“Change creates opportunities to grow, but it also creates opportunities to slip.”— Philip Fisher

Executive Summary

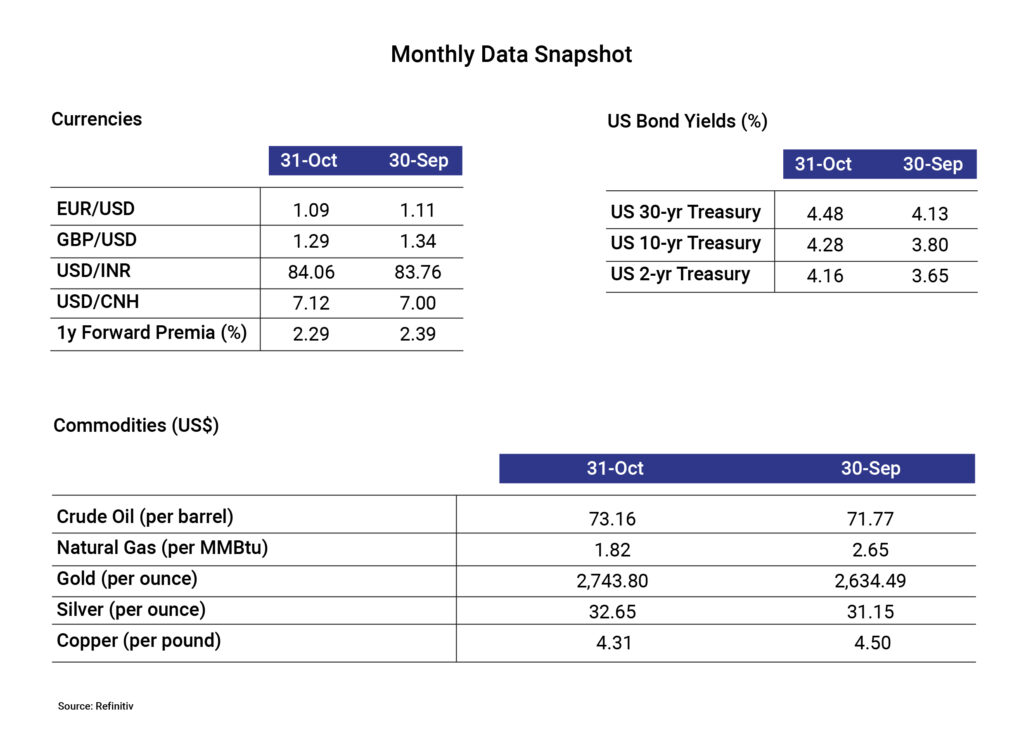

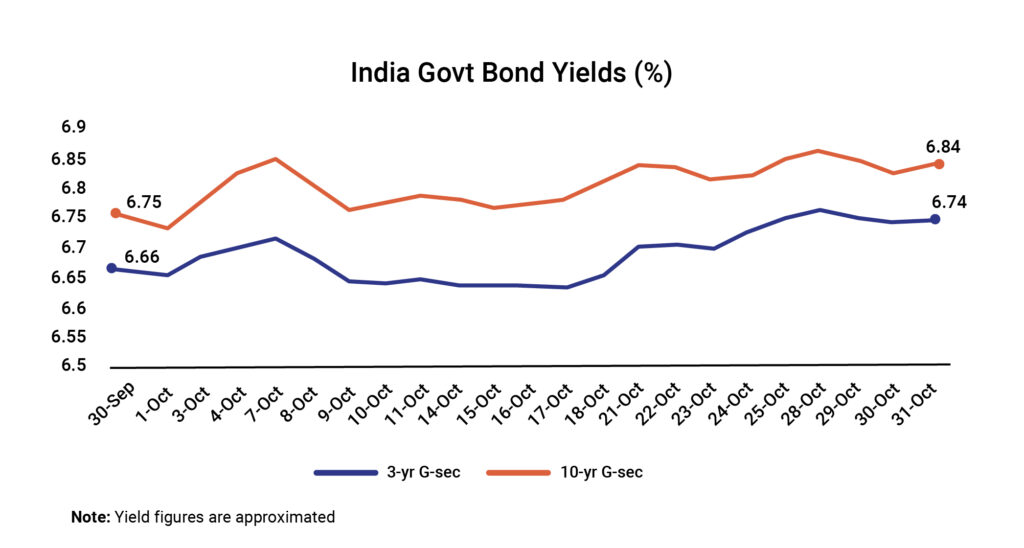

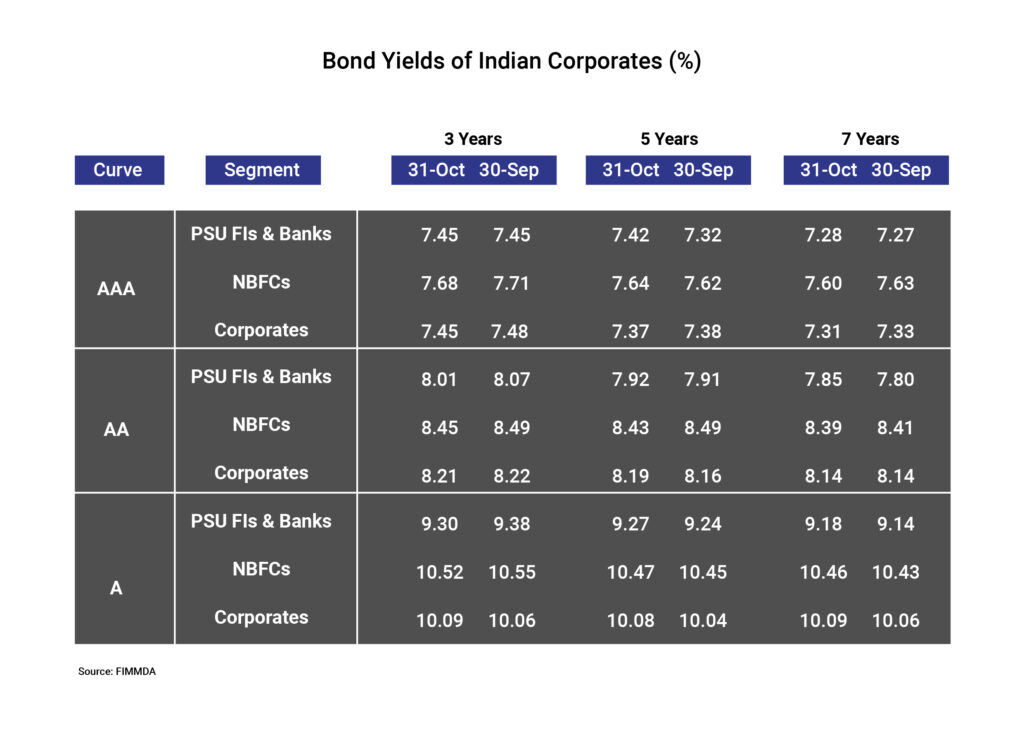

After the larger-than-expected rate cut of 50 basis points (bps) by the US Fed, markets braced for election impact as the yields corrected significantly throughout October ahead of the event risk and a stronger set of macro data prints. The US 10-year treasury moved up by ~75 bps from September lows as markets increasingly scaled down rate cut expectations from the Fed going forward. Elsewhere, ECB reduced rates for the third time in October with markets expectation of another cut this calendar year.

On the domestic front, RBI maintained the status quo on policy rates accompanied by a change in stance to neutral. The RBI Governor reiterated the focus on the 4% inflation target on a durable basis. Geo-political risks, particularly, tensions in the Middle East, need to be closely watched in case the fallout leads to any significant surge in crude prices.

