The Co-living space is a communal accommodation setup where residents share common areas while maintaining private bedrooms. The concept isn’t new, but the modern Co-living model gained prominence in the second decade of the 21st century and soon emerged as an investment opportunity in India.

In developed countries like the US and UK, the model appealed to young professionals and students as they preferred organized shared spaces over traditional rental accommodations owing to the affordability and convenience of shared space as well as to enjoy modern amenities.

In India, the market for Co-living space started developing both from the demand and supply side due to a rapidly evolving urban landscape, demographic trends, and changing preferences for accommodation. The model turned out to be a sustainable solution to the ever-growing urban space scarcity while meeting the demand for quality accommodation by the millennial population.

Growth Drivers

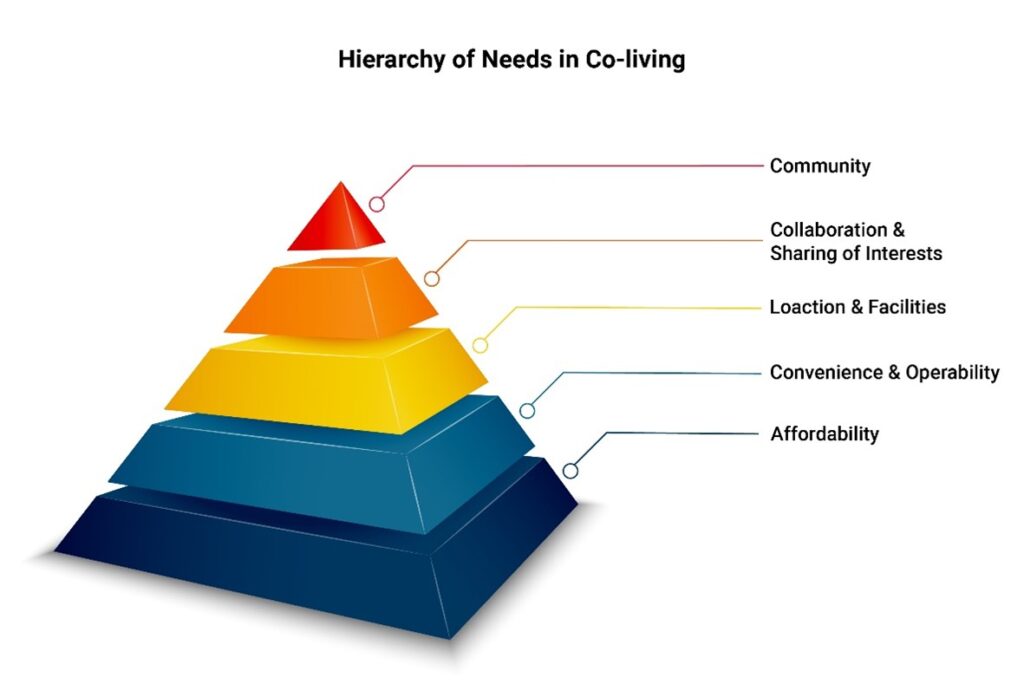

Flexible, convenience, affordability, and social exchange: The Co-living model provides flexibility, convenience, affordability, and community-driven housing solutions to residents due to factors such as:

