SEBI approved the framework for Accredited Investors for the Indian securities market in June 2021. The market watchdog aimed to create lighter regulations for a class of investors, who are equipped with good knowledge about the risk and returns of financial products — mainly the complex ones such as alternative investment funds (AIFs) and portfolio management services (PMS) — and have the ability to make informed decisions about their investments. SEBI also allowed Accredited Investors to invest with ticket sizes that are lower than the stipulated minimum amount as per the regulations in respective financial products. Per SEBI, these moves will eventually help it focus more deeply on regulatory resources for vulnerable sections of the investors class to protect them from malpractices such as mis-selling.

The concept of Accredited Investors is not new though. It has emerged in asset management jurisdictions of countries like the US, Singapore, and Hong Kong, where regulatory norms are relaxed for a class of sophisticated investors (for example, “Qualified Clients” in the US) due to their higher industry knowledge and larger appetite for risk.

Eventually, SEBI came up with detailed modalities of the framework for Accredited Investors framework and amended the regulations for AIFs, PMS, and Investment Advisers accordingly.

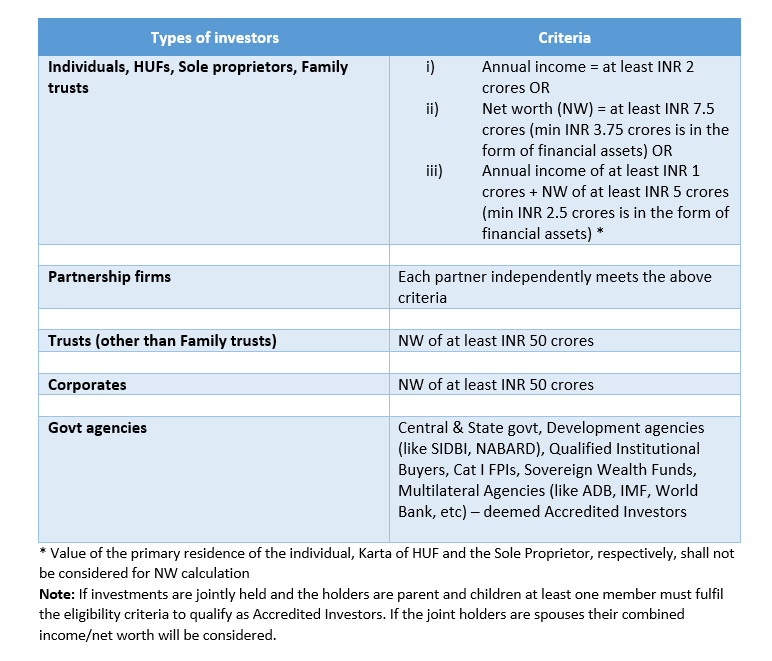

Who all can be Accredited Investors?

Who will provide the certification for Accredited Investors?

