Global Economic Updates

Central bank policy actions

- The Federal Open Market Committee (FOMC) kept the benchmark interest rates unchanged at 5.25%-5.50% for the 4th consecutive time as expected by the Street. Since March 2022, the US Federal Reserve hiked rates 11 times to combat inflation. As per the previous FOMC meeting, rate cuts are likely to happen in 2024. However, the Fed’s recent policy statement cast doubt on the prospect of a rate hike on the immediate horizon.

- The European Central Bank (ECB) maintained the status quo on its benchmark interest rates at the record high level of 4% in order to make sure inflation is firmly under control before any rate cut decision, which is expected later this year. ECB President Christine Lagarde said, “We need to be further along in the disinflation process before we can be sufficiently confident that inflation will actually hit the target in a timely manner”.

- The Bank of England (BoE) maintained the status quo on its interest rates, as expected, at the 15-year high of 5.25%, which stood since August following the end of nearly 2 years of rate hikes. The decision came with a majority of 6-3. The bank is still cautious about the surge in inflation as it’s still above the target level of 2% and hovering around 4% currently.

- The Central Bank of Philippines (BSP) kept its benchmark interest rates unchanged as the bank perceives the risks of inflation to be receded but remain tilted upward. Its 7-member monetary board kept its target reverse repurchase rate at 6.5% and held the overnight deposit and lending rates at 6% and 7%, respectively.

- China’s central bank cut its 5-year loan prime rate for the first time since last June by 25 basis points to 3.95%. However, the bank left its 1-year rate unchanged at 3.45% to ease pressures on the troubled real estate market.

- The Bank of Indonesia maintained the status quo on rates at 6% as widely expected to support its currency rupiah and limit imported inflation pressures. The central bank was upbeat about the 2024 global growth, driven by the US and India, and stayed positive on domestic growth prospects.

Inflation readings

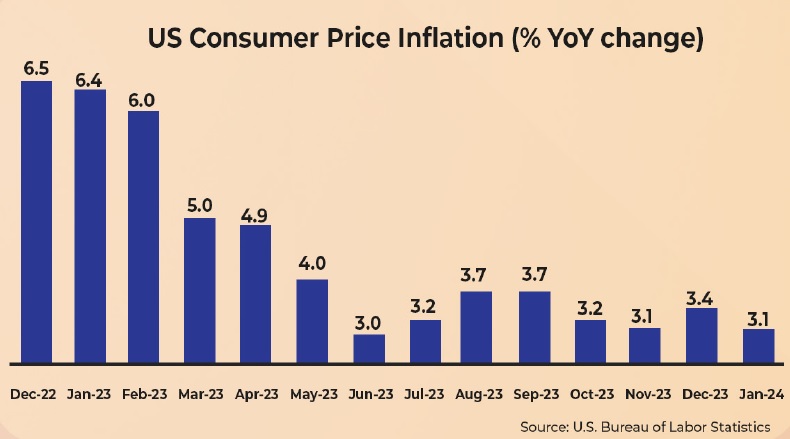

- Consumer price inflation in the US came in at 3.1% YoY in January, which is lower than 3.4% YoY in December 2023. However, it was higher than the consensus estimates of 2.9%. Core inflation, which excludes volatile food and energy prices, decelerated to 3.9% YoY in January from 3.7% in December but it came in above the market expectations of 3.7%. Despite the upward surprise caused by higher shelter and healthcare expenses, the downward trajectory in inflation following its surge in 2022 makes the situation favourable for a near-term interest cut in the US.

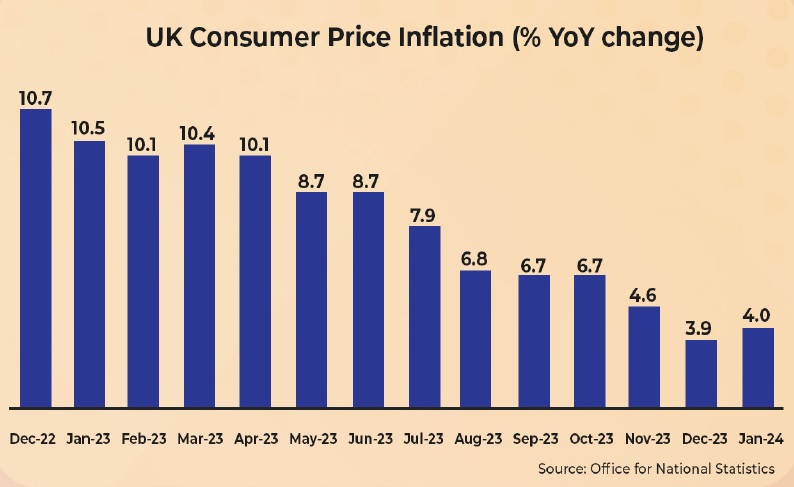

- Consumer price inflation in the UK edged higher to 4% YoY in January from 3.9% in December 2023. However, it is lower than the consensus estimates of 4.2%. The upward pressure is led by housing and household services, mainly higher gas and electricity charges. Core inflation, which excludes volatile food, energy, alcohol, and tobacco prices, was 5.1% in the month, which was below the consensus estimate of 5.2%.

