Global Economic Updates

Central bank policy actions

- The Bank of Canada kept the key rates unchanged – the overnight rate at 5%, the Bank Rate at 5.25%, and the deposit rate at 5%, while continuing with its policy of quantitative tightening. The bank noted the slowdown in the global economy and stated a moderation in growth further as past increases in rates and the recent surge in global bond yields weigh on demand. It has projected global GDP growth of 2.9% in 2023, 2.3% in 2024, and 2.6% in 2025. The European Central Bank also kept interest rates unchanged for the first time in more than a year between 4% to 4.75%. The ECB President indicated a “broad-based” decline in inflation to 4.3% in September due to drop in fuel costs and easing food prices. The Reserve Bank of New Zealand kept its cash rate steady at 5.5% on the expected line reiterating that previous tightening had helped constrain spending and hence the rates need to remain at a restrictive level to ensure that consumer inflation returns to the 1-3% target range. The Central Bank of Philippines raised interest rates by 25 basis points (bps) to 6.5% indicating further tightening as it warned inflation to stay above its target (2-4%) till the middle of 2024.

Inflation readings

- Consumer Price Inflation (CPI) in the US came in at 3.7% YoY in September, which is slightly faster than the expected pace of 3.6%. Rent and homeowner monthly payments were the biggest contributors to inflation in the month. The core inflation, which excludes food and energy prices, was 4.1% YoY in September (in line with expectations) versus 4.3% YoY in August.

- CPI in the Eurozone declined to its lowest point since October 2021 at 4.3% YoY in September compared with 5.2% YoY in August. Core inflation, which excludes the impact of volatile energy, food, alcohol, and tobacco prices, dipped from 5.3% YoY in August to 4.5% YoY in September. The contributors to lower inflation are services (4.7% in September vs 5.5% in August), non-energy industrial goods (4.1% vs 4.7%), and food, alcohol & tobacco (8.8% vs 9.7%). Energy costs declined further as well (-4.6% vs -3.3%).

- CPI in Europe’s largest economy Germany eased to its lowest point since the Ukraine war to 4.3% YoY in September (versus expectations of 4.5% YoY) from 6.4% YoY in August. Thanks to easing food inflation to a larger extent. Core inflation was 4.6% YoY in September compared to 5.5% in August.

- CPI in the UK remained steady at 6.7% YoY in September, which is an 18-month low reported in August, missing the market expectations of a mild softening to 6.6%. This happens as surging fuel costs amid a sharp rise in global oil costs offset the impact of monthly fall in food prices.

Other economic indicators

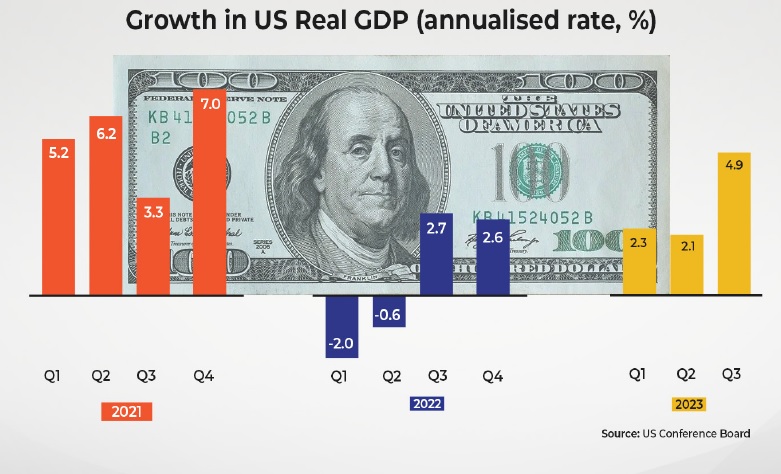

- The US economy expanded at the fastest pace since the last quarter of 2021 by an annualized rate of 4.9% in the third quarter of 2023. The growth is above the market forecasts of 4.5% and a 2.1% rise in the previous quarter. Thanks to strong growth in private consumption, expansion in private inventories, and continued support by government spending, despite a fall in real disposable income.

- The Gross Domestic Product (GDP) of the UK rose 0.2% QoQ in the second quarter of 2023, indicating a faster post-pandemic recovery, as per the revised data by the Office for National Statistics. This put Britain on a faster track of economic growth compared to Germany or France.

- The growth in China’s economy decelerated to 4.9% YoY in July-September from 6.3% in Q2 2023. However, the reading came in above market forecasts of a 4.5% rise. The slowdown is attributed to weak global demand for its exports and the struggling real estate sector.

