“The economy is not sending any signals that we need to be in a hurry to lower rates.”— Jerome Powell, Federal Reserve Chair

Executive Summary

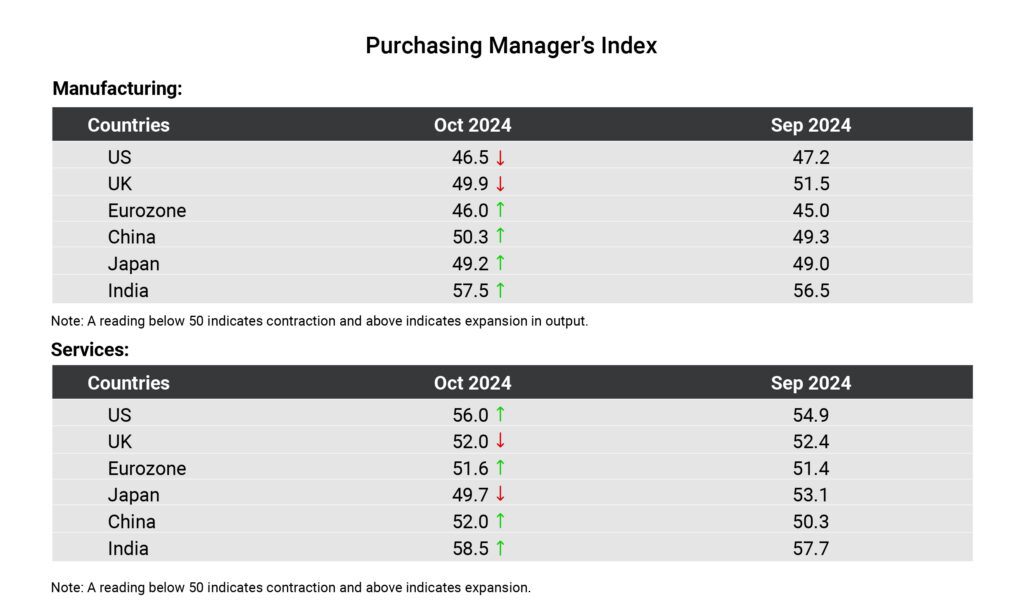

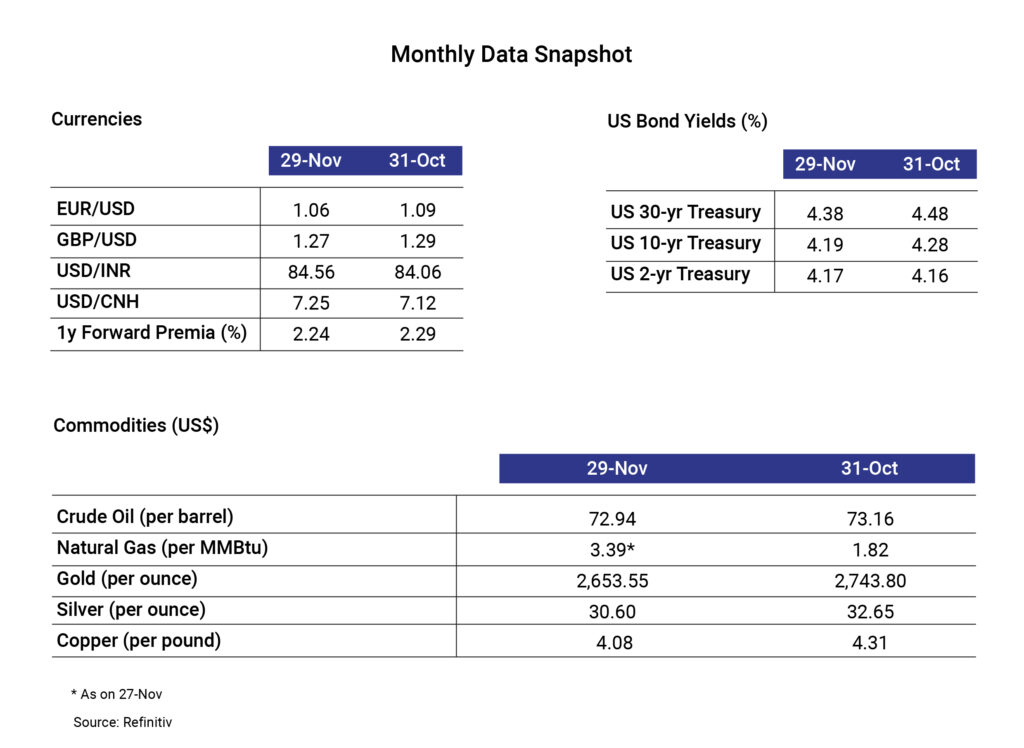

November saw Trump regain the US presidency in a Republican sweep while the Fed continued the rate-cut trajectory reducing interest rates by another 25 basis points (bps) after the 50-bps trim in September. Markets were relatively well braced this time for a Trump victory with US10-year treasury selling off by almost 70 bps ahead of the elections. Increased tariffs, and corporate tax cuts amongst other Trump’s election promises, if implemented, would certainly prove to be inflationary making it hard for the US Fed to keep cutting rates. Markets reduced rate cut expectations by about 100 bps and priced in the significant term premium. Currency markets saw sharp movements as well, with the dollar index rising almost 2% on election results. While US yields and the dollar index cooled off from intra-month highs, uncertainty for markets remains given Trump’s unpredictability and volatile temperament, as seen during his last presidential tenure. We have already started seeing tweets and rhetoric throughout the month and markets now await Trump’s inauguration and specific policies that he will implement and their likely spillovers to the rest of the world. Till then, speculation and volatility will remain the norm in the market. Elsewhere, the Bank of England reduced rates by 25 bps and ECB is expected to reduce by another 25 bps later this month.