- Inflation in Europe’s largest economy, Germany, dipped to its lowest level since June 2021 at 2.9% YoY in January 2024 compared with 3.7% YoY in December 2023 due to the favourable impact of falling energy prices, flash estimates revealed. However, the favourable impact of energy prices has masked the worrisome trend of monthly price increases for consumer goods and food.

Other economic indicators

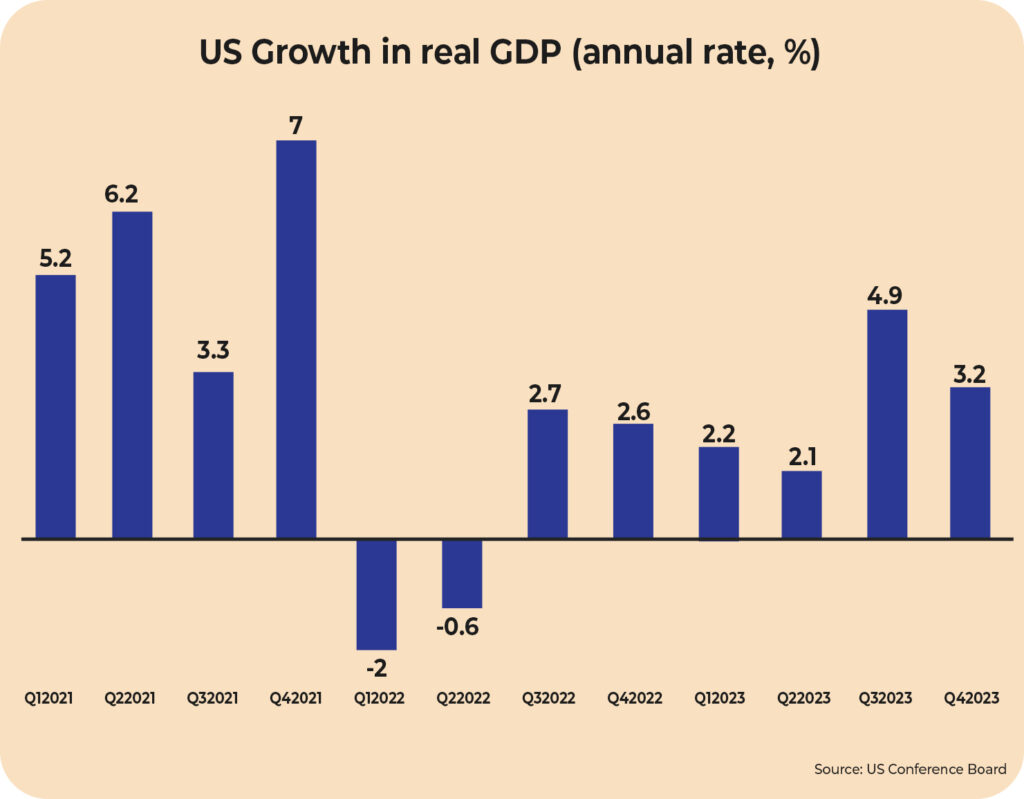

- The US economy expanded at a sluggish rate in the final quarter of CY2023 at 3.2% compared to the earlier quarter growth of 4.9%. However, the GDP growth remained above 2% for the last 6 quarters driven by a rise in consumer and government spending, private investment, and exports defying fears of a recession in the world’s largest economy.

- The growth in the US job market was surprisingly higher in January as nonfarm payrolls rose 353,000 in the month compared to the Dow Jones estimate of 185,000. The unemployment rate was 3.7% in the month, slightly lower than the estimate of 3.8%. The wage growth was also stronger as average hourly earnings increased 0.6%, which is 2x the monthly estimate.

- Consumer confidence in the US recorded its third consecutive monthly rise hitting the highest level since July 2021. The University of Michigan sentiment rose to 79.6 in February from 79 in January, indicating resilience among consumers despite interest rates being at their highest level in over two decades.

