The credit landscape in India has increasingly turned congenial towards growth in private credit. In 2022, private credit transactions in the country stood at over US$5 billion (excluding venture debt, debt funding in financial services players and offshore bond raises), as per a report by Ernst & Young.

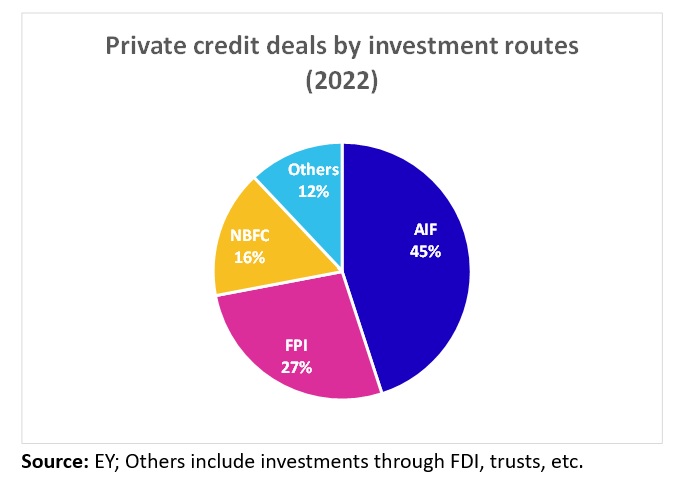

In the overall private credit space, global funds, which constituted nearly 60% of the transactions by value, preferred the Alternative Investment Fund (AIF)/Foreign Portfolio Investment (FPI) route for investments whereas domestic funds, constituting over 30% of the transactions, preferred using only the AIF route. On an aggregate basis, the share of investment routes in the private credit market was dominated by AIFs in 2022 as shown below:

In 2022, the deal value for AIFs in the private credit space stood at US$2.3 billion (INR 18,000 crore+).

But what are the catalysts for the growth of AIFs in the private credit space in India? The factors are both supply and demand sides.

Supply and demand factors for growth in AIFs in the private credit space

On the supply side, the banking sector became increasingly risk averse over the years towards the mid-corporate space and focusing more on large corporates or enterprises with AAA or AA rated issuers. When it comes to non-banking finance companies (NBFCs), the growth in wholesale lending has remained flat in the recent past (FY20 to FY22). Additionally, mutual funds have started aligning their portfolio increasingly to the debt papers of large corporates with higher credit rating profiles after several restrictions placed by the market regulator Securities and Exchange Board of India (SEBI) in 2020.

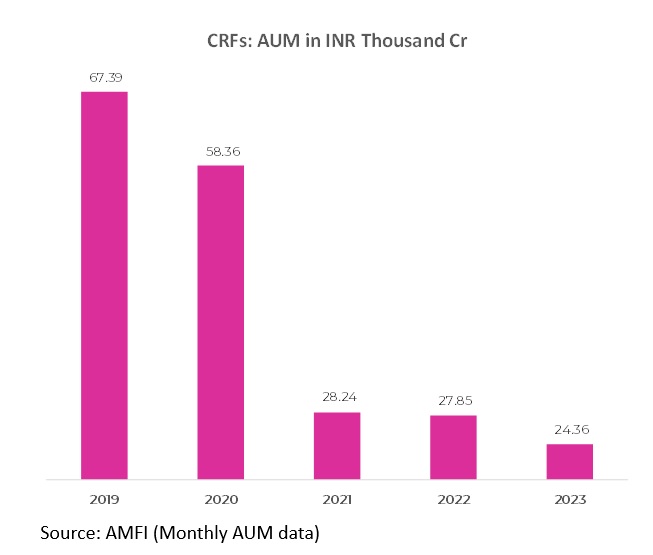

Further, after the Franklin Templeton crisis in 2020, assets under management (AUM) of Credit Risk Funds (CRFs) has been declining due to increasing redemption by retail investors. This coupled with higher preference for higher rated issuers by CRFs led to lesser availability of funds for lower rated papers.

