Global Economic Updates

Central bank policy actions

- The US Federal Open Market Committee (FOMC) unanimously kept the federal funds rate steady at the 22-year high target range of 5.25%-5.5% for the third time in a row. However, the median projection for interest rates at the end of 2024 has been reduced to 4.5% and 4.75%, signalling 75 basis points (bps) of cuts from current levels. Assuming 25 bps per cut, it translates to three rate cuts in 2024.

- The European Central Bank (ECB) kept its key interest rates unchanged — main refinancing operations at 4.5%, the marginal lending facility at 4.75%, and the deposit facility at 4%. The rates have been kept steady for the second meeting in a row, following 10 consecutive hikes from July 2022 to September 2023. ECB stated, “While inflation has dropped in recent months, it is likely to pick up again temporarily in the near term.” Inflation in the Euro zone has been declining in the last two months from 4.3% YoY in September to 2.9% in October and then to 2.4% in November.

- The Bank of England (BoE) kept its borrowing rates unchanged at a 15-year high of 5.25% for the third time in a row. Six of the nine members of the Monetary Policy Committee voted to keep rates steady while three opted for a quarter-point hike. However, rate hikes do not look imminent due to the cutback in consumer spending that has been affecting the British economy, which shrank unexpectedly by 0.3% in October following 0.2% growth in September. BoE’s policy actions have been successful in reducing the inflation from the 4-decade high of over 11% YoY in October 2022 to 4.6% on-year in October 2023 (vs. 6.7% in September). However, it’s still above the bank’s target level of 2%.

- The Bank of Canada retained its key overnight rate at 5% while leaving the door open to another hike due to concerns about inflation while acknowledging an economic slowdown. The central bank hiked rates by a quarter point in both June and July to a 22-year high. Inflation decelerated to 3.1% YoY in October but remained above the target level of 2%.

- The Bank of Japan (BoJ) maintained its ultra-loose monetary policy by keeping its interest rates at -0.1% while sticking to its yield curve control policy that sets the upper limit for 10-year government bond yield at 1% as a reference. The central bank prefers to wait for a longer time to make a decision for exiting the negative rate. BOJ Governor Kazuo Ueda said, “Uncertainty over the outlook is extremely high and we have yet to foresee inflation sustainably and stably achieve our target. As such, it’s hard to show now with a high degree of certainty how we can exit”.

- Chinese banks maintained their benchmark loan prime lending rate — 1-year rate at 3.45% and 5-year rate at 4.2% — following a similar move by the People’s Bank of China (PBOC) of keeping its medium-term lending facility unchanged recently after a cut in August. This came amid the expectations of China’s top leaders maintaining supportive monetary policy in 2024, which indicates moderate cuts in policy rates in early 2024.