- No fixed lease tenure

- Flexible terms of entry and exit

- Curated meal plans

- Shared cost for utility, Wi-Fi, and modern amenities

- Common areas for social interaction

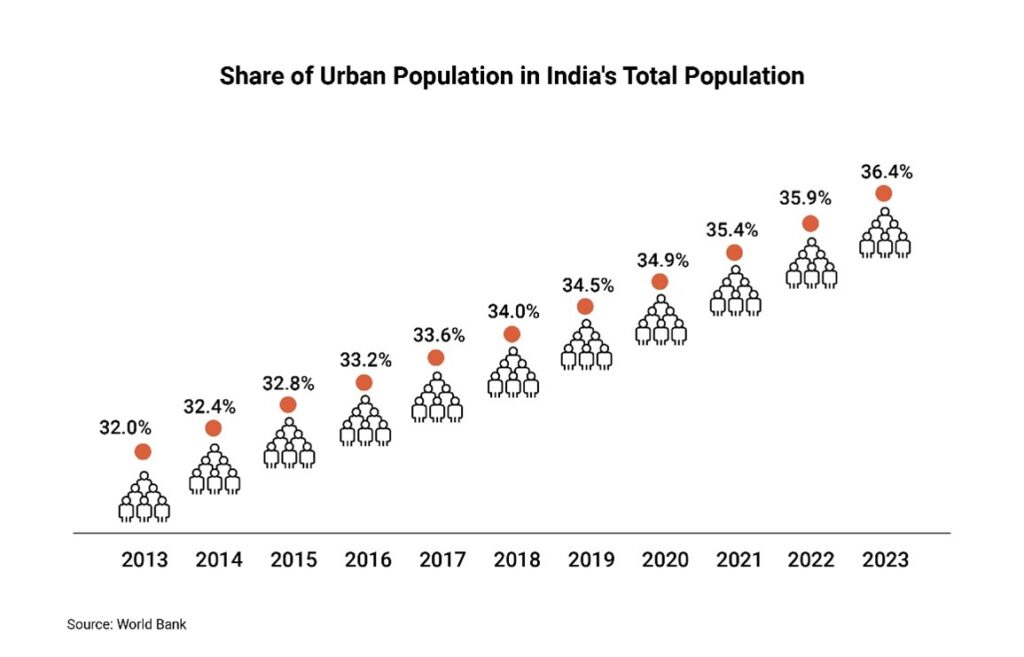

Urban migration: Over the last decade, India’s urban population recorded an annual growth rate of ~4%. This happened as people migrated to urban centers from rural areas due to employment opportunities and in pursuit of higher education. In 2023, about a third of India’s population lived in cities. About 1 crore youth join the workforce every year leading to higher demand for affordable living options near the Central Business Districts.

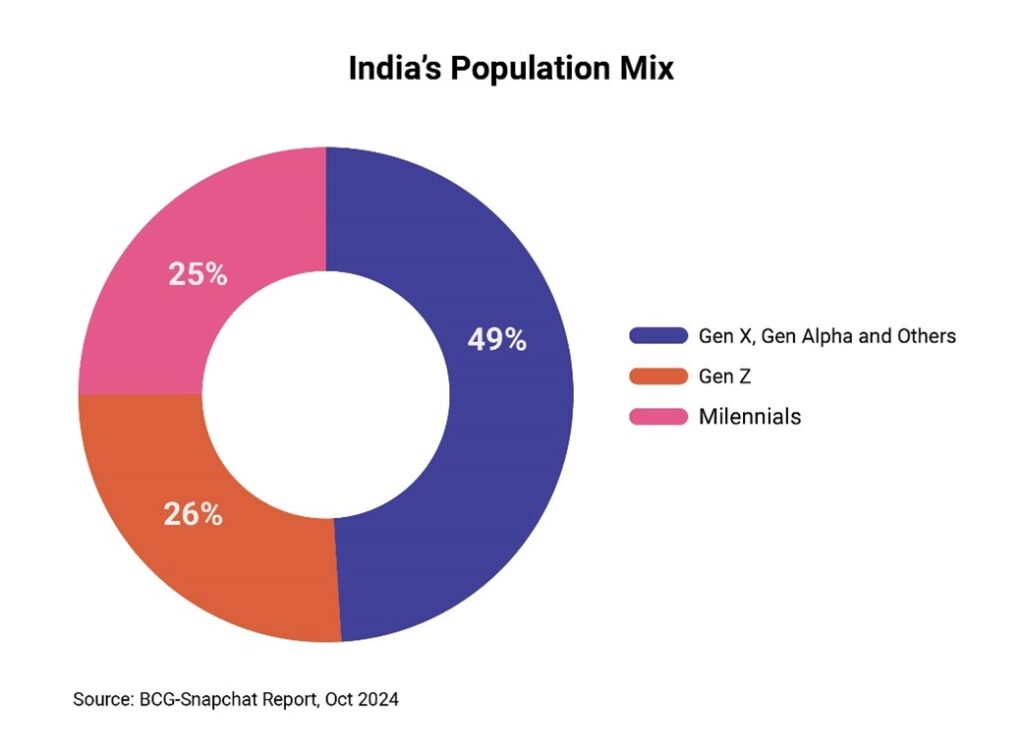

Growth in Millennials/Gen Y: There is constant growth in India’s millennials or the Gen Y population, who are people born between 1981 and 1994 (aged 30 to 43 years), resulting in an increased demand for Co-living spaces. The millennial population in the country stands at 25% of the total population, which is higher than the global average of 23%. Along with the Gen Z population, the median age of the Indian population is 28 years, making it one of the youngest emerging economies.

More than 40% of India’s working population are migratory millennials, who are increasingly attracted to urban hubs such as Gurugram, Bengaluru, Hyderabad and Chennai. This happens as India becomes the world’s third largest start-up hub leading the young workforce to take up employment in new cities or relocate to other cities on job assignments.

