The Reserve Bank of India-led Monetary Policy Committee (MPC) raised the repo rate for a straight third time this financial year citing elevated risks of inflation, which is expected to remain above the upper tolerance level of 6% through the first three-quarters of FY23. The repo rate was unanimously increased by 50bps to 5.4% with immediate effect, taking the aggregate hike of 140 bps in three months.

The retention of the stance at “withdrawal of accommodation” implies that further hikes are likely in order to control inflation while supporting growth. However, similar to the FOMC, the RBI MPC remained non-committal and did not provide any guidance about the future trajectory of hikes, which makes sense given the uncertain macro environment.

RBI kept its inflation forecast unchanged at 6.7% for FY23, driven largely by elevated core inflation (which remains sticky around 6%) and global uncertainties. We believe there are downside risks to RBI’s inflation forecast due to falling commodity prices on fears of a recession in advanced economies. However, the bar for easing remains very high since inflation is still expected to be higher than RBI’s upper tolerance band. Hence, we see hikes to continue taking the terminal repo rate to 5.75-6% by the end of the year.

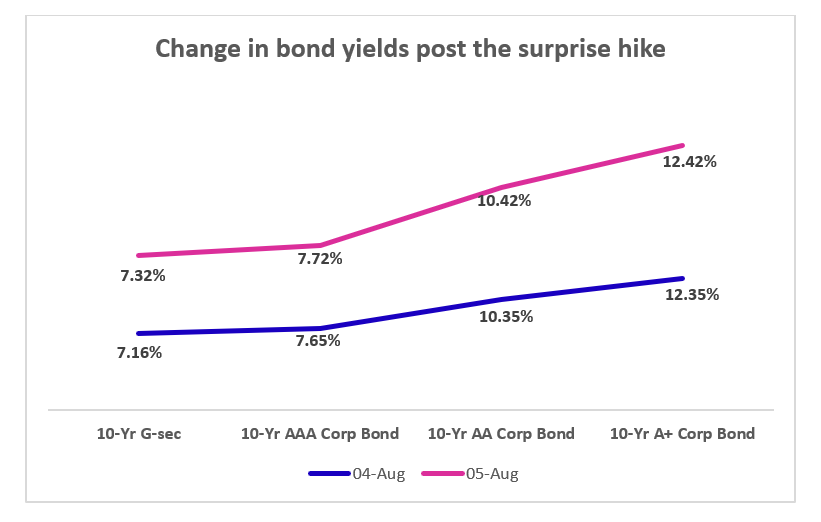

The Indian bond market spooked as it was expecting RBI to take a softer path due to slide in commodity prices, in particular crude. The 10Y G-sec yield clocked the highest single session rise in three months, surging 16bps to close at 7.3% on the day of the MPC meet. The rise in corporate bond yields is depicted in the chart below.

Impact on mid-market debt

The transmission of the benchmark interest rates would pick up pace as hikes continue and RBI keeps its hawkish stance intact. Until now, the transmission of hikes was more pronounced with higher credit-rated issues like AAA and AA. But going forward mid-market firms are expected to witness the pinch of rising borrowing costs as well, which could dampen the growth of these firms to some extent. This, along with a volatile macroeconomic environment, might deter them at the margin for greenfield expansion. However, significant deleveraging that has taken place in the space and stable operating metrics of these firms are expected to make the impact and future movements on their balance sheets lenient.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.