On the demand side, there are huge requirements for growth capital by mid-market corporates or entities with below AA or no credit rating as they need to scale up their businesses increasingly. India is on a high growth path, and mid-market corporates have been contributing heavily to the economy. As per government data, micro, small, and medium enterprises (MSMEs) in India contribute over 30% to the country’s GDP and have a share of 40-50% in all Indian exports. However, there are hardly any takers for unrated or below AA-rated debt creating a significant credit gap for the segment in the market. This happens even though on average, 90%+ of these corporations in the rating bracket of A+ to investment grade are profitable.

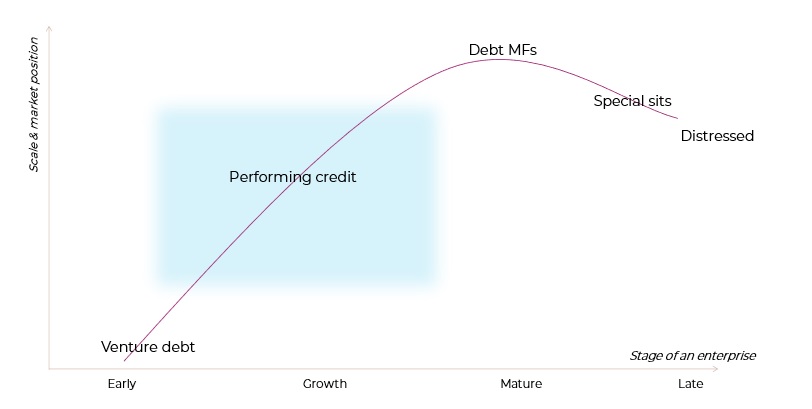

Due to these factors, AIFs have been increasingly catering to the mid-market space with strategies of Performing Credits, Special Situations, and, or Distressed Credit. According to industry experts, Performing Credits is the space where a sizeable amount of fresh AIF flows is getting deployed.

What is Performing Credit?

The Performing Credit space is defined as the space where the borrowing entities are profitable and are operating companies with visible cashflows; proven and stable business models; over 3 years of vintage; and a revenue range of INR 300 to 4000 crores. These are mid-market enterprises that are typically rated in the investment grade universe, going up to AA-. Forming the essential middle range of entities that ensure a robust economy, these entities are predominantly well discovered by the banking system.

In the risk-return spectrum, the Performing Credit space depicts the white space between the low yield, high-rated space occupied by debt mutual funds and high-risk space favored by special situation, distressed, and venture debt funds. This space typically yields 8 – 16% gross returns and offers superior risk-adjusted returns.

Considering the life-cycle stages of a corporation, entities in the performing credit space are typically in the growth stage, as opposed to early-stage entities preferred by venture debt firms or mature and late-stage companies that find themselves in distress or need situational funding.

However, despite having stable financials and banking lines of credit, these mid-market enterprises in the Performing Credits face a significant credit gap that is being mitigated by a few AIFs typically following a strong philosophy of investing in the space. These entities are increasingly being served by such AIFs due to the following reasons —

- Limitations of banking lines of credit: Although banking lines of credit are available to these entities, there will be limitations due to internal policies of the bank. For example, product development in a software-oriented entity will not be treated as capital expenditure like it would be in a manufacturing firm, hence, a bank may refuse to fund the same. Moreover, banks tend to have rigid underlying templates, say, a checklist with requirements that may not be relevant to a business. The inability to meet any of the criteria like these set by the bank would lead to the rejection of loans applied by the mid-market corporates. However, AIFs will be open to take flexible securities which banks may avoid. For example, a fund may lend to an operating company basis the collateral provided at the holding company level or the fund will allow a second charge on working capital cash flow.