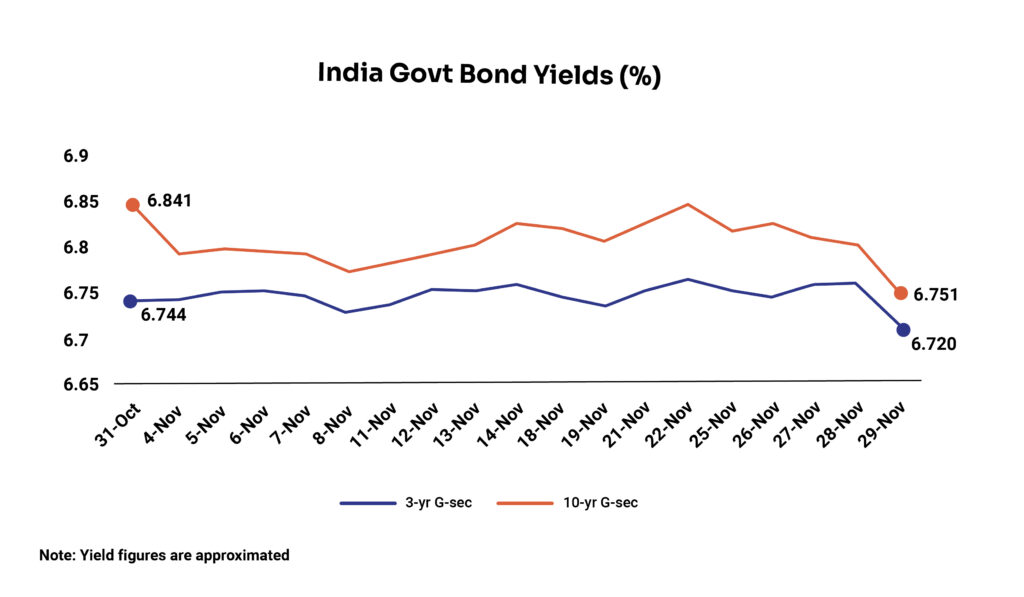

On the domestic front, a couple of weak data prints puts RBI in a delicate situation. Inflation came in higher than expected at 6.2%, with the core inflation at sub-4%. On the growth front, headline GDP sharply fell to a two-year low of 5.4% versus expectations of a north of 6%. Elevated inflation, weaker growth, and a fragile global backdrop make the next policy decision tougher for RBI. Given the focus on inflation from the RBI governor that we have seen over the last couple of months, it seems that the central bank will stick to a status quo on rates. Liquidity conditions have tightened as well of late, largely on the back of aggressive foreign exchange (FX) intervention, and on that front, we might see some support from RBI’s MPC meeting. On the FX front, the Indian currency (INR) has performed significantly better than its peers, largely on the back of central bank intervention. FX reserves are down ~$48bn from the peak, a majority of which was utilized for smoothening INR depreciation. While domestic fundamentals still remain strong, INR will not remain aloof from the EM complex and any sharp deterioration there on the back of US policies will have a follow-on impact on INR, though may not by the same magnitude. Despite the drawdown, the currency chest still remains strong, and central bank will continue to smoothen any sharp depreciation pressures on it.

Domestic Updates

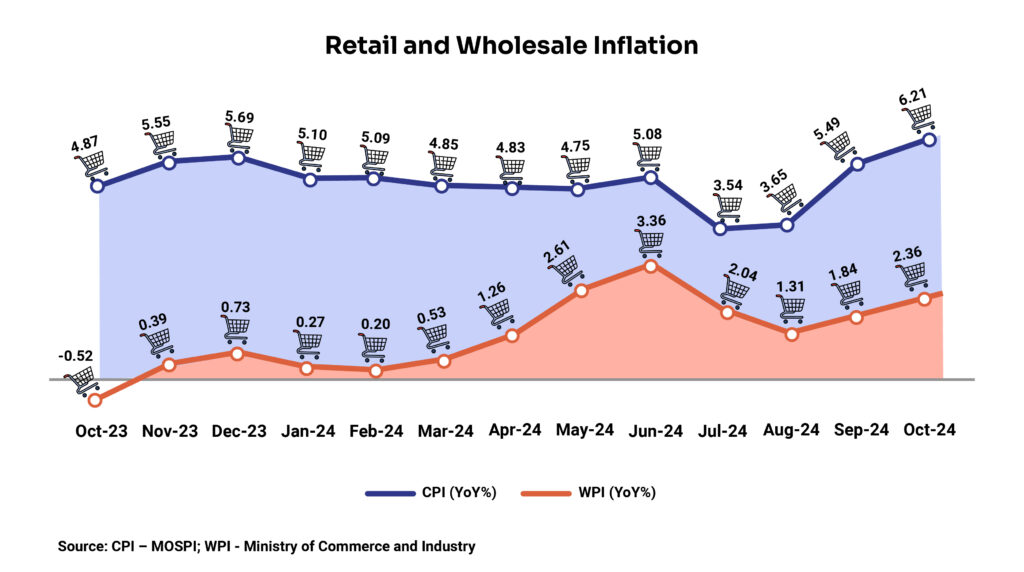

India’s retail inflation breaches the RBI`s tolerance band, wholesale inflation rises to a 4-month high

The retail inflation in India, which measures a change in the Consumer Price Index (CPI), rose to a 14-month high of 6.21% YoY in October 2024 from 5.49% YoY in September and 4.87% YoY in October 2023. The rise in retail inflation is attributable to food inflation which grew at a double-digit rate of 10.87% in October compared to 9.27% in September. Vegetable inflation (42.2% YoY in Oct vs. 36% YoY in Sep) and Oils and fats inflation (9.51% YoY in Oct vs. 2.47% YoY in Sep) have contributed majorly towards the spike in food inflation in October.

