The first securitisation program in India in 1991 was based on an auto loan portfolio with Citibank. The investor base in the deal was limited to mutual funds because other financial institutions were reluctant to foray into the space due to its unsecured nature, lack of clarity with respect to the at-par treatment of the certificates with other debt securities, and very low volume in the secondary market.

At the turn of the last century, there had been increasing participation by companies like Kotak Mahindra and Ashok Leyland Finance, who started securitizing their auto loan portfolio to buyers like ICICI and Citibank, with many of them being rated by credit rating agencies. However, most of these deals were bilateral instead of SPV-based.

The surge in auto loans-based ABS was driven by multiple factors such as

- Increasing participation of international players in the Indian auto market

- Presence of features (like instalment and hire purchase finance) in auto loans meeting securitisation criteria

- Safety due to title over assets

- Development of a resale market for cars that let financiers use foreclosures effectively in delinquencies

CV loans

The pools based on commercial vehicle (CV) loans have been the dominant class in India’s ABS market and form a major part of rated auto loans-backed ABS pools. Commercial vehicles, which are used for transporting goods or passengers, are classified into Light, Medium & Heavy depending upon their gross vehicle weight. The market for CV loans is estimated at Rs. 5 lakh crores. The five states — Maharashtra, Tamil Nadu, Rajasthan, Uttar Pradesh, and Gujarat account for 45% of all CV loans.

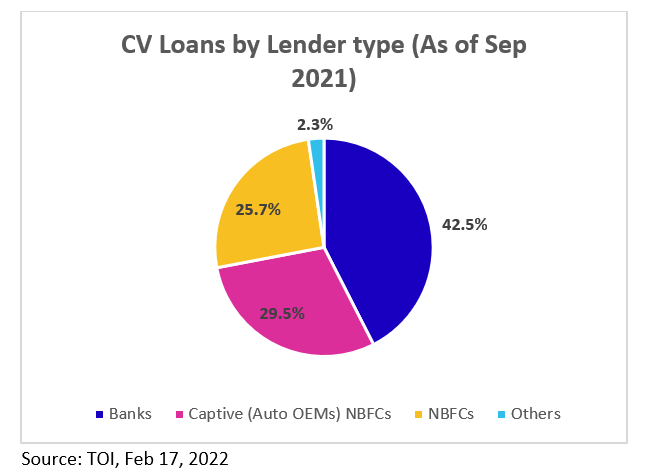

Banks and captive financiers mostly dominate the New CV financing while NBFCs dominate the Used CV financing. The NBFC space includes major players like Cholamandalam Finance, Sundaram Finance, Shriram Transport Finance, Tata Motors Finance, etc.

It is to be noted that a large portion of used CV financing is still controlled by the unorganised sector (mainly moneylenders). Hence, the share of NBFC expects to increase with the formalization of the financing sector. Cholamandalam Finance is one of the leaders in Used LCV financing. Emerging players like SK Finance, Kogta Financial, and others expect to gain a significant share in the market with formalization of the sector.

Performance of CV-based ABS pools

As per a Dec 2021 study by ICRA, securitisation pools based on CV loans have depicted stable collection performance historically, including events like demonetisation and GST implementation in India. It is the segment that depicted faster resilience after a sporadic fall in collection efficiency due to nationwide lockdown in the first wave of COVID. Thanks to the steady performance of Light CVs due to a booming e-commerce sector and pick-up in demand for Medium & Heavy CVs due to the government’s focus on infra and real estate spending.

Over 2012-2021 (up to Sep), the cumulative collection efficiency of CV pools (except the ones that originated in 2020) remained above 90%. It has been noted that, historically, collections remained the weakest in the first quarter of every fiscal year and the strongest in the last quarter of every fiscal year. This happens due to urges of the CV financiers to boost collections at the end of the financial year to bring down the ratio of non-performing assets (NPA) and cut the provisioning requirement that hits their bottom line.

