The faster transition to electric mobility in India is one of the highest needs of the hour given India’s pledge to reduce greenhouse gas (GHG) emissions by 33-35% by 2030 compared to 2005 levels. Given the fact that 2-wheelers account for more than 70% of vehicles on Indian roads, there is no doubt that the transition to e-mobility in India is highly dependent on electric 2-wheelers (E2W) compared to other classes of passenger vehicles in the segment. Hence, the role of E2W in achieving India’s GHG reduction goal is very critical as they emit up to 50% lesser GHGs compared to traditional internal combustion engines (ICE).

ICEs contribute to both air and noise pollution while E2W produces zero tailpipe emissions mitigating climate change and helping reduce noise pollution which is a major concern in urban areas. Also, the transition to E2W leads to minimal energy wastage and a lower carbon footprint as they offer a more efficient powertrain than ICE, resulting in an efficient conversion of electrical energy into mechanical energy. Furthermore, they are cheaper to design and manufacture and have lower grid load requirements. These factors, along with increasing consumer awareness are resulting in the development of domestic manufacturing capabilities of E2W in India, the world’s largest 2-wheeler market, and elsewhere in Southeast Asia.

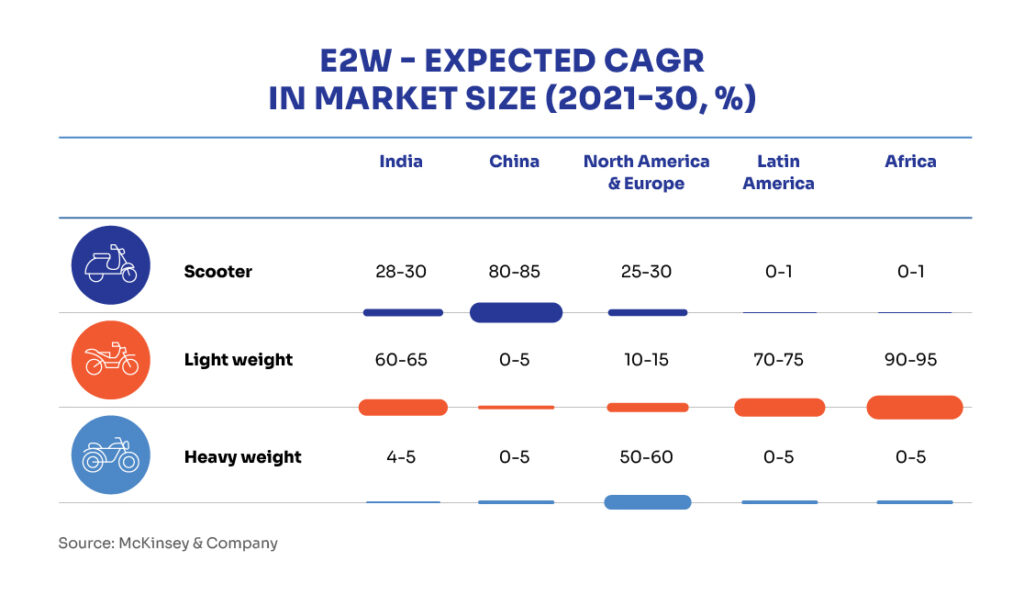

If we look at the trend in the adoption rate of E2W across the world, a significant bifurcation is visible with respect to the class of 2-wheelers. While developing countries like China are inclined towards transportation-oriented 2-wheelers developed countries like North America are focusing more on the heavyweight (more than 250 CC) segment.