As the rise in retail inflation remains a concern, RBI Governor Shaktikanta Das stated that the shift in neutral monetary policy stance does not signal a potential rate cut. He further added that there are ‘significant upside risks to inflation’ and that a rate cut would only be considered if inflation is sustainably closer to the RBI’s medium-term target of 4%.

Meanwhile, the Finance Ministry’s Monthly Economic Review highlighted that, despite existing pressures on select food items, food inflation is expected to ease with the agriculture sector likely to benefit from strong kharif harvest, increase in minimum support prices, adequate inputs, and favourable monsoons in the coming months. However, India`s economic outlook could still be impacted by geopolitical factors.

Inflation based on the wholesale price index (WPI) jumped to a 4-month high of 2.36% YoY in October from 1.84% YoY in September due to an increase in two out of three major segments of WPI – Primary Articles, Fuel and Power, and Manufactured Products. Inflation for primary articles increased to 8.09% in October from 6.59% in September driven by an increase in food prices while the inflation for the manufacturing segment slightly moved up to 1.5% in October from 1% in September.

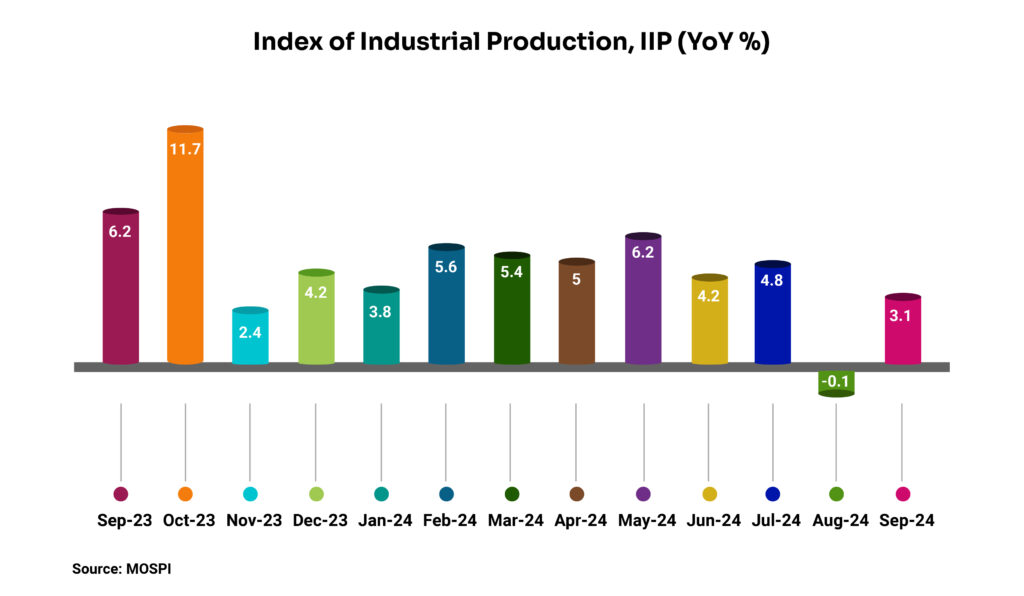

India’s industrial output shows renewed momentum

India’s industrial output, as measured by the Index of Industrial Production (IIP), returns to its upward trajectory at 3.1% in September after declining by 0.1% in August. The manufacturing sector (the largest in the IIP basket) is the main growth driver with an increase of 3.9% YoY. Electricity generation grew 0.5% YoY, while mining output increased 0.2% YoY.

