The securitisation market kickstarted in the US in the 1970s when home mortgages were pooled by govt-backed agencies. In India, asset securitisation is comparatively new being a little over three-decades long. India’s first credit rating agency CRISIL rated the first such transaction in 1991 when Citibank securitized a pool from its auto loan portfolio. The market was first regulated in 2006 with new guidelines being implemented in 2012 after the global economic crisis and thereafter in 2021. Since then, securitisation in India has been witnessing rapid growth with non-banking financial companies (NBFCs) remaining the main originators of loans to the sector.

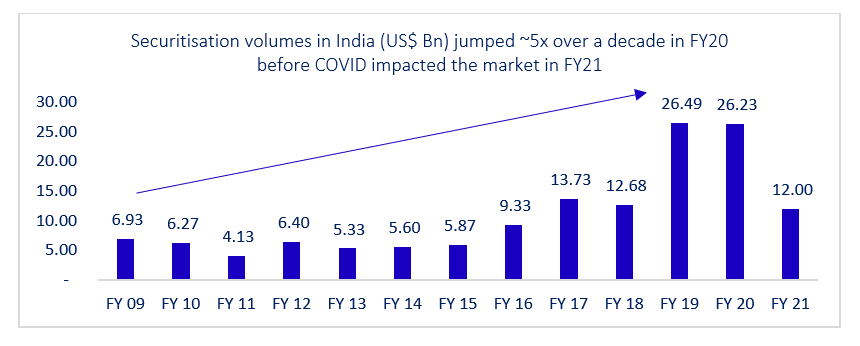

The annual securitization volume jumped by nearly 5x to over US$ 26 bn in FY20 before the COVID-19 pandemic took a toll.

Before deep diving into the key factors and framework behind the rising trends in the sector, let us briefly examine how the market operates and its underlying structure.

Securitisation meaning and structure in India

Securitisation is a process where assets like home loans (falls under mortgage backed securities or MBS), auto loans, microfinance loans, credit card debt (all three fall under asset backed securities or ABS) are pooled and repackaged as interest-bearing securities. The transaction involves shifting the assets from the balance sheet of the originator to the balance sheet of an intermediary which could either be an asset reconstruction company (ARC) for stressed assets/bad loans or a Special Purpose Vehicle, SPV (a legal entity typically set as a trust to undertake a specific business purpose or activity) for non-stressed assets/performing loans.

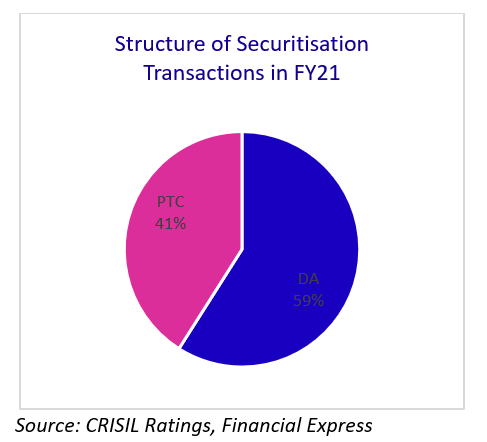

In the Indian market, the pooled assets are sold to the investors either in the form of pass-through certificates (PTCs), which are like bonds, for standard assets, or security receipts (SRs) for stressed assets. PTCs or SRs represent claims on incoming cash flows (like the principal repayments and interest) from such pooled assets. The main advantage that the originator gain from this process is that it frees up its balance sheet creating liquidity and/or rebalances its loan exposure by receiving consideration from the investors much before the maturity of the underlying loans. On the other hand, collections from the underlying loans held by the SPV are passed on to PTC investors.

In India, banks and financial institutions are also allowed to enter Direct Assignment (DA) transactions to sell their loan books at a fixed interest rate to other banks or financial institutions. Such transactions do not involve an SPV or the issuance of PTCs. In fact, the Indian banks and financial institutions predominantly prefer DA structures for securitizing their assets.

Regulatory climate

Over the past few years, the Indian govt has been focusing to develop the securitisation market by providing a robust regulatory mechanism. This particularly happened after NBFC crises like that of IL&FS and DHFL, which accelerated the need to provide alternate sources of funding to Indian corporates. The Indian regulator is also interested in enhancing participation from foreign portfolio investors (FPIs) in securitisation transactions.

The regulator for securitisation of performing and non-performing assets is RBI. When it comes to performing assets, the market is governed by the following RBI guidelines:

- The Guidelines on Securitisation of Standard Assets, 2006

- The Guidelines on Securitisation Transactions, 2012

- Master Direction – Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021

The recent among these brought significant winds of change with respect to the development of a robust secondary market. It is to be noted that the provisions in the new guidelines are applicable to banks, all NBFCs, including housing finance companies (HFCs), NABARD, NHB, EXIM Bank, and SIDBI.

The latest guidelines, issued last September, expect to result in improved transparency, risk-based pricing, and deepening of the market. The introduction of STC (Simple, Transparent, and Comparable) concept should enable better risk assessment, benchmarking, and pricing with criteria around minimum track record and performance history of 5 years and 7 years for retail and non-retail exposures, respectively.

The residential mortgage backed securities (RMBS) expects to prosper with relaxation in Minimum Holding Period (MHP) — the duration for which a bank or NBFC is required to hold the loans on its book before selling them — and reduction in Minimum Retention Ratio (MRR) — which is designed to ensure that the originators have a continuing stake in the performance of securitised assets so that they carry out proper due diligence of loans to be securitised for RMBS.

Given the regulatory climate and advantages that the securitisation market pose, what opportunities exist for the market in India and how to tap them? In the next post, we will answer these questions.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.