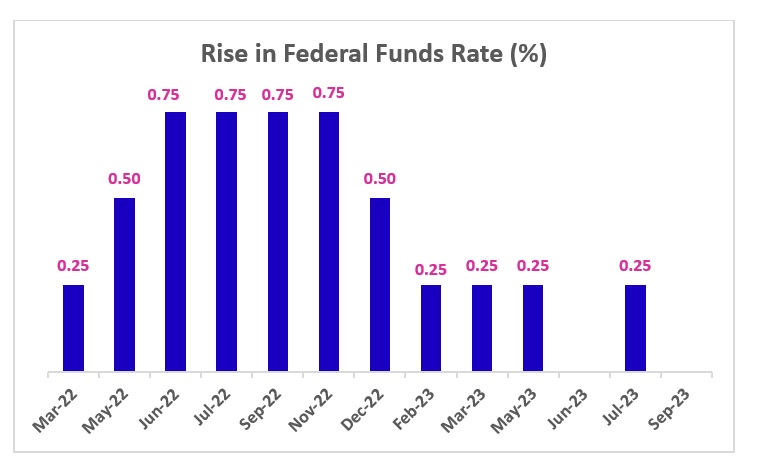

The US Federal Reserve kept its key interest rates unchanged at 5.25-5.5% in a unanimous decision by the Federal Open Market Committee (FOMC). This happened after the committee took the benchmark rate to a 22-year high at their July meeting with a 25 basis points (bps) hike. The key rate set at the meeting determines what American banks would charge each other for overnight lending but it impacts other forms of consumer debt as well.

While the status quo was on the expected line what was more important is how FOMC would pave the way for future rate hikes. “Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain,” FOMC said while adding that it remains “highly attentive to inflation risks”.

The committee tightened its hawkish stance in the meeting indicating a further rate hike (probably a quarter percentage point) by the end of 2023. A total of 12 out of 19 members in the committee believed it to be appropriate while the remaining seven favoured to keep the rates steady. If the hike materializes, the Fed will end up making a dozen rate hikes since the tightening cycle began in March 2022.

For 2024, the Fed indicated more tightening than previously expected. The committee projected the median Federal Funds rate at 5.1% in 2024, which is higher than the June estimate of 4.6%. The committee has further projected rates to dip to 3.9% in 2025 and 2.9% in 2026. This is the first time FOMC provided a rate outlook for 2026. The projected rate for 2026 is higher than the “neutral” rate of interest (which is neither stimulative nor restrictive to growth) of 2.5%.

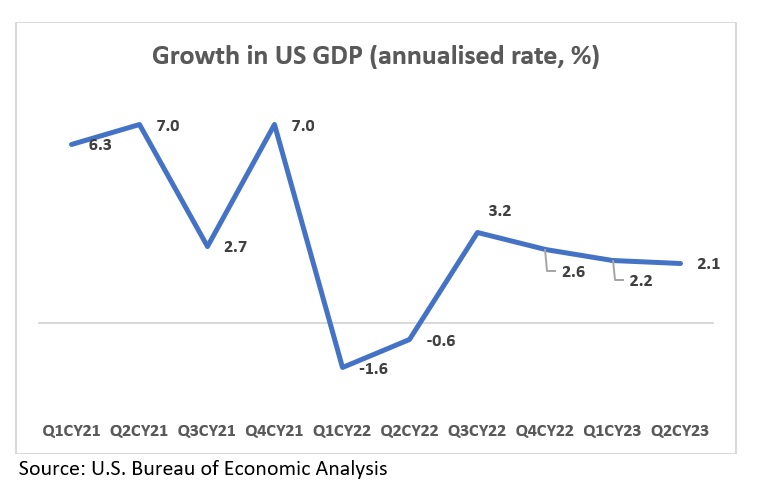

Apart from providing an outlook on future rate hikes, the FOMC also upgraded its 2023 estimates for economic growth from 1% earlier to 2.1% at the meeting. It further projected a GDP growth of 1.5% in 2024. The unemployment rate is expected to peak at 4.1% in 2023, which is lower than the 4.5% estimated in June.

Other Macroeconomic Events

Global Updates

- The European Central Bank (ECB) hiked its key interest rate by 25 basis points (for the 10th time in 14 months) to a record 4%, indicating this could be its last rate hike amid the subdued economic activity over January-June. The latest hike is geared towards the target inflation of 2%. Meanwhile, the European Commission sees average inflation settling at 6.5% in 2023 and raised its inflation forecast for 2024 from 3.1% earlier to 3.2%. The commission has revised the growth projection for the Eurozone down by 0.2 percentage points (ppts) to 0.8% for 2023 and 0.3 ppts to 1.4% for 2024 on the back of weaker growth momentum.