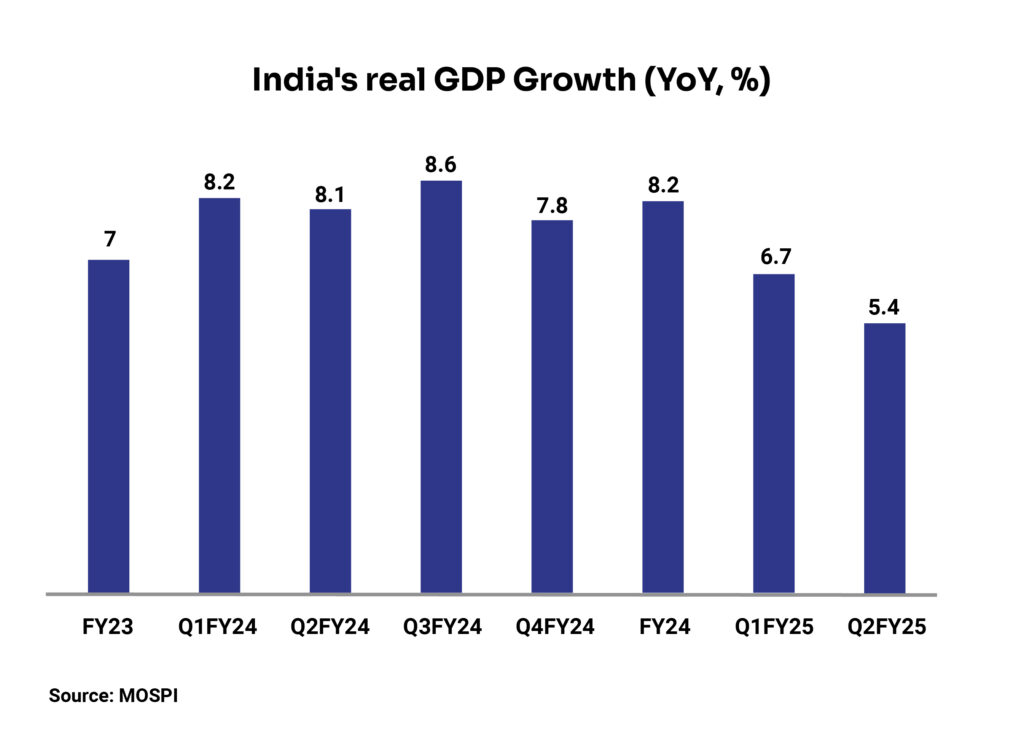

India’s real GDP growth slips to 7-quarter low

India’s economic growth slowed to a two-year low at 5.4% YoY in Q2FY25 against 8.1% YoY in Q2FY24. Despite the fall, India remains the fastest-growing economy (China’s GDP growth in the July-September quarter was recorded at 4.6%). Gross Value Added (GVA) also moderated to 5.6% in Q2 from 6.8% in Q1.

Inflation played a significant role in the slowdown of India`s real GDP growth. The surge in retail food inflation reduced the capacity of consumer spending. The deceleration is also attributed to the slowdown in all sectors except agriculture which stood at a 5-quarter high of 3.5%. Consumption and investment demand slowed down in the second quarter of FY25. However, consumption is expected to have picked up with the festive rural spending and upcoming wedding season in the third quarter of the fiscal year.

Gross FDI inflows grew 43% YoY in Q2FY25

Gross Foreign direct investment (FDI) in India surged 43% YoY to US$13.6 billion in July-September 2024 from US$9.52 billion in July-September 2023. Total FDI including equity inflows, reinvested earnings and other capital grew 28% YoY to US$42.1 billion in H1FY25. However, net FDI moderated to US$3.6 billion in H1FY25 from US$3.9 billion in H1FY24. In the July-September quarter, about 50% of inwards investments came from Singapore.

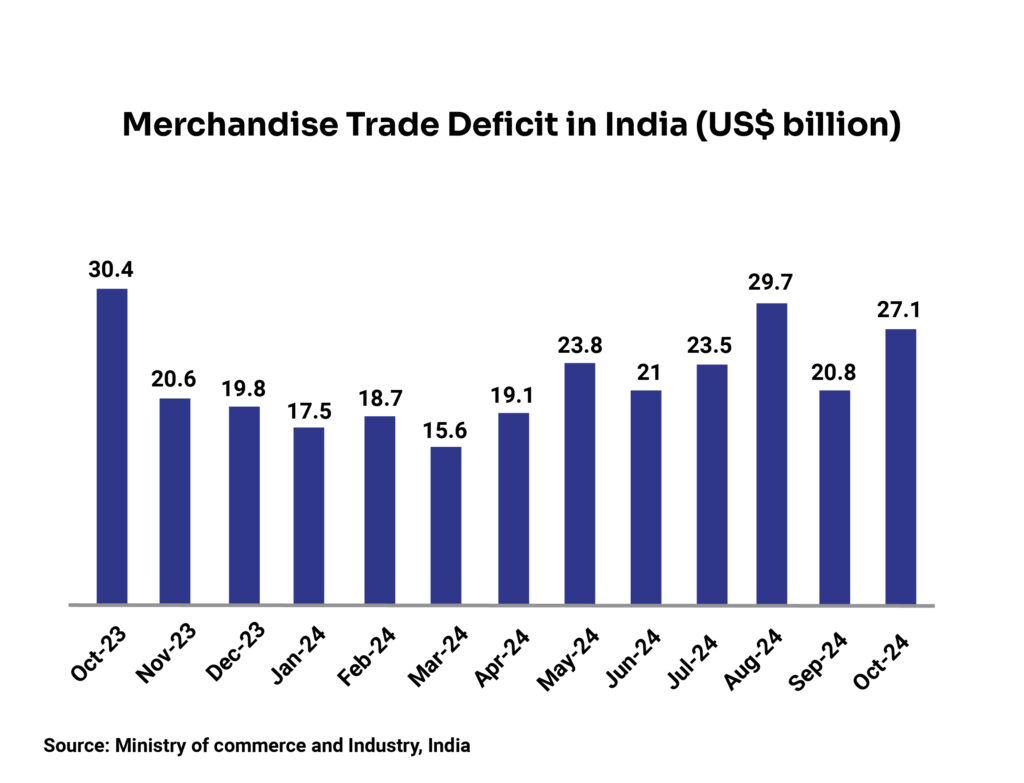

India’s trade deficit narrows

India’s merchandise trade deficit rose to a 2-month high of US$27.1 billion in October but narrowed on a year-over-year basis from US$30.4 billion in October 2023. This happened as the merchandise trade exports grew 17.3% YoY to US$39.2 billion while Imports rose ~4% YoY to $66.34 billion, which is an all-time high.

