Global Economic Updates

Central bank policy actions

- The People’s Bank of China kept the benchmark lending rates unchanged for the 5th consecutive month in their recent statement. The 1-year loan prime rate (LPR) remained steady at 3.45% while the 5-year LPR is held at 4.2%. The LPRs are based on an average of the lending rates that China’s biggest banks offer their best clients.

- The Central bank of Turkey raised its key interest rates by 250 basis points to 45% in its prolonged battle against double-digit inflation. However, the hike in the 1-week repo rate was in line with economists’ expectations. Inflation in the country rose to ~65% YoY in December 2023 from 62% YoY in November 2023 while the domestic currency Lira hit a record low against the greenback. Lira went down nearly 40% against the USD year to date and lost over 80% of its value against the same in the last 5 years.

Inflation readings

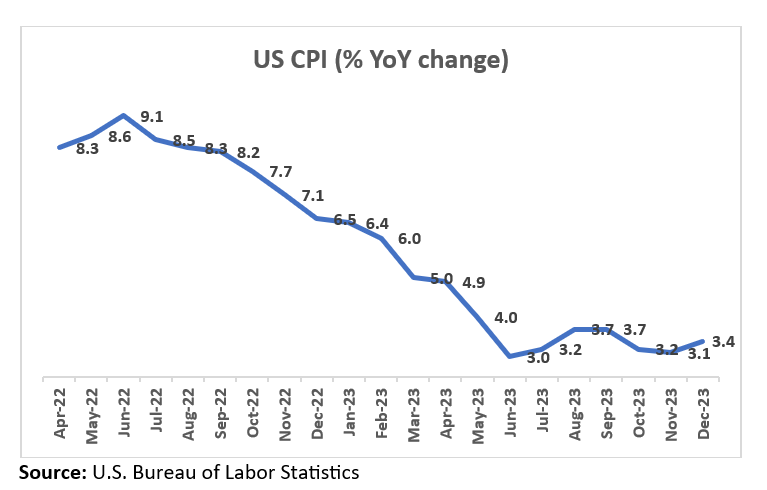

- Consumer price inflation in the US increased to 3.4% YoY in December 2023 from 3.1% in November 2023 and came in above the consensus estimate of 3.2%. Core inflation, which excludes volatile food and energy prices, declined to 3.9% YoY in December compared with 4% in November. Housing costs contributed over half of the overall increase in prices followed by escalating prices of energy and car insurance.

- Consumer price inflation in the Euro Zone slightly accelerated to 2.9% YoY in December 2023 from an over 2-year low of 2.4% in November 2023, but came in below the market consensus of 3%, flash estimates revealed. The drop in energy prices eased to 6.7% YoY in December from 11.5% in November. Meanwhile, the annual rise in prices of alcohol, and tobacco continued to soften.

- Consumer Price inflation in Australia decreased to a near 2-year low of 4.3% YoY in November 2023 from 4.9% in October and came in lower than market forecasts of 4.4%. The segments witnessing significant price rises during the month were housing (+6.6%), food and non-alcoholic beverages (+4.6%), insurance and financial services (+8.8%), and alcohol and tobacco (+6.4%).

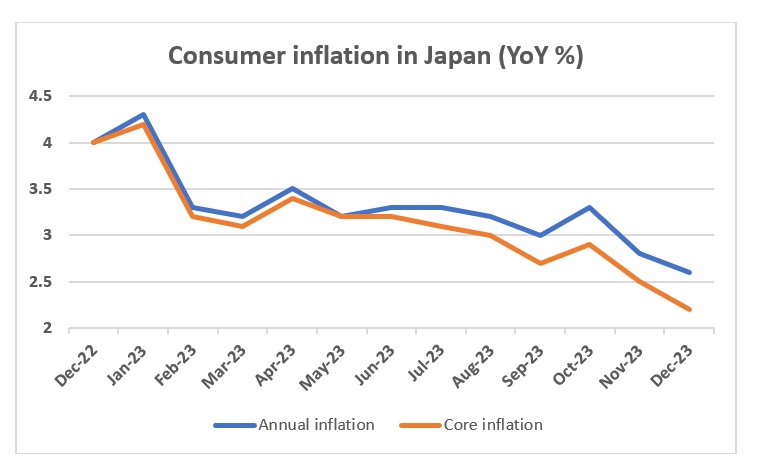

- Japan’s consumer price inflation in December 2023 softened to the lowest level since July 2022 at 2.6% YoY compared with 2.8% in November 2023 driven by lowest rise in food prices in 14 months. Moderation in healthcare (2.4% vs 2.5%) and communication (4.8% vs 4.9%) costs in the country also led to the softer inflation during the month.

