RBI’s Monetary Policy Committee (MPC) continued with its pause on the hike in repo rate — the rate at which the central bank lends short-term funds to commercial banks — for the third time in a row in a unanimous vote. RBI hit the brake on the rate hike cycle in April this year after six consecutive hikes aggregating 250 basis points (bps) since May 2022.

A majority of five out of six MPC members remained focused on ‘withdrawal of accommodation’ believing the monetary transmission is still in progress which will progressively align the headline inflation with the target (4%) while supporting growth.

Growth Projections

With risks evenly balanced, the central bank retained the projection for GDP growth at 6.5% for FY24 with 8% in the first quarter, 6.5% in the second quarter, 6% in the third quarter, and 5.7% in the terminal quarter of the fiscal year.

The central bank expressed concerns about the global growth scenario due to elevated inflation, high levels of debt, volatile financial conditions, and other factors. However, it believes India can withstand the external headwinds better than many other economies. It has highlighted many factors indicating economic resilience in the domestic economy, some of which include —

- Sustained growth in air passenger traffic, passenger vehicle sales, and households’ credit.

- Incipient recovery in rural demand, marked by growth in agricultural credit and higher FMCG sales volume, which could be strengthened by prospects of a better kharif season.

- Higher capacity utilisation in the manufacturing sector compared to the long-term average.

- Healthy services sector activity marked by the expansion in e-way bills, toll collections, railway freight, and rise in services purchasing manager’s index (PMI) reading.

- Strong construction activity in the first quarter as indicated by healthy growth in cement production and steel consumption.

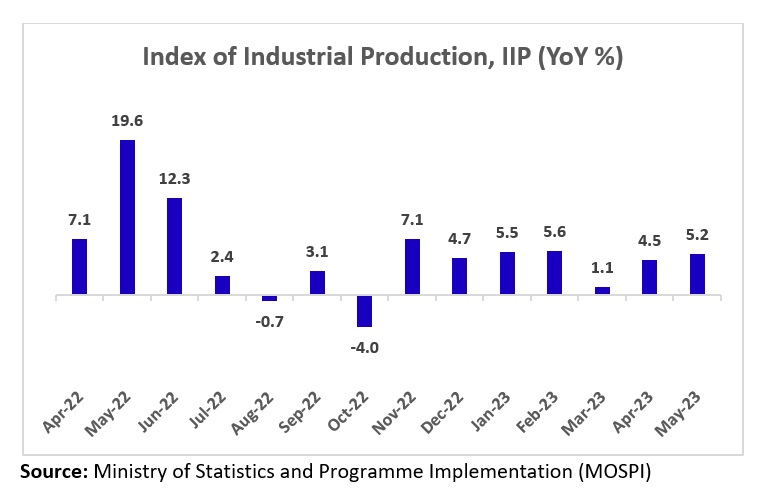

- Strong momentum in industrial activity as evident from the recent trend in the index of industrial production (IIP). Notably, the growth in IIP in May accelerated to a 3-month-high of 5.2% from 4.5% in April driven by strong growth in the mining and manufacturing sectors.

Inflation projection

RBI revised upward the inflation projections for FY24 by 30 bps to 5.4%. However, in the previous MPC meet, it cut the inflation forecast from 5.2% to 5.1%. The uptick in projection is caused by a recent spike in vegetable prices, especially tomato, along with elevated prices of cereals and pulses.

Quarter-wise, the forecast has been accordingly raised from the earlier level of 5.2% to 6.2% for the Jul-Sep quarter and from 5.4% previously to 5.7% for the Oct-Dec quarter. However, the projection for the fourth quarter of FY24 has been kept intact at 5.2%.

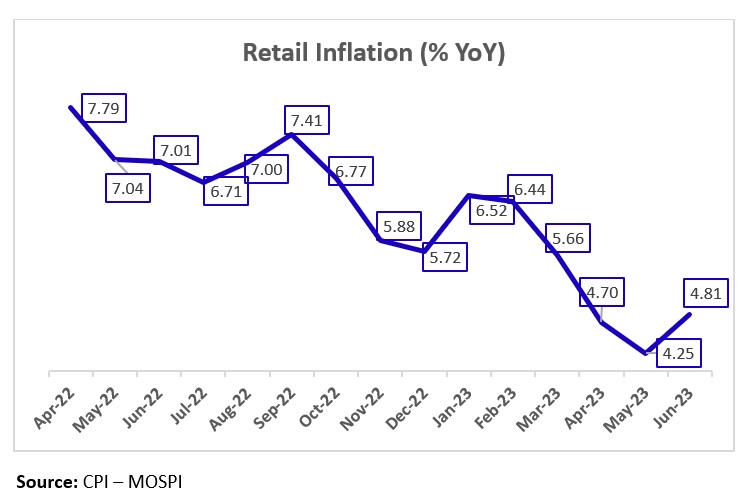

The headline inflation plunged to the 25-month low of 4.25% in May before rising to 4.81% in June due to vegetable prices, which may see a correction soon, as per RBI Governor Shaktikanta Das. However, El Niño weather conditions along with global food prices need to be closely monitored causing the central bank to remain watchful about the risks to price stability.

Incremental CRR

RBI has noted a rise in the level of surplus liquidity in the system due to the return of INR 2,000 currency notes to banks among other factors such as the pickup in government spending and capital inflows, and surplus transfer by RBI to the government.

The central bank is of the view that excess liquidity can pose risks to price and overall financial stability. Hence, it has asked scheduled banks to maintain an incremental cash reserve ratio (I-CRR) of 10% on the increase in net demand and time liabilities (NDTL) between May 19 and July 28 to suck up the surplus liquidity. However, this would be a temporary measure to manage excess liquidity and will be reviewed on September 8 while the existing CRR remains intact at 4.5%.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.