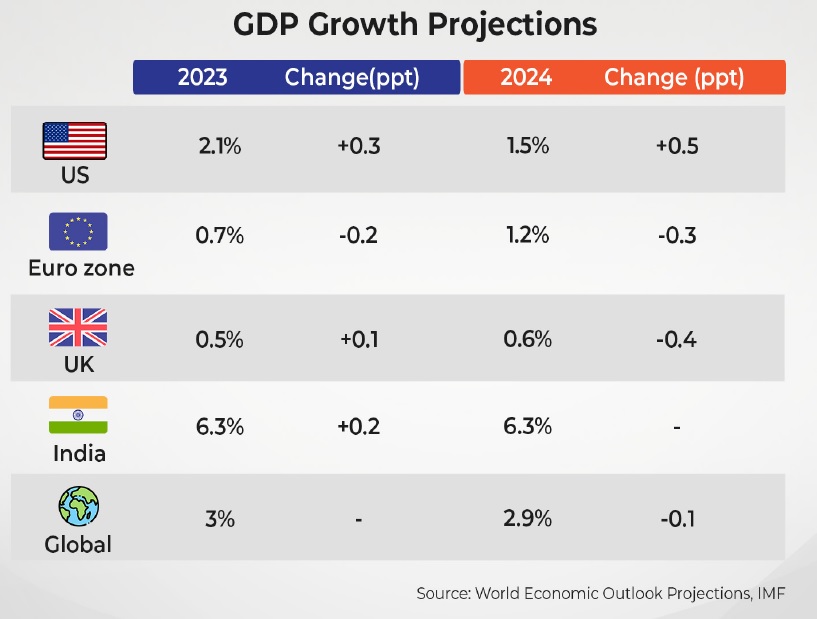

- The International Monetary Fund (IMF) released its global growth forecast in World Economic Outlook last week. The UN agency raised the GDP forecast for the US due to stronger business investment, favourable consumption growth, and an expansionary government fiscal position. It has lowered the forecast for the Euro zone due to contraction in the German economy among other factors. The growth forecast for India upped to 6.3% for 2023 from 6.1% earlier, due to stronger-than-expected consumption during April-June. The agency reiterated the forecast of global growth for 2023 at 3% and lowered the same for 2024 by 0.1 percentage points (ppt). IMF noted resilience in the global economy despite geopolitical conflicts, energy crisis, and the tightening of monetary policy.

Domestic Economic Updates

- India’s manufacturing sector activity moderated as the seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) declined to a 5-month low of 57.5 in September from 58.6 in August due to the sluggish pace of new orders tempering the production growth. Nevertheless, the index remained in the expansionary zone (above the 50 threshold) driven by strong demand.

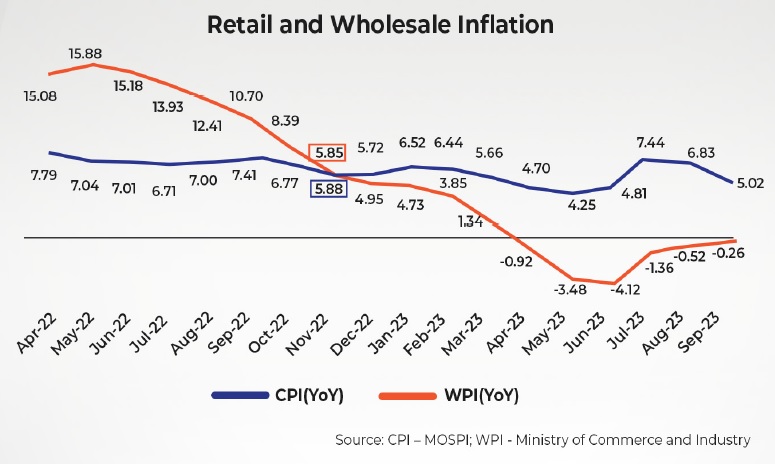

- India’s headline retail inflation came back to the central bank’s tolerance range (2-6%) at 5.02% YoY in September compared with 6.83% YoY in August. Thanks to the huge slide in vegetable prices. The reading, a 3-month low, is also lower than the consensus estimates of 5.4% YoY for the month. Meanwhile, the wholesale price inflation remained in the negative territory for the sixth straight month, but the deflation decelerated to -0.26% YoY in September compared to -0.52% in August, which was a 5-month high. As per the Commerce Ministry, “Deflation in September 2023 is primarily due to fall in prices of chemical & chemical products, mineral oils, textiles, basic metals, and food products as compared to the corresponding month of previous year”.

