In the Union Budget FY2024-25, the Centre attempts to strike a balance between job growth, rural development, and fiscal prudence. While fiscal discipline is crucial for better sovereign ratings in hopes of a stronger tax collection, a continued capex push is essential to create jobs and to support the economy to become the world’s third largest by 2030. Let us have a look at the Budget announcements to examine the contours of key economic indicators.

GDP growth

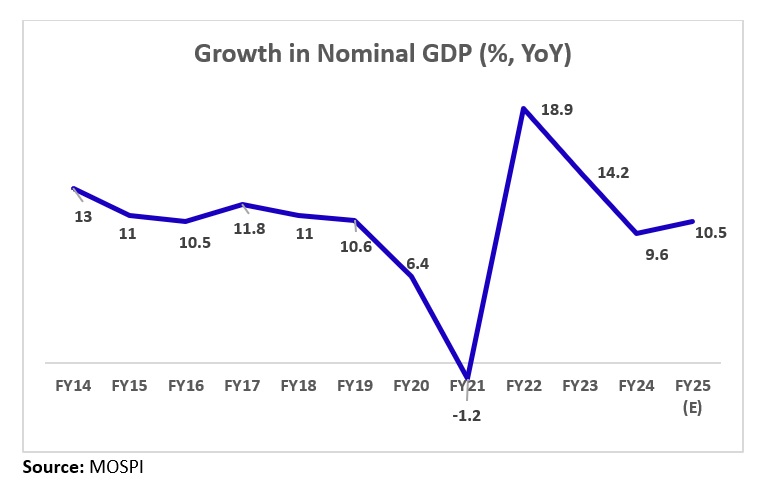

The Centre kept the target for nominal GDP (measured at current prices) growth unchanged at 10.5% in the Union Budget compared with the Interim Budget. In absolute terms, the nominal GDP target is pegged at INR 326.4 lakh crore in FY25, a decline from INR 327.7 lakh crore set in the Interim Budget but up from INR 295.4 lakh crore in FY24.

Real GDP growth, which measures annual GDP growth at constant prices (Base year: 2011-12), has been pegged at 6.5-7% for FY25, as per the Economic Survey 2023-24, presented before the Union Budget.

For FY24, India’s GDP growth came in at 8.2% for FY24 with key drivers being private consumption and investment. The growth in the primary sector (agriculture and mining) was recorded at 2.1%, with agriculture at 1.4% and mining at 7.4%. The secondary sector (manufacturing, electricity, construction) grew 9.7%, with manufacturing and construction sectors recording growth of 9.9% and electricity at 7.5%.

For FY25, the recent Economic Survey indicated some of the key factors of the growth. Firstly, improved balance sheets will aid the private sector in catering to a strong investment demand. Secondly, the forecast of normal rainfall by the India Meteorological Department and the satisfactory spread of the southwest monsoon is expected to boost the performance of the agriculture sector thereby supporting the resurgence of rural demand. Thirdly, the maturity of structural reforms such as the Goods and Services Tax (GST) and the Insolvency and Bankruptcy Code (IBC) is expected to bring the envisaged outcomes.

Inflation

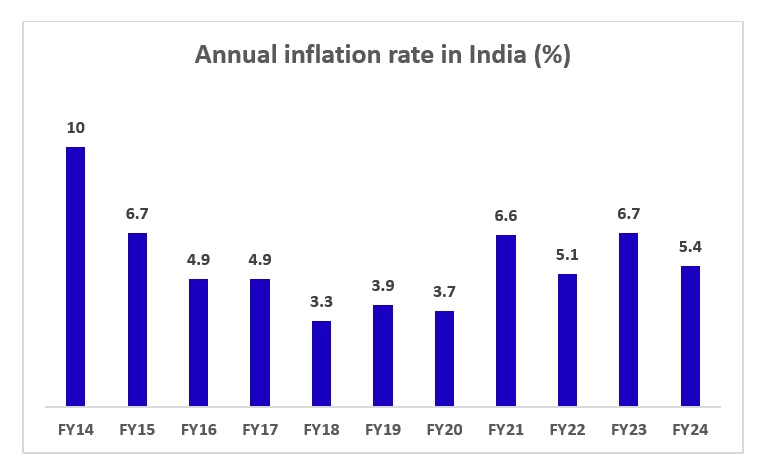

The Budget speech evoked confidence on inflation to be tamed down closer to the 4% target. The Centre has managed to tame down the inflation in FY24 through administrative and monetary policy measures despite global uncertainties, supply chain disruptions, and the vagaries of monsoon.

According to the recent Economic Survey, the decline in retail inflation in FY24 is mainly driven by goods and services inflation, which fell to 4-year and 9-year lows (core inflation), respectively. Food inflation continues to be a concern due to inclement weather and crop damage that impacted farm output and prices. It rose from 6.6% in FY23 to 7.5% in FY24, as per the Survey. RBI has projected annual inflation to go down to 4.5% in FY25 and 4.1% in FY26, assuming normal rainfall and the absence of external shocks.