- The Reserve Bank of Australia kept the interest rates unchanged at 4.1% for the third time at the September policy meeting but warned of monetary policy tightening going forward. The central bank stated that recent data were consistent with inflation returning to the target range of 2-3% in late 2025.

- The Bank of Canada decided to hold its key overnight interest rates at 5% with the Bank Rate at 5.25% and the Deposit rate at 5%. The central bank will continue with quantitative tightening. The CPI inflation in Canada rose to 3.3% in July after softening to 2.8% in June, averaging near the bank’s projection of 3%. However, the bank noted that the “Canadian economy has entered a period of weaker growth, which is needed to relieve price pressures”.

- The Bank of Japan continued with its ultra-loose monetary policy by keeping the short-term interest rates unchanged at -0.1% and capping the 10-year Japanese government bond yield around zero, both as expected. The decision was based on “extremely high uncertainties” on the domestic and global growth outlook. The Bank of England maintained its key interest rate at 5.25% following 14 consecutive hikes. Britain’s consumer inflation softened to 6.7% in August, which is the lowest level since Feb 2022. The People’s Bank of China also kept its 1-year loan prime rate unchanged at 3.45% while the 5-year benchmark loan rate — the peg for most mortgages — was held at 4.2%. This happened as the economy started showing signs of stabilization following the policy support. Meanwhile, Turkey’s central bank raised its key interest rate by 500 bps to 30% following a series of rate hikes. The country is struggling with years of steepening inflation and depreciating currency. Turkish Lira is down ~30% against the USD year-to-date while its annual inflation jumped to ~59% in August.

Inflation readings

- Consumer price inflation in the US accelerated from 3.2% YoY in July to 3.7% YoY in August (against the consensus of 3.6%) due to higher gas prices. However, core inflation, which strips out the effect of volatile food and energy prices, slowed from 4.7% in July to 4.3% in August, the lowest since Sep 2021.

- Inflation in the Euro Zone remained steady at 5.3% YoY in August compared to the previous month and came in above the consensus of 5.1%. However, core CPI softened to 5.3% in August from 5.5% in July. Energy prices declined at a slower pace (-3.3% in August vs. -6.1% in July) while inflation in food, alcohol, and tobacco was 9.8% in August vs. 10.8% in July; non-energy industrial goods was 4.8% in August vs. 5% in July; services was 5.5% in August vs. 5.6% in July.

- Inflation in Europe’s largest economy Germany came in at 6.4% YoY in August, preliminary data from the Federal Statistics Office revealed. This compares with a reported inflation of 6.5% in July. Core CPI remained steady at 5.5% YoY in the last month.

- The consumer price inflation in the UK unexpectedly dropped to 6.7% YoY in August from 6.8% in July against projections of 7% due to a rise in fuel prices and alcohol tax. According to the Office for National Statistics, the drop is led by a fall in hotel prices and airfares, as well as food prices rising by less than the same period last year.

- Consumer prices in China returned to positive territory in August by rising 0.1% YoY, showing signs of stabilisation in the economy, compared to a 0.3% fall in July. Producer prices data also indicated some recovery as the decline was less intense in August at 3% YoY compared to 5.4% and 4.4% in June and July, respectively.

- Australia’s consumer price inflation accelerated to 5.2% in August from 4.9% in July due to rising fuel prices and rents. However, the Reserve Bank of Australia board members decided to leave the Official Cash Rate unchanged at 4.10% at the recent meeting.

Other economic indicators

- Manufacturing activities in the US, UK, and the Eurozone remained in the contractionary zone in August as suggested by the Purchasing Managers’ Index (PMI) survey data. In the US, manufacturing PMI fell from 49 in July to 47.9 in August due to shrinkage in new orders on the back of weaker economic conditions. In the Eurozone, manufacturing PMI rose from 42.7 in July to 43.5 in August but conditions in the sector remained under stress. New orders are falling steeply placing huge pressure on production lines. In the UK, manufacturing PMI declined from 45.3 in July to 43 in August due to weak domestic and export demand. In fact, PMI dipped to the 39-month low during the month. However, manufacturing PMI in China improved from 49.2 in July to the expansionary zone at 51 in August driven by increase in new domestic orders.

- In the services sector, the US and China remained in the expansionary zone while the activities in the Eurozone and UK showed contraction, as per PMI readings. In the US, services PMI rose from 52.7 in July to 54.5 in August (the highest reading since February). In the Eurozone, services PMI slipped from 50.9 in July to a 30-month low of 47.9 in August. The fall was prominent in countries like Germany (44.6) and France (46). In the UK, the services sector contracted for the first time since January as the PMI declined from 51.5 in July to 49.5 in August due to weak demand. In China, Caixin Services PMI declined from 54.1 in July to 51.8 in August due to sluggishness in sector activity due to weak demand.

