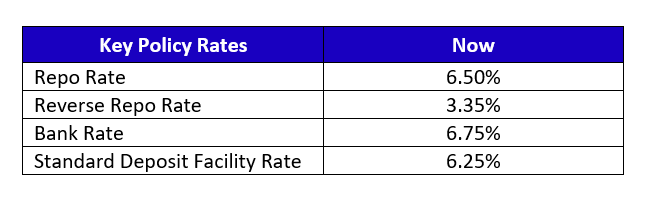

In a unanimous vote, RBI’s Monetary Policy Committee (MPC) hit the pause button for the second consecutive time in raising the repo rate — the rate at which the central bank lends short-term funds to commercial banks. While doing so, RBI retained the policy stance as “withdrawal of accommodation”, implying it could consider further hike rates if necessary.

The two consecutive pauses occurred after RBI MPC hiked the repo rate for the sixth time in a row this February. Since May 2022, RBI hiked repo rates by 250 basis points (bps). In FY23, the rate hiking cycle began with a 40 bps hike followed by three consecutive hikes of 50 bps and then with 35 bps in Dec 2022 and 25 bps in Feb 2023.

Factors influencing future policy decisions

Inflation

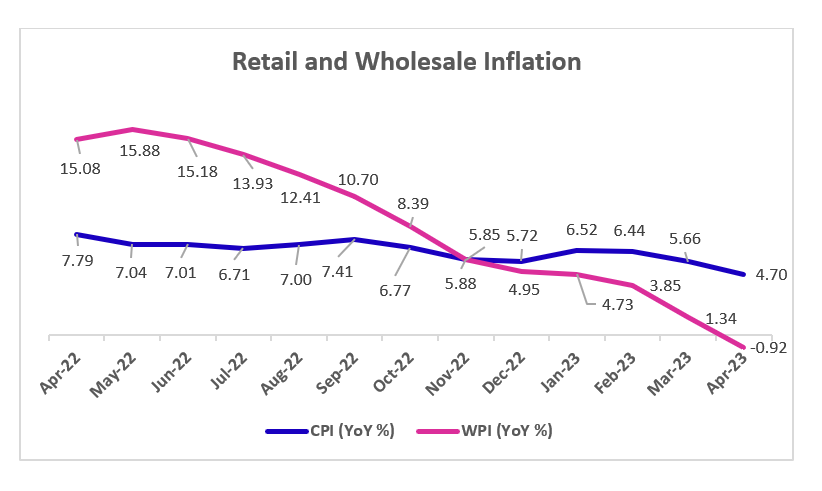

Retail inflation is one of the key factors that kickstarted the rate hike cycle in May last year. A month before that, in April, the inflation based on the Consumers Price Index (CPI) peaked to a near 8-year high of 7.79% due to supply chain disruptions caused by geopolitical tensions, and soaring crude and food prices. The chain of aggressive rate hikes by RBI began to restore the inflation levels to the central bank target range of 4 +/- 2%.

This April, retail inflation softened to an 18-month low of 4.7% YoY and remained within the tolerance band of RBI for the second consecutive month. Food inflation cooled off to 3.84% in April from 4.79% in March. The producers’ price inflation based on Wholesale Price Index (WPI) fell to a negative territory hitting a 34-month low of -0.92% YoY in the month.

