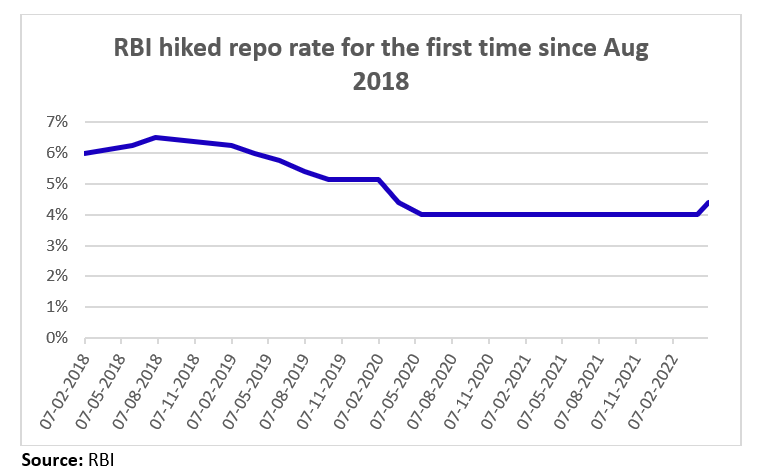

On May 4, RBI announced 40 basis points (bps) hike in repo rate (the rate at which RBI lends short-term funds to commercial banks) to 4.4% effective immediately and a 50bps rise in cash reserve ratio (the share of bank deposits held as reserves with RBI) to 4.5%. Both the quantum of hike and timing was surprising for the markets as the central bank was expected to hike rates in June.

RBI has kept the reverse repo rate (the rate at which RBI borrows funds from commercial banks) unchanged and retained the monetary policy stance as ‘accommodative’ while focusing on ‘withdrawal of accommodation’.

Double whammy

A day later, the US Fed announced a 50bps hike (biggest since 2000) in interest rates to the range of 0.75% to 1% and launched the “Quantitative Tightening” program. However, the hike was broadly in line with market expectations and is considered less hawkish as the FOMC Chair retracted the earlier consensus of a 75bps hike in the next meeting. The Fed has indicated a further 50bps hike over the next two meetings.

The European Central Bank (ECB) is expected to join the bandwagon by raising rates soon. Its next meeting is on Jun 9. As per a policymaker at the bank, there is room for up to three hikes this year.

Inflation fear

The surprise hike followed RBI’s shift in focus towards controlling inflation at the April meeting due to global supply bottlenecks and a surge in commodity prices, especially crude oil at US$100+ levels, following geo-political tensions. Food inflation is a major concern due to shortages of key items like wheat and edible oil in international markets. The pressure on food prices expects to intensify further due to higher feed costs and fertilizer prices. Globally, food prices rose 33% year-on-year in Apr 2022.

Recalling the April meeting, RBI raised the inflation forecast from 4.5% to 5.7% for FY23. At the same time, RBI lowered the GDP growth forecast from 7.8% to 7.2% for the fiscal year. Retail inflation rose to a 17-month high at 6.95% in Mar 2022, breaching the upper end of inflation target of 2%-6% of the Monetary Policy Committee (MPC) for three consecutive months.

While raising rates, the US Fed mentioned combating inflation will remain its major focus as the continued pricing pressure due to demand- and supply-side factors were exacerbated by new crises like the Russia-Ukraine conflict and lockdowns in China. ECB is also expected to end its near-decade-long quantitative easing policy due to the rise in inflation to roughly four times its 2% target.