- The IMF, in its latest World Economic Outlook, raised the forecast for global growth by 0.2 percentage point (ppt) to 3.1% YoY for 2024 compared to the October forecast (the same as in 2023) due to resilience in the US and emerging economies and strong consumption-driven growth. For 2025, the growth is expected to accelerate to 3.2%. However, the UN agency is cautious about the outlook for Europe due to the impact of geopolitical conflicts, and tight monetary conditions, among other factors. It expects the growth in the block to be 0.5% in 2023 and 0.9% in 2024. The higher forecast for 2024 is attributed to stronger household consumption. For India, the IMF raised the growth forecast by 40 basis points (bps) to 6.7% for FY24 and 20 bps to 6.5% for both FY25 and FY26 due to resilience in domestic demand.

- PMI readings: In the US, economic activity in the manufacturing sector remained in the contraction zone for the 15th consecutive month in January 2024. PMI reading by the Institute for Supply Management (ISM) came in at 49.1% in January, up 2 ppt from the seasonally adjusted 47.1% in December 2023. The slight improvement in the reading is led by a rise in new orders, fall in backlogs, and a rise in production. In China, the PMI reading for January came in at 49.2% compared with 49% in December 2023 due to higher production and a rise in orders. In India, the HSBC India Manufacturing PMI stood at 56.5 in January 2024 compared with 54.9 in December 2023. The improvement is driven by the strongest growth in the output and new orders since September and a further rise in export orders.

- Composite PMI Readings: The J.P. Morgan Global Composite PMI, which tracks economic activity in the manufacturing and service sector across the globe, rose to 51.8 in January from 51 in December 2023. The January reading is the highest since June 2023 as service sector activity rose at the quickest pace since July 2023 and the manufacturing sector returned to the expansion territory for the first time in 8 months, driven by increased production in the consumer goods sub-industry.

- Japan’s economy unexpectedly slipped into a recession led by sluggishness in consumption and capital expenditures. Its GDP fell at an annualised rate of 0.4% in Oct-Dec 2023 after a 3.3% decline in the prior quarter when the market expected a 1.4% rise for the quarter. With this, Japan lost the title of the world’s 3rd largest economy to Germany as the nominal GDP of the former was US$4.21 trillion compared with US$4.46 trillion for Germany in 2023.

Domestic Economic Updates

- Union Budget: In the Interim Union Budget for FY 2024-25, Finance and Corporate Affairs Minister Nirmala Sitharaman announced the capital expenditure outlay of INR 11.1 lakh crore for the fiscal year, which is up 11.1% YoY and accounts for 3.4% of the GDP. The fiscal deficit is targeted to reduce below 4.5% of GDP by FY2025-26 (down from 5.8% as per the revised estimate for FY2023-24) from the estimated 5.1% of GDP for FY 2024-25. As per the First Advance Estimates of National Income of FY 2023-24, presented along with the Budget speech, India’s real GDP is expected to grow at 7.3%, which is closer to the RBI’s upward revision in growth projections to 7% for the fiscal year driven by strong growth in the second quarter.

- RBI Monetary Policy: RBI’s Monetary Policy Committee (MPC) has unanimously decided to keep the repo rate unchanged at 6.5% for the sixth consecutive time. 5 out of 6 members voted to remain focused on the withdrawal of accommodation to progressively align inflation with the target (4% within a band of +/- 2%) while supporting growth. The MPC revealed optimism about the domestic economic activity which they expect to continue driven by the momentum in investment demand, positive business sentiments, and rising consumer confidence.

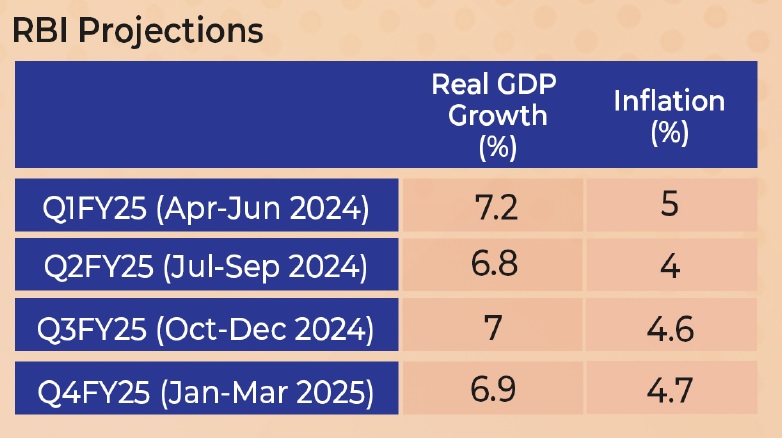

- Projections: The MPC projected a 7% growth in real GDP for the next fiscal year 2024-25 (Earlier they have projected the same 7% real GDP growth for FY2023-24). However, the inflation projection has been lowered to 4.5% for FY25 from the forecast of 5.4% for FY24. (Refer to the table for the quarterly breakup of real GDP and inflation projections for the fiscal year 2024-25)