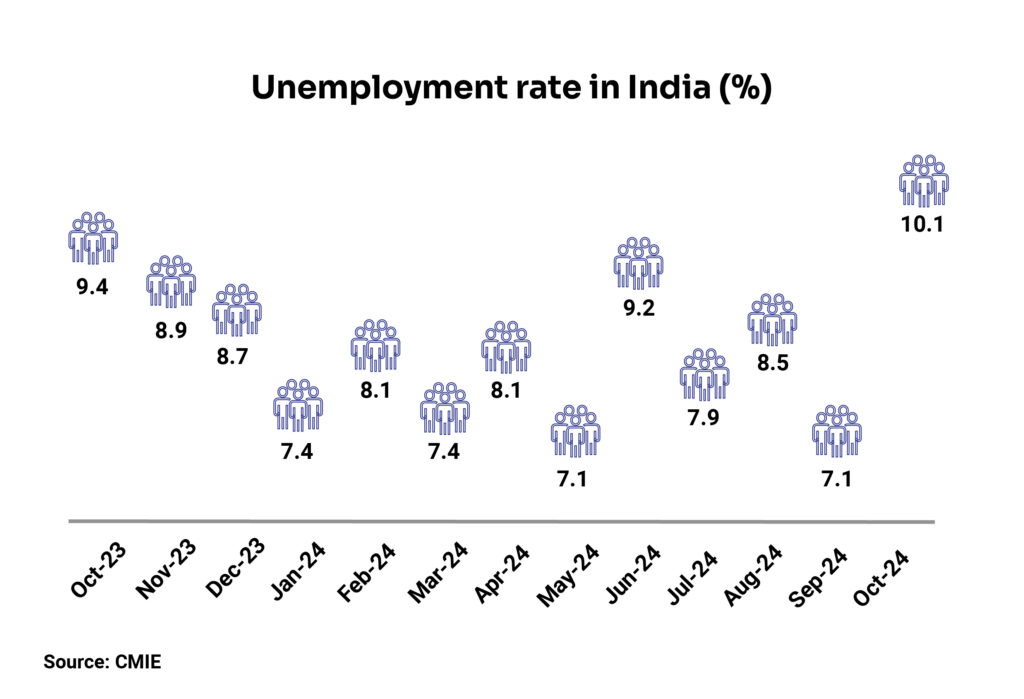

Unemployment rate surpasses 10% for first time in over 2 years

The unemployment rate surged to 10.1% in October from 7.1% in September, according to the survey by the Centre for Monitoring Indian Economy (CMIE). It’s the first time in 29 months the rate has surpassed 10%. As per CMIE, the rate generally remains high in October but it’s significantly high this year, which is attributable to a spike in rural unemployment from 6.2% in September to 10.8% in October. Urban employment went down to 8.4% in the month.

India’s forex reserves dip to 2-month low

India’s foreign exchange reserves dropped by US$2.7 billion to a 2-month low of US$682.13 billion on November 1. It was the fifth consecutive week of decline taking the previous four weeks’ decline to US$20.1 billion. The decline is attributed to RBI’s support to rupee amid foreign capital outflows amid geopolitical tensions and rise in demand for Chinese assets after Beijing’s stimulus measures.

New credit guarantee scheme for MSMEs

The Centre launched a new credit guarantee scheme for MSMEs, offering collateral-free loans of up to Rs 100 crore. Under the scheme, banks would use their own credit assessments instead of seeking third-party guarantees. The move is led by long-standing challenges to secure finances by MSMEs, mainly for term loans to purchase plant and machinery. The Centre also announced plans to open branches of the Small Industries Development Bank of India (SIDBI) in every MSME cluster across India in 2-3 years, with ~25 branches coming up this financial year.

