The origins of microfinance institutions in India can be traced back to 1974 when a Gujarat-based trade union Self-Employed Women’s Association (SEWA) established SEWA Bank to provide financial services to underprivileged women in rural areas. The bank along with other organisations like Working Women’s Forum (Chennai) immediately preceded the emergence of Self-Help Groups (SHGs) in India.

SHGs are a small group of 15-20 people, mostly women, formed to encourage habits of thrift, impart micro-credit, and promote micro-entrepreneurship among the members. The SHG model intended to create a common pool using contributions from members, who in turn can take loans from the pool during emergencies, mostly at flat interest rates. Thanks to the NGO, Mysore Resettlement and Area Development Agency (MYRADA), which started the SHG movement in the 1980s in South India. By 1986-87, there were roughly 300 SHGs under MYRADA.

As SHGs grew large enough and their credit needs increased, MYRADA started linking the entities to banks in 1984-85. In 1989, the SHG model was adopted by the National Bank of Agriculture and Rural Development (NABARD), which launched the SHG-bank linkage programme (SBLP) in 1992. SBLP formed the premise of microfinance activities and led to the recognition of the MFI sector in India.

In 1996, RBI decided to put SHGs under the “Priority Sector Lending (PSL)” portfolio of banks. The model became successful in states like Andhra Pradesh, Tamil Nadu, Kerala, and Karnataka, all receiving 60% of SBLP credit by 2005-06. Eventually, two models of microfinance emerged involving bank linkage as follows:

1. SBLP: Direct financing of SHGs by commercial banks, regional rural banks, and cooperative banks

2. MFI: Financial institutions like NBFCs, cooperative societies, trusts, and companies constituted under Section-25 of the Companies Act, 1956 extending microcredit to low-income groups for short tenures without any collateral for income-generating activities as well as for consumption, housing, and other purposes.

As the microfinancing sector grew and strengthened its position in furthering financial inclusion in India, concerns regarding regulating the sector arose in order to monitor, supervise, and promote MFIs in India. While NBFCs fell under the purview of RBI, other financial institutions (as mentioned in the MFI model) didn’t. The regulatory issue was exacerbated when the microfinance crisis struck in Andhra Pradesh (the motherland of the sector) in 2010 when some MFIs were accused of practicing a forced recovery process that purportedly led suicide of some borrowers. In the wake of the crisis, RBI eventually introduced a comprehensive regulatory framework in 2011, integrating customer-centric principles in the operations of NBFC-MFIs.

The need for asset securitisation for MFIs

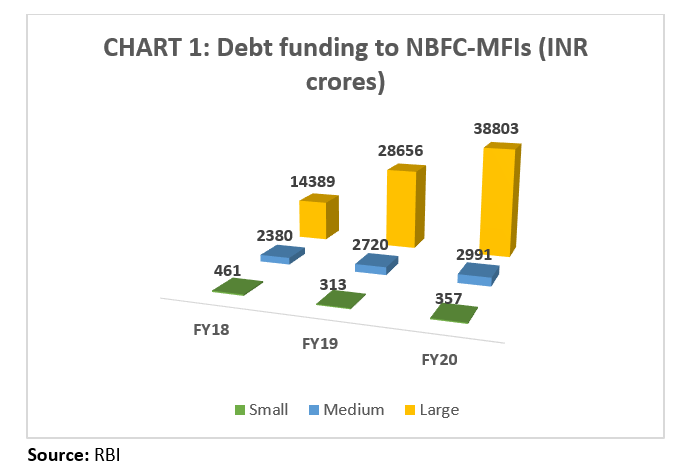

Despite serving the objective of financial inclusion, Indian MFIs, mostly the small and medium ones, often get deprived of subsidized credit used for lending. The problem had been exacerbated post crises in the sector (like the one in Andhra Pradesh in 2010), which made the funding to the sector mire in political and other external risks. The below chart on the debt funding over FY18-20 describes the scenario.

From the above chart, it is evident that a major part of the funding had been sourced by Large NBFC-MFIs (mostly from banks), who have a gross loan portfolio (GLP) of over INR 500 crores, while Small (GLP<INR 100 crores) and Medium (GLP of INR 100-500 crores) NBFC-MFIs (majorly dependent on other NBFCs for funding) found it difficult to arrange funding. Hence, it became critical for small and medium players to look for an alternative source of funding like asset securitisation that not only frees up their capital and helps them sustain higher portfolio growth but also lets them avail transparent and market-linked financing as opposed to opaque bilateral deals.

Notably, the nature of loans in the MFI sector makes them an ideal instrument for asset securitisation due to the following reasons:

- Granular structure

- Related to diversified business activities, mostly agriculture and allied activities, while the rest are linked to non-agriculture activities (trade, service, manufacturing), and household finance (education, medical, etc.)