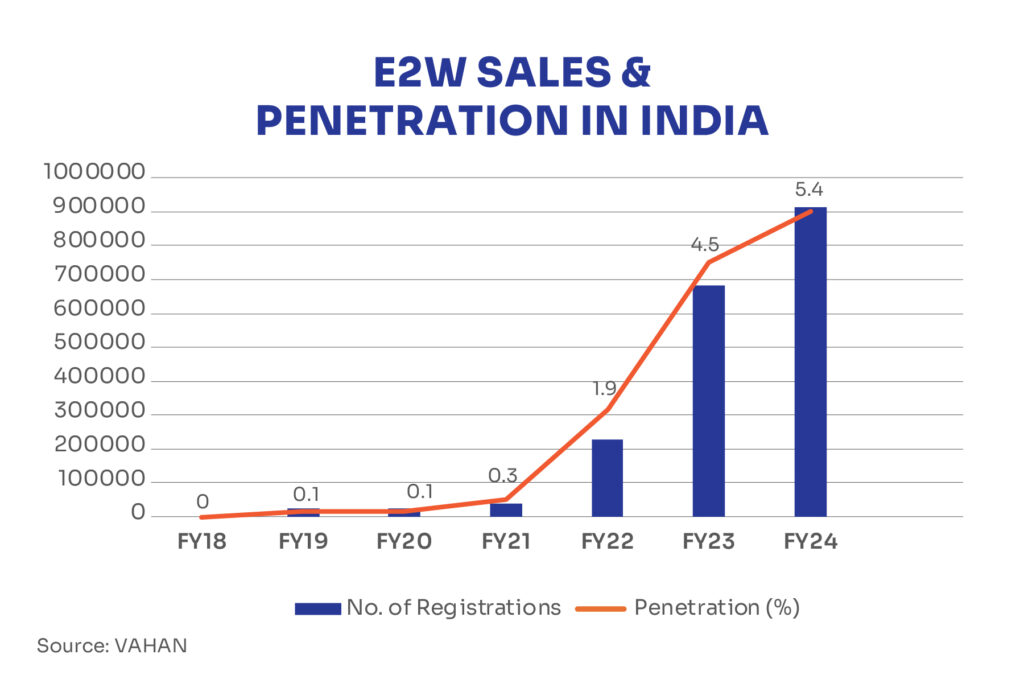

The below chart indicates that the adoption rate of E2W in India has been increasing at a rapid pace in the past few years.

Within the E2W segment in India, e-scooters hold the dominant market share due to factors such as affordability, lightweight design, shorter charging times, and good maneuverability. In fact, the share of e-scooters in the overall scooter sales jumped from below 10% to roughly 15% on average in FY23 and FY24.