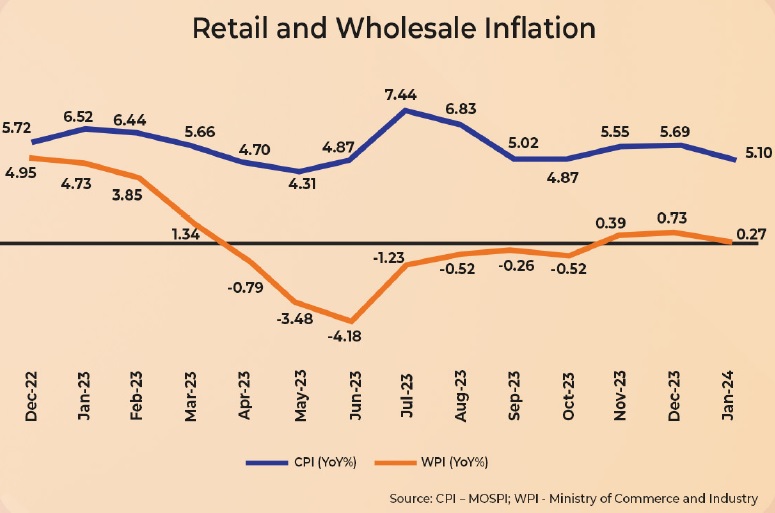

- India’s retail inflation plunged to a 3-month low of 5.1% YoY in January after rising to a 4-month high of 5.69% YoY in December 2023. The fall is attributed to the moderation in food inflation, which softened to 8.3% in January from 9.53% in December 2023. Urban food inflation eased to 9.02% in January from 10.42% in December, while rural food inflation declined to 7.91% in January from 8.49% last December. The core inflation (excludes volatile food and fuel prices) in January declined to the 50-month low of 3.6% in January.

- India’s wholesale inflation eased to a 3-month low of 0.27% YoY in January, which is further down from 0.73% in December 2023, led by moderation in food inflation, mainly vegetables. Wholesale food inflation declined to 6.85% in January from 9.38% in the prior month as vegetable prices softened to 19.71% in January from 26.3% in the prior month. Potatoes are in deflation while inflation in fruits, eggs, milk, fish, and milk have muted.

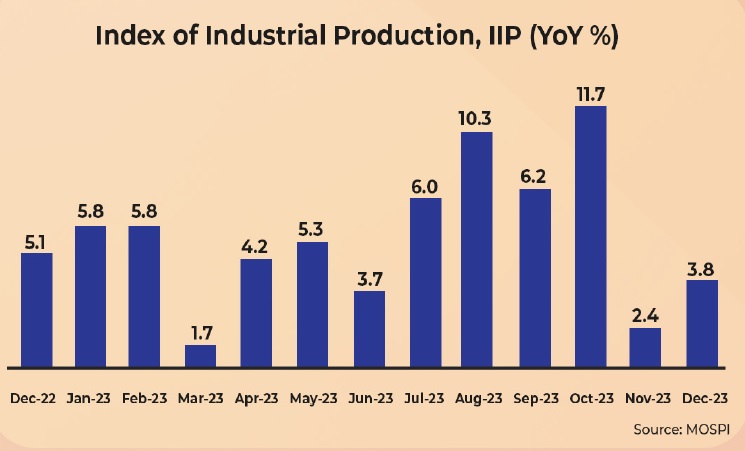

- Industrial output, measured by the index of industrial production (IIP), grew 3.8% YoY in December compared with 2.4% YoY in November. The improvement is driven by a sharp uptick in manufacturing activity (up 3.9% YoY in Jan vs. 1.2% in Dec), while the mining and electricity sectors grew by 5.1% YoY and 1.2% YoY, respectively. In terms of the use-based categories, all showed improvement on a YoY basis except primary goods.

- India is expected to become the 3rd largest economy in the next three years with a GDP of US$5 trillion, which may hit US$7 trillion by 2030 due to continued reforms, the Finance Ministry stated. Currently, India is the 5th largest economy with a GDP of US$3.7 trillion and the government has “set a higher goal of becoming a ‘developed country’ by 2047. With the journey of reforms continuing, this goal is achievable,” revealed the Ministry.