Inflation readings

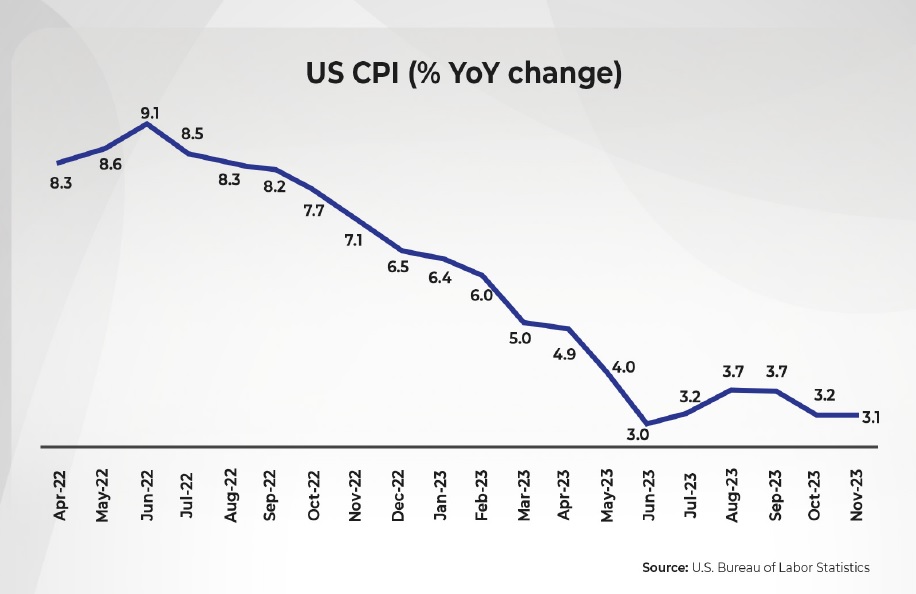

- Consumer price inflation in the US cooled off to 3.1% YoY in November from 3.2% in October led by a decline in energy costs (gasoline prices fell 6% and fuel oil was down 2.7%). Core inflation, which excludes volatile energy and food prices, came in at 4 % during the month. Shelter prices, which account for nearly one-third of the CPI, rose 6.5% on annual basis, steadily declining since peaking in early 2023.

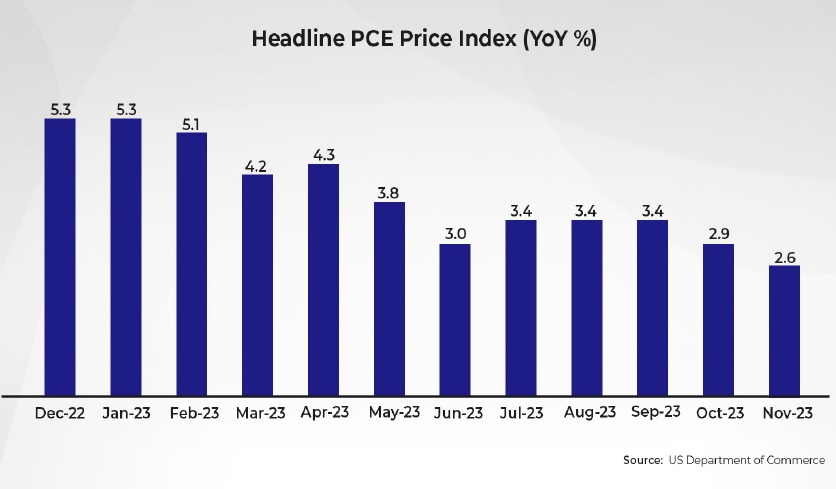

- The US personal consumption expenditures (PCE) price index, a gauge used by the US Federal Reserve for inflation (as it’s based on what consumers actually spend on goods and services rather than the cost of goods and services as measured in the consumers price index), approached closer to the central bank’s inflation target of 2%. The headline PCE index rose 2.6% YoY in November 2023 versus 2.9% in October 2023 after peaking over 7% in mid-2022. The core PCE index (which excludes volatile food and energy costs) increased 3.2% YoY in the month, down from 3.4% in October 2023. On a monthly basis, the headline PCE fell 0.1% in November 2023, which is the first monthly decline since April 2020. Sliding energy prices is one of the key factors that kept inflation in check.

- Annual inflation in the Euro zone fell to its lowest level since July 2021 at 2.4% YoY in November compared to 2.9% in October but it was in line with expectations. The fall is attributed to a sharp decline in energy prices (down 11.5% in November vs. 11.2% in October). Core inflation, which excludes volatile food, energy, alcohol, and tobacco prices, also decreased to 3.6% in November from 4.2% in October.

- Consumer price inflation in Europe’s largest economy, Germany declined to 3.2% YoY in November from 3.8% YoY in October due to falling energy prices (4.5% YoY). It’s the lowest pace of price increases since June 2021 and weaker than the consensus estimates of 3.5%.

- Annual inflation in Canada held steady in November at 3.1% YoY, which was the same pace as in the prior month. However, it was higher than expectations of 2.9% for the month. Higher mortgage interest costs, food prices, and rent caused consumers to cut back on purchases keeping the upward pressure on prices in check.

- Annual inflation in the UK decelerated to 3.9% in November, which is the lowest since September 2021, from 4.6% in October and came in below the consensus estimate of 4.4%. The slowdown is attributed to a fall in fuel costs and softening of food inflation.

