Sustainability Reporting: Need of the hour

There’s always an element of uncertainty attached to the global economic, social, and environmental landscape. The uncertainty levels heighten due to disruptive events like climate-related disasters and pandemics among others. Upon closer observation, major global disruptions and imbalances are impending, sprouting from extended human negligence of sustainability issues (environmental, social, economic) and disregard of the Earth’s planetary boundaries. Needless to say, the human race is to blame for all the aforesaid shortcomings. We had it all coming!

Human negligence on sustainability issues has compounded over time, and it is only when the ramifications hit quite close to home that awareness and solutions start gaining momentum. The uncertain times we are in herald a global sustainable transition, which for businesses means adopting better ways of doing business and moving away from their Business as Usual (BAU) practices.

As businesses grapple with addressing the rising stakeholder and investor demands and regulatory pressure on sustainable practices, accountability and transparency have emerged as the differentiator that separates credible sustainable businesses from the rest. A good practice that sustainable businesses follow aside from prioritizing and embedding sustainability holistically, includes accounting for and disclosing their positive and negative impacts on the environment, society & economy through mediums like sustainability reporting. Sustainability reports are very effective in communicating and channelizing an organization’s sustainability performance across wider audiences.

Vivriti’s Mission & Sustainability Reporting

Sustainability and impact have been the underpinning purpose driving Vivriti Group’s impactful mission of bringing parity in the Indian mid-market credit space. As a financial institution that deals in debt and equity, our role in the global sustainable transition is paramount through ensuring sustainable financial flows and being a sustainable player in the market. From our business initiatives that are designed to achieve wide-scale financial inclusion, to our responsible business practices (both internal and external), we have been continuously striving to improve our sustainability performance. What better way could there be than to showcase the same through our sustainability reports! Sustainability reporting is an annual exercise for Vivriti, and it has been a transformational medium to display our adoption of responsible, accountable, and transparent practices to wider stakeholders.

Our first sustainability report, ‘Sustainability at Scale’, reflects the achievement of sustainability and impact through our financially inclusive instruments, along with the initiation and integration of sustainable business initiatives.

Our second and latest sustainability report, ‘Beyond Inclusion’ – is centered around surpassing our mission’s objective and magnifying our impact by building ‘a circle of sustainable champions’ through our client-focused ESG offerings. The theme aptly reflects our ongoing commitment to improve our own sustainability performance while uplifting others in the journey. Over the past year, we have devised and implemented various measures to achieve the latter. We formed an ESG Committee, framed and rolled out relevant ESG policies, developed an ESG risk assessment framework, started conducting portfolio-level ESG due diligences, and designed monitoring and stewardship engagement for our clients. Through such client focused ESG measures, we aim to help all our clients embed similar practices and improve their sustainability performance.

Sustainability reporting is a global reporting practice among companies, and there are many reporting frameworks available that companies can choose to align with. Adherence to a widely used framework like the Global Reporting Initiative (GRI) standards helps ensure consistency, comparability, and standardized reporting. Our second sustainability report is based on the updated 2021 GRI standards, which makes it mandatory for companies to follow the reporting principles & disclosure requirements therein. We have measured and provided disclosures on all the parameters required by GRI 1 – Foundation 2021, GRI 2 – General Disclosures 2021, and GRI 3 – Material Topics 2021.

The core of sustainability reporting comprises disclosing and reporting relevant information backed by verifiable data. The appointment of a third-party independent consultant to audit and verify our report has given an additional layer of credibility to the reported information. We also ensured our data collection, measurement, and reporting methods were systematic and methodical.

Below are the steps we followed in measuring and disclosing the reported data:

- All data asks were mapped with the requirement of the reporting framework

- For data collection, management & measurement, we involved all verticals – Admin, HR, Compliance, Risk, IT, Finance, Sustainability & Impact Team

- Appointed a third-party consultant to audit and verify the reported information

- Only verified information and data have been disclosed in the report

Delving into the reported information

(I) Effective risk management & board oversight

Sustainability and impact are ingrained in our vision, mission and values, and its prominence has been ratified at the Board level while percolating across the organization. Our ESG interventions holistically address not only the ESG risks & opportunities from our operations (through our sustainability strategy, framework & initiatives) but also that of our clients (through our ESG risk management framework, exclusionary sector list, Vivriti’s Sustainability Assessment Model (VSAM), client ESG due diligence, and monitoring & stewardship engagement).

(II) Environmental & Social accountability

Our environmental & social initiatives are derived from our responsible business intent that transcends our operating boundaries and includes our value chain players through shared responsibility.