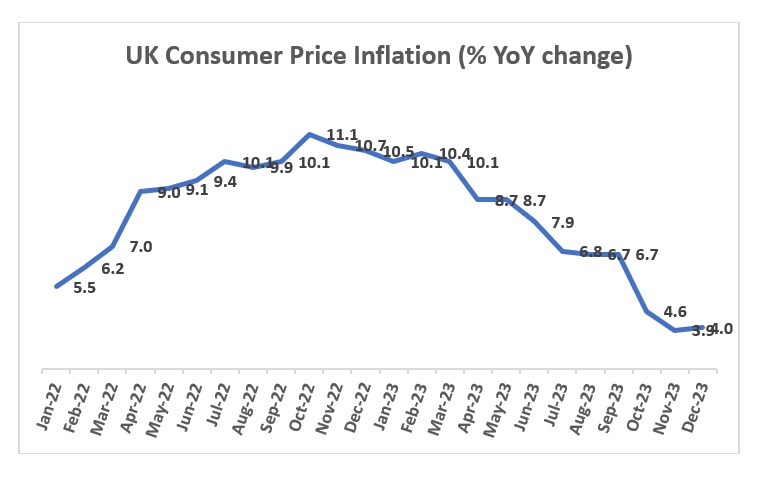

- Consumer price inflation in the UK rose to 4% YoY in December 2023 from 3.9% YoY in the previous month due to a rise in alcohol and tobacco prices. It’s higher than the market consensus of 3.8%. Core inflation, which excludes volatile food, energy, alcohol, and tobacco prices, remained flat at 5.1% YoY in December 2023 compared to the previous month.

PMI Readings

- Both Institute for Supply Management (ISM) and S&P Global Purchasing Managers’ Index (PMI) data for the US indicated continued stress in the sector due to a decline in output and a faster downturn in new orders. ISM manufacturing PMI rose slightly from 46.7 in November 2023 to 47.4 in December 2023 while S&P Global manufacturing PMI declined from 49.4 in November to 47.9 in December 2023. It was the 14th consecutive month that the PMI stayed below 50, which is the contraction zone.

- PMI readings in China indicated some resilience in the economy. The Caixin China General Manufacturing PMI rose from 50.7 in November to 50.8 in December 2023, beating the consensus estimate of 50.4. This indicated improvement in the sector health in the four out of the past five months. A strong rise in output and new orders led to the improvement in activity. PMI readings in the services sector pointed to a sustained recovery. The Caixin China General Service PMI rose from 51.5 in November to 52.9 in December 2023, beating the consensus estimate of 51.6.

- PMI reading for the services sector in the UK indicated continued strength in the sector. The S&P Global/CIPS UK Services PMI rose from 50.9 in November to 53.4 in December 2023, which is above the initial estimates of 52.7. This marked the second consecutive month of expansion in the UK services sector in sharp contrast to the contractionary trend in the Eurozone.

- While most economic indicators in India indicated robust growth, its manufacturing PMI reading showed a downturn despite remaining in the expansionary zone. The HSBC India Manufacturing PMI declined from 56 in November to an 18-month low of 54.9 in December 2023. Economists noted that this could indicate expected moderation in activities in the fourth quarter of FY24 despite strong momentum in the sector.

- Global economic activity strengthened at the end of 2023 driven by better inflows of new work and a pick-up in business confidence. The J.P.Morgan Global PMI Composite index increased from 50.5 in November to 51.0 in December. Services sector activity improved for the 11th successive month in December 2023 while the slide in manufacturing activity continued for the 7th consecutive month in the month at the global level.

Other economic indicators

- Consumer confidence in the US improved significantly on-year due to the downward trajectory of inflation and a better outlook on general economic conditions. It was captured in the rise in University of Michigan’s consumer sentiment index to the highest level since July 2021 at 78.8 in January 2024. The reading came in above the last month’s print of 69.7 and the forecast of 70 despite the public opinion showing concerns on the nation’s economic health.

- Recessionary conditions in Germany that began at the end of 2022 GDP in Europe’s largest economy fell 0.3% YoY in full-year 2023 due to relentless inflationary pressures, higher energy prices, and weak exports. However, compared to the pre-Covid phase, in 2019, GDP rose 0.7% in the year.