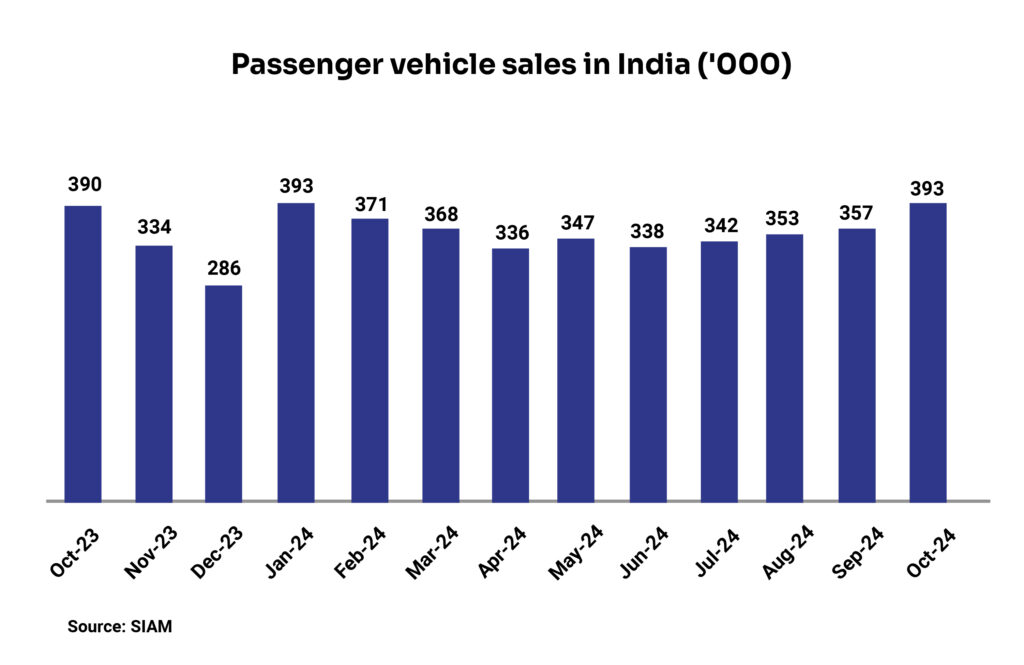

Passenger Vehicle sales surge to highest-ever October print

Total passenger vehicle (PV) sales in India rose 0.9% YoY to its highest-ever October sales of 393,238 units, as per data from the Society of Indian Automobile Manufacturers (SIAM). This growth is fuelled by strong consumer demand during the festive season.

According to data from the Federation of Automobile Dealers Association (FADA), which shows actual retail sales from showrooms versus the SIAM, which puts out dispatches to dealers from auto factories, passenger vehicle sales grew by 32.4% YoY in October to 483,159 units. The growth is mainly driven by the rural market, especially in 2-wheeler and PV segments, supported by higher Minimum Support Price (MSP) for rabi crops. Two-wheelers saw an impressive growth of 36.3% YoY while 3-wheelers witnessed a comparatively modest growth of 11.5% YoY in October. In the 2-wheeler segment, good crop yields, favourable rural sentiments, and the upcoming wedding season are expected to drive demand, as per FADA.

Global Update Roundups

Monetary policies

- US: The Federal Reserve cut the benchmark overnight borrowing rate by 25 basis points (bps) to a target range of 4.50%-4.75%, as widely expected by the market, in a unanimous vote. This followed the Fed’s more aggressive 50 bps cut announced this September for the first time since 2020. The overnight rate affects consumer debt instruments such as mortgages, credit cards, and auto loans. The rate cuts are a result of inflation drifting back to the central bank’s 2% target and labour market showing indications of softening. It’s a “recalibrating” policy back to a state where it no longer needs to be restrictive as Fed Chair Jerome Powell has earlier mentioned.

- UK: The Bank of England (BoE) cut its benchmark interest rates for the second time since 2020, lowering them by 25 bps to 4.75%. However, the central bank indicated that the future reductions would be gradual (investors believe it could be slower than the European Central Bank) due to the new government’s first budget which is likely to have an upside impact on inflation causing it to take more time than expected to reach the central bank target of 2%.

- Japan: The Bank of Japan (BoJ) retained the short-term interest rates steady at 0.25% as widely expected. However, the central bank indicated that interest rates may rise given the subsiding risks in the US economy. It projected inflation to hover around its 2% target in coming years.

