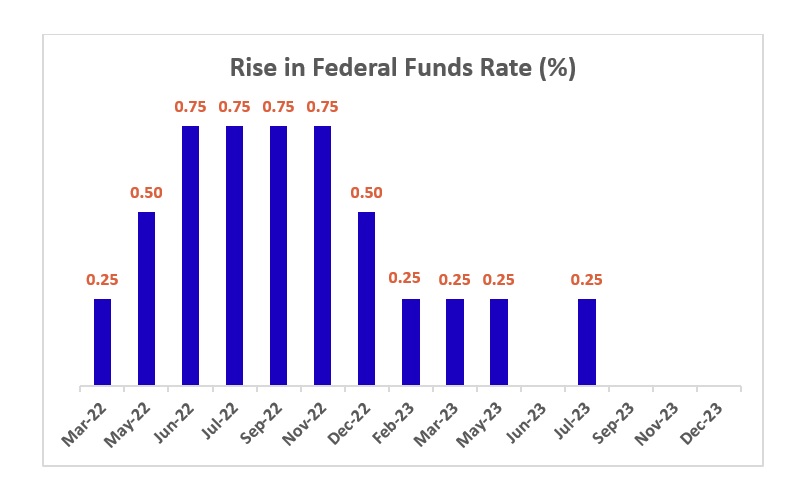

The 19-member US Federal Open Market Committee (FOMC) unanimously kept the federal funds rate steady at the 22-year high target range of 5.25%-5.5% for the third time in a row after following a spate of 11 rate hikes since March 2022 (including four in 2023) to combat inflation.

“Inflation has eased from its highs, and this has come without a significant increase in unemployment. That’s very good,” said Jerome Powell, the Federal Reserve Chair. In fact, this is the first time the Fed has formally acknowledged progress in its fight against inflation since its first spike in June 2022.

Inflation in the US came down to 3.2% YoY in October from September’s reading of 3.7% and last year’s peak of 9.1%. It came in below the consensus estimate of 3.3%. The core CPI, which excludes the impact of food and energy prices, went up 4% YoY in October, which was also below the consensus estimate of 4.1%.

While sounding confident, Powell is not yet ready to commit that the work is over. “This result is not guaranteed. It is far too early to declare victory,” he said while warning that the US economy could still enter recession unexpectedly despite being resilient in 2023.

Rate Cuts and Economic Projections

Projections after the Fed meeting indicated the end of the tightening cycle. A near-unanimous 17 of 19 Fed officials predicted lower policy rates by the end of 2024. The median projection for interest rates at the end of next year has been reduced to 4.5% and 4.75%, signalling 75 basis points (bps) of cuts from current levels. Assuming 25 bps per cut, it translates to three rate cuts in 2024.

In the Summary of Economic Projections (SEP), the Fed foresees core inflation peaking at 2.4% in 2024, which is lower than September’s projection of 2.6%, before softening to 2.2% in 2025 and 2% (the target rate) in 2026.

Projections for GDP growth have been lowered marginally from 1.5% to 1.4% in 2024 and are seen to improve to 1.8% in 2025 and 1.9% in 2026. Meanwhile, the unemployment rate is expected to rise from 3.7% currently (in November) to 4.1% in 2024 and continuing at that level in 2025 and 2026.

Fed’s ‘dot plot’, which maps out directions in policymakers’ expectations for interest rates going ahead, shows individual expectations of four more cuts in 2025 and three more in 2026, while longer-range projections seem to be less firm.

Our Take

Overall, the US Fed’s comments on the progress on inflation and its discussion of rate cuts during the policy meeting (in deviation from the last policy where there were no discussions on cuts) are perceived to be dovish. The statements on taking action, if prices were to rebound, were conveniently ignored as the focus shifted to the Fed’s muted response on the cuts being priced already and easing financial conditions.

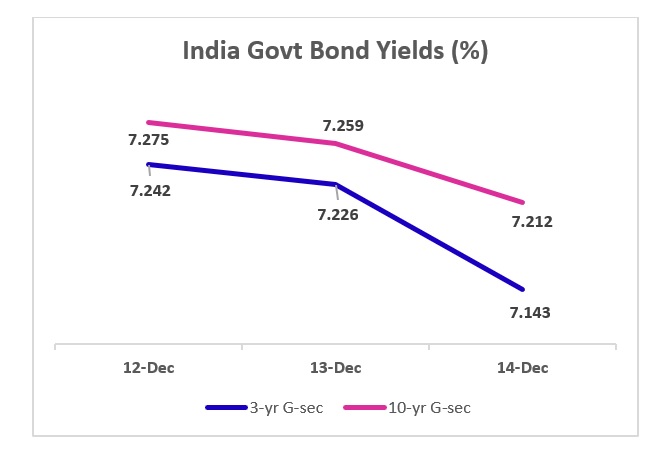

Markets cheered the policy with US bond yields dropping 20-30 bps led by the front end of the curve, with a 90% probability of a rate cut as early as March next year. Risk assets roared and the dollar weakened in response to the last policy of an extremely volatile year.

While the gradual direction of yields looks softer, markets have gone a little ahead in pricing much more aggressive cuts than what the Fed indicated. While the hiking cycle is broadly behind us, cuts could be delayed if there are a couple of adverse data surprises, keeping rates a little higher for longer.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.