Capital expenditures

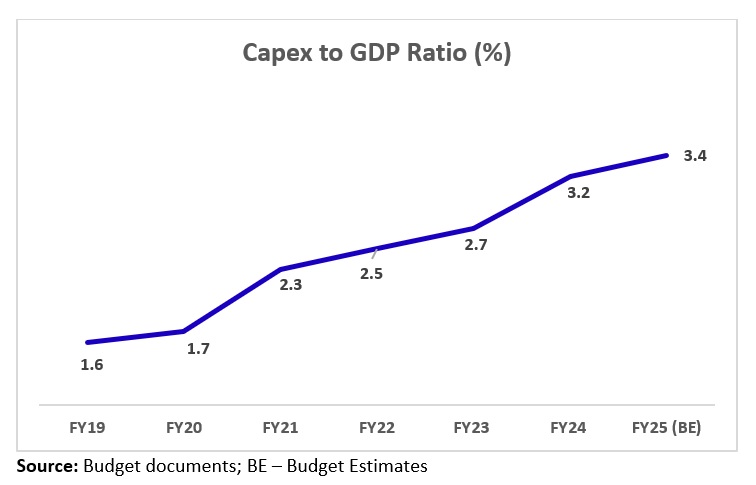

The Centre retained the capital outlay of INR 11.11 lakh crore for FY25, which is the same as the Interim Budget presented in February this year. This reflected a 2x rise in spending on infrastructure over the past three years to generate demand and create more jobs across the economy via deployment in core sectors like cement, steel, fertilizers, etc. As a percentage of GDP, long-term capex rose from 1.7% in FY20 to 3.4% in FY25.

Despite the no change in capex, the mix of capex allocation has changed to some extent compared to the Interim Budget. For example, interest-free 50-year capex loans to states witnessed an increase (to INR 1.5 lakh crore from INR 1.3 lakh crore in Interim Budget) while allocations to agriculture, housing, urban development (smart cities & metro projects), education, and National Health Mission in terms of schemes stepped up.

Fiscal consolidation continues

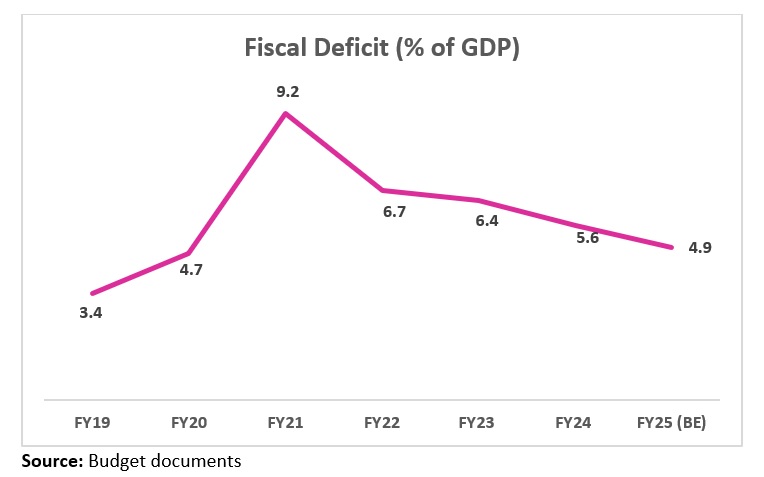

The Centre has cut its fiscal deficit target to 4.9% of GDP in FY25 from 5.1% of GDP in the Interim Budget. Consequently, it has reduced the borrowing estimates to meet its fiscal deficit target by issuing dated securities. The estimate for gross borrowing has been reduced to INR 14.01 lakh crore from INR 14.13 lakh crore in the Interim Budget while the net borrowing estimate stands at INR 11.63 lakh crore for the year. Both gross and net borrowings are lower than FY24 by 9.2% and 1.5%, respectively.

Post the Budget announcement about a reduction in market borrowing, the bond market reacted as yields went down and touched an intra-day low of 6.926% but soon recovered and ended the day flat at 6.969% as the reduction in borrowing was lower than expected.

The reduction in borrowing estimates for FY25 is supported by higher revenue receipts mainly due to additional RBI & PSU dividends. (The Budget set a revenue receipts target of INR 31.3 lakh crore for FY25, an increase of 14.7% from FY24.) The RBI dividend was higher than expected and provided a fiscal space of 0.4% of GDP compared to the Interim Budget. The additional fiscal space has been utilized to hike expenditure by 0.2% of GDP and the rest to reduce fiscal deficit by 0.2% of GDP compared to the Interim Budget. Gross tax-to-GDP ratio is anticipated to rise to 11.8% in FY25 from 11.6% in FY24.

The Centre voiced its commitment to maintain the fiscal deficit each year at a level that would put government borrowing on a declining path as a percentage of GDP. Next year, it aims to lower the fiscal deficit target below 4.5% of GDP.

Disclaimer:

The views provided in this blog are the personal views of the author and do not necessarily reflect the views of Vivriti. This article is intended for general information only and does not constitute any legal or other advice or suggestion. This article does not constitute an offer or an invitation to make an offer for any investment.