If we look at the issuers’ ratings across CV pools, the market is highly skewed towards AAA-rated issuers. In 2021-22, nearly 97% of issuances by volume in the sector were rated AAA(SO), indicating an asymmetry in the market with respect to the price discovery of securities at the lower end of the rating curve.

Factors affecting CV financing and pools

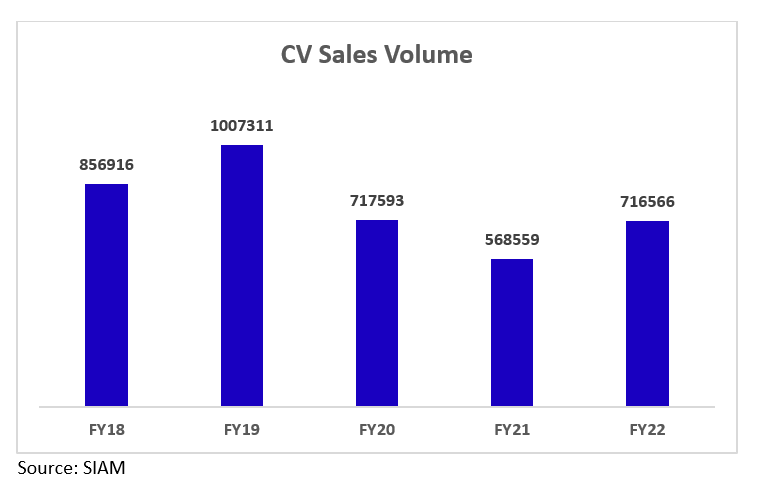

The growth in CV financing depends on sales numbers, penetration of the financial market, and a rise in average ticket size of loans. As evident in the below chart, sales volume has been recovering post-Covid in FY22 (sales grew 26% YoY) but is yet to recover to the pre-pandemic level. Thanks to the recovery in demand from construction, e-commerce, and mining sectors with gradual unlocking of the economy and higher infrastructural spending by the Centre on large projects.

The performance of CV securitisation pools depends on the factors discussed below—

Fuel prices: The performance of auto loans-backed ABS pools is linked to fuel prices as vehicle loans are repaid from CV operators’ earnings, which are highly impacted by the fuel costs they bear. A significant rise in fuel prices could cause difficulty for the vehicle operators to pass on the price hike to customers, leading to margin erosion and higher delinquencies. However, strong growth in economic activity could be a savior supporting the earnings of CV operators and positively impacting the delinquency rate.

Freight rates: Higher freight rates help the CV operators protect their margins leading to lower delinquencies. The economic downturn during Covid dampened the demand for transportation of goods and negatively impacted the freight rates. However, with a recovery in the economy and higher spending by the government on infra projects, freight rates and fleet utilization have been improving lately.

Monsoon: Normal monsoon brightens the outlook of CV loans-backed pool performance. A bumper harvest season due to favorable monsoon pushes up the demand for medium- and heavy-duty CVs and result in the availability of better freight rates.

Two-wheeler loans

Despite accounting for a meager ~2% of securitisation in India, pools based on two-wheeler loans are expected to be the emerging asset class in the market once the secondary market valuations of the vehicles and other nuances are understood. About 75% of two-wheelers in the country are purchased using loans, where banks and NBFCs comprise 60% and 40%, respectively.

As the impact of the pandemic start abating, collections in two-wheeler ABS pools started recovering from the second quarter of FY22 and stood at ~94% in Dec 2021. Delinquencies in the pools are expected to be similar to the pre-pandemic level.

The two-wheeler loan segment is expected to grow at an annual rate of more than 10% over the next five years due to factors such as a rise in demand for electric two-wheelers owing to higher preferences for EVs and government subsidies for the same, steady increase in disposable income, rural development, etc.

Stay tuned to know about microfinance segment of the ABS market in our next post.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.