- Consumer price index in China fell 0.5% YoY in November, which is steeper than the 0.2% decline in October. It was the fastest pace of decline since November 2020, led by declining food and energy prices. The intensified deflationary pressure suggests weak domestic demand in the economy.

- Annual inflation in Japan eased to the 16-month low at 2.8% YoY in November 2023 compared to 3.3% in the prior month due to the least increase in food prices in 10 months (food prices rose 7.3% YoY in November 2023 vs. 8.6% in October 2023). The core inflation also softened to a 16-month low of 2.5% in November 2023. However, both are still above the 2% target set by the Bank of Japan.

PMI Readings

- ISM Manufacturing Purchasing Manager’s Index (PMI) in the US remained unchanged at 46.7 in November compared to the previous month. However, it came below forecasts of 47.6, indicating a contraction in the manufacturing sector. New orders and inventories dipped at slower pace while pricing stability has been witnessed due to easing energy costs.

- Activity in China’s manufacturing sector was restored to the expansionary phase as suggested by the General Manufacturing PMI, which climbed to 50.7 in November from 49.5 in October. The PMI reading is the highest since August and beat the market forecasts of 49.8.

- India’s Manufacturing PMI improved to 56 in November from 55.5 in October, indicating expansion for the 29th month in a row. It is led by a strong demand and better input availability while improvements in the employment scenario helped.

Other economic indicators

- The Japanese economy contracted 0.7% QoQ in Q3CY2023, compared with a flash estimate of a 0.5% decline and a downwardly revised growth of 0.9% in Q2CY2023. The contraction in GDP is the first since Q3CY2022 led by declines in private consumption, capital expenditures, and public investment.

- Industrial output in the US grew 0.2% MoM in November, which is less than the expected rise of 0.3%. However, it is better than the revised 0.9% decline in the previous month. Manufacturing output, which comprises 78% of overall production, rose 0.3% MoM in November vs. 0.4% expected by analysts.

Domestic Economic Updates

- The Reserve Bank of India’s Monetary Policy Committee (MPC) unanimously opted to keep the repo rate at 6.5% at the bi-monthly policy meeting last week. Meanwhile, the MPC has upheld its stance at ‘withdrawal of accommodation,’ with a 5:1 majority. The central bank has revised the GDP growth forecast upwards to 7% from the earlier projection of 6.5% as it anticipates a stronger revised growth of 6.25% in the second half of FY24 compared to the earlier estimate of 5.85%. However, the bank has retained the inflation projections at 5.4% for FY24, expecting a gradual alignment of quarterly headline inflation towards its 4% target by the second quarter of FY25.

