The debt capital market, where investors buy & sell debt fixed-income securities mostly in the form of bonds, is an important source for fundraising in a developing nation like India. The Indian market is one of the largest in Asia.

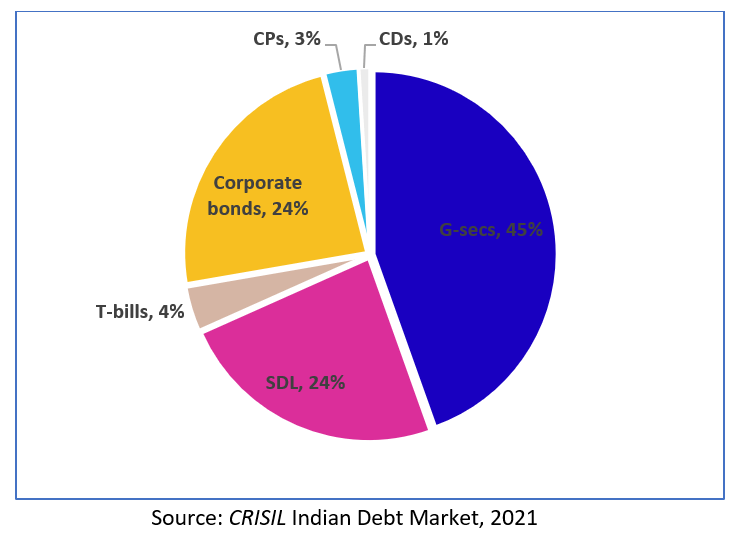

The debt capital market is divided into two parts – Public debt and Private debt. The Public debt comprises Govt securities (G-secs), State Development Loans (SDL), and Treasury bills while the Private debt market includes Corporate Bonds, Commercial Papers (CPs), and Certificate of Deposits (CDs). Here is the share of each type of fixed income securities in total outstanding amount (FY20):

The Great Divide

The Indian debt capital market is highly fragmented, both at the broader level and at the segment level. The overall market is dominated by sovereign bonds or g-secs, which account for ~30% of GDP in terms of issuances outstanding (FY20). The corporate bond market, on the other hand, accounts for ~16% of GDP. Despite being Asia’s third-largest economy, the size of India’s Corporate Bond market as a % of GDP stands closer to countries like Thailand and the Philippines.

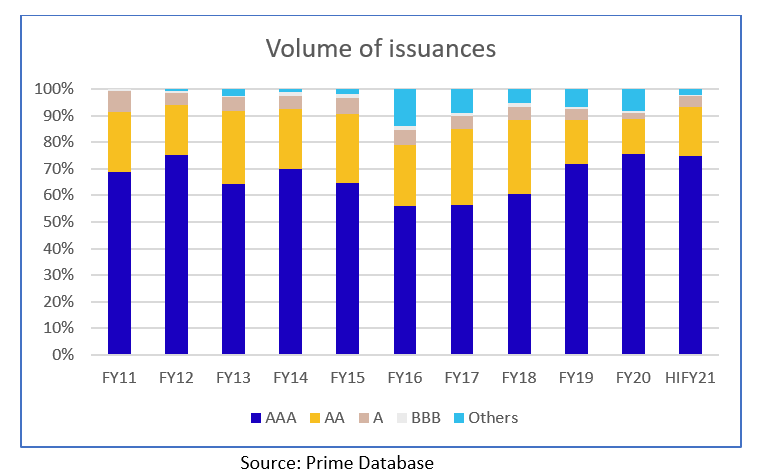

There is a wide disparity within the Corporate Bond market as well. The investors’ appetite in the market is highly skewed towards higher-rated instruments (AA & above). Also, the share of issuances by top 10 players over total issuances have been scaling up since FY16 and rose to 50% in FY21 as COVID-19 has turned the situation unfavourable against smaller and low-rated issuers with a greater flight of capital towards safer instruments.

The disparity also makes it difficult for thousands of enterprises to access the debt market and leads to mispricing of their bonds. As evident from the issuances volume below, higher-rated (AAA and AA) issuers have been dominating the Corporate Bond market over the last decade.

