As we have learned, the yield spread of corporate bonds over g-secs rises sharply as the credit ratings of the bonds go down below AAA. Thanks to the asymmetry and eventual mispricing. Hence, there is a significant return available as we go down the rating curve. But are there enough incentives available to investors if they go down the rating scale? Does the pick-up in yield more than compensates for the increase in risk while delving into that region?

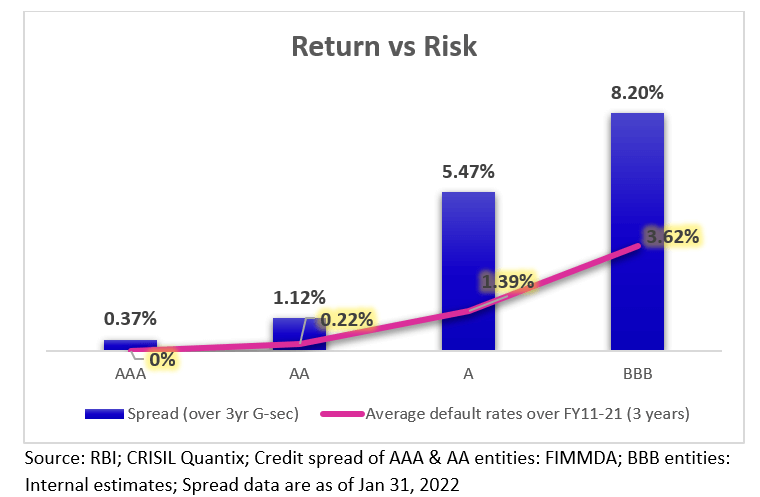

If we look at the default rates across the rating scale and compare them with respective spreads, we come up with surprising results. The below chart suggests that papers with CRISIL AAA rating never defaulted while AA-rated papers have default rates of 0.22% on a 3yr rolling average over the past decade. The numbers go up to ~1.4% for A-rated bonds and 3.6% for BBB-rated ones.

As we plot the default rates on spreads, we see that the premium of return over risk is disproportionately higher if one moves down the rating scale. For example, if we move from AAA to AA-rated bonds, the investors can reap 112bps excess returns over the risk-free rate but take only a 22bps higher impact on their risk profile. When compared with AA-rated bonds, the excess return jumps up to ~800bps for BBB-rated bonds, where investors take ~340bps (=362-22bps) higher impact. In simple words, this means that additional returns that investors might get for taking exposure to bonds in the below-AA part of the rating scale more than compensate for the additional risks when we compare them with AAA and AA-rated bonds.

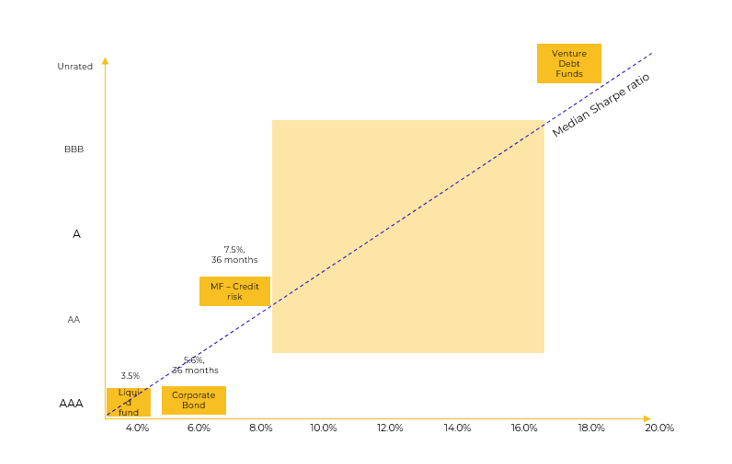

This looks like a lucrative opportunity for investors but how deep is this opportunity and how far it has penetrated the Indian market? To better understand the depth and coverage of the market we can plot the risk-adjusted return, as measured by the Sharpe ratio, of the corporate bonds and see how the market players are positioned along the line.

The zero to 8% yield range at the bottom part of the median Sharpe ratio line is mostly covered by mutual funds. It mainly comprises Liquid Funds having exposure to g-secs and treasury bills, Duration funds like Short-term & Ultra Short-term, Credit Risk funds (which have at least 65% exposure to AA- or lower-rated bonds), and Corporate Bond funds (having least 80% of their total assets in highest rated instruments). The portfolios operating in this range are disproportionately skewed towards safety due to risk parameters set by SEBI and low liquidity risk on account of being open-ended vehicles.

