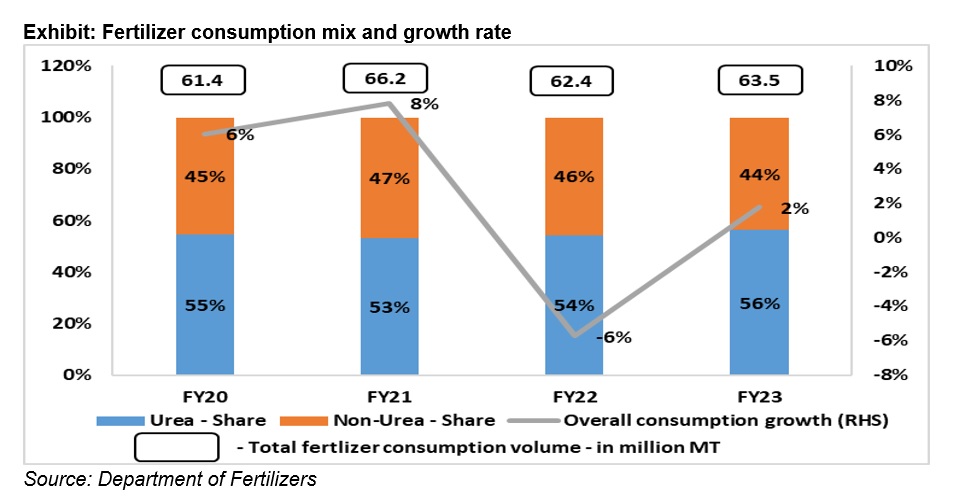

Fertilizer is an essential part of the agriculture value chain and plays a key role in enhancing farm output. India is the second largest consumer of fertilizers globally, after China, with annual consumption of around 63.5 million metric tonnes in fiscal 2023. Given the criticality of the sector to India’s overall agricultural production, the fertilizers industry is closely regulated by the Government and is also highly subsidised with subsidy pay-outs of around INR 2.5 lakh crore in fiscal 2023.

At present there are around 25 different varieties of fertilizers consumed in India which can be broadly categorised into Nitrogenous, Phosphatic, Potassic and Complex fertilizers depending on the nutrient content. Urea (a type of nitrogenous fertilizer) is the most prevalent variety in India, accounting for more than 50% of the overall consumption.

After witnessing decline in FY22, fertilizer consumption in India recovered in FY23 with normal monsoons and increased fertilizer availability with easing of global supply disruptions. Higher subsidy payouts by the Government compensated for the higher input costs. In the current fiscal, consumption is expected to grow by around 1-3% in FY24 amid normal monsoon expectations and stable MRPs provided to farmers. Urea remains the dominant form of fertilizer considering its lower MRP and preference with lower and middle income farmer groups. However, share of non-urea is expected to improve over the long term with government measures and increasing awareness amongst farmers about adverse effects of excess nitrous fertiliser usage on soil fertility.

On the supply side, India is also the third largest producer of fertilizers globally and meets 70% of its own demand through domestic production.

Import dependence is lower for urea at around 20% of consumption, while it is higher for non-urea fertilizers at around 40% of consumption, due to the lack of key raw material availability for some varieties. Key raw materials for fertilizers include natural gas (for Urea), ammonia, rock phosphate, sulphur and phosphoric acid. India does not have significant reserves of rock phosphates or potash, key raw material for phosphatic and potassic fertilizers respectively. Besides, for urea, around 60-70% of the natural gas requirement is met through imported liquified natural gas (LNG). This in turn leads to high import dependence of raw materials for the industry.

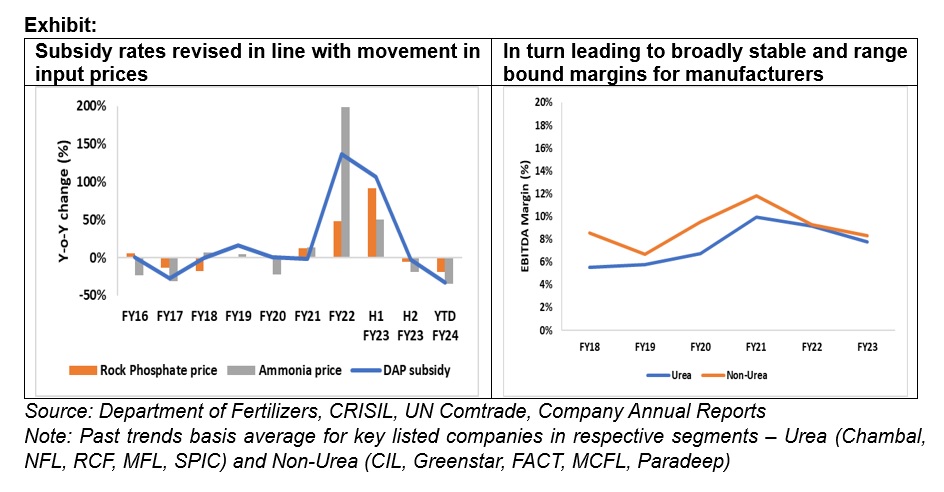

Landed costs for raw materials increased sharply in FY22 and H1 FY23 owing to supply constraints following export sanctions on Russia and Belarus, and restrictions by China on exports of fertilizers. For instance, rock phosphate prices more than doubled to around $280 per ton in H1 FY23, compared to around $100 per ton two years earlier. Similar sharp increase was witnessed for other raw materials like ammonia, natural gas, sulphur as well.