(a) Environmental Initiatives:

1. Measures to minimize negative environmental impact:

- Energy-efficient electronic appliances, lighting, and air-conditioning systems

- Low-flow water fixtures with sensors and aerators

- Hand dryers installed near wash basins to replace the usage of paper napkins

- E-waste from all offices is collected centrally at the Chennai Office and further handled by a third-party waste handler for sustainable and safe waste treatment and disposal

- Negligible food wastage ensured in our offices in Chennai & Mumbai

2. Carbon emissions reduction/ decarbonization measures supporting transition to a low carbon economy:

- Our Mumbai Office currently purchases a green power tariff and is powered by 100% renewable energy

- Aligning our lending & investing towards a responsible & climate-focused portfolio through the implementation of the ESG Policy, Energy Policy, and Green Finance Framework

3. Climate action & ambition:

- In the purview of our cognizance and responsibility towards climate emergency and action, we have adopted decarbonization initiatives and ESG risk management framework that applies to our operations and to our portfolio

- Our climate commitments will continually be strengthened to gradually align with 1.5 to 2 deg C pathways

- Future adoption of relevant global frameworks and target-setting (Taskforce on Climate related Financial Disclosures (TCFD), Carbon Disclosure Project (CDP), Science Based Targets Initiative (SBTi), etc.)

- We are a current TCFD Supporter and will be adopting the TCFD framework for managing climate risks and opportunities by 2024 or later.

(b) Social Initiatives:

As a socially responsible business, we have implemented various initiatives focused on the upliftment & wellbeing of our people and communities.

1. Focus on our people:

- Our policies and initiatives catering to Health, Safety & Environment (HSE), Diversity, Equity & Inclusion (DE&I), Human Rights, Prevention of Sexual Harassment (POSH) ensure our workplaces are safe, inclusive, ethical & free from any discriminatory practices

- Employee benefits:

- Financial assistance provision for educational advancement, professional development, relocation, personal travels, emergencies & childcare

- Interest-free employee loans, car leases, bonuses, Employee Stock Option Plans (ESOPs), medical insurance benefits & various leaves

- Technical training & performance management measures

- Weekly team reviews, annual/quarterly goal setting, monthly town halls, team outings, offsites, sports league & festival celebrations

- Other perks – complimentary meals, free daily cab facility for employee commuting, remote working opportunities, and mental health support for new mothers. Our Chennai Office also has games, gym and creche facilities.

2. Focus on our communities

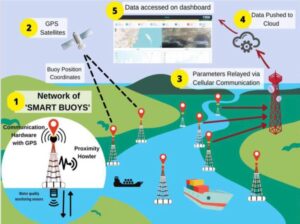

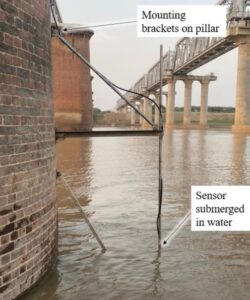

As a responsible business, our positive impact on communities and our social responsibility is non-negotiable. Our Corporate Social Responsibility (CSR) focus areas span across various social initiatives – environmental sustainability & community development, financial literacy, employee engagement, and research & advocacy. The CSR initiatives shortlisted in FY22-23 include a lake restoration project in partnership with the NGO – Environmentalist Foundation of India, and seed funding for two innovative projects of start-ups from the IITM Incubation Cell, Chennai; where, one project is building an advanced sensor technology for real-time river water quality detection & timely intervention for the river Ganga, and the other project is building disability-friendly electric vehicles that can be operated by wheelchair users in university campuses.

Planys Technologies – River Ganga Project

Yali mobility – EVs for wheelchair users

Rajanthangal Lake, Kanchipuram - Before

Rajanthangal Lake, Kanchipuram - After

Conclusion

Priority ESG topics or material topics addressed in the report are derived from the stakeholder materiality assessment that we conduct annually. The materiality assessment revolves around double materiality, anchoring on the internal impact that sustainability issues have on the organization and the organization’s external impact on society, environment and economy. The topics are reflective of the gaps and areas that need intervention to ensure a sustainable business.

Utilization of various stakeholder engagement channels and mediums, including the materiality exercise, has been pivotal in determining our priority material topics. The report presents the case studies of the top 3 material issues thus identified, with a deeper dive into the risk & opportunity, business case & impact, and addressal and progress measurement of the issues.

Branching from our robust governance measures that address ESG risks & opportunities to implementation of targeted policies, frameworks & initiatives, our commitment to sustainability is strongly rooted on the grounds of ethical, accountable & transparent business practices that are based on leading & emerging sustainability and ESG trends. We strive for continuous improvement in our practices catering to the financial and ESG materiality of our operations and beyond (by building a ‘circle of sustainable champions’), while maintaining People, Planet & Profit at the forefront of our business’s strategy and operations.

——————————————————————————————————————

List of Abbreviations Used:

- ESG – Environmental, Social & Governance

- VSAM – Vivriti’s Sustainability Assessment Model

- GRI – Global Reporting Initiative

- GHG Protocol Standards – Greenhouse Gas Protocol Standards

- TCFD – Task Force on Climate-Related Financial Disclosures

Disclaimer:

The views provided in this blog are of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.