Domestic Updates

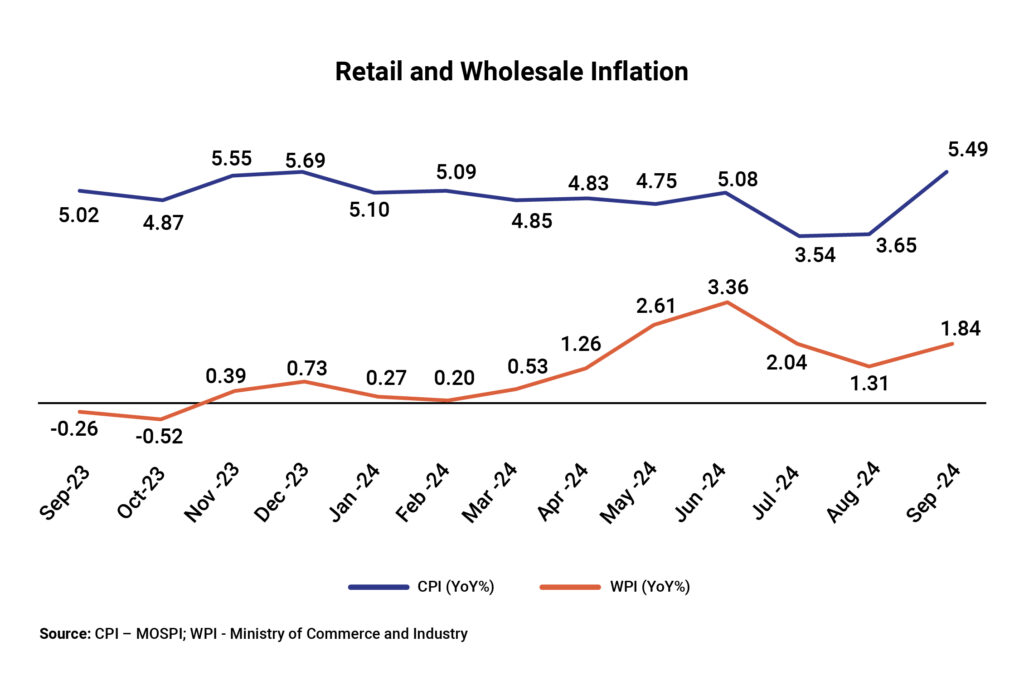

India’s retail inflation rises closer to the upper RBI band, wholesale inflation accelerates

The retail inflation, measured as a change in the Consumer Price Index (CPI), rose to a 9-month high of 5.49% YoY in September from 3.65% in August but remained within the RBI’s target range of 2-6%. The increase is attributable to a spike in food inflation to a 3-month high at 9.24% in September from 5.66% in August. Due to persistent unfavourable weather conditions, vegetable inflation rose to a 14-month high at 36% YoY in September from 10.71% in August.

Inflation based on the wholesale price index (WPI) moved slightly upwards to 1.84% YoY in September from 1.31% in August, after two consecutive months of decline. WPI is divided into three groups — Primary Articles (22.6% of total weight); Fuel and Power (13.2%); and Manufactured Products (64.2%). The acceleration in wholesale inflation was mainly caused by the rise in inflation for primary articles from 2.42% in August to 6.59% in September due to a sharp rise in the prices of food articles.

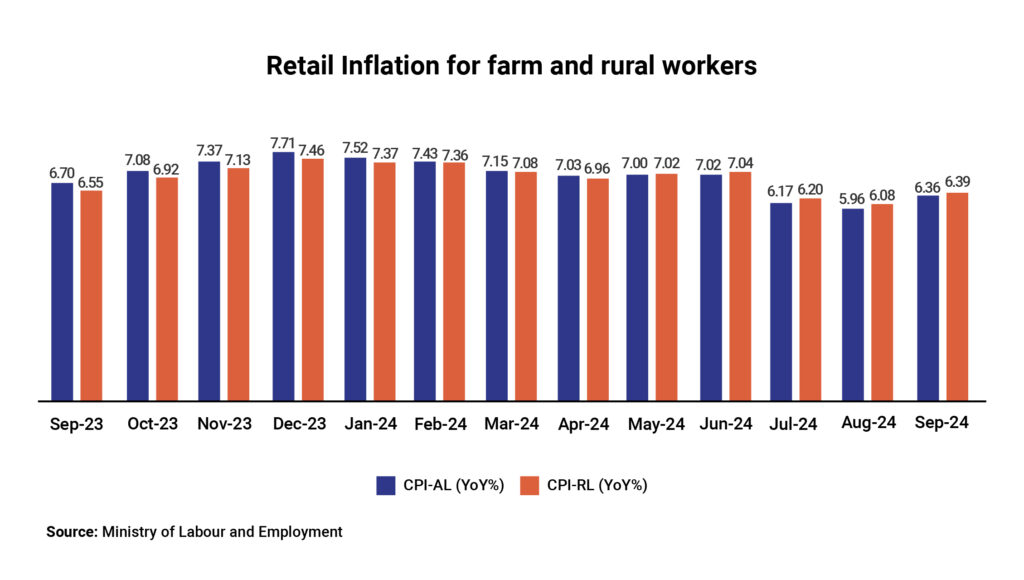

Meanwhile, retail inflation for farm and rural workers rose to 6.36% YoY and 6.39% in September 2024, respectively, from 5.96% YoY and 6.08% in the previous month.