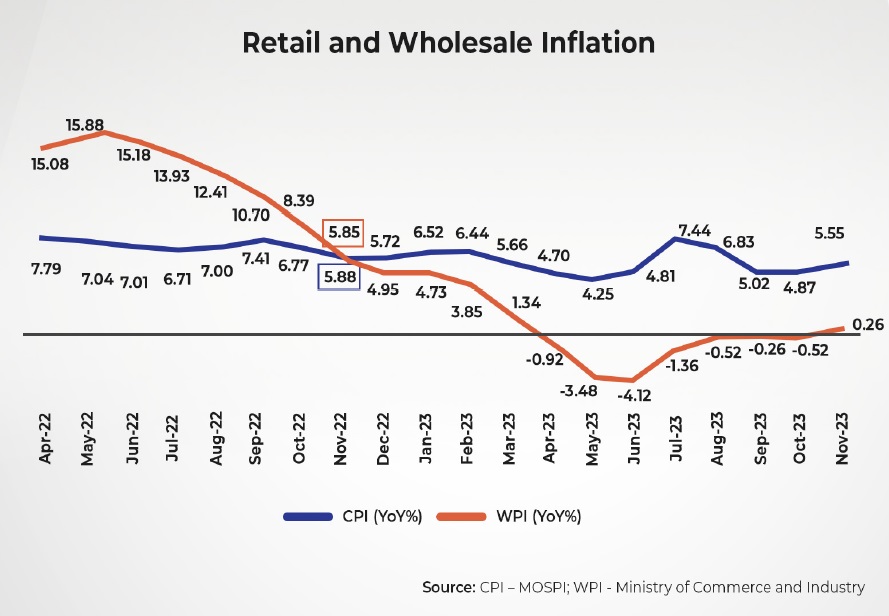

- Consumer price inflation rose to 5.55% YoY in November from 4.87% in October. It came in below market expectations of 5.7% and remained within the Reserve Bank of India’s tolerance band of 2-6% for the third month in a row but above the medium-term target of 4% for 50 consecutive months. Food inflation, which accounts for ~50% of the overall consumer price basket, increased to 8.7% in November, the highest in three months, from 6.61% in October, led by cereals, vegetables, pulses, and fruits. The core inflation reduced from 4.3% YoY in October closer to the RBI’s medium-term target of 4.1% in November. Thanks to moderation in prices of housing, clothing and footwear, fuel and light, and miscellaneous categories compared to October 2023.

- Wholesale price inflation turned positive at 0.26% YoY in November after remaining negative since April 2023 and beat market estimates of a 0.08% rise. The uptick is attributed to higher prices of “food articles, minerals, machinery & equipment, computer, electronics & optical products, motor vehicles, other transport equipment and other manufacturing, etc.,” an official statement revealed. Food inflation was 8.18% in November compared to 2.53% in October.

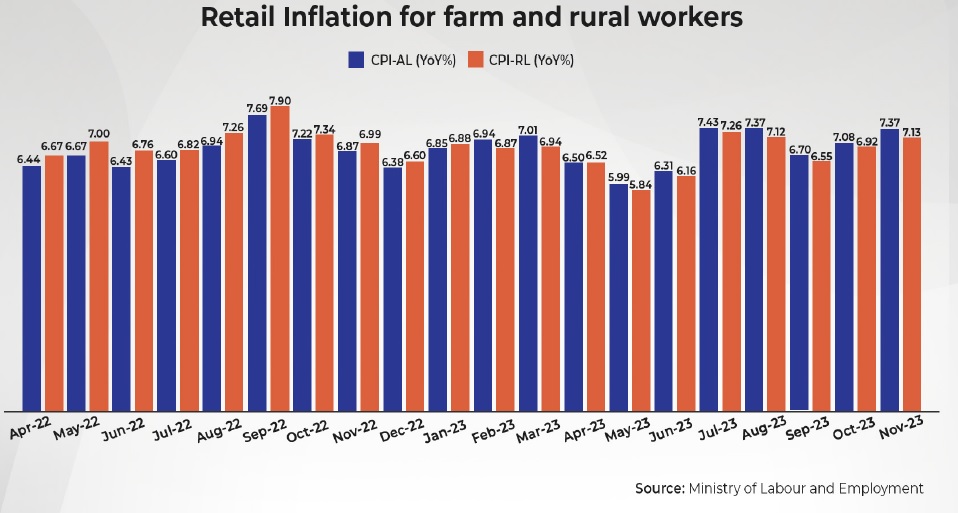

- Retail inflation for agricultural labourers (AL) and rural labourers (RL) increased moderately from 7.08% and 6.92% YoY, respectively, in October, to 7.37% and 7.13%, respectively, in November. The rise is attributed to an increase in prices of certain food items like rice, wheat, atta, pulses, onion, turmeric whole, garlic, and mixed spices.