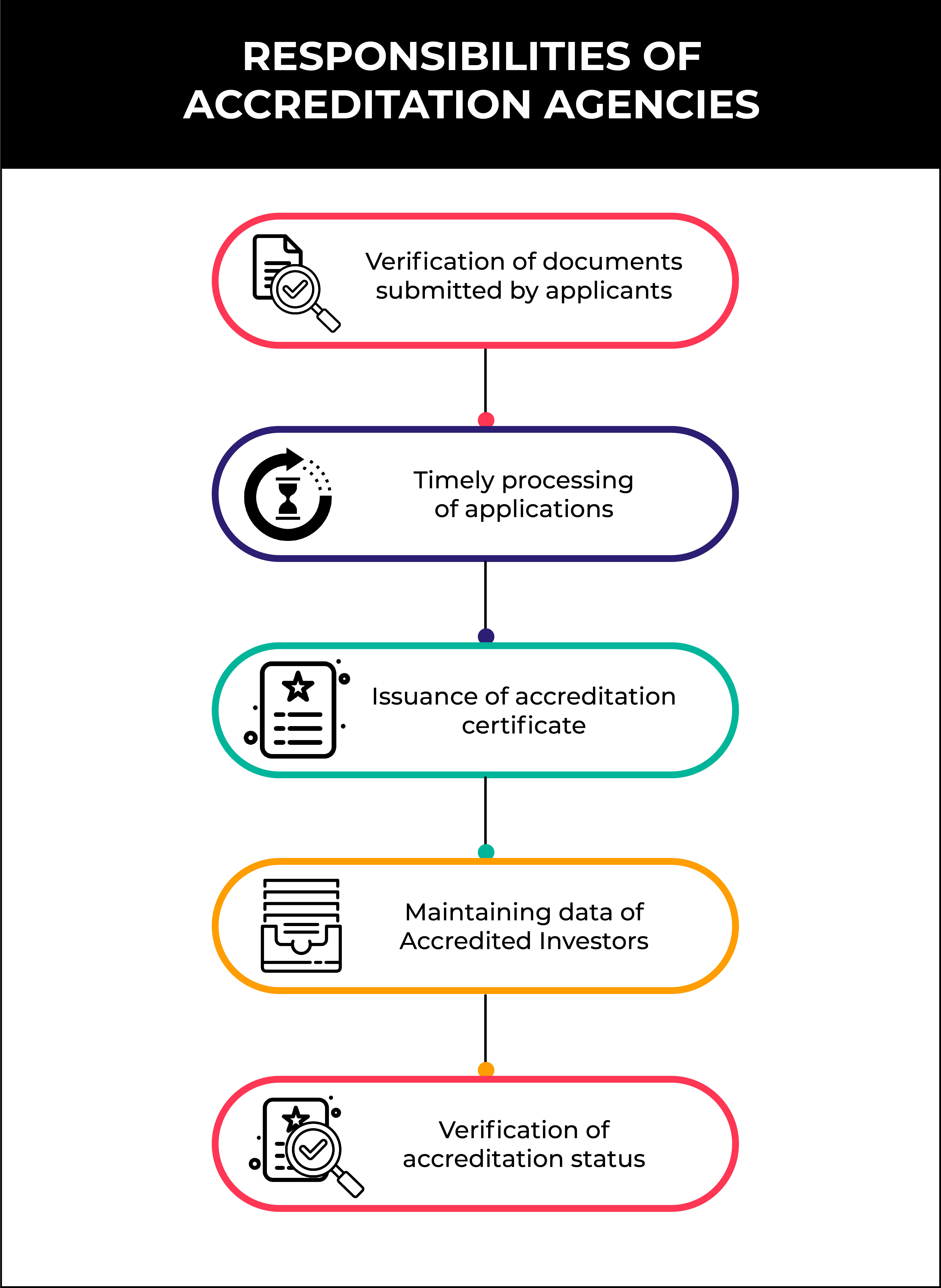

Certificates for Accredited Investors would be provided by Accreditation Agencies (AAs), which can be subsidiaries of stock exchanges or depositories (National Securities Depository Limited or Central Depository Services Limited) or any other institution that meets the eligibility criteria. For the subsidiaries to qualify as AAs, the stock exchanges should meet a few conditions like minimum of 20 years of presence in the Indian securities market, an NW of at least INR 200 crores, presence of nationwide terminals, etc.

As of May 2022, three entities have been recognised by SEBI as AAs. They are:

- BSE Administration & Supervision Ltd (wholly owned subsidiary of BSE Ltd)

- CDSL Ventures Limited (wholly owned subsidiary of CDSL)

- NSDL Database Management Ltd (wholly owned subsidiary of NSDL)

If the applicant meets the eligibility criteria, they will be issued an Accredited Investors certificate, which will have

- A unique accreditation number

- Name of the accreditation agency

- PAN of the applicant

- Validity of accreditation

It is to be noted that the accreditation certificate will be given for either one year or two-year periods. It will be valid for one year if granted based on the financial information of the past one year, and two years, if the applicant meets the eligibility criteria for each of the preceding three years and submit the supporting documents for that period.

Implications for AIFs

SEBI’s Accredited Investors framework is expected to help AIFs source more funds from the market and develop highly customised products. The higher ticket size of INR 1 crore made AIFs more or less exclusive to high net-worth individuals (HNIs) and financial institutions.

With the new Accredited Investors framework, investors will be able to infuse an amount in AIFs that could be lower than the stipulated minimum amount of INR 1 crore, subject to appropriate disclosures and terms of the agreement between the investor and fund manager.

Large value funds

While amending AIF regulations, SEBI has introduced the concept of “large value funds” (LVF) for Accredited Investors. LVF for Accredited Investors refers to AIF schemes where each investor (other than the manager, sponsor, employees, or directors of the AIF or employees or directors of the manager) infuses at least INR 70 crores. Accredited Investors in LVF can avail of regulatory relaxations, which are as follows

1. Relaxed norms for portfolio diversification: Category I and II AIFs and allowed to invest up to 50% of their investable corpus in a single investee company. This is compared to the earlier 25% limit for other AIFs of the same category. Also, Category III AIFs are allowed to invest up to 20% of their investable funds in a single investee company compared to the earlier limit of not more than 10%.

2. Extension of AIF tenure: Previously, AIF regulations permitted a two-year extension of the fund tenure of close-ended AIFs (subject to approval of two-thirds of the unit holders by value of investment in AIF). This was not considered by many investors and investment managers as the economic option for the fund. The amendments now allowed LVF AIFs to get an extension beyond two years, subject to the consent of investors, terms of the agreement between the investor and investment manager, and other fund documents. This is expected to provide the Accredited Investors of LVFs with higher flexibility in shaping the fund’s own course.

3. PPM requirements: Earlier AIFs were mandated to file a private placement memorandum (PPM), which is the offering document laying out objectives, risks, financials, and terms of the funds, at least 30 days prior to the launch of the scheme and required them to provide comments of SEBI on the PPM within 30 days of filing the PPM. The new regulations have exempted AIFs (in the LVF category) from the requirement of SEBI comments and allowed them to launch schemes by filing the PPM with SEBI before the launch. This is expected to ease regulatory scrutiny for AIFs falling in the LVF category.

No doubt, the framework of Accredited Investors and the latest amendments by SEBI could provide a conducive environment for asset managers in the AIF space. To know how to participate in our funds as Accredited Investors, please contact us!

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.