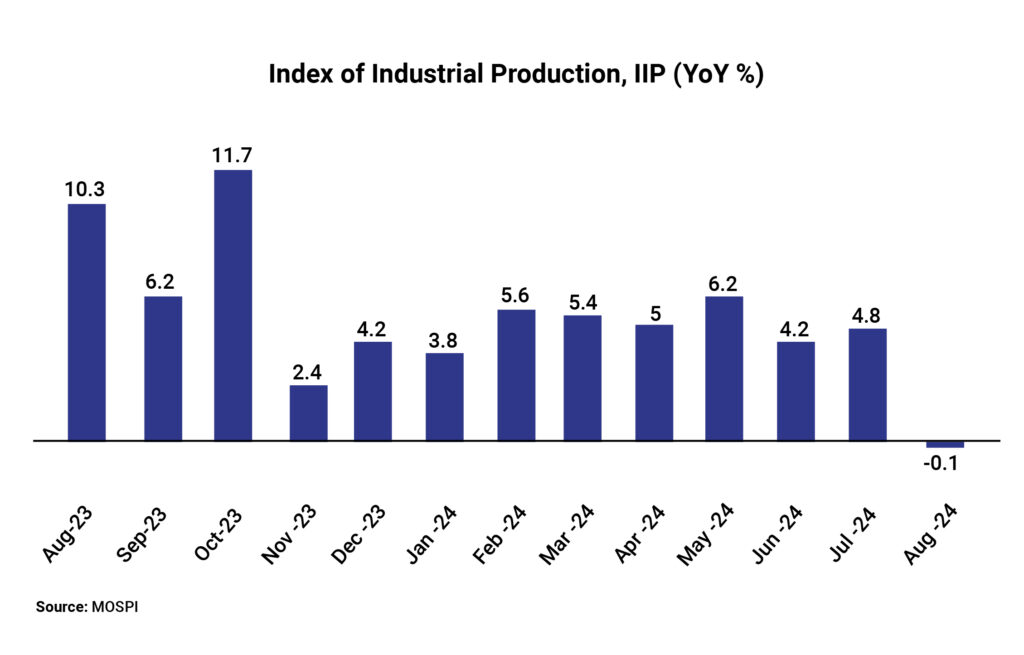

Mining and electricity drag India’s industrial output

India’s industrial output, as measured by the Index of Industrial Production (IIP), declined 0.1% YoY in August against a growth of 4.8% in July due to contraction in two out of three major components of IIP – mining, manufacturing, and electricity. Mining and electricity output declined 4.2% and 3.7% YoY, respectively while manufacturing output grew only 1% during the month.

RBI maintains status quo in the repo rate but changes its policy stance

The Reserve Bank of India (RBI) keeps the benchmark repo rate (the rate at which RBI lends money to commercial banks in exchange for securities) unchanged at 6.5% for the 10th consecutive time in its 4th bi-monthly Monetary Policy Committee (MPC) meeting for FY25. The central bank committee mentioned that it is prudent to maintain greater flexibility and optionality, given the present circumstances. Other key rates such as Standing Deposit Facility (SDF), Marginal Standing Facility (MSF), and Bank Rate have been kept unchanged at 6.25%, 6.75%, and 6.75%, respectively. The significant diversion in the current MPC was the change in policy stance unanimously from ‘withdrawal of accommodation’ to ‘Neutral’, which means that the central bank can either raise or reduce benchmark rates based on how the key economic indicators like inflation and GDP are panning out.

Net FDI to India doubles

Net foreign direct investment (FDI) in India more than doubled to US$6.62 billion in April–August 2024 from US$3.26 billion in April–August 2023, as per RBI. Gross inward FDI rose ~32% YoY to US$36.1 billion in April–August 2024. About two-thirds of the gross FDI inflows went to manufacturing, financial services, communication services, electricity, and other energy sectors. Nearly 75% of the inflow came from Singapore, Mauritius, the UAE, the Netherlands, and the US.

India’s trade deficit abates

India’s merchandise trade deficit narrowed to US$20.8 billion in September, which is the lowest in the last 5 months, from US$29.7 billion in August and US$23.5 billion in July. In September, merchandise exports slightly dropped to US$34.58 billion from US$34.71 billion in August, while imports fell drastically to US$55.36 billion from US$64.36 billion in August.

China is India’s largest source of imports

According to the Commerce Ministry, China became the largest source of imports during April-September 2024 with inbound shipments rising 11.5% to US$56.3 billion. It is followed by Russia, the UAE, the US, Iraq, Saudi Arabia, Indonesia, Korea, Switzerland and Singapore. On the other hand, the US became the top export destination for India in the same period with outbound shipments increasing 5.6% to US$40.4 billion.