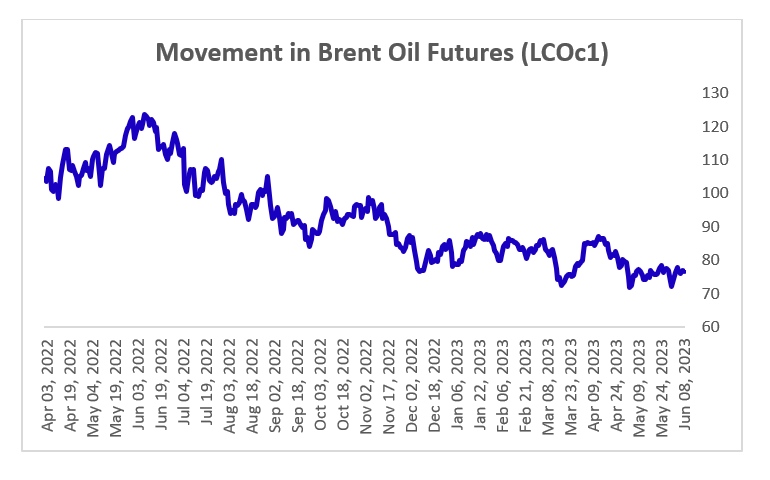

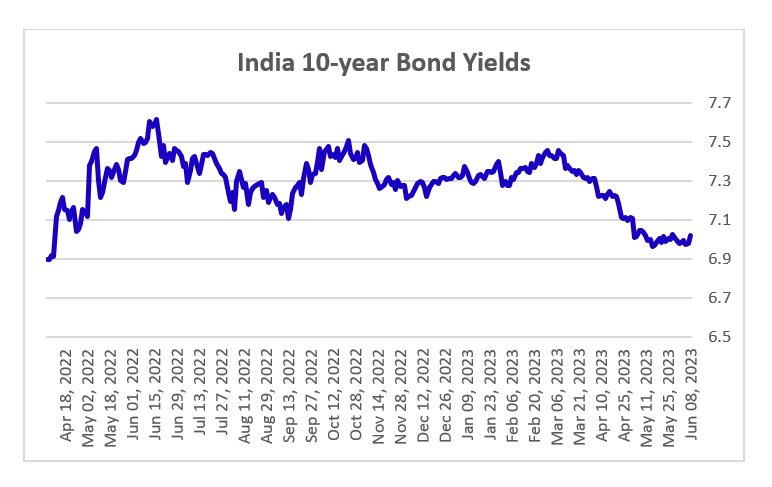

Since the rate hike cycle began, crude oil prices fell from their peak of ~US123/bbl in Jun 2022 to ~US$76/bbl on Jun 8. In the same timeframe, the benchmark 10-year yield, an indicator of future expectation of interest rates, dropped from its peak of ~7.6% in mid-Jun 2022 to ~7.0% on Jun 8.

RBI MPC has cut its projection for inflation for FY24 from 5.2% to 5.1%. It includes a forecast of 4.6% for the first quarter, 5.2% for the second quarter, 5.4% for the third quarter, and 5.2% for the fourth quarter.

While the tamed inflation forecast may indicate a longer pause, RBI Governor Shaktikanta Das said that “Our goal is to achieve the inflation target of 4%, and keeping inflation within the comfort band of 2-6% is not enough.” The chances of inflation falling below 4% may not happen in the near term, however, the prediction of a favourable monsoon and stronger GDP growth bodes well for the pause scenario.

Monsoon, GDP growth, and other tailwinds

The Indian Meteorological Department recently predicted a “normal” monsoon for this year at the long period average (LPA) of 96% despite the higher probability of El Nino, a climate condition pattern that describes the unusual warming of surface waters in the eastern tropical Pacific Ocean. However, IMD revealed that most parts of India will witness deficient rainfall in June, except for some areas in peninsular regions.

India’s GDP (at constant 2011-12 prices) grew at a faster rate of 6.1% YoY (higher than estimates) in Q4FY23 compared with 4.5% YoY in the previous quarter. Given this pace, the annual growth came in at 7.2% YoY driven mainly by improvements in agriculture, manufacturing, mining, and construction sectors.

RBI has projected a growth of 6.5% in real GDP for FY24. It was the same forecast the central bank made in the April meeting when it was revised upwards from 6.4%. Throughout the fiscal year, the growth is distributed as 8% for the first quarter, 6.5% for the second quarter, 6% for the third quarter, and 5.7% for the fourth quarter.

As per Shaktikanta Das, “Domestic demand conditions remain supportive of growth. Urban demand remains resilient, with indicators such as passenger vehicle sales, domestic air passenger traffic, and credit cards outstanding posting double-digit expansion on a year-on-year basis in April. Rural demand is also on a revival path – motorcycle and three-wheeler sales increased at a robust pace in April, while tractor sales remained subdued.”

Further, healthy economic indicators like strong growth in GST collections (up 12% YoY to INR 1.57 lakh crores in May, following a record-high GST collection of INR 1.87 lakh crores in April) and encouraging PMI reading (hit the 31-month high of 58.7 in May and remained above the 50-mark for 22 consecutive months) certainly indicates resilience in the domestic economy.

Lastly, the movement of the US Federal Reserve is something to look out for as it sets the sentiment of a rate hike across the globe. Last month, US Fed raised the key short-term interest rates by 25 bps to a range of 5-5.25%, pushing borrowing costs to their highest level since August 2007. However, market experts believe that the Fed is expected to leave interest rates alone in the upcoming meeting next week. As per CME FedWatch Tool, Fed futures are reflecting a ~76% probability of a pause and ~24% probability of a 25 bps hike in the Jun 14 meeting at the time of writing.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.