- Real GDP growth in the US slightly decelerated to 2.1% in the second quarter of 2023 from the revised 2.2% in the first quarter of the year. However, the reading came in line with the market expectations. The last reported quarter was marked by growth in business investment, consumer spending, and state and local government spending, partially offset by a decline in exports.

- The Asian Development Bank (ADB) revised the economic growth projection for developing nations of Asia-Pacific to 4.7% in 2023 from 4.8% previously while the growth forecast for 2024 is kept unchanged at 4.8%. Healthy domestic demand and the reopening of the Chinese economy aided growth in the first half of the year and the impact is expected to continue. However, weakness in China’s real estate sector, higher interest rates globally, supply chain disruptions, export restrictions, and higher risk of droughts and floods caused by El Niño pose a threat to economic growth. ADB has slightly lowered India’s projection from 6.4% to 6.3% for 2023 due to sluggish exports and the negative impact of the erratic rainfall on agriculture output. However, the growth for 2024 is retained at 6.7% as higher private investment and industrial output are expected to drive growth.

Domestic Updates

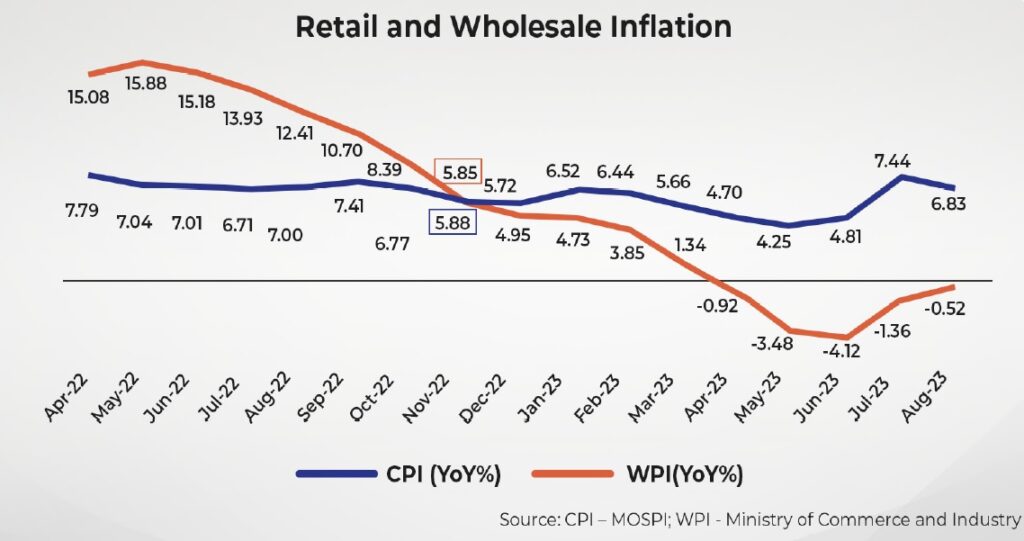

- India’s retail inflation softened to 6.83% YoY in August from a 15-month high of 7.44% YoY in July due to a decline in food prices, mainly vegetables. However, inflation for the month remained above the upper end of the RBI target band (2-6%) for a second consecutive month. Food items, which have ~50% of weightage in the index, saw prices rising by 9.94% in August versus 11.51% in July.

- The deflation in wholesale prices continued for the fifth consecutive month. In August, the wholesale price index-based inflation rose to a 5-month high of -0.52% from -1.36% in July. Inflation in food items remained in double digits but eased to 10.60% in August from 14.25% in July. The deflation in fuel and power basket declined to -6.03% in August from -12.79% in July.

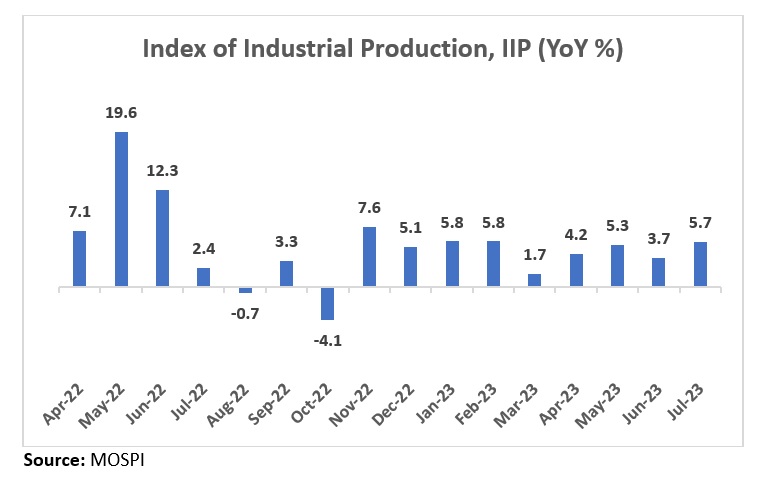

- The growth in India’s industrial output accelerated to a 5-month high of 5.7% YoY in July from 3.7% in June. The reading came in above the consensus estimate of 5%. The growth during the month was supported by improvements in all 3 sectors – mining (up 10.7% YoY), manufacturing (up 4.6% YoY), and electricity (up 8% YoY).