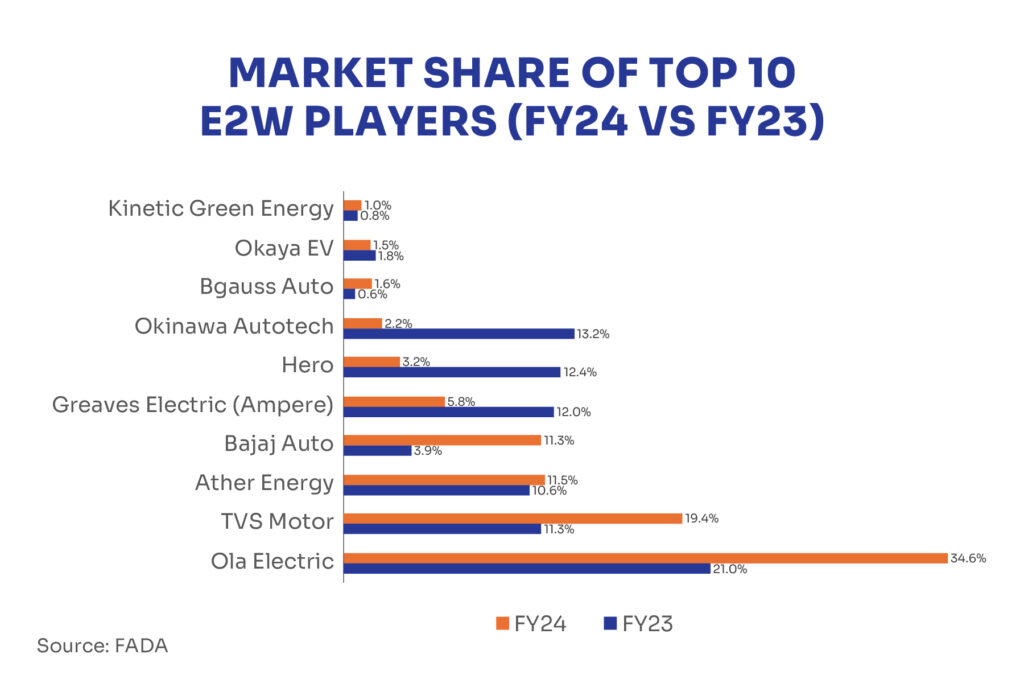

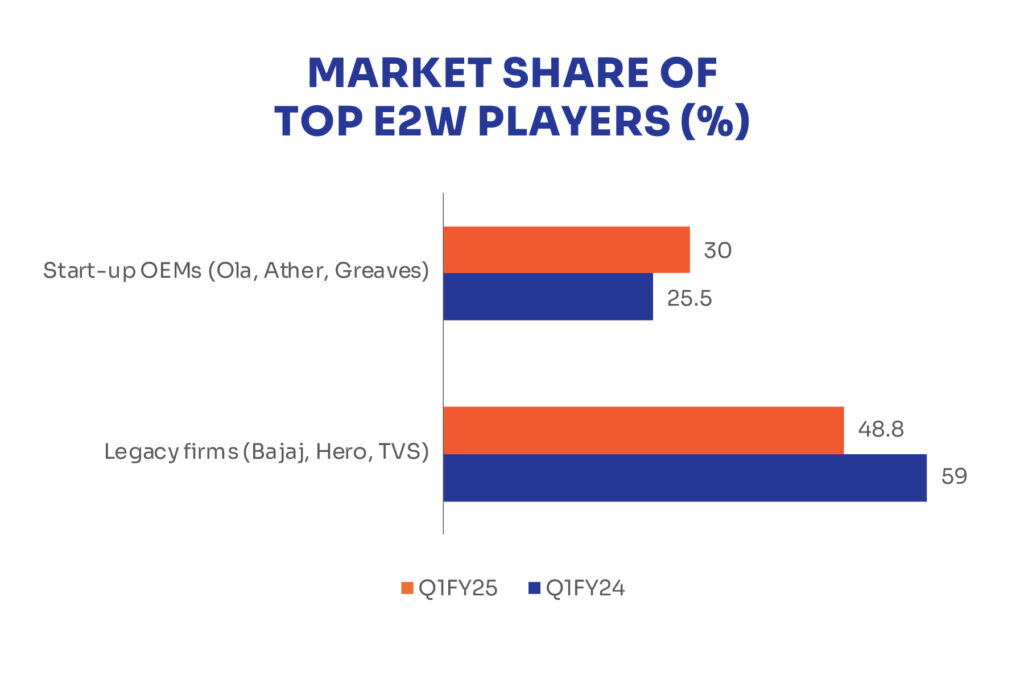

Competition – E2W Players in India

The competition in the E2W market in India is unique and converse to what it is in the ICE 2W market at the beginning. In the ICE market, incumbents like Hero MotoCorp, Bajaj Auto, TVS Motor, etc., continue to dominate the market. However, in the E2W market, the legacy players face strong competition from new players like Ola Electric, Ather Energy, and Okinawa Autotech due to several factors such as their high reliance on offline channels, OEM-led apps, and digital purchase journey provided by start-up OEMs, etc. However, things have changed lately as legacy players started expanding their presence in the evolving market by setting up more touchpoints, service networks, new product launches, and collaboration in charging networks with new players (for example, Hero and Ather).

Factors driving the transition

Bike rental model: The emergence of bike rental model in Tier-I and Tier-II towns spearheaded by companies such as Bounce, Vogo, and YULU brought the utility of E2W to the forefront not only for commuting but also for e-commerce and hyperlocal deliveries as well as long-term rentals. Their subscription plan, ranging from hourly to weekly, monthly, and annual, offered a lot of flexibility to users. Overall, the subscription plans and bike aggregation model by some operators have accelerated the adoption of E2W for both private and commercial purposes.

Government support: The Government of India (GoI) has rolled out several incentives to promote and incentivize E2W and overall EV adoption. In 2015, the Faster Adoption and Manufacturing of (hybrid &) EVs (FAME I) was launched, a major initiative under the National Electric Mobility Mission Plan (NEMMP), to address the concern by subsidizing EV use and manufacturing. The first phase was later extended to increase subsidies and reduce the GST rate on EVs. The second phase was launched in 2019 and extended till March 2024. FAME II was aimed at electrification of Public and Shared Transport subsequently aligning with the base objectives of FAME I.

In 2021, GoI also launched the Production Linked Incentive (PLI) scheme under the Make in India initiative to boost the manufacturing of advanced chemistry cell battery storage. Further, in 2022, the Battery Swapping Policy for EVs was introduced to promote battery-swapping methods.

These government supports have helped reduce the cost of ownership, boosted customer awareness, and helped the launch of feature-rich models, alleviating cost concerns of owning E2W thereby attracting budget-conscious consumers.

Delivery business: The rise of the delivery business in India, especially post-COVID-19, has pushed the adoption of E2W mobility as it provides an efficient and cost-effective solution for last-mile deliveries. Further, E2W facilitates agile transportation in crowded urban areas while reducing operational costs and carbon emissions.

Total Ownership Costs (TCO): TCO per km plays a pivotal role in the transition to E2W in India as it influences consumer decisions to adopt them. Compared to ICE 2-wheelers, E2W reduces operating expenses of ownership due to significantly lower fuel costs and minimal maintenance requirements / expenses.