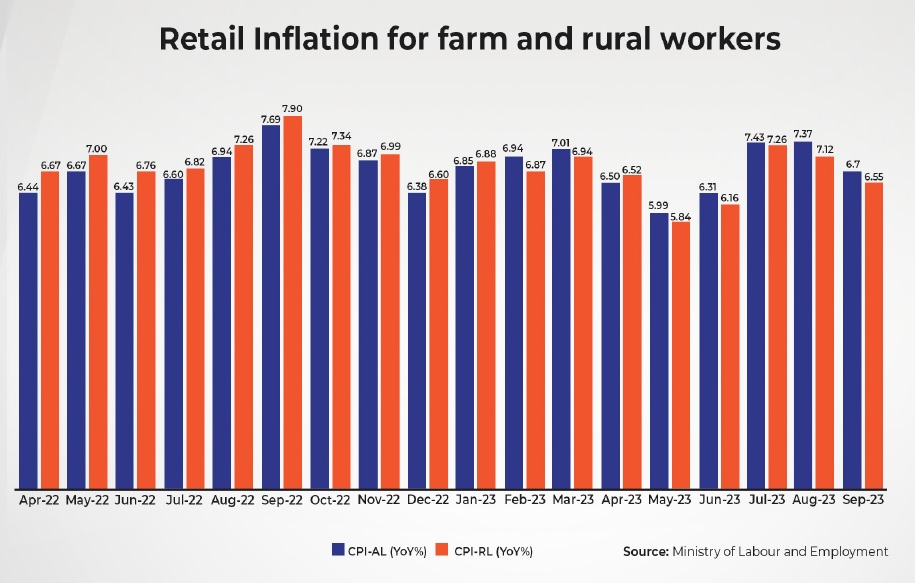

- Retail inflation for agricultural labourers (AL) and rural labourers (RL) fell from 7.37% and 7.12%, respectively, in August 2023 to 6.70% and 6.55%, respectively, in September 2023. The food inflation fell from 8.89% and 8.64% respectively, in August 2023 to 8.06% and 7.73% respectively, in September 2023.

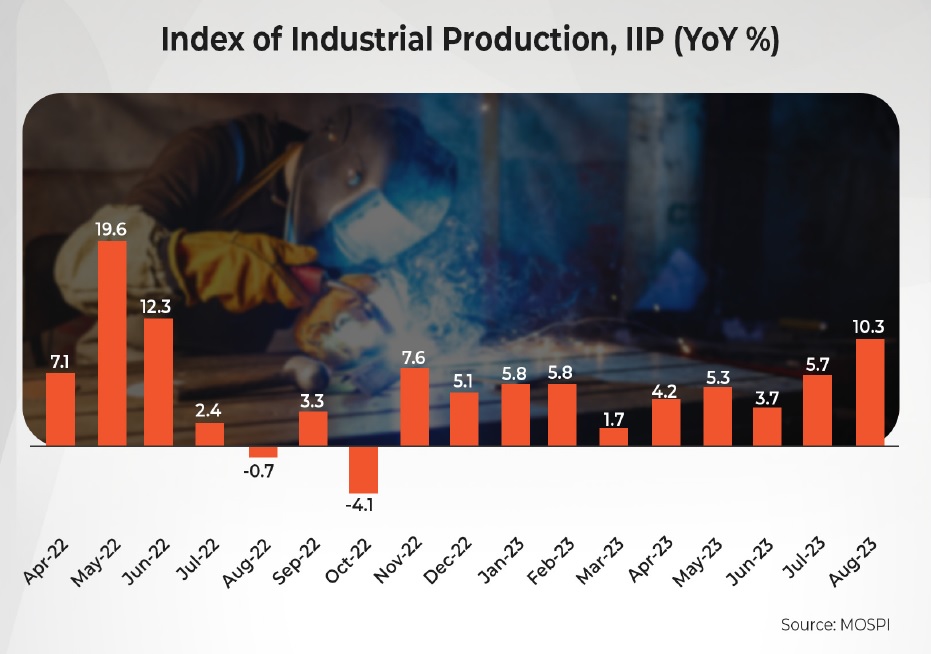

- The growth in India’s Index of Industrial Production accelerated to a multi-month high of 10.3% YoY in August from 5.7% in July driven by solid growth in the mining (12.3%), manufacturing (9.3%), and electricity (15.3%) sectors. Resilient domestic and export demand aids the growth in all sectors.