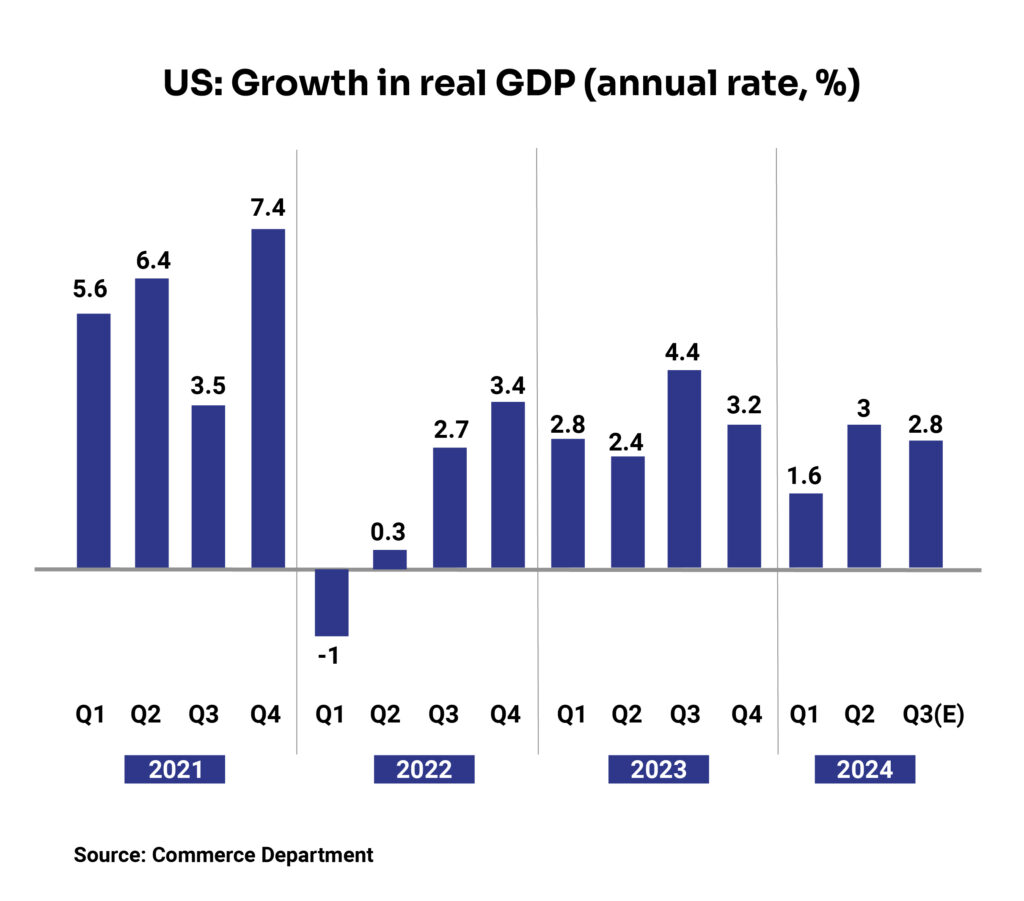

GDP growth

- US: The US GDP grew at an annualized pace of 2.8% in the third quarter of the calendar year, the second estimate of the Bureau of Economic Analysis revealed. The final estimate is due on December 19. The growth is said to be driven by strong growth in consumer spending (3.5%), which accounts for ~70% of US economic activity, and a 7.5% surge in exports, which is the most in 2 years.

- UK: The UK GDP grew 0.1% QoQ as per the preliminary estimate. It is the smallest growth rate in three quarters, indicating a slowdown in the economy. The service sector growth came in at only 0.1%, while the production sector declined by 0.2% due to a 2.7% decline in electricity, gas, steam, and air conditioning supply. The UK economy expanded 1% YoY in Q32024, as per preliminary estimates, above 0.7% in Q22024.

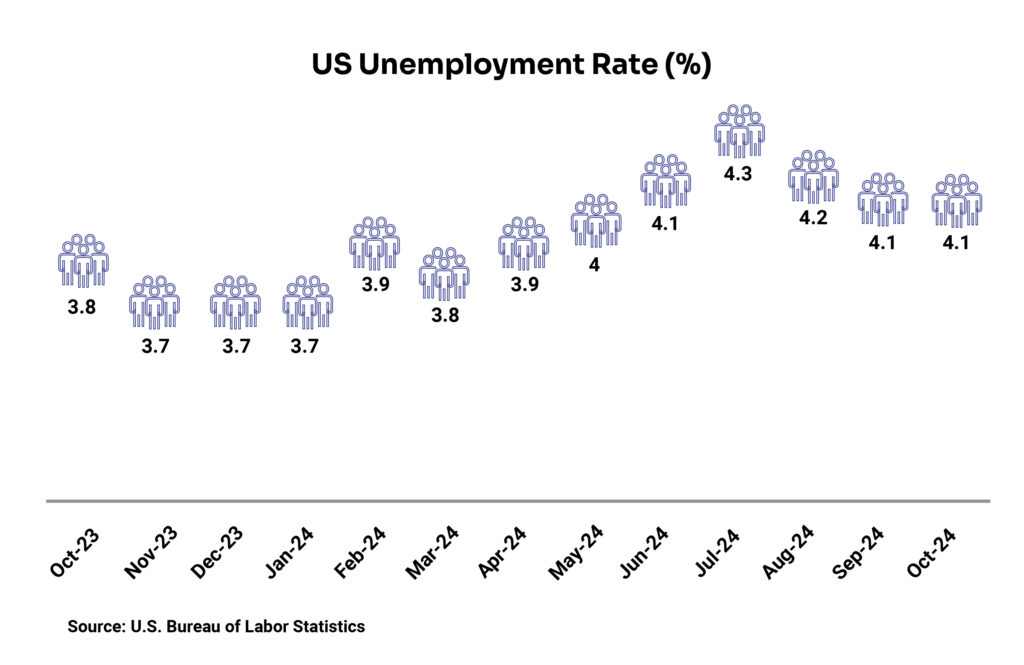

Unemployment

- US: The unemployment rate remained unchanged at the 3-month low of 4.1% in October compared to the previous month after declining from the 12-month peak of 4.3% in July 2024. The number of unemployed individuals was unchanged at 7 million while permanent job losers rose slightly to 1.8 million.

- Canada: The unemployment rate in Canada remained unchanged at 6.5% in October compared to the prior month and hovered around the 12-month high of 6.6% recorded in August 2024. The unemployed population increased by 900 people to 1,429,000 while joblessness dipped steeply for the youth (-20,800 to 403,400). The labour force participation rate eased by 0.1 percentage points MoM to 64.8%.

- China: Unemployment in China declined to a 4-month low of 5% in October (below market estimates of 5.1%) from 5.1% in September. The jobless rate for locally registered residents declined by 0.1 percentage point to 5.1% in the month while the same for non-local registrants and non-local agricultural registrants was 4.8% and 4.7%, respectively.

- Japan: The unemployment rate rose 0.1 percentage point to 2.5% in October, worsening for the first time in 3 months as more people chose to stay in employment after reaching their retirement age. It is up from September’s 8-month low of 2.4%, meeting market expectations. The number of people who voluntarily left their jobs fell 5.4% to 700,000 while people who reached retirement age increased by 5.4% to 390,000.