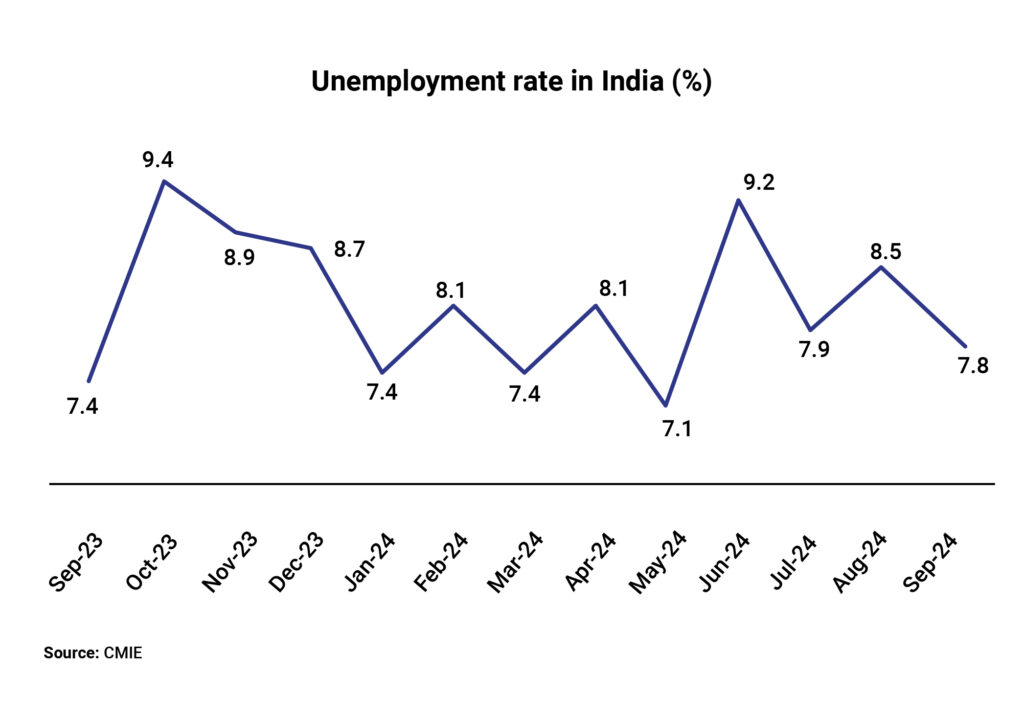

Unemployment rate dips to 4-month low

The unemployment rate in India dipped to a 4-month low at 7.8% in September from 8.5% in August, according to the survey by the Centre for Monitoring Indian Economy (CMIE). However, there were fewer people actively looking for jobs as depicted in the fall in labour participation rate from 41.6% to 41% in September 2024.

India’s personal income tax collections growth surpasses corporates

India’s personal income tax collections grew at a pace that is double the pace of corporate tax collections over the past decade, according to data revealed by the Central Board of Direct Taxes. The personal income tax collection surged 294.3% to INR 10.45 lakh crore between FY15 to FY24 while the corporate tax collections jumped 112.9% to INR 9.11 lakh crore in the same period. The total number of taxpayers increased from 5.7 crore in FY15 to 10.4 crore in FY24 while the number of tax returns more than doubled from 4 crore in FY15 to 8.6 crore in 2024. With this, the tax-to-GDP ratio increased from 5.6% in FY15 to 6.6% in FY25. Maharashtra, Karnataka, Delhi, Tamil Nadu, and Gujarat contributed over 72% of net direct tax collections.