- China’s GDP grew 5.2% YoY in the fourth quarter of 2023, which is higher than the target set by Beijing (~5%) but lower than market expectations of 5.3%. The growth was marginally higher than 4.9% in the previous quarter. In 2023, the country’s industrial production grew 4.6% YoY, retail sales of consumer goods went up 7.2% YoY and investments in fixed assets rose 3% YoY.

Domestic Economic Updates

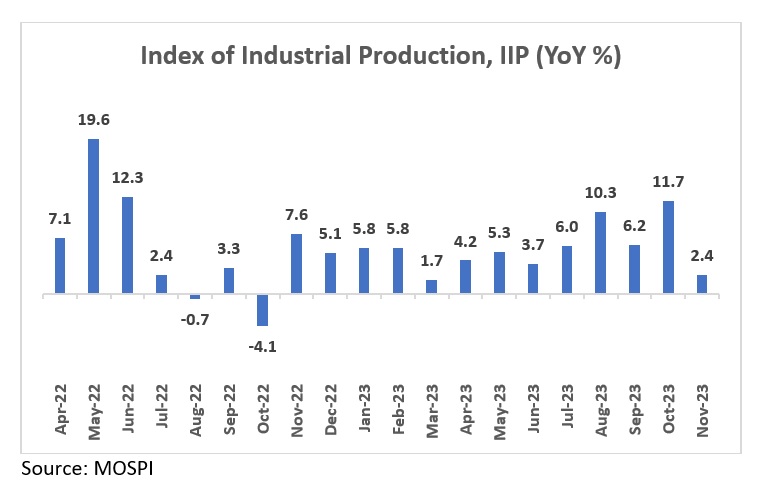

- The growth in India’s index of industrial production (IIP) slowed to an eight-month low of 2.4% YoY in November due to moderation in manufacturing activity (1.2%), electricity (5.8%), and mining (6.8%) sectors, and a high base effect. In the index, 17 out of the 23 manufacturing industries (includes food, textiles, leather, wood, computers, and paper among others) witnessed contraction in November.

- Retail inflation surged to a 4-month high of 5.69% in December 2023 from 5.55% in November 2023 due to higher prices of food items such as pulses, spices, fruits, and vegetables. The inflation continued to remain within the RBI’s tolerance band of 2-6% for the last 4 months. However, the core inflation declined to 48-month low of 3.89% in December 2023, the first time in the post-pandemic period, from 4.1% in November.

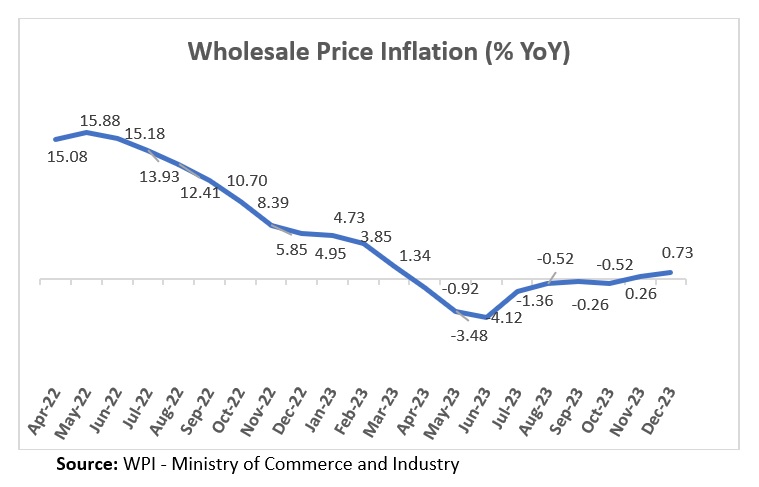

- India’s wholesale price inflation climbed up to a 9-month high of 0.73% in December 2023 from 0.26% in November 2023 driven by higher prices of food articles, machinery and equipment, other manufacturing and transport equipment, computer, electronics, and optical products. This is the second month in a row the WPI-based inflation came in the positive territory after remaining negative for seven consecutive months.

