegetable prices.

With the 67-month low inflation print, the average inflation in Q4FY5 stood at 3.7%, which is lower than RBI’s prior estimate of 4.4%, while the average inflation for FY25 stood at 4.6%, lower than the same by 20 bps. Extreme heat during the summer may pose upside risks, however, a favourable base expects to keep inflation in check.

The deceleration in inflation is expected to provide RBI the needed comfort to continue with the rate cut cycle. Since the beginning of this calendar year, the central bank reduced repo rate by 50 bps to 6% with the early-April cut of 25 basis points. Due to a downside potential for domestic inflation led by lower global oil prices (with an expected pass through), expected normal monsoon and higher foodgrain production, a cumulative repo rate cut of another 50 bps is expected in this fiscal year. The rate cut cycle could get even deeper if the domestic economy experiences a slowdown below RBI’s growth projections for the year (6.5%).

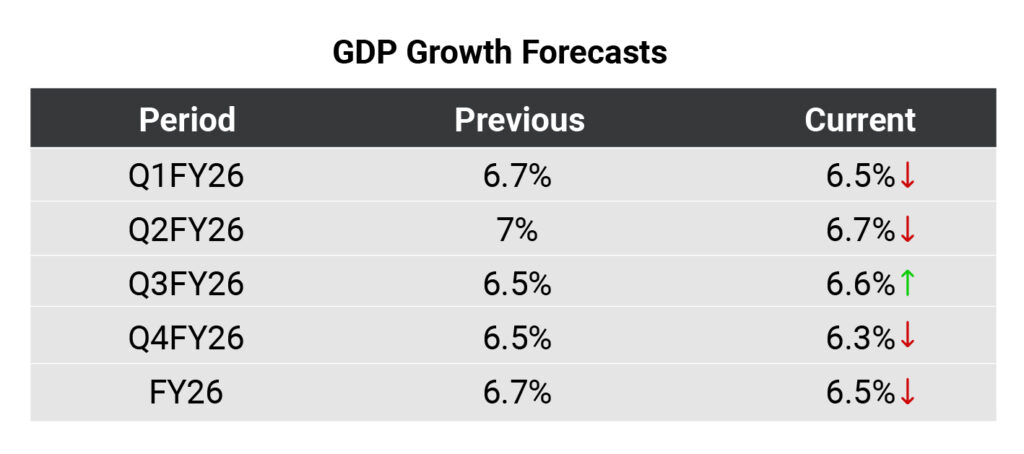

Following are the revisions in real GDP growth and Inflation forecasts announced by the RBI Monetary Policy Committee:

India`s industrial output growth dips to 4-year low

India’s industrial output, which is measured by the Index of Industrial Production (IIP), recorded a growth of 4% in FY25, reflecting a sharp deceleration from 11.4% in FY22. This slowdown in the industrial activity can be attributed to global economic uncertainty that is hampering trade and export growth, weak consumption demand, and a decline in private and government capital expenditure. Moreover, the data released by National Statistics Office (NSO), highlights the YoY slowdown in all the three sectors.

Manufacturing sector (largest in IIP basket) grew 3% YoY in March 2025 (versus 2.8% in February), but the growth slowed down significantly from 5.9% in March 2024. Electricity sector, considering the summer months, rose 6.3% in March 2025 (against 3.6% in February) but the growth was lower than 8.6% in March 2024. On the other hand, the mining sector growth dipped to 0.4% in March 2025 compared to 1.3% a year ago. In March 2025, the drop in the mining sector output was largely offset by the improvement in manufacturing and electricity sector.

India’s industrial output growth surpassed in March from the downwardly revised estimate of 2.7% in February driven by MoM growth in two of its three components, manufacturing, and electricity. While there has been an improvement in the IIP numbers post August 2024-low, they have become volatile in the following months. Looking ahead, the growth in IIP would be likely be determined by the intensity and impact of trade tariffs and favourable domestic drivers.

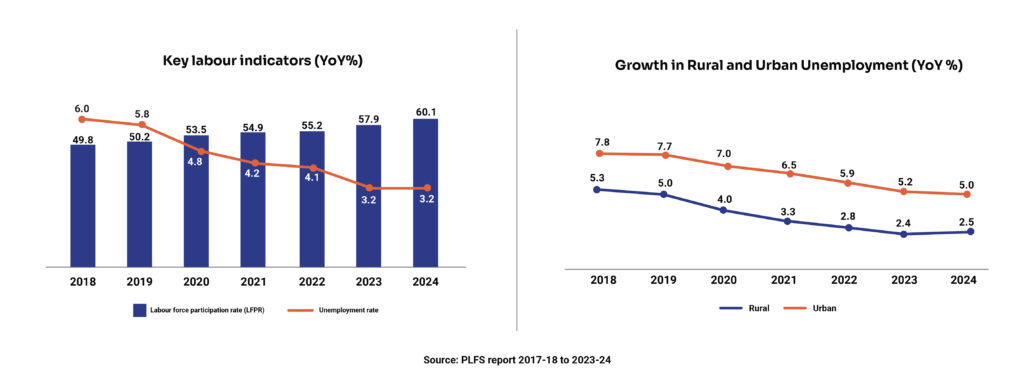

India’s unemployment rate at 7-year low, factors like upskilling and economic resilience at play

The unemployment rate in India declined to a 7-year low of 3.2% in 2024 from 6% in 2018 according to the Periodic Labour Force Survey 2023-24. The labour force participation rate (LFPR), which is measured as a percentage of people in the labour force i.e. the people who are working, seeking or are available for work, grew to 60.1% in 2024 from 49.8% in 2018. Thanks to the stable economic growth post pandemic, increasing women participation in the workforce, growing youth population, improved employment opportunities, and the government initiatives to develop skills and foster entrepreneurship.