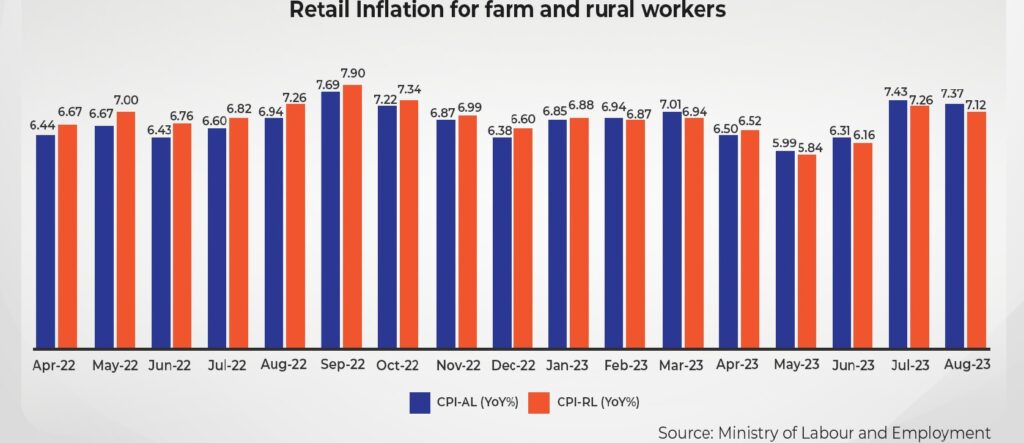

- Retail inflation for Agricultural Labourers (AL) and Rural Labourers (RL) softened marginally to 7.37% YoY and 7.12% YoY, respectively, in August driven by lower fuel prices and a decline in costs of clothing, bedding, and footwear. The major contribution towards the rise in the general index of AL and RL occurred due to food items caused by higher prices of rice, wheat atta, pulses, milk, meat-goat, sugar, gur, chillies-dry, turmeric, garlic, onion, mixed spices, etc.

- Foreign direct investment (FDI) into India declined 34% to US$10.94 billion during the first quarter (Apr-June) of fiscal 2024. FDI inflow fell from countries including Mauritius, Singapore, the US, and the UAE during the quarter. Maharashtra remained the top destination for FDI, followed by Karnataka, Gujarat, and Delhi.

- India’s manufacturing sector grew at the fastest pace in 3 months in August driven by a solid rise in new orders and production. This is reflected in the S&P Global Manufacturing PMI survey as the reading increased from 57.7 in July to 58.6 in August, which is the second-biggest rise in about 3 years.

- The Reserve Bank of India (RBI) announced that it would discontinue the incremental cash reserve ratio (I-CRR) in a phased manner. Introduced in August, I-CRR was meant to absorb the surplus liquidity generated by various factors, including the return of 2,000 rupees notes to the banking system. The central bank mandated banks to maintain an I-CRR of 10% on the rise in their net demand and time liabilities (NDTL) between May 19 and July 28, 2023. The central bank will now release the amount that banks have maintained under I-CRR in stages.

- JPMorgan Chase will include Indian bonds on its emerging market index, JPM Government Bond Index-EM Global Diversified Index. It will be the first global index provider to include Indian bonds. Effective from Jun 28, 2024, the inclusion will enable foreign fund inflows to the nation’s debt market. The JPM Government Bond Index-EM Global Diversified Index was launched in June 2005 as the first comprehensive global local emerging markets index. It tracks local currency bonds issued by emerging market governments and has assets under management of ~US$213 billion.

- The growth in India’s GDP was 7.8% (the highest in four quarters) in the first quarter of FY24, which is faster than the 6.1% reported in the previous quarter. The acceleration can be attributed to the contribution of a robust services sector and strong capital expenditure. In particular, the growth is largely attributed to contributions from trade, hotel, transport, communication, and services related to broadcasting along with financial, real estate, and professional services. The economic growth is lower than the RBI projection of 8% for the first quarter. However, street estimates projected a growth of 7.7% in the quarter.

- S&P Global Ratings retained India’s GDP growth forecast at 6% for FY24 citing global economic slowdown, monsoon risks, and delayed rate hikes. The projection is lower than RBI’s growth forecast of 6.5% for the fiscal year. The global rating agency also forecasted growth of 6.9%, 6.9%, and 7% for FY25, FY26 and FY27, respectively.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.