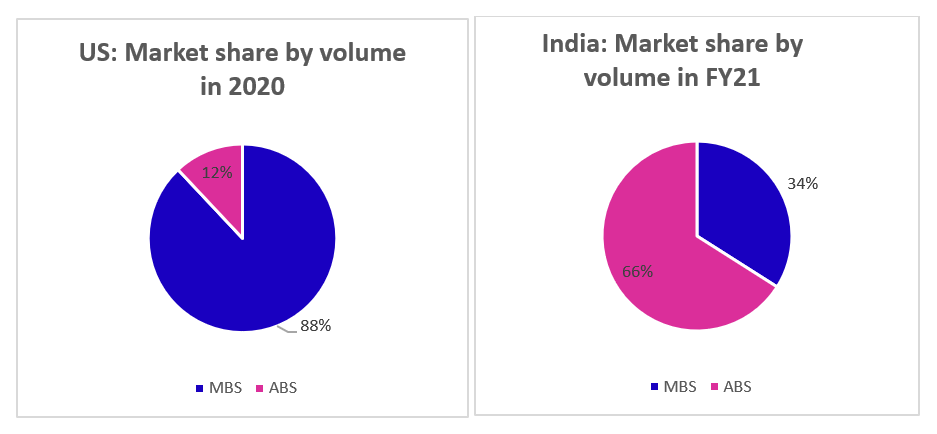

In the US, the asset securitisation market is dominated by mortgage backed securities (MBS). The reason for its easy take-off was the comfort of investors based on the belief that mortgaged properties do not depreciate in value, unlike other physical assets. However, in India, asset backed securities (ABS) took precedence over MBS starting predominantly with auto loans. Although the MBS market has huge potential, it did not grow as large as the ABS market in India primarily due to issues like

- long tenure of loans

- complex foreclosure norms

- low spreads

- RBI regulations with respect to Minimum Holding Period (MHP) — the duration (earlier 12 months) for which a bank or NBFC is required to hold the loans on its book before selling them — and Minimum Retention Ratio (MRR) — which required NBFCs to hold a minimum percentage of the book value of the loans being securitised to ensure their adequate skin in the game even after securitisation. These norms were later relaxed though where MHP was reduced to 6 months and MRR was lowered to 5% of the book value of the loans (irrespective of the tenor) being securitised in the case of MBS.

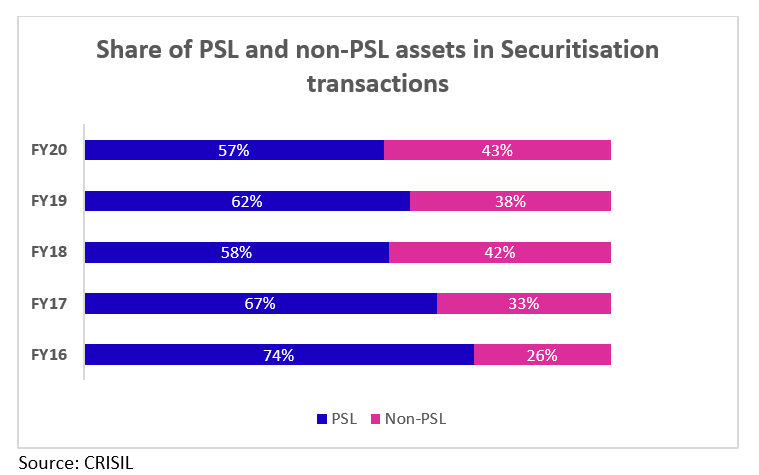

The majority of traction that India’s securitisation market gained over the years is due to Priority Sector Lending (PSL) by banks. RBI has mandated the banks to lend to priority sectors like agriculture, micro, small & medium enterprises (MSMEs) to boost financial inclusion in India.

The non-banking financial institutions sold PSL pools via securitisation to banks as and when they fell short of their PSL target. Historically, PSL securitisation has accounted for three-fourths of the market. However, the market share of PSL volumes has started coming down over the past few years due to increasing interest in the non-PSL segment, particularly MBS and receivables backed by auto loans, two-wheeler loans, gold, etc., with rising participation from mutual funds, NBFCs, and Development Financial Institutions (DFIs) like MUDRA, Nabsamruddhi Finance (a subsidiary of NABARD), Small Industries Development Bank of India (SIDBI), etc. In India, NBFCs and housing finance companies act as key originators of securitization deals, while banks act as the leading investors in these pools due to their PSL targets.

Investors are increasingly shifting toward non-PSL assets due to a higher appetite for yields. The yields on non-PSL-backed assets/PTCs are at least 50 basis points (bps) higher than PSL-backed PTCs, both belonging to the same originator.

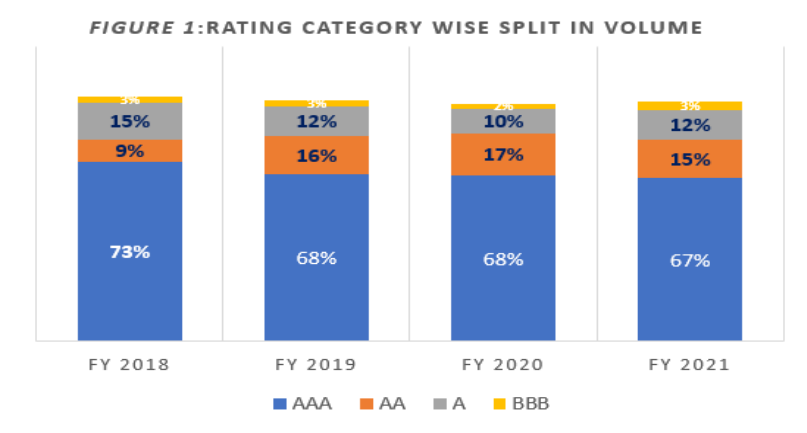

If we look at the issuers’ ratings across securitisation pools, we see that the market is highly skewed towards AAA-rated issuers in terms of volume as shown below.