Fewer parts: E2W, like other EVs, requires significantly fewer parts than traditional ICE 2-wheelers. For instance, an ICE 2-wheeler has more than 150 components that are split between the engine and transmission assemblies while the powertrain in an E2W has just 25 components. This reduces the maintenance needs of E2W; however, their components are more complex than ICE components.

Challenges in transition

Despite the strong momentum in EV adoption, the road to the E2W transition in India is still patchy. Challenges loom with respect to concerns about vehicle safety, battery life, insufficient charging infrastructure, and other factors. Let’s deep dive into some of them.

Battery: The battery is the key and the most expensive component of E2W like other EVs. It accounts for 35-40% of the vehicle price and about 50% of the battery cost is attributed to cathode which is mainly made up of Lithium, Cobalt, Manganese, and Nickel. Currently, the majority of OEMs are dependent on imports to meet their battery requirements, and their domestic operations only involve the assembly of battery packs.

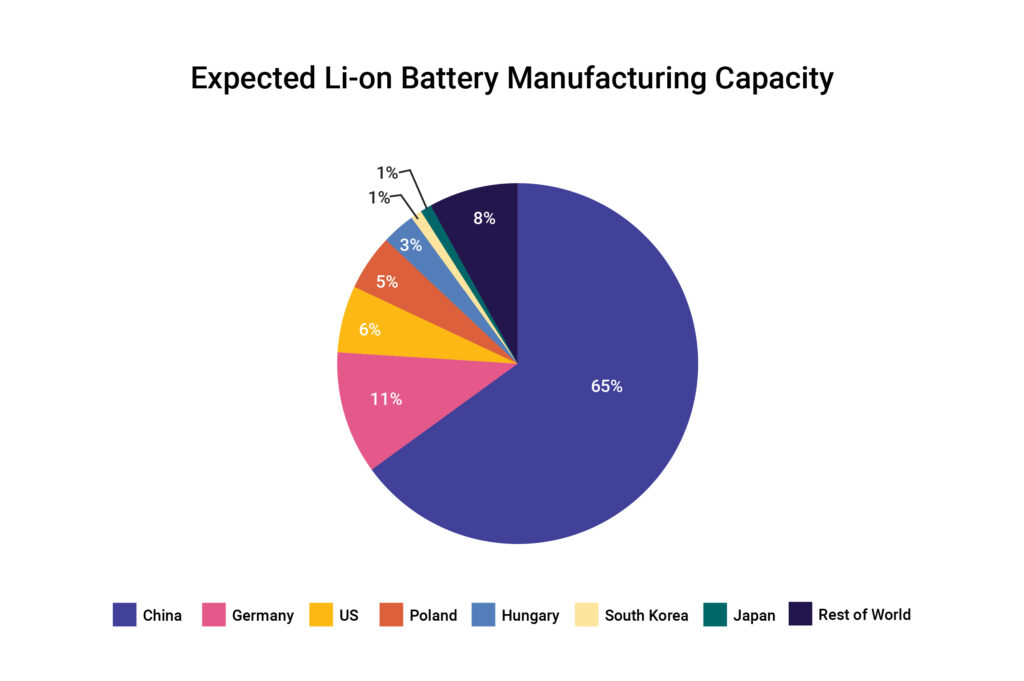

Over 95% of the world’s lithium is imported from four countries – Australia, Chile, Argentina and China. Australia, which houses the world’s largest lithium mine, Greenbushes, exports ~95% of its lithium to many countries, the top buyer being China. Given the rising adoption of EVs in India, the battery demand for EVs in India is expected to quadruple from ~15GWH currently to ~60 GWH by FY30. As a result, the development of a battery manufacturing ecosystem in India holds the key to the targeted adoption of E2W and EVs in India.

Reduction in subsidy: GoI has cut back subsidies to OEMs due to a lack of localization of procurement and assembly of vehicles. The FAME II subsidy scheme, which ended its run on March 31, 2024, saw both Cap on demand incentive (as a percentage of showroom price) and Demand incentive (INR per kWh) reduced from 40% to 15% and INR 15,000 to 10,000, respectively, since 2023. This amendment had hit the pace of transition to E2W in India in the recent past. GoI has replaced FAME II with the Electric Mobility Promotion Scheme 2024 (EMPS 2024) which will offer support only up to INR 10,000 per two-wheeler.

Negative publicity: The use of E2W in India faced negative publicity in the past and is vulnerable to incidents of accidents and malfunctioning due to inferior vehicle quality. The fear and concerns about vehicle safety have slowed the pace of transition to some extent.

Disclaimer:

The views provided in this blog are of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.