Recent reports suggest that millennials in India tend to stay in one city for approximately 6 months to 2 years before moving to new ventures. These millennials have the option to choose an entire accommodation space at a higher cost or shared spaces at affordable rentals. Sensing the demand, Co-living operators are catering high-quality accommodation to them while providing the flexibility to switch between cities without long-term commitments.

Job opportunities in Tier 2/3 cities: Although top metro cities constitute the largest share of the Co-living market, increasing job opportunities in Tier 2 / 3 cities are adding to the next leg of growth in the market. More than 20 such cities are driving the demand for the model, which include Jaipur, Lucknow, Chandigarh, Dehradun, Surat, Vadodara, Bhubaneshwar, Nagpur, Nashik, Coimbatore, Mysore, Vizag, Kochi, Trivandrum, Jamshedpur, Guwahati, Patna, Indore, Ranchi, Bhopal, Thrissur, and Agra.

Rise in real estate prices: The average real estate prices in India surged 23% YoY in India’s top seven cities in the first half of FY25. During the period, Delhi NCR recorded the highest increase in average ticket size (INR 145 crore), followed by Bengaluru (INR 1.21 core), Hyderabad (INR 1.15 crore), Chennai (INR 95 lakh), and Pune (INR 85 lakh). Given the scenario, Co-living presents an affordable and practical alternative to young professionals looking for high-quality and well-maintained accommodation spaces closer to Central Business Districts without any high upfront costs.

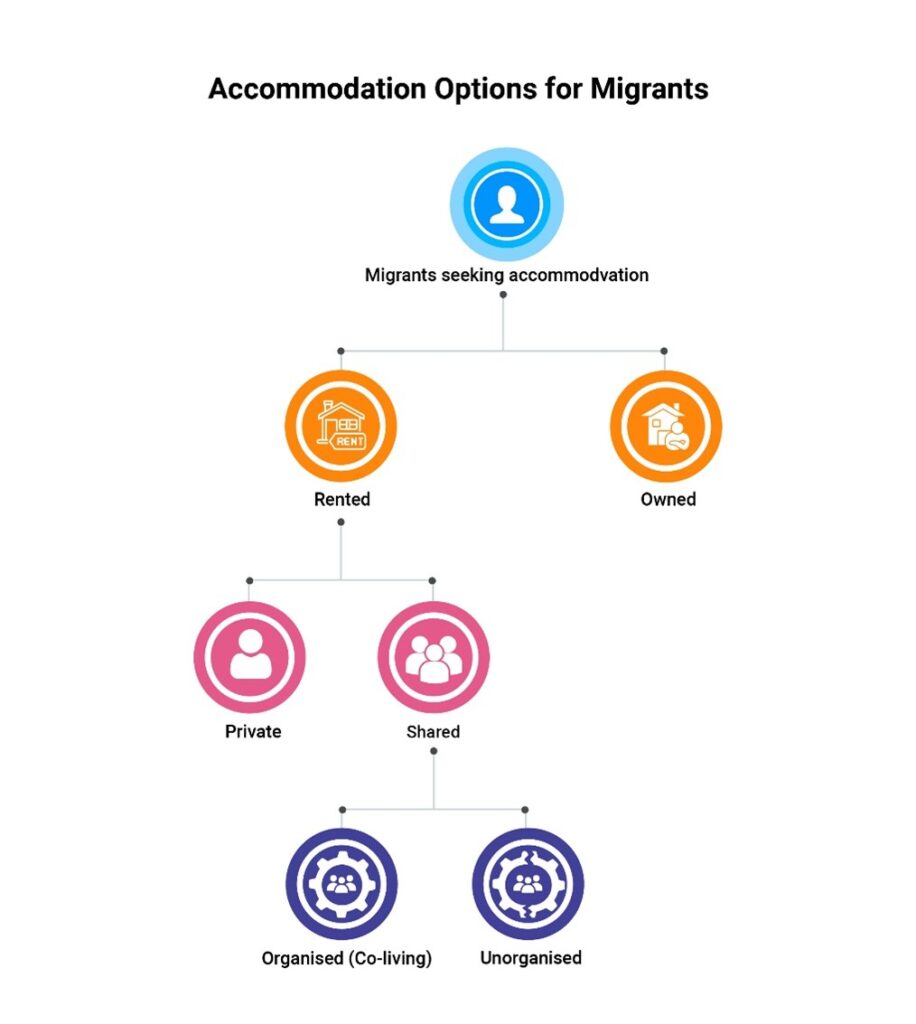

Organized vs. Unorganized Shared Living Operators

Unorganized operators: This primarily refers to PGs and private hostels, which fail to meet the needs and aspirations of the millennials. These traditional accommodation options lack modern amenities and offer rigid rental terms. In this model, residents often face the hassle of lump sum deposits and untoward landlord behavior.

