In the first part of the series, we primarily discussed what is ESG, where is India in this equation & how Vivriti kick-started its sustainability journey. Taking this forward, we would focus more on Vivriti’s ESG & Impact philosophy to include our sector choices as well as our ESG risk & opportunity assessments.

Our ESG & Impact philosophy

In order to move a step closer to our goal, we need businesses and entrepreneurs to adapt to the Indian ecosystem and traditions in such a manner that sustainability and impact become key outcomes and not end up merely as checkboxes.

We cater to the diverse needs of our customers across various sectors including but not limited to financial services, renewable energy, healthcare, agriculture, and infrastructure. We seek to implement our mission through two business models. Firstly, through our NBFC entity Vivriti Capital, where we build credit history and robust lending processes. Secondly, through our AMC arm Vivriti Asset Management, which aims to channel global capital to its funds’ portfolio companies. Both these businesses are set up with a clear goal of ensuring inclusive and equitable growth for mid-market enterprises in India.

To deliver the impact where it matters the most, we employ a sector agnostic strategy, thus broadening the scope to a wider audience. We have delivered both direct & indirect forms of impact through multiple channels as discussed below:

Direct impact through thematic lending and investment in sectors such as microfinance, small and medium enterprises, Agri finance, healthcare, and clean energy.

For instance, Vivriti has financed an emerging leader in the underserved solar power market, infusing the requisite capital for the latter’s growth plans. Similarly, Vivriti helped an SME lender commence its capital market journey by investing in its first listed bond.

Our financial services portfolio, largely comprising of retail NBFCs, has the last-mile reach fuelling credit to millions of households and microenterprises. This enabled us to not only target financial inclusion but also fundamentally reduce economic inequalities through the empowerment of women & promotion of rural entrepreneurship.

Indirect impact through better ESG engagement by proactively embracing the opportunity to introduce new ways of stewardship. As part of its diligence process, Vivriti has been advising its portfolio companies on better governance and disclosure practices, in turn helping them tap the right avenues of capital in the long term. We have also suggested improvement in processes that enable companies to drive ground-level impact for their end customers.

For instance, we encouraged a mid-sized asset financer to employ a better auditor helping it attract an institutional pool of capital. On another occasion, when one of the rural financing lenders lacked employee enabling policies, through our engagement, we were able to drive home the point that employee well-being initiatives and processes are necessary for the company’s long-term growth strategy.

ESG Risk & Opportunities assessments

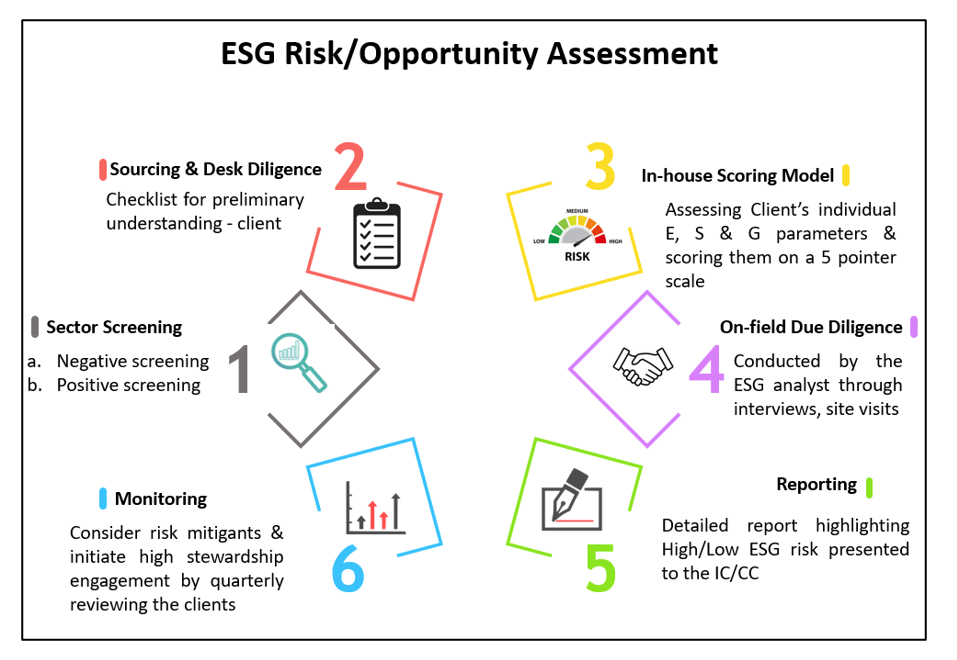

Adopting ESG assessment presents both risks and opportunities for an organisation. Our comprehensive framework enables us to identify, evaluate, monitor, and manage ESG risks. We follow a risk-based approach where clients/transactions that carry high ESG risks are subjected to enhanced evaluation and due diligence by a specialised ESG team for approval.

We intend to measure and monitor the ESG footprint of our portfolio companies by integrating the ESG risk assessment process with on-field diligence and periodic risk monitoring. This would also help us enhance our stewardship efforts and strengthen our engagement with the portfolio companies.

The Future of ESG

Today, ESG research is going deeper and becoming more sophisticated. As the taxonomy of ESG has evolved, so too has the ability to use data to analyse the world of ESG. Integrating ESG metrics into research on a thematic or issue-led basis, such as how various exclusion strategies will impact a portfolio or integrating ESG factors into investment recommendations, is seeking attention. Over the past decade, the growth in awareness and the adoption of ESG has been one the most dominant trends in the investment industry and is likely to be true for the next decade as well.

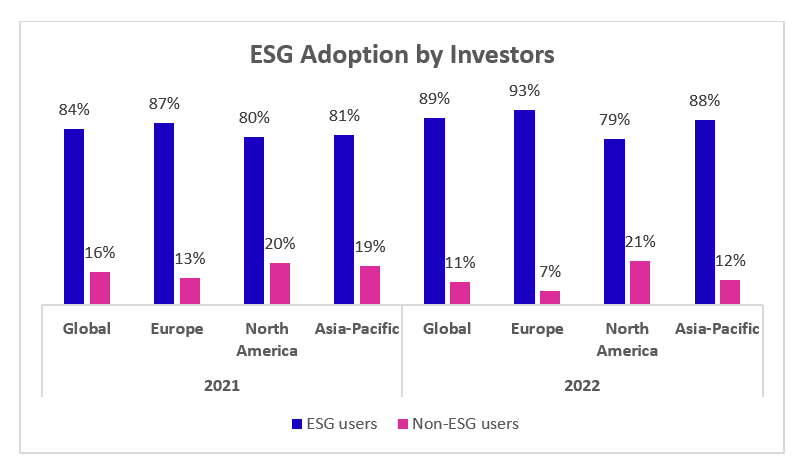

As per a 2022 study on global ESG trends by the Harvard Law School, the momentum toward the adoption of ESG in the investment approach continues. Europe took the lead in ESG charge, all of which are depicted in the chart below:

The focus is also shifting from what a company invests in to how it invests, and that trend will gather pace in the coming years. This is a growing but niche part of the ESG market that aims to get to the core of what responsible markets are. This is likely to result in significantly greater scrutiny of investment practices and bring institutions into the ESG world as contributors to rather than facilitators of the ESG movement. In the past decade, ESG has moved from a niche investment area to an overlay of a foundation of investing, permeating every aspect of capital markets and the investment industry.