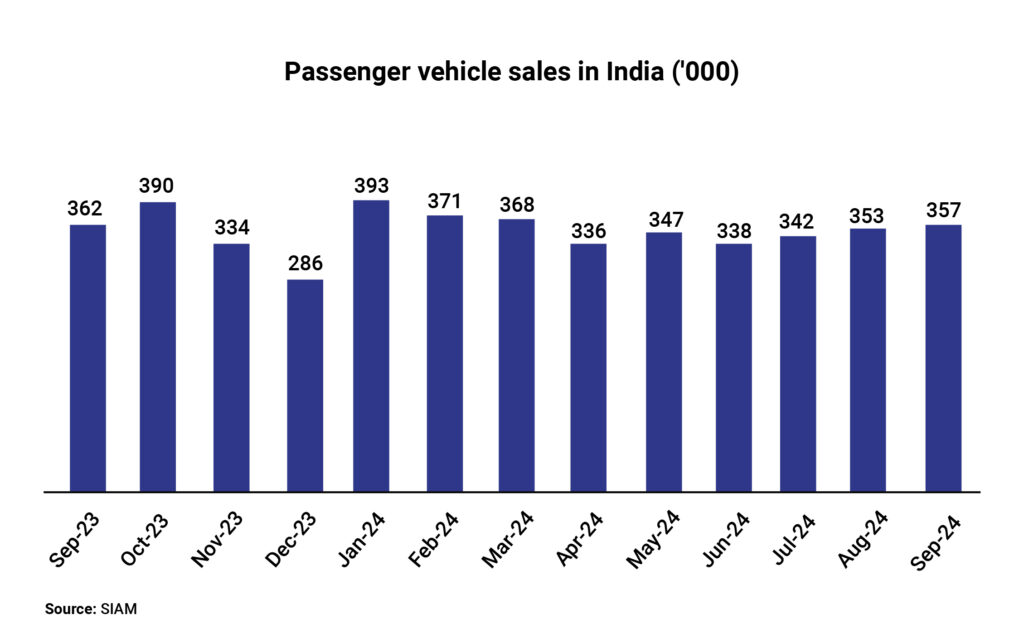

Passenger vehicle sales recover after 2 months of decline

Total passenger vehicle sales in India increased ~1.1% YoY to 356,752 units in September from 352,921 units in August, as per data from the Society of Indian Automobile Manufacturers (SIAM). According to data from the Federation of Automobile Dealers Association (FADA), which shows actual retail sales from showrooms, versus the SIAM, which puts out dispatches to dealers from auto factories, passenger vehicle sales fell 9.3% YoY in September. Two-wheelers and commercial vehicle sales declined 8.5% and 10.5% YoY, respectively while sales of tractors grew 14.7% YoY.

World Bank upgrades India’s growth forecast

The World Bank upped its real GDP growth forecast for India from 6.6% (projected in April 2024) to 7% for the fiscal year 2025 ending March 2025. As per the international financial institution, recovery in agricultural output and strong private consumption led by employment growth are expected to auger well for the domestic economy. The revised forecast is in line with the IMF, which has retained India’s growth forecast at 7% for FY25.

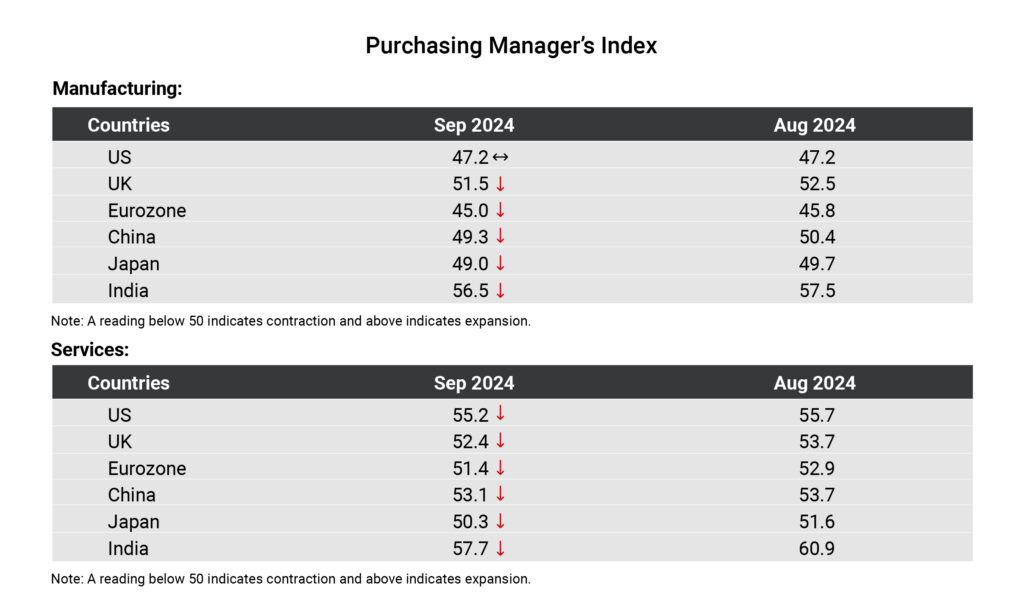

Global Update Roundups

Monetary policies

- ECB: The European Central Bank cut its deposit rate for the third time in 2024 by 25 bps to 3.25% in an effort to boost economic growth amid softening labour market and moderation in inflation. The European Union has been struggling with poor consumer spending and weak economic indicators, and the subdued growth resulted in lower inflation, which came in at 1.7% in September, its lowest level in 3 years. More cuts are likely; however, the ECB did not provide any direction for its next move.

- People’s Bank of China: The People’s Bank of China has cut its benchmark lending rates by 25 bps in an expected move to boost the economy. The 1-year loan prime rate (LPR), which affects corporate loans and most household loans, has been cut to 3.1%, while the 5-year LPR, which serves as a benchmark for mortgage rate, has been reduced to 3.6%.

GDP growth

- Global growth: The International Monetary Fund (IMF) in its October World Economic Outlook has kept the global growth unchanged at 3.2% in 2024 and 2025 stating that the “global economy remained unusually resilient throughout the disinflationary process”. The UN agency expects global headline inflation to decline from an annual average of 6.7% in 2023 to 5.8% in 2024 and 4.3% in 2025. It foresees advanced economies to return to their inflation targets earlier than emerging market and developing economies.