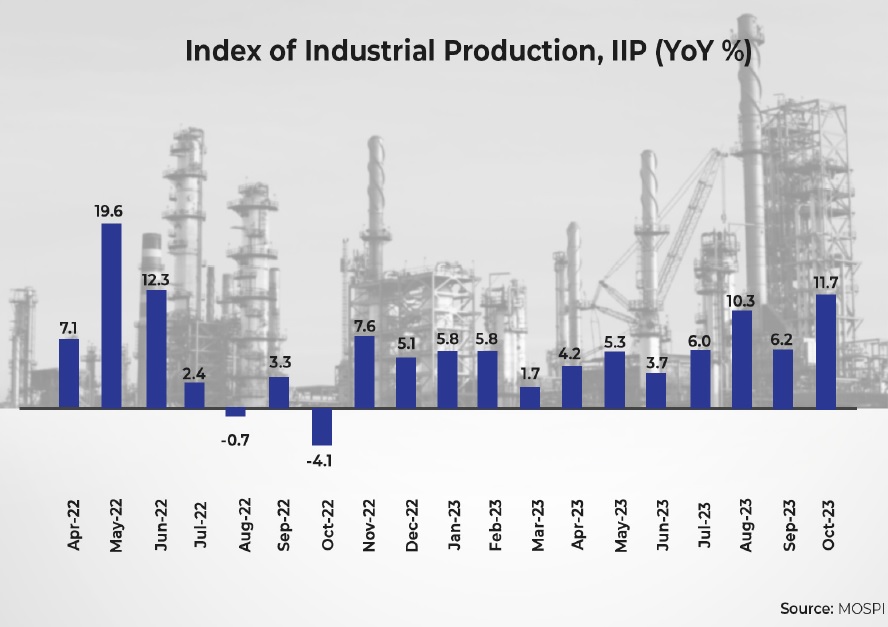

- Industrial output in India indicated strong resilience as the Index of Industrial Production (IIP) grew 11.7% in October (beating market expectations of 10%), which is a 16-month high, compared to a decline of 4.1% a year ago. Output across industries registered a double-digit growth except for a few like intermediate and consumer non-durable goods. Manufacturing output, which accounts for over three-fourths of the IIP, increased 10.4% YoY in October 2023 compared to a contraction of 5.8% in October 2022 and a growth of 4.5% in September 2023.

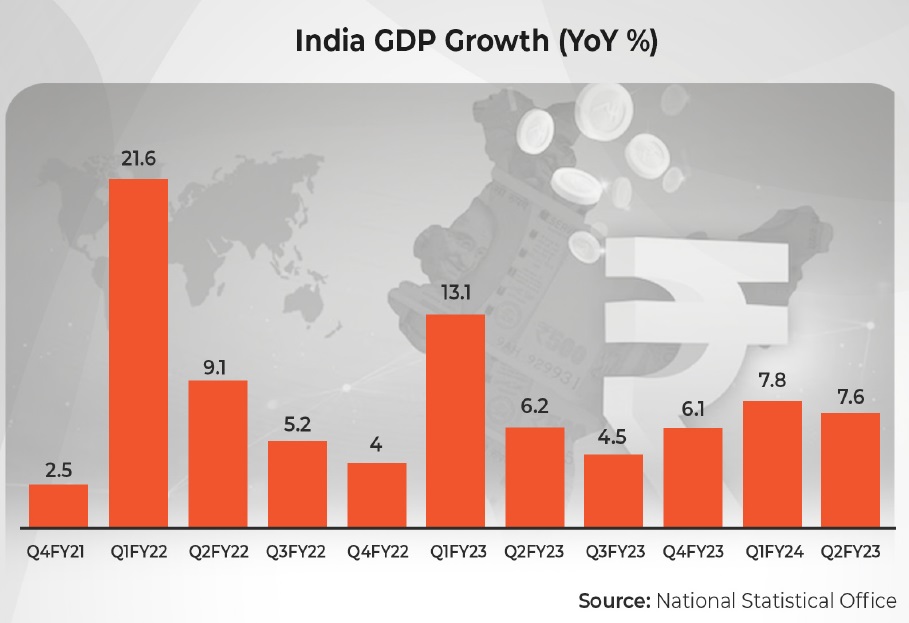

- India’s GDP growth for the second quarter of FY24 (July-September 2023) came in at 7.6% YoY, surprising positively compared to the RBI estimate of 6.5% and the consensus estimate of 6.8% for the quarter. However, the growth moderated from the 4-quarter high of 7.8% in the previous quarter due to a slowdown in private consumption (3.1% YoY in Q2FY24 vs 6% in Q1FY24). The share of private consumption in the GDP has declined, however, there is a significant increase in the share of investments as shown in the Gross Fixed Capital Formation. The growth in Gross Value Added (GVA) was 7.4% YoY in Q2FY24, which is lower than 7.8% in Q1FY24 due to a slowdown in the agricultural sector led by the erratic monsoon.