- Short tenor, typically 12-24 months

- High frequency of repayment (weekly or monthly starting immediately after loan disbursement unlike bank loans), which matches well with periodic cash flow from borrowers’ livelihood and enhances the predictability of cash flows to SPVs, which issues ABS

The trend in MFI securitisation and the market asymmetry

Owing to the need for alternative sources of funding and the ideal nature of microloans, asset securitisation has been increasingly preferred as a tool for raising funds by NBFC-MFIs.

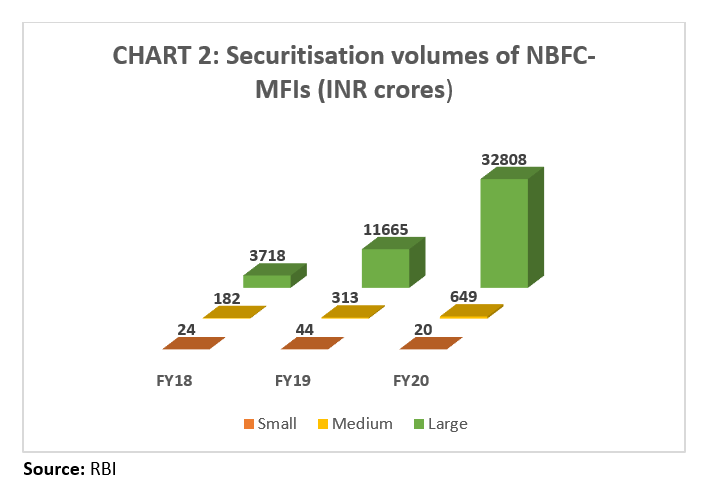

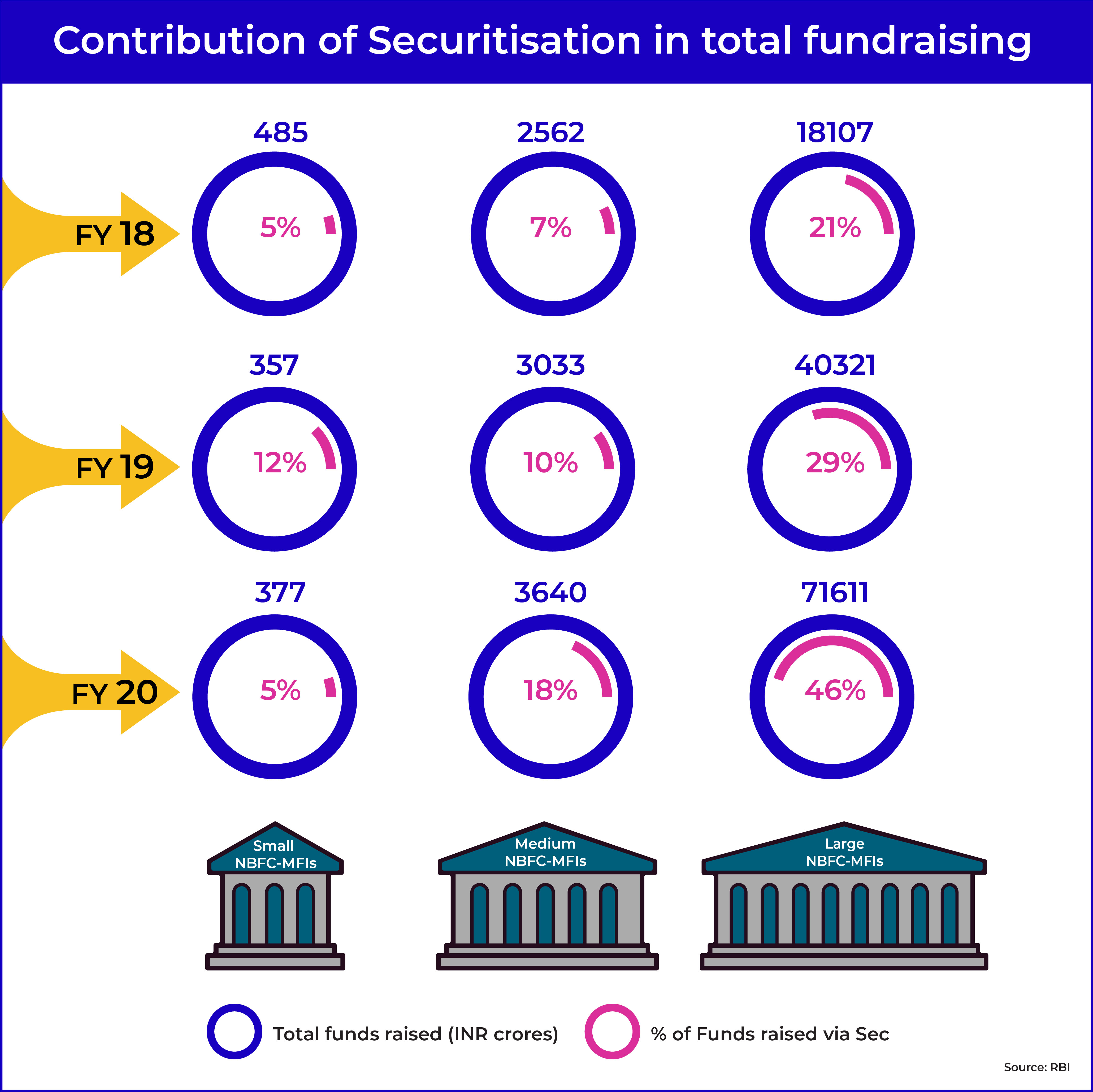

In Chart 2, if we compare FY20 vs FY18, we see that there is a ~9x increase in securitisation volumes for large NBFC-MFIs and ~4x rise in volumes for medium NBFC-MFIs over the same time frame. However, if we look at the market share across the sizes of NBFC-MFIs a strong asymmetry is visible as the securitisation volumes are highly skewed towards large players.

Performance of MFI pools

Pre-pandemic era

In the pre-pandemic era, the microfinance sector has been exposed to several crises such as the moneylending acts in Andhra Pradesh (2011), demonetisation in 2016, political debate, natural disasters, etc. Despite the negatives, the asset quality in the sector remained stable over 2017-20.

One example of resilience in the sector could be the period post the demonetisation in Nov 2016. Collections in the sector had recovered to ~98% by Jun 2017.

Post demonetisation, disbursement models of MFIs became cashless; nevertheless, collections in the sector remained largely cash-based. This could be attributed to the women borrowers, the majority of which receive their income in cash.

Post-pandemic era

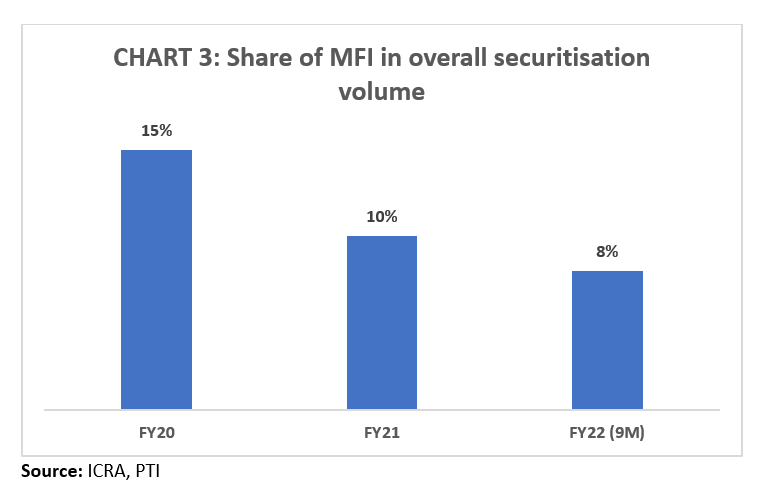

The pandemic has significantly impacted the securitisation of MFI pools at the onset. The share of funding via securitisation to the disbursements of NBFC-MFIs fell from ~35% in the pre-pandemic era to below 20% after the pandemic. The pandemic also had a meaningful impact on the MFI volume in the securitisation market as shown below

