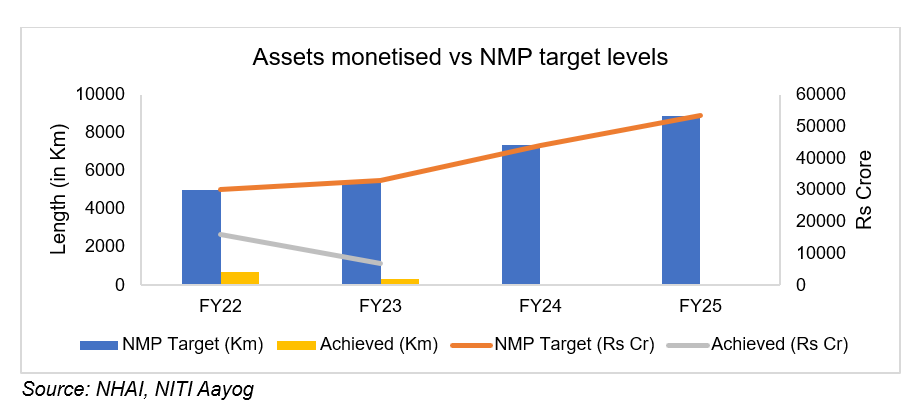

Road assets account for ~27% of national monetisation pipeline (NMP) drafted by NITI Aayog. Under NMP, 26,700 km of road assets valued at INR 1.6 lakh crore were to be monetised over a 4 year period (FY22-FY25). Till Mar’23, only ~14% (by value) of the targeted assets have been monetised, as against plan of ~39%, owing to muted interest from private sector for some of the stretches considering high traffic and toll collection risks to be taken by the buyers. Hence NHAI is expected to significantly ramp up efforts in the coming 2 years to meet NMP target.

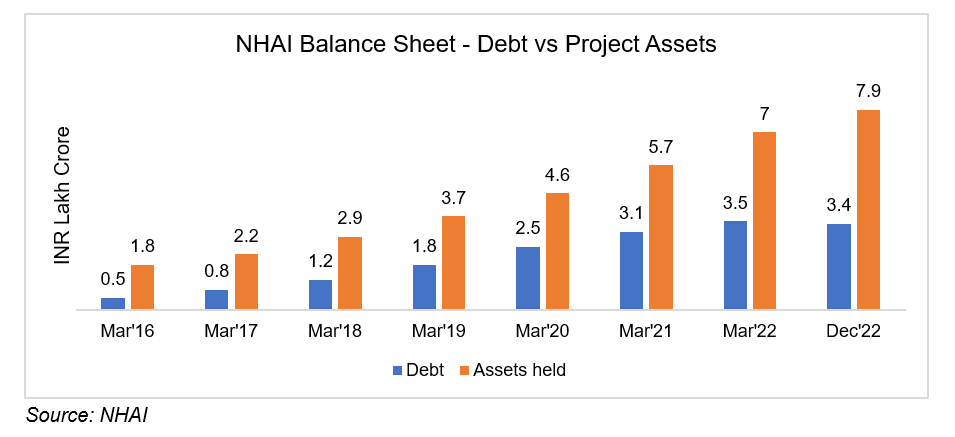

Monetising more assets is critical from NHAI’s perspective as well, to contain leverage:

With spurt in new project awards through Hybrid Annuity Model (HAM) and Engineering, Procurement and Construction (EPC) routes in last 5 years, which require 40-100% of the project funding to be borne by NHAI, it’s borrowing has risen to over INR 3.4 lakh crore as of Dec’22, as against INR 1.8 lakh crore 3 years ago. NHAI’s funding requirement will only increase in the coming years, with expected roll out of more road projects under Bharatmala Pariyojana and other schemes. Hence monetisation of operational assets will be critical for NHAI to contain leverage.