Market reaction

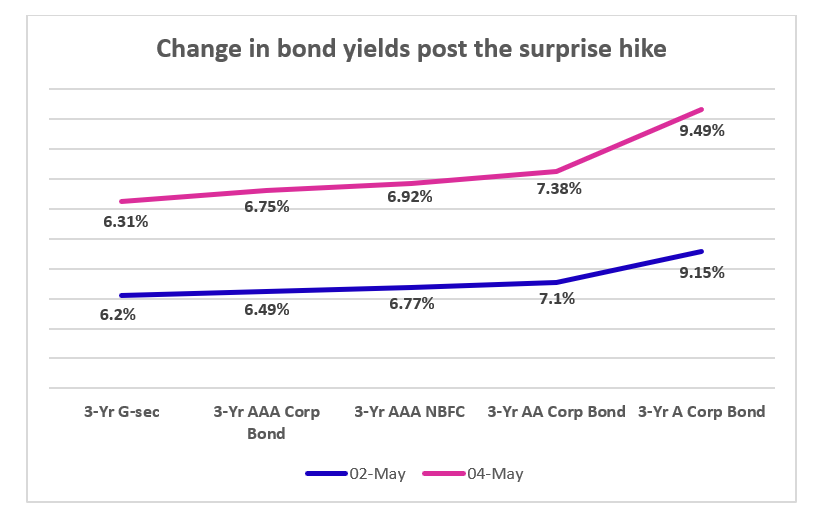

India’s bond market spooked post the surprise hike. The benchmark 10yr g-sec yield rose to its 3-year high at ~7.4% after the rate hike. The anticipated draining of liquidity of INR 87,000 crores by RBI due to a hike in CRR and expectations of forthcoming rate hikes expect to keep the bond yields elevated.

Corporate bond yields across the rating categories have been affected too as depicted in the chart below.

Lending rates set to rise

Since Oct 2019, all banks were mandated to lend at floating interest rates linked to the External Benchmark-Linked Lending Rate (EBLR) to make transmission of monetary policy rates effective.

EBLR has been linked to an external benchmark such as the RBI repo rate or Treasury Bill yield. Hence, a rise in repo rate implies a higher cost of borrowing for commercial banks, which will lead to a simultaneous rise in interest rates on loans.

Would the mid-market debt be impacted?

Assuming a quick and equivalent transmission of repo rate, the mid-market enterprises that are heavily reliant on the loan market expect to be impacted due to the rise in bank EBLR. Also, the immediate linkage of mid-market debt to bond yields has been found to be stronger with respect to the hike. For instance, if we consider the A-rating space (refer to the chart), the yield has nearly absorbed the repo rate hike on May 4.

Impact on mid-market debt in the Non-Financial Services sector

A rising rate environment is unfavourable for mid-market enterprises, particularly in the discretionary sectors, as well as for long-tenor infrastructure projects with fixed returns. However, companies with established brands can pass on the rise in costs due to a hike in interest rates to consumers. The overall impact expects to be less significant though due to the lower leverage of the corporates on average compared to the previous rising rate environment.

Impact on mid-market debt in NBFC

The rate hike could lead to an immediate uptick in the cost of borrowings for most NBFCs from Q2FY23, impacting their Return on assets (ROA) for a couple of quarters. However, the overall impact on their Net interest margin (NIM) could be limited as the pricing of loans is also expected to increase. If the proposed RBI framework to remove the interest rate ceiling for NBFC-MFIs is implemented, all segments of retail credits are expected to be less impacted.

What about economic growth?

The Indian economy expects to continue its journey on the recovery path due to normalcy in activities post the third wave of Covid, resurgence of private consumption and discretionary spending, and the forecast of a normal monsoon supporting rural demand. Capacity utilisation of India Inc. went up ~72% for the manufacturing sector in Dec 2021 quarter from ~68% in the prior quarter. Imports of non-oil, non-gold, silver and precious metals imports, which is a measure to gauge the strength of the domestic demand, rose ~30% in Apr 2022.

The Federal Open Market Committee chair in the US has also emphasized that ‘growth will remain solid in 2022’ and expects private sector balance sheets to be strong enough to bear the impact of a tightening monetary policy.

Impact on our products

We see no implication on the fund’s current investments. With the increase in the yield, the mid-market player will become dependent on alternative lending sources which will increase the scope for debt asset managers to negotiate for better yields.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.