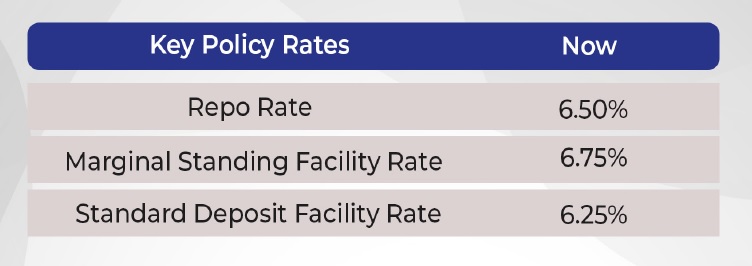

- The Reserve Bank of India kept the repo rate unchanged at 6.5% in its fourth bi-monthly monetary policy meeting in a unanimous vote by all six members. The central bank remains focused on the withdrawal of accommodation to support growth. It retained real GDP growth forecast at 6.5% and inflation forecast at 5.4% for FY24.

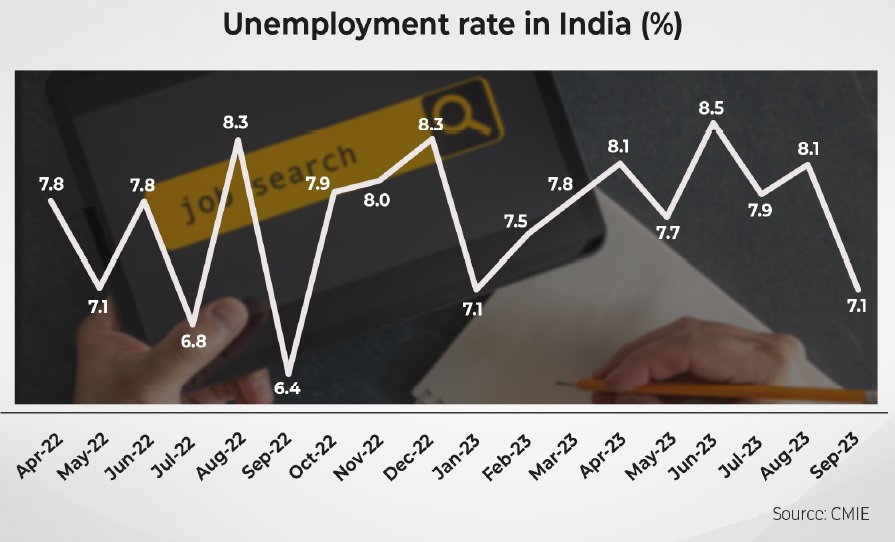

- India’s unemployment rate declined to a 12-month low of 7.1% in September as per data released by the Centre for Monitoring Indian Economy (CMIE). It reinforces the view that economic activities have picked up ahead of the festive season. The unemployment rate softened in both urban (from 10.09% in August to 8.94% in September) and rural areas (to a 12-month low of 6.2% in September).

- The domestic air traffic grew 18.3% YoY to 12.25 million passengers in September and over 6% compared to the pre-pandemic era. In terms of passenger load factor (PLF), all airlines witnessed a higher capacity utilisation sequentially in September led by Vistara at 92%. IndiGo continued to be the largest domestic airline with a market share of 63.4% followed by Vistara at 10%, Air India at 9.8%, AirAsia India at 6.7%, SpiceJet at 4.4%, and Akasa at 4.2%.

- India’s trade deficit fell to a 5-month low of US$19.4 billion in September, reflecting a YoY fall of more than 30%. This happened as imports fell 15% YoY to US$53.8 billion while exports fell only 2.6% YoY to US$34.5 billion in the month. Economists expected a trade deficit of US$23.25 billion for the month.

- Domestic sales of passenger vehicles rose to 10.7 lakh units in July-September, which is the highest level recorded in any quarter, as per the Society of Indian Automobile Manufacturers (SIAM). It went up 3.6% from the corresponding quarter a year ago. Three-wheelers clocked the highest-ever sales at 1.95 lakh units during the quarter. The rise is attributable to pre-festive season sales. On a monthly basis, sales rose 1.8% YoY to 3.6 lakh units in September.

- India, which is currently the world’s 5th largest economy, may overtake Japan to be the world’s 3rd largest by 2030, stated S&P Global Market Intelligence. This is estimated after noticing the fast pace of economic growth in 2021 and 2022 and sustained strong growth in 2023 so far. Currently, the US is the largest economy with a GDP of US$25.5 trillion followed by China with US$18 trillion, Japan with US$4.2 trillion, and Germany with US$4 trillion. India is expected to record a nominal GDP of US$7.3 trillion by 2030.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.