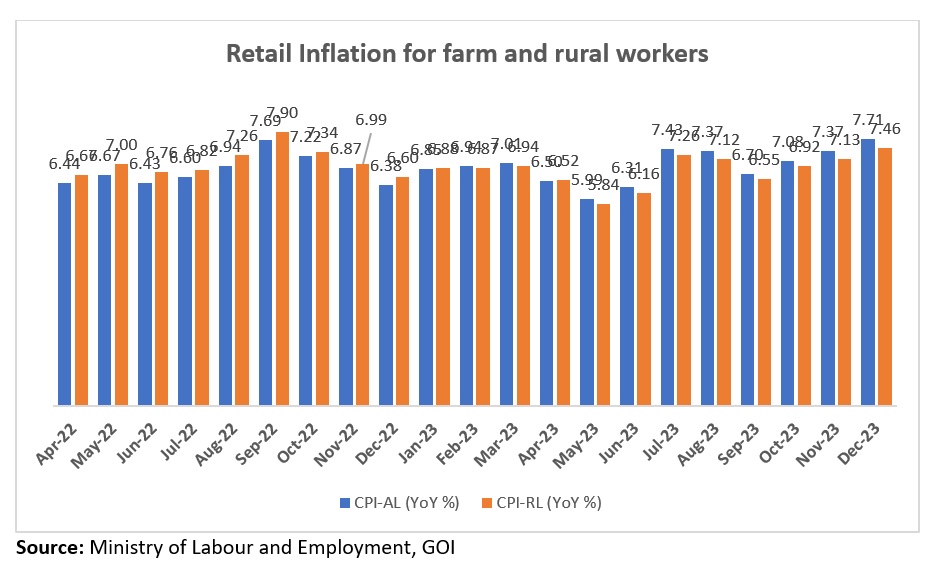

- India’s retail inflation for Agricultural Labourers (CPI-AL) and rural labourers (CPI-RL) rose to a multi-month high of 7.71% and 7.46% YoY, respectively due to an increase in prices of food items such as rice, wheat atta, jowar, bajra, maize, pulses, milk, meat goat, sugar, garlic, among others. Food inflation for farm and rural workers hardened to 9.95% and 9.8% in December 2023 compared to 9.38% and 9.14%, respectively, in November 2023. The maximum hike in CPI-AL and CPI-RL has been recorded by Andhra Pradesh driven by higher prices of rice, jowar, bajra, ragi, fruits and vegetables (especially brinjal, lady finger, cucumber), etc.

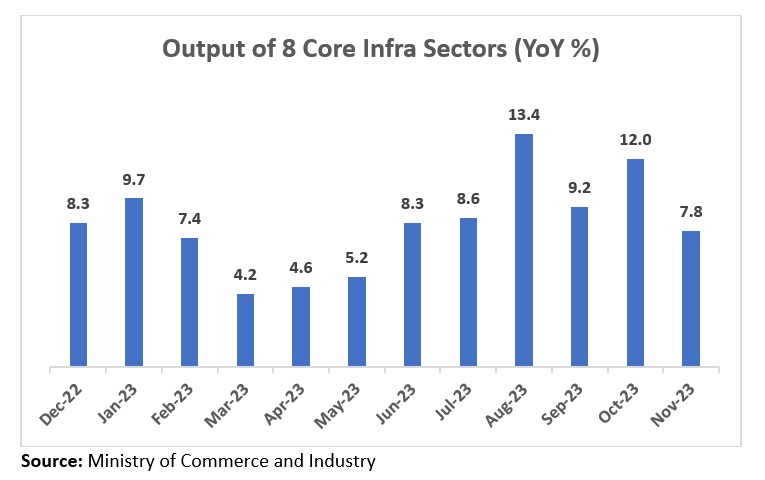

- Output growth in India’s 8 core infrastructure sectors — Coal, Natural Gas, Crude Oil, refinery products, fertilisers, Cement, Steel, Electricity — indicated a slowdown as it decelerated from a 12% YoY in October to a 6-month low of 7.8% YoY in November 2023. The growth was higher than the 5.7% recorded in November 2022 but it’s the slowest one recorded since May 2023, when the output of 8 core sectors grew 5.2% YoY. Sectors that showed contraction include Crude Oil at (-0.4% YoY vs. 1.3% YoY in October 23) and Cement (-3.6% YoY vs. 17.4% YoY in October) mainly due to a high base effect. Meanwhile, sectors like refinery products, steel, coal, and electricity contributed the most to the YoY increase in the month.

- The unemployment rate in India, among persons aged 15 years and above, softened from 8.9% in November to 8.7% in December 2023, according to a survey conducted by the Centre for Monitoring Indian Economy (CMIE). Despite easing, the rate remained at the higher range of 8-10% from October to December 2023. In October 2023, the unemployment rate was 9.4%.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.