Organized operators: Organized players differentiate themselves from unorganized players by the quality of their accommodation, and service offerings, providing value-added features like tech-enabled applications, mobile apps for rent payments, maintenance requests, and social interaction within the community, etc. They typically charge a premium of 20-30% over unorganized players due to superior amenities, safety, and convenience.

In the last few years, the spurt in Co-living spaces has been led by organized players, who are joining hands with landlords/owners or local developers and gaining share from the unorganized market. Further, major Private Equity (PE) deals led by global players like Tiger Global, Goldman Sachs, Sequoia Capital, Warburg Pincus, and others (including local PE and venture debt firms) in the Co-living space supported the growth of Co-living ventures in India.

Organized Operator Models

Lease & Operate: This is the predominant model in India due to its asset-light strategy. The operators lease residential units or an entire block from a landlord/property owner, and sub-lease individual rooms to end-users. Hence, they get rid of huge capex resulting from buyout of the properties. Being an asset-light model, it helps them to scale up fast as the properties are taken up on a fixed-term lease or revenue share basis for a particular period. Examples include Zolo Stays, CoHo, Stanza Living, Oxfordcaps.

Management Contract: In this model, the operator signs long-term agreements with developers /investors/property owners to run their premises as Co-living space. They act as a service provider and get a commission for operating the facility. Residents enter into a lease agreement with the owner, who is responsible for the P&L from the property. Examples include Zolo Stays, NestAway.

Franchise: Here an organized Co-living operator allows the property owner / unorganized PG/hostel operator to use its brand name. The latter runs the Co-living space while accessing the technology platform, staff training, marketing capability, and vendor reach of the organized operator. This model is suitable for operators seeking aggressive expansion while retaining its service standards and quality of infrastructure. On the other hand, it helps property owners generate higher returns without losing ownership. Examples include Zolo Stays, Placio.

Hybrid: This is a mix of Lease & Operate and Management Contracts models. This model helps the Co-living operator adopt a multi-pronged business strategy in a relatively new market to expand aggressively. Examples include Zolo Stays, CoHo.

Return Economics

Co-living space in India caught the eyes of global investors over the last 10 years. The materialization of several PE deals (as mentioned above) is a testament to that, and more and more institutional investors are showing active interest in the space. Attractive return economics is the key factor behind the emergence of this alternative real estate model.

From the operator’s perspective, the profitability of the Co-living operation depends on the type of operator model discussed earlier. An asset-light model like Lease & Operate is prevalent while others prefer a revenue-sharing arrangement or fixed rental arrangement.

The operating profit margin for an operator generally ranges between 10 to 20%, which depends on factors such as scale of operations, type of operating model, bargaining power of occupants, operator’s negotiation power with vendors for food/broadband, etc. (JLL-FICCI, 2019) It also depends on the ability of the operator to charge a premium from tenants/landlords by fixing the inefficiencies of an unorganized shared rental market.

From a landlord’s perspective, Co-living offers an attractive return of 2 to 4x of traditional residential asset classes (Colliers, 2021) when rental yields in the traditional housing market have stagnated at ~3%. This primarily happens as the cost of shared spaces such as kitchens and living areas are amortized over a larger number of beds resulting in a return efficiency on a per bed basis. Factors that influence landlord’s yields include the type of operator model, product positioning, type of value-added services, etc.

Conclusion

The Co-living space in India offers a huge investment opportunity given the untapped potential in the market. While Tier-1 cities like Delhi NCR, Mumbai, Bengaluru, Hyderabad, Chennai, and others will spearhead the growth, developments in Tier 1/3 cities will further support the growth. As per Cushman & Wakefield, the Co-living market size is expected to more than double from ~US$5 billion (2019) to ~US$11 billion by 2025 in Tier 1 cities (top 8) and from ~US$1.5 billion (2019) to over US$3 billion in Tier 2/3 cities (top 22) by 2025.

Factors such as the rising millennial workforce, urban migration, and the growth of the student population are expected to drive the demand for organized Co-living spaces. From the supply side, attractive return economics compared to traditional rental models would result in an influx of new players in the market creating high-tech and flexible Co-living spaces.

Disclaimer:

The views provided in this article are of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.