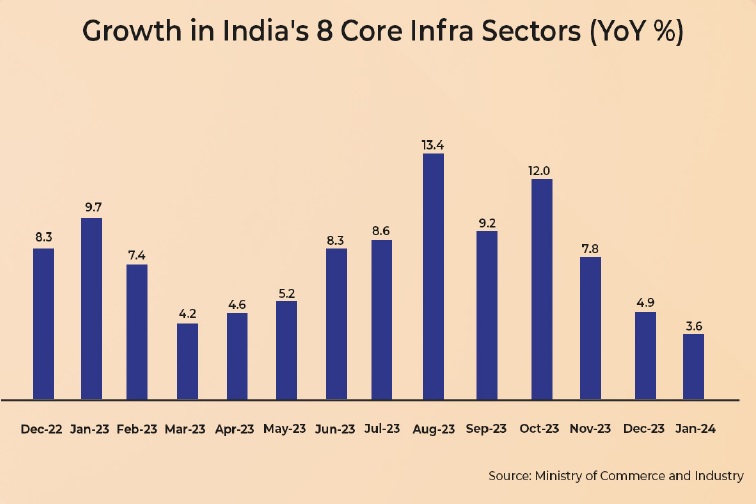

- The growth in the output of eight core infrastructure sectors, which accounts for about 2/5th of the nation’s industrial output, dipped to a 15-month low of 3.6% YoY in January from the upwardly revised 4.9% YoY in December 2023 and the year-ago level of 9.7%. The deceleration is attributed to an unfavourable base, a fall in output in refinery products and fertilisers, and slower growth in three sectors including coal, steel, and natural gas.

- India’s unemployment rate in urban areas dipped to 6.5% in Q3FY24 (Oct-Dec 2023) vs. 6.6% in Q2FY24, as per the Periodic Labour Force Survey. It’s the lowest reading since the start of their survey. The decline is caused by the fall in the male unemployment rate from 6% in Q2FY24 to 5.8% in Q3FY24 while the female unemployment rate remained flat at 8.6% in Q3FY24. Notably, the unemployment rate in urban areas has been falling steadily since the high of 12.6% in Q1FY22 (Apr-Jun 2021) due to Covid.

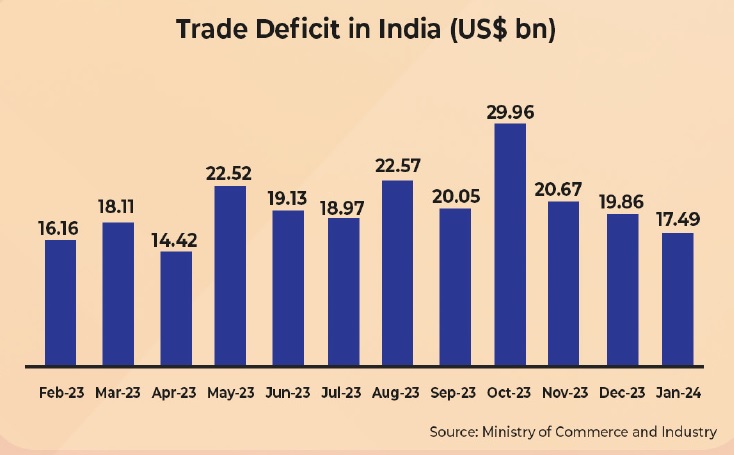

- India’s merchandise exports escalated 3.1% YoY to US$36.9 billion in January, led by both oil and non-oil exports. Imports grew 3% YoY to US$54.4 billion led by oil and gold imports, while non-oil non-gold imports went down marginally. The merchandise trade deficit narrowed to a 9-month low of US$17.49 billion in January from US$19.8 billion in December 2023 as imports declined to US$54.41 billion in January compared with US$58.25 billion in December.

- The HSBC India Services Purchasing Managers’ (PMI) Index, which tracks the economic activity in India’s service sector, rose to a 6-month high of 61.8 in January 2024 from 59 in December 2023 due to the fastest growth in new orders in 6 months and the highest growth in export sales (to countries like Afghanistan, Australia, Brazil, China, Europe, the UAE, and the US) in 3 months. The expansion in business volumes supported the job creation in January, which was the most pronounced in 3 months as well.

- India’s private sector activity rose to a 7-month high as HSBC Flash India Composite PMI Output Index rose to 61.5 in February from 61.2 in January. The growth is driven by both manufacturing and service sector firms. Manufacturing activity rose to a 5-month high and services activity climbed to a 7-month high in February. Highest sales were recorded from Africa, Asia, Australia, Europe, the Americas, and the Middle East.