- China: China witnessed a slowdown in the economy as GDP growth declined from 4.7% in the second quarter of 2024 to 4.6% in the third quarter reflecting the need for additional stimulus. The Chinese government already announced interest rate cuts and policy measures to support the property and equity market. Chinese lawmakers are now expected to approve additional budget or debt sales to fund public spending as part of the promised fiscal support.

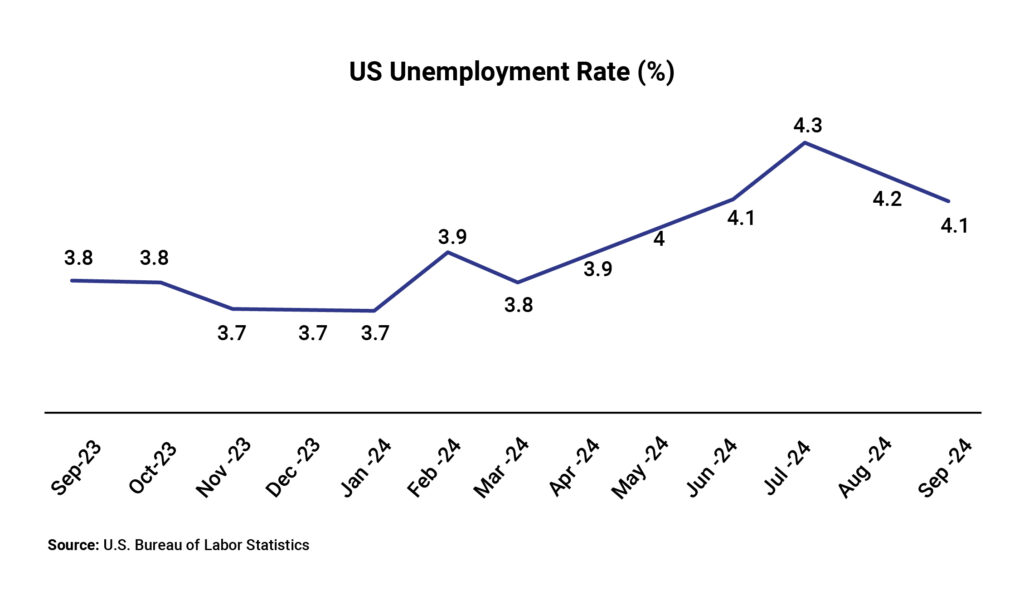

Unemployment

- US: The unemployment rate eased to 4.1% in September, the lowest in three months, from 4.2% in August, exceeding market expectations of an unchanged rate. This happened as the number of unemployed individuals declined by 281,000 to 6.8 million, while employment levels rose by 430,000 to 161.8 million. The labour force participation rate was steady at 62.7% in the month.

- Canada: The labour market recovered as the unemployment rate declined to 6.5% in September, after consecutive increases since January 2024, from the 34-month high of 6.6% in August, defying the consensus estimates of 6.7%. The number of unemployed decreased by 30,800 from the prior month to ~1.43 million due to a decline in unemployment for the youth.

- China: Unemployment in China declined to a 3-month low of 5.1% in September (below market estimates of 5.3%) from 5.3% in August. The jobless rate for locally registered residents declined to 5.2% in the month.

- Japan: Japan’s unemployment rate declined to the lowest level since January at 2.4% in September from 2.5% in August. It came down from July’s 11-month peak of 2.7% and less than market forecasts of 2.5%.