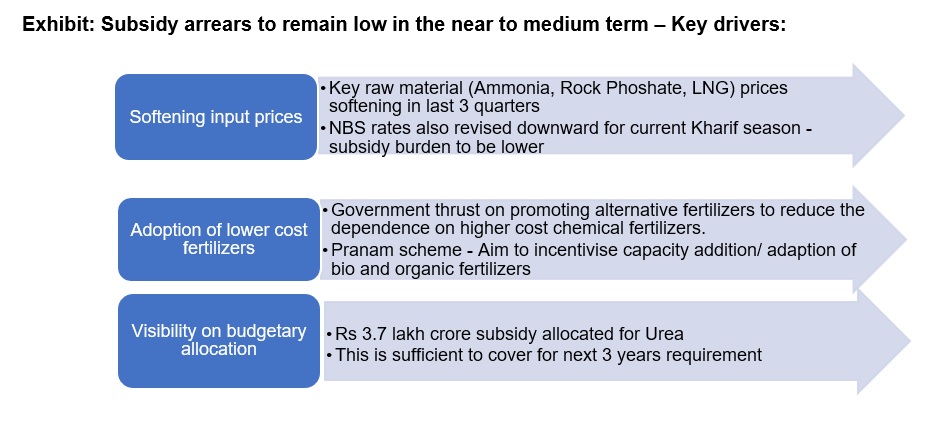

However, the input prices have started correcting from H2 FY23 onward with easing global supply scenario and are expected to reduce further towards the long term average levels in the near to medium term.

India’s urea capacity is around 29 million tonnes and non-urea capacity is around 20 million tonnes, with average capacity utilization of around 90%. Except for revival of few closed units (predominantly Urea producers), no major greenfield or brownfield capacities are expected to come onstream in the medium term, and hence existing capacities are expected to operate at high utilization levels to meet fertilizer demand.

In this context, for domestic fertilizer manufacturers, while demand and volume expectations remain steady, falling raw material prices and lower subsidy rates are expected to lead to lower revenues in the current fiscal. Profitability margins however are expected to remain rangebound as volatility in raw material prices are largely absorbed through subsidies, providing protection to manufacturer margins.

- On urea side, subsidy contributes around 90% of realization and subsidy rates are directly linked to underlying raw material (pooled gas prices) enabling complete pass through.

- On non-urea side, subsidy contribution is relatively lower at around 50-60% of realization and is determined by the nutrient based subsidy (NBS) rates fixed by the Government periodically. The Government has been proactive in adjusting NBS rates in the past in line with movement in underlying raw material (ammonia, rock phosphates) prices thereby protecting the margins of manufacturers.

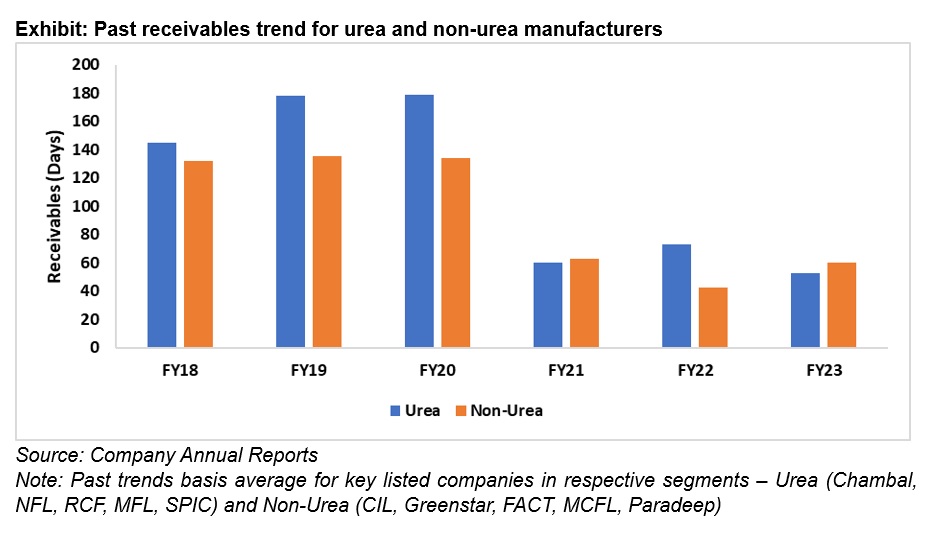

Working capital build up has been a key monitorable for the industry due to the high dependence on Government subsidies. Subsidy arrears for fertilizer manufactures had been elevated till fiscal 2020 owing to delays in subsidy receipts from Government. However, the same has substantially reduced in the last 3 years following the one-time additional subsidy of Rs 65,000 crores rolled out by the Government in fiscal 2021 under Aatmanirbhar 3.0 package.

Going forward, we don’t expect similar build up in arrears as seen prior to 2021, considering sufficient budgetary allocation for fertilizers and softening prices in turn reducing the subsidy burden for the Government. Further, the Government has also implemented the Direct Benefit Transfer (DBT) scheme) ensuring faster transmission of subsidies to the manufacturers.

With stable margins and subsidy receivables being under control, credit profiles of manufacturers are expected to remain healthy and should enable their access to financing from both banks and capital market investors.

Disclaimer:

The views provided in this blog are of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.