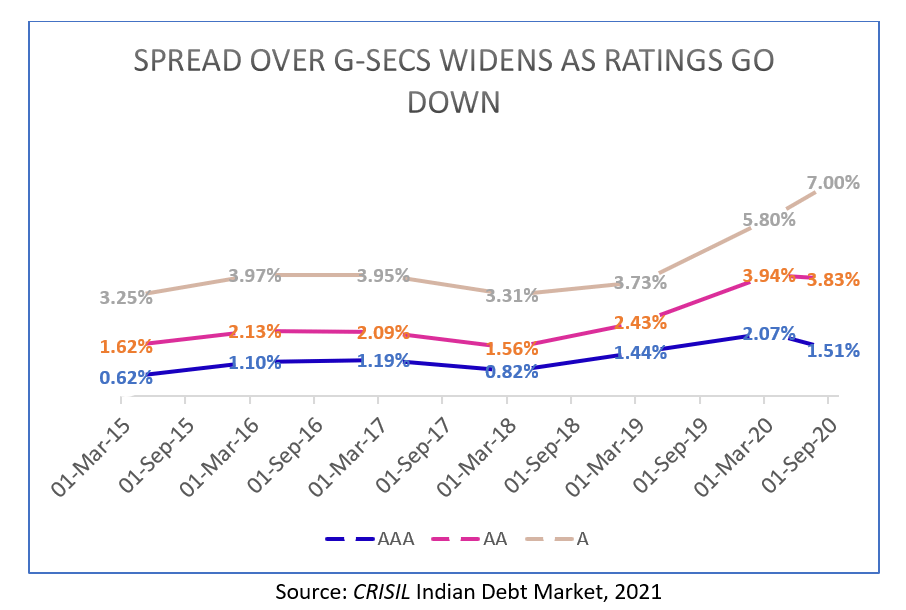

When it comes to corporate bond prices, we can see that the spread in bond yields over (risk-free) g-secs rise sharply as the credit ratings of the papers go down below AAA. The spread of A-rated bonds as of Sep 2020 stood at 7%, which is ~550bps higher than that of AAA-rated bonds. Hence, corporate bond yields are shooting up but disproportionately due to a higher appetite for risk as we go down below the rating curve.

The Problem of Asymmetry

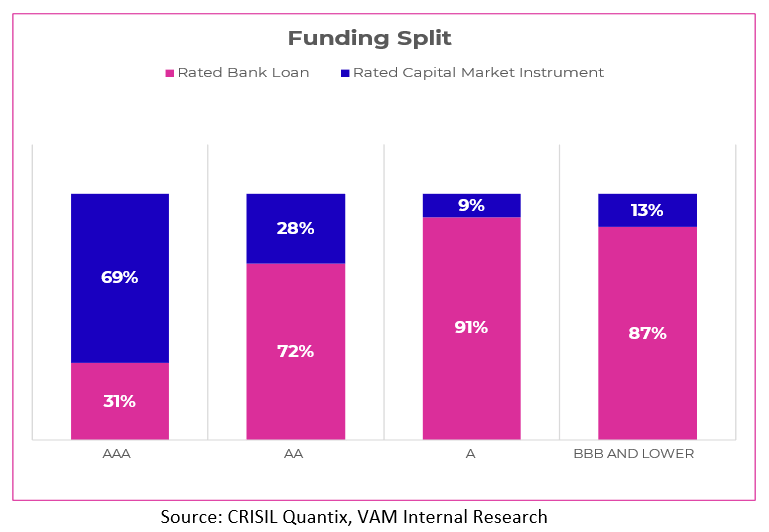

Given the volume and yield data, it is now clear that there are hardly any takers for below AA-rated bonds in the market. However, the mid-market corporates who have been issuing these bonds need capital to fund their growth plan. As the bond market is unable to fulfil their borrowing needs, the corporates turn to loan markets for funding. The problem has been exacerbated with a recovery in the economy after COVID as these corporates increasingly need to scale up their businesses.

As the below chart suggests, the ratio of the bond market to bank loans became much lower over the last decade as we go down the rating curve from AAA to BBB and below. Unlike mature economies, mid to large corporates rated below AA are disproportionately reliant on loan markets, creating an asymmetry in the market.

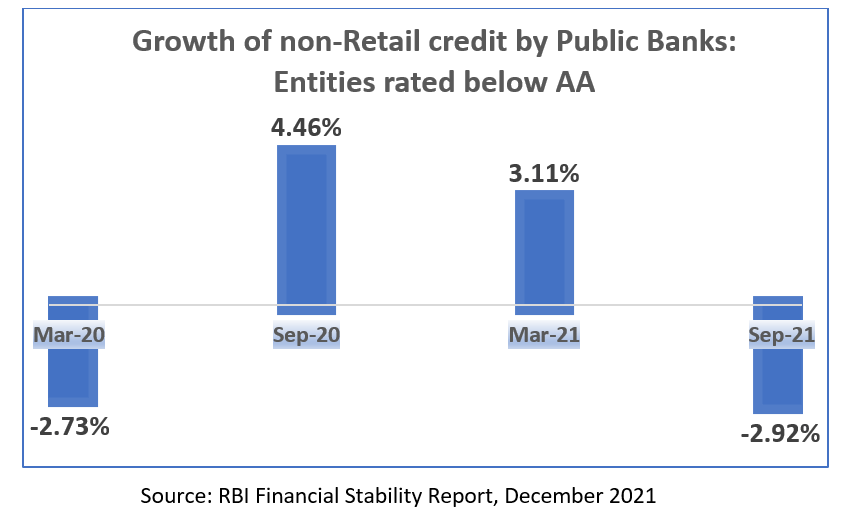

The asymmetry became more prominent as Indian banks and NBFCs turned increasingly risk-averse while lending to mid-market corporates posts debt crisis (like that of IL&FS) and financial difficulties faced by these corporates due to COVID. The growth of non-retail loans by public-sector banks to entities rated below AA began to shrink over a year till Sep ‘21 as shown below:

Hence, the problem of asymmetry has a two-fold outcome. It hinders mid-market corporates/issuers to access the right kind of capital they need, and, on the other hand, it deprives investors of enjoying superior yields. Resolving the issue might lead to a win-win situation but there is a caveat! Investors stepping into the domain might face companies mired with a high risk of default. However, the perceived risk is deemed to be much higher than the actual risk. But how? Stay tuned for our next post (Part II).

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.