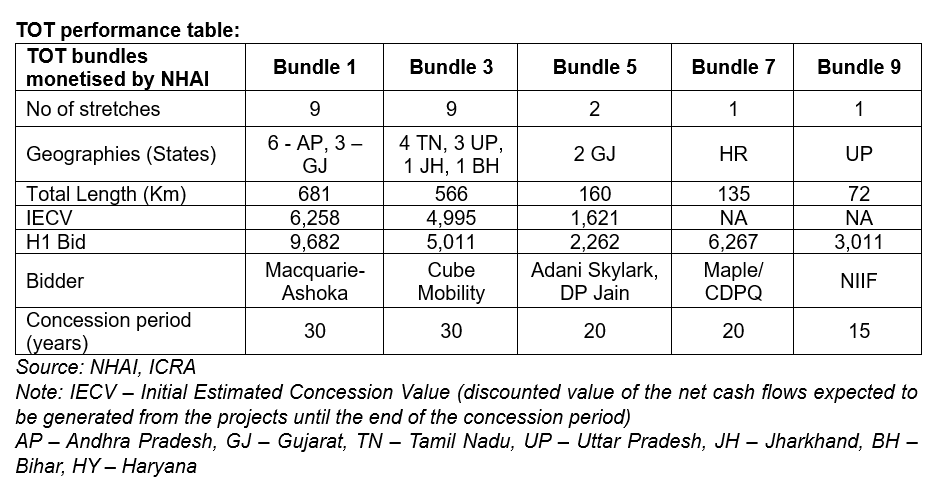

NHAI has been trying TOT and InvIT routes to monetise operational road projects, however, response has been mixed:

In last 3 years, NHAI has been able to monetise assets through (Toll Operate Transfer (TOT) and InvIT routes – 22 stretches monetised through TOT (aggregate length of 1,612 km) and 8 stretches monetised through InvIT (aggregate length of 632 km). However, bidding intensity for the assets remain relatively weak owing to high operational risks that private contractors need to take on, pertaining to traffic movement, toll collection efficiency, O&M, etc. Hence only assets which have good vintage of toll collections and low traffic risk have found bidders, albeit the bid premiums over the base concession values for such assets have been high.

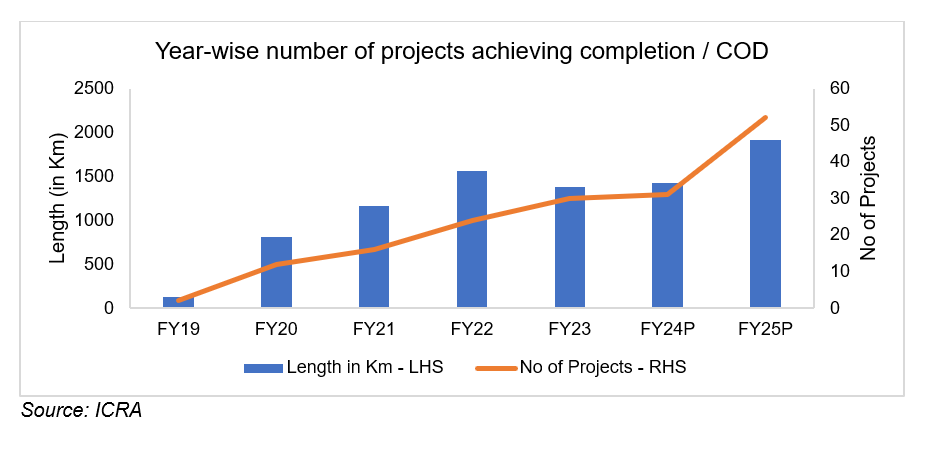

With only 15% of the NMP targets achieved in the last 2 years, the pace of monetisation is expected to increase in the next two years. For FY24, NHAI has already identified a pipeline of 46 assets with aggregate length of 2,612 km, which is more than the combined length of stretches monetised in last 2 years. Besides, around 80 under-construction projects are expected to achieve commercial operations date (COD) in next 2 years, which will in turn become ideal candidates for monetisation.

Traffic risks to remain a deterrent for private participation, hybrid structures can be explored:

While the pipeline of projects to be monetised remains strong, many of the stretches will remain exposed to the high operational risks. Under the current model, entirety of the traffic and toll collection risks are passed on to the private concessionaires which has resulted in dwindling interest for some of the riskier assets. Hybrid structures, where part of the traffic risk is borne by the authorities and assured minimum annualised payments are made to concessionaires, could alleviate some of the challenges with the existing TOT model.

Expectations for capital providers and developers:

Successful monetisation of projects by NHAI will directly benefit road developers, as NHAI would be able to award more projects for implementation. Besides, with lower leverage, NHAI could award more projects through the HAM or EPC routes, which would reduce the project financing burden on the contractors, as compared to BOT route. Furthermore, monetisation by NHAI could also have knock-on effects for capital providers as project debt refinancing opportunities will emerge, especially if the assets are picked up by strong sponsors.

To summarise, VAM expects a spurt in the road assets monetisation by NHAI in the next 2 years in order to meet NMP targets of the Government. Finding suitable assets for monetisation is not expected to be a challenge for NHAI, given the substantial number of projects which were recently constructed, or are in advanced stages of completion. Faster pace of monetisation would help NHAI control leverage on its balance sheet, and thereby enable awarding of more projects through HAM / EPC route in future. Having said that, traffic risk has to be adequately distributed or compensated in order to encourage higher private participation.

Disclaimer:

The views provided in this blog are of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.