The AAA-rated issuances mainly comprise pools based on commercial vehicles, MBS, and loan against property (LAP). Originators like Fullerton, HDB, Indiabulls, Mahindra, Sundaram, Shriram Transport, and Cholamandalam are mostly crowding these issuances.

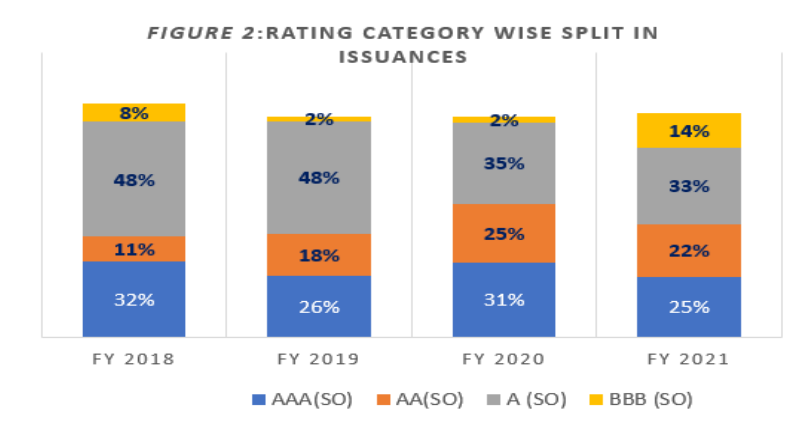

However, in terms of the number of issuances, the number of issuers at the lower end of the rating scale such as A and BBB is as good as that in the upper end. Hence, combining Figures 1 and 2, it’s evident that issuers at the lower end of the rating scale lack due access to the market as their originator volumes are way lower than AAA-rated issuances. Given this scenario, the price discovery of securities at the lower end can only improve if the market is flushed with excess liquidity prompting the investors to go for such issuances. This was evident during the quantitative easing post-Covid, however, with gradual tightening amid rising inflation lately, demand for such issuances could get impacted.

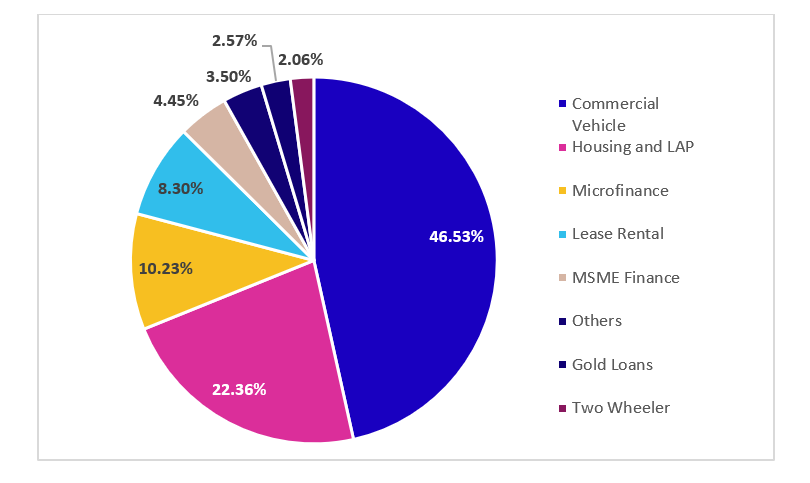

Here’s a look at the category-wise break-up of pooled assets in the Indian securitisation market (FY21):

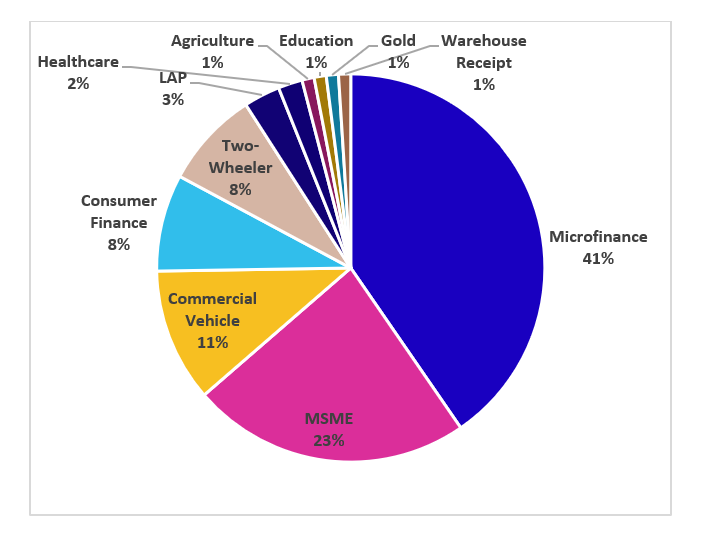

If we look at the number of issuers at the lower end of the rating curve such as A (SO) and BBB (SO) ratings, the structure of category-wise break-up changes as shown below (FY21):

Next, we will take a deeper look at individual segments of the ABS market.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.