- S&P Global Ratings revised India’s GDP growth forecast upwards by 0.4 percentage points to 6.4% for FY24. The US-based ratings agency believes a strong momentum in the domestic economy will offset headwinds from food inflation and weak exports. The agency has however cut the growth forecast for FY25 from 6.9% to 6.4% due to subdued global growth, a higher base, and the lagged impact of rate hikes. In a recent report titled ‘China Slows India Grows’, the agency estimated India’s growth in 2026 to be 7% compared with 4.6% for China expecting Asia-Pacific’s growth engine to shift from China to South and Southeast Asia.

- Philippines-based multilateral funding entity Asian Development Bank (ADB) upgraded FY24 growth projections for India from 6.3% to 6.7% due to higher-than-expected FY24 second quarter GDP growth (7.6%). For FY25, ADB has kept its growth forecast unchanged at 6.7%. Notably, RBI recently upgraded its growth forecast for FY24 from 6.5% to 7%.

- The growth in India’s eight core sectors, comprising coal, crude oil, steel, cement, electricity, fertilisers, refinery products, and natural gas, came in at 12.1% YoY in October versus 9.2% (revised) in September, as per the data revealed by the Ministry of Commerce and Industry. A low base and double-digit growth in electricity, natural gas, coal, steel, and cement led to higher growth in the month.

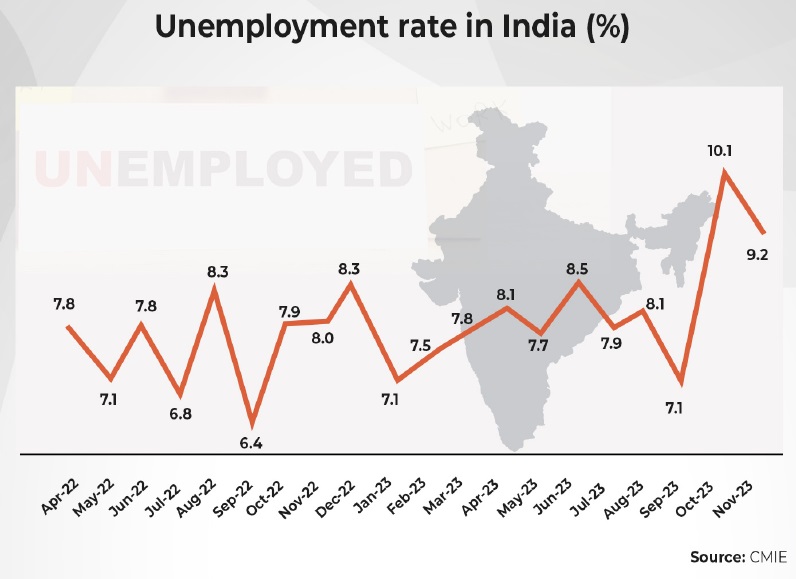

- India’s unemployment rate dropped to 9.16% in November from a 29-month high of 10.05% in October, due to a fall in unemployment in rural areas as November is the month when harvesting of the kharif paddy crop begins, and sowing of rabi-crops picks up. The rural unemployment rate declined to 9.05% in November (vs. 10.82% earlier), while the urban unemployment rate increased to 9.39% (vs. 8.44% earlier).

- India’s gross fiscal deficit during April-October 2023 stood at ~INR 8 lakh crores, which is ~45% of its annual budgeted estimates. The deficit slightly narrowed from 45.6% reported in the comparable period a year ago. Total receipts were recorded at INR 15.9 lakh crores, while overall expenditure in the period stood at INR 23.9 lakh crores.

- India’s current account deficit (CAD) narrowed to 1% of GDP in the second quarter of FY24 compared to 1.1% of GDP in the previous quarter and 3.8% of GDP in the same quarter a year ago. In absolute terms, CAD declined to US$8.3 billion in the second quarter of FY24 from US$9.2 billion in the first quarter of FY24 and US$30.9 billion in the second quarter of FY23. The decline in CAD is attributed to the moderation of the merchandise trade deficit, higher inflows from services trade, and higher remittances.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.