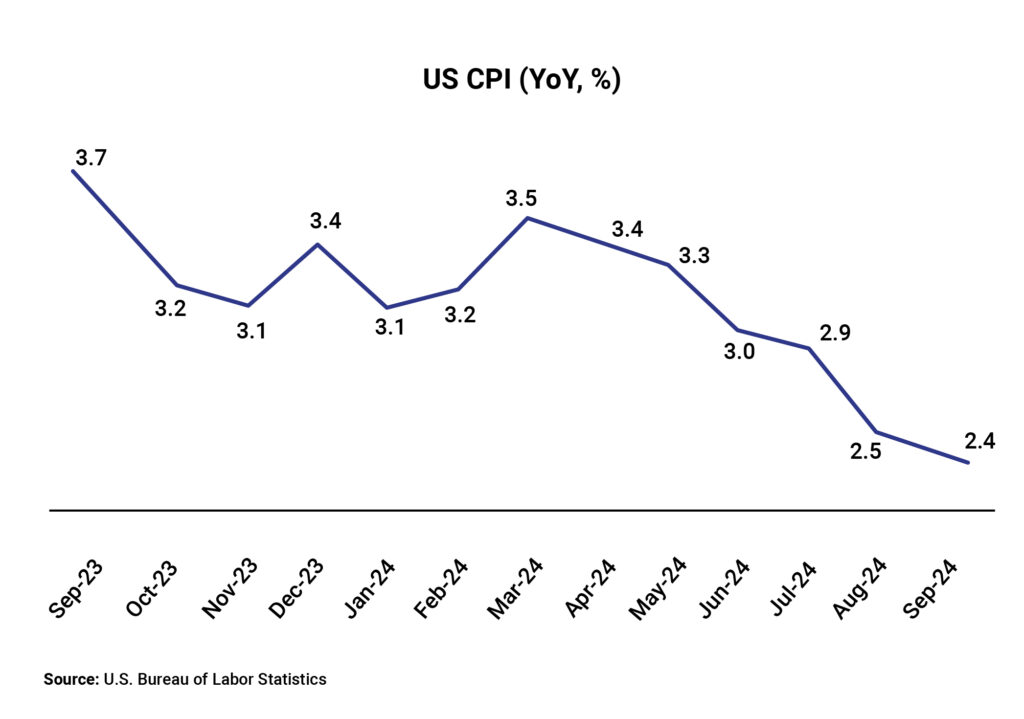

Inflation readings

US: The inflation rate in the US decelerated for a sixth consecutive month to 2.4% YoY in September from 2.5% in August but came in above the Dow Jones estimate. It’s the lowest inflation recorded since February 2021 and supports the US Fed’s confidence of inflation coming back towards the 2% goal. Core inflation increased 10 bps MoM to 3.3% in September. A fall in energy prices (-6.8% in September vs -4% in August) is one of the primary factors behind the fall in inflation.

- Eurozone: The annual inflation rate in the Eurozone declined to 1.8% in September, the lowest since April 2021, compared to 2.2% in August, but came in below the consensus estimates of 1.9%. However, it is below the 2% target set by the European Central Bank. This happened as energy prices fell (-6% vs -3%) and inflation for services decelerated (4% vs 4.1%).

- UK: The annual inflation rate declined to 1.7% in September, which is the lowest point since April 2021 and compared to 2.2% in each of the previous two months. Transport costs (-2.2% vs 1.3%) is the largest contributing factor to the fall in inflation rate due to lower prices of airfares and motor fuels.

- China: The annual inflation softened to 0.4% in September from 0.6% in August, indicating a slowdown in the economy. It missed the consensus estimates of 0.6%.

- Japan: The annual inflation declined to the lowest level since April at 2.5% in September from 3% in August. The deceleration in prices of electricity and gas and moderation in prices of food, furniture/household utensils, transport, and culture contributed to the fall in inflation.

Consumer confidence

- US: The consumer confidence index improved to 108.7 in October from a revised 99.2 reading in September. It is the biggest jump in confidence since March 2021. This happened as people expressed optimism about the job market. Many noticed a fall in grocery prices though overall inflation remained a concern.

- Japan: The consumer confidence index declined to 36.2 in October from 36.9 in August, which was the 5-month high. This happened as households’ sentiment in the country weakened for income growth, employment, willingness to buy durable goods, and overall livelihood.

- UK: Consumer Confidence indicator hit the lowest level in the year at -21 in October compared to -20 in September. Concerns on potential tax increases in the Budget weighed on household and business sentiments.

- Euro: Consumer confidence in the Euro Area increased by 40 bps to -12.5 in October from -12.9 points in September. The improvement was led by consumers’ enhanced outlook on their household financial situation.

Balance of Trade

- US: The trade deficit surged 15% to two-and-half-year high of US$108.2 billion in September from US$94.2 billion in the prior month. US imports rose ~4% to US$282.4 billion in the month ahead of the holiday shopping season while exports fell 2% to US$174.2 billion.

- China: China continued to report a trade surplus, but it narrowed to US$81.7 billion in September from US$91.02 billion in the same period a year earlier. This is attributed to a fall in manufacturing activity with new export orders declining to their worst in 7 months.

- Japan: Japan’s trade deficit narrowed to JPY 294.34 billion in September from JPY 695.3 billion in September 2023. The reported figure was much higher than the market forecast of a deficit of JPY 237.6 billion. Exports declined unexpectedly by 1.7% to JPY 9,038.20 billion, the first dip since November 2023, while imports rose 2.1% to JPY 9,332.55 billion.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.