At the other extreme, there are Venture, Distressed Debt, and Real Estate funds operating in the above-16% yield range. It’s a region fraught with high risk where asset managers focus on promoter funding, financing companies that are turning a page, etc.

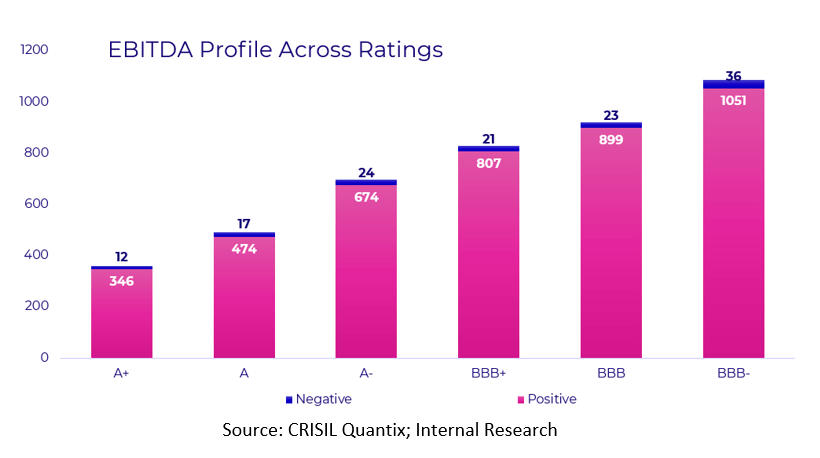

The gap between the two extremes is huge and lacks any specific strategy. It is populated by corporates lying mainly in the A to BBB bucket. These corporates have little access to the bond market and huge reliance on the loan market as we have discussed in Part I. However, these are the companies that stand a fair chance given the fact that they are largely profitable. The below chart suggests that over 90% of them in any rating bracket are profit-making.

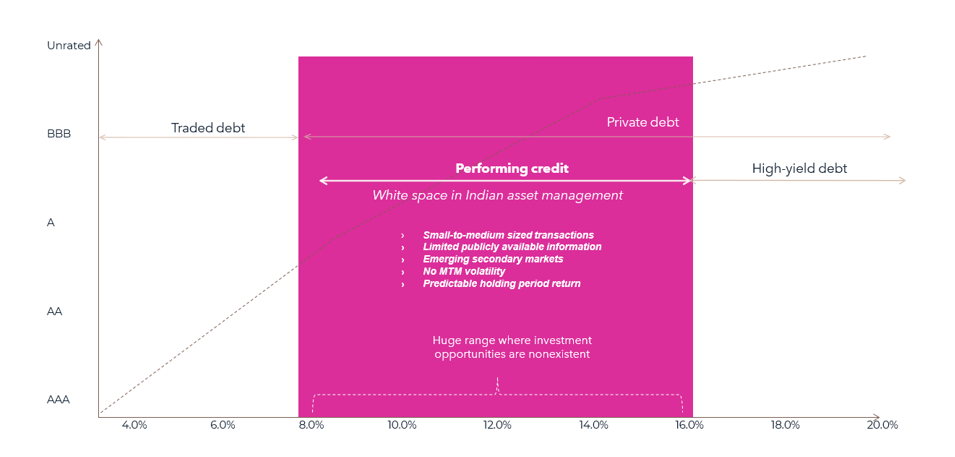

If we examine more, we will see that over 4,000 companies that are considered in the chart could be either in cyclical or defensive sectors but are very steady. They could be operating in sectors like energy, healthcare, consumer, financial services, manufacturing, supply chain, logistics, etc. To summarise, the huge space in consideration consists of papers issued by stable companies which are undiscovered and yielding high risk-adjusted return. It’s a space called Performing Credit, which is left after accounting for non-performing credit that carries high default risks and most actively traded debt securities like AA and AAA-rated bonds.

As we identify the market, the next question comes about how to explore the market. As many of these companies are not listed and many are completely reliant on loan markets instead of the debt capital market, it is hard to find data and information about them. Hence, there are huge barriers to entry. Even if you nail down some of these companies, other challenges exist like pricing their securities, tracking their performance, etc. Lastly, what investment vehicle is appropriate to address this space? In the next few posts, we will answer these questions.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.