- Flexible repayment schedules: Banks generally offer ‘cookie-cutter’ type of products to entities. There is insistence on an EMI structure irrespective of how the underlying cash flow of the business appears. For example, a SaaS entity may be borrowing to hire senior management personnel. In such a case, they would prefer a moratorium period before they start repaying capital. An AIF is able to offer this moratorium due to its ability to structure flexible deals.

- Access to capital market: The companies seek out non-bank funding through issuances of instruments such as bonds to get access to the capital markets. The preference for capital markets stems from flexibility in raising capital, better price discovery, and diversification of resource profiles. This is why mature entities prefer capital markets.

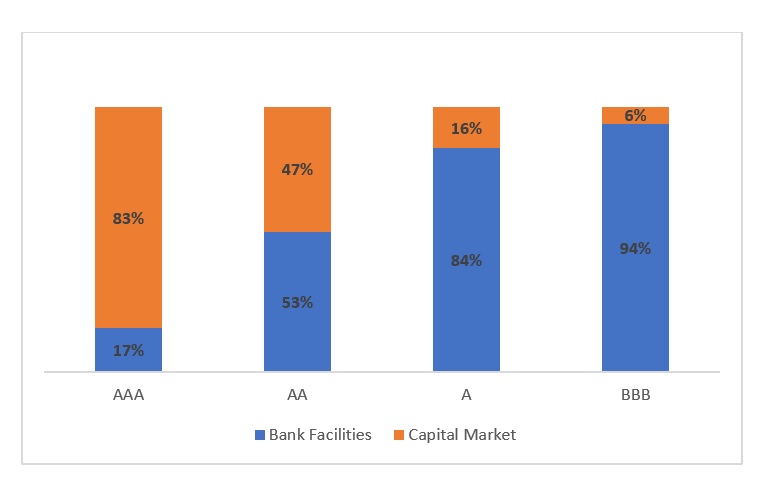

If we look at the ratio of the bond market to bank loans over the last decade, we see A and BBB rated entities are disproportionately reliant on loan markets compared to higher-rated entities, creating an asymmetry in the market.

The entities in the Performing Credit space, to whom banks generally offer Term Loans, are able to issue bonds via AIFs. Often, and especially for corporates, an issuance for a fund may be the entity’s maiden capital market issuance and rating exercise. The fund may also be able to provide guidance in navigating the nuances of capital market issuance.

It is now clear why AIFs could be a preferred route of capital raising for mid-market enterprises. In fact, AIFs present a win-win situation for both the portfolio entities and the investors. There are a number of factors due to which investors benefits from investing in Performing Credits via a pooled investment vehicle like AIF as discussed below:

- Correlation to the economy: The risk-return spectrum in an AIF portfolio has a low correlation to the economy and public markets. Investors can take exposure to several sectors with low or minimal correlation and several entities within the sector by investing through a pooled fund.

- Identification of right assets: Given that entities in the performing credit space are unlisted, they may have low levels of public exposure. For an investor to hold such entities in their portfolio, they would need to actively diligence these entities with a customized framework for each entity. However, fund managers are better placed to do the same through careful selection and ongoing monitoring along with ecosystem checks (other lenders, equity holders, customers, merchants, rating agencies, etc.). Further, by regular monitoring of investments, the fund managers are able to identify early warning signals and can take appropriate remedies.

- Exit mechanism through regular monitoring: By having regular monitoring of investments, the asset managers are well-placed to identify early warning signals and take appropriate remedies.

- Deal structuring: The ability to negotiate the right covenant, right ticket size, tenor of the investment, principal amortization structure, etc. requires a deep understanding of the portfolio entities, and modelling of cashflows under normal and stress scenarios is best left for an experienced asset manager.

- Diversification: Losses can be averted or minimized through diversification and granularity at the portfolio level. Investing through a pooled fund ensures that the investor simultaneously has exposure to multiple entities and sectors, thereby limiting the risk of an unforeseen event.

Disclaimer:

The views provided in this blog are of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.