However, the collection efficiency had quickly recovered after the first wave due to the higher exposure of NBFC-MFIs to rural areas (which contributes ~75% of loan portfolio), which were less affected by the pandemic. The scenario was different after the second wave though. Collections dipped after Apr 2021 due to high infections that deeply affected the rural belts as well. As the infections started abating, a strong recovery in monthly collection efficiency was witnessed (to nearly 100%) after the first quarter of FY22.

In the first nine months of FY22, micro loan securitisation volumes improved significantly to ~INR 6,200 crores from ~INR 1,900 crores in the comparable period a year ago. However, volumes are yet to recover to pre-Covid levels (~INR 29,000 crores in FY20). “Given the substantial pickup in DA and PTC deals in the fourth quarter of FY22 and thereafter, the recovery in volumes seems better than FY21”, says Abhishek Dafria, the Vice President and Group Head of Structured Finance at ICRA Limited. “As disbursements are picking up for many players, securitisation volumes in the sector are also expected to go up”, he adds.

Outlook

Going forward, collections in MFI pools expect to remain healthy with the easing of lockdowns, vaccination of the population, and resilience in economic activities. Although the rising interest rates scenario is a concern, MFIs expect to be not as hit as previously. Thanks to the RBI regulation that removed the interest rate ceiling on loans offered by the NBFC-MFIs effectively from Apr 2022, enabling them to pass on the rate hike to the borrowers. “With a proven track record across multiple crises, MFI securitisation – a unique asset class when compared to the global asset classes – would find traction among the global investors too, owing to its multiple ESG positives and a huge market to invest”, said Dipen Ruparelia, Head of Products at Vivriti Asset Management.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.