In addition, the significant fall in urban and rural unemployment to 5% and 2.5% in 2024 from 7.8% and 5.3% in 2018, respectively has contributed towards the drop in the unemployment rate. As technologies evolve, there is a necessity to balance its impact on the workforce and to equip them with the necessary skills. Investing in technological advancement and implementing more flexible labour regulations could further strengthen the labour market.

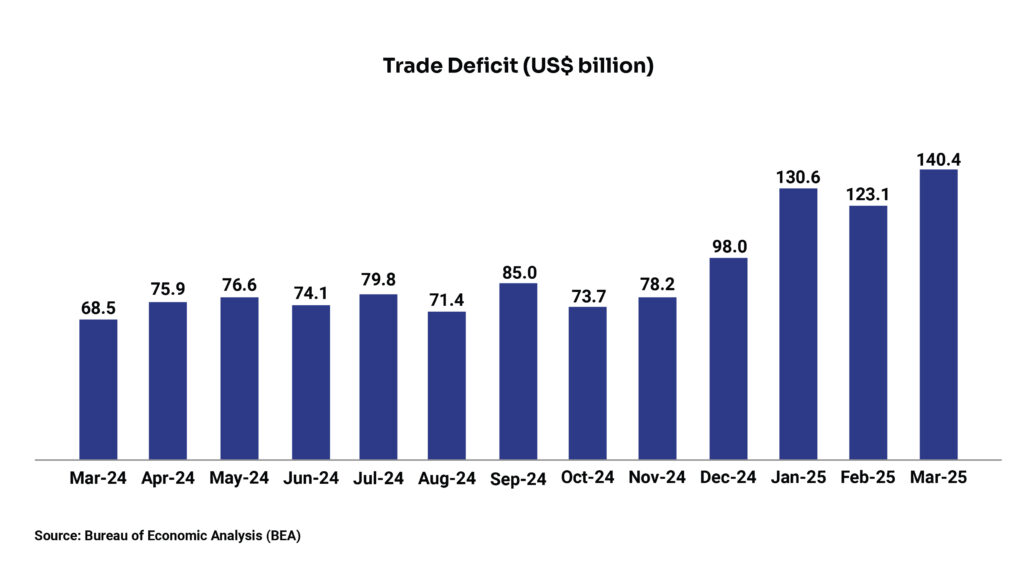

US heads for negative quarterly growth 1st time in 3 years, trade deficit at record high

The US economy shrank for the first time in three years as advance estimates by the Bureau of Economic Analysis depicted a 0.3% annualised fall in GDP in the first quarter of 2025. It’s the first negative quarterly growth since the first quarter of 2022. Trump’s tariff play led to an unexpected rise in imports, as observed by many economists across the board. Imports surged 41.3% during the quarter, driven by a 50.9% increase in goods, which was the highest growth recorded, except during Covid times, since 1974. This happened as businesses front-run tariffs before its implementation in early April.

Apart from imports (with a 5-percentage points impact), the 5.1% decline in government spending due to cuts from the Department of Government Efficiency (D.O.G.E.) impacted the GDP growth by 0.3 percentage points. These were partially offset by growth in investment, consumer spending, and exports. Personal consumption rose (1.8%) but recorded the slowest gain since Q2 2023 while it rose 4% in the prior quarter. Private domestic investment surged nearly 22% driven by a 22.5% rise in equipment spending ahead of the tariff implementation.

It is yet to see whether the economy could rebound in the current quarter, which is enough to avoid a stagflation (a period of tepid growth and high inflation) after the drag from import goes away.

The higher import caused the US trade deficit to hit a record high of US$140.5 billion in March. Imports rose 4.4% to an all-time high of US$419 billion while exports went up 0.2% to US$278.5 billion, which was also a record high. The biggest contributor to imports was consumer goods, especially pharmaceutical, most of which originated from Ireland.

US inflation continues to ease but Fed awaits further cuts

Consumer price inflation in the US came in at 2.4% YoY in March 2025, continuing the easing trajectory since the beginning of the year. The consumer price index declined a seasonally adjusted 0.1% in March, translating to a 12-month rate of 2.4% down from the January peak of 3%. Falling energy prices kept the inflation in check. Gasoline prices fell over 6% in the month leading to a broader 2.4% decline in the energy index. The secondary factor for the lower inflation was the drastic fall in travel-related costs, including airfares (fell 5.3% MoM) and hotel room tariffs (down 3.5%).

The US President has urged the Fed to cut interest rates, but the central bank held them steady in its recent meeting citing upside inflation risks. The US Fed kept the federal funds rate unchanged at 4.25%-4.5%, extending its pause in rate cuts since January. The Fed Chair Jerome Powell said a “great deal of uncertainty” remains about the implications of President Donald Trump’s tariff policy. As per market consensus, the US fed is unlikely to cut rates until June.

Disclaimer: The information provided in this article is for general informational purposes only and is not an investment, financial, legal or tax advice. While every effort has been made to ensure the accuracy and reliability of the content, the author or publisher does not guarantee the completeness, accuracy, or timeliness of the information. Readers are advised to verify any information before making decisions based on it. The opinions expressed are solely those of the author and do not necessarily reflect the views or opinions of any organization or entity mentioned.