Inflation readings

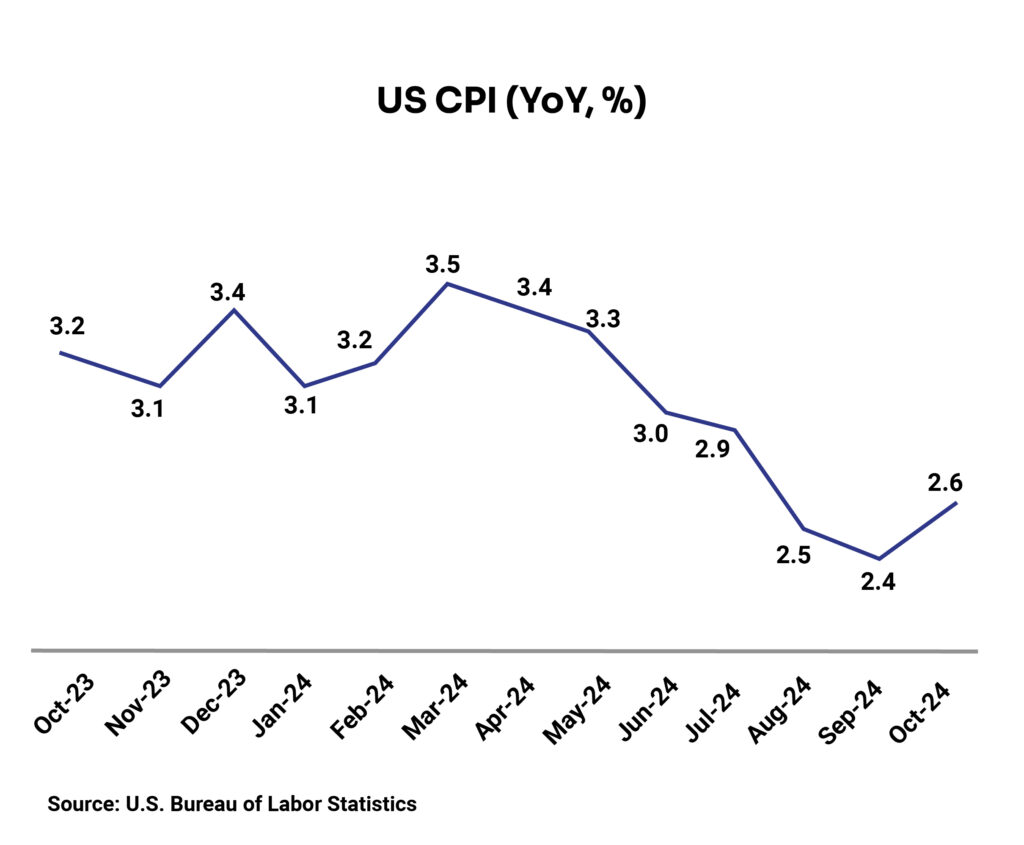

- US: The inflation rate rose to 2.6% YoY in October 2024 from 2.4% in September due to a rise in shelter and food prices (4.9% and 2.1%, respectively) partially offset by a fall in energy prices (4.9%). The inflation was in line with market expectations. The core inflation was 3.3% YoY, which is the same compared to September. Meanwhile, the U.S. core PCE price index, the Federal Reserve’s key inflation metrics, rose by 2.8% YoY in October 2024, which is the highest in 6 months and in line with market estimates.

- Eurozone: The inflation rate accelerated to 2% YoY in October from 1.7% in September. The biggest contributor to the inflation rate came from services (+1.77 percentage points), followed by food, alcohol & tobacco (+0.56 pp), and non-energy industrial goods (+0.13 pp).

- UK: The inflation rate in the UK sharply accelerated beyond the central bank’s target (2%) to 2.3% in October from 1.7% in September and surpassed the consensus estimates of 2.2%. The uptick is attributed to an increase in the regulator-set energy price cap that took effect in October leading to high energy bills and price hikes in the dominant service sector.

- China: The annual inflation rate declined to a 4-month low of 0.3% after peaking at 0.7% in February this year over the last 12 months. This happened as non-food prices continued to decline (-0.3% vs -0.2% in September), largely driven by further declines in the cost of transport (-4.8% vs -4.1%) and housing (-0.1% vs -0.1%).

- Japan: The inflation rate dipped to 2.3% in October 2024 from 2.5% in the previous month, hitting its lowest level since January. The deceleration is attributed to prices of electricity (up 4.0% vs 15.2% in September), gas (3.5% vs 7.7%), furniture and household utensils (4.4% vs. 4.8%), culture (4.3% vs. 4.8%), and communication (-3.5% vs -2.6%) and education (-1.0% vs. -1.0%).

Consumer confidence

- US: The consumer confidence index continued to improve and reached 111.7 in November compared with 109.6 in October. The monthly rise is driven by optimism about the labour market, particularly with respect to future job availability, which reached its highest level in nearly 3 years. However, consumers’ expectations about future business conditions were unchanged and they were slightly less optimistic about future income.

- Japan: The consumer confidence index rose to 36.4 in November from October’s 5-month low of 36.2 and in line with market forecasts. This happened as household sentiment improved for income growth (40.2 vs 39.4 in September), willingness to buy durable goods (29.9 vs 29.7), and overall livelihood (34.3 vs 34.2).

- UK: The GfK consumer confidence in the UK rose 3 points to -18 in November 2024, marking its first improvement in 3 months. The improvement is driven by lower interest rates, rising wages, and reduced concerns about tax hikes. The new government budget which unveiled a significant rise in spending, taxes, and borrowing also impacted the reading.

- Euro: The consumer confidence in the Euro Area dipped 1.2 points to -13.7 in November. It came in below the long-term average and surpassed market expectations of -12.4.

Balance of Trade

- US: The US trade deficit widened from US$70.8 billion in August (revised) to US$84.4 billion in September, surpassing the consensus estimates of US$84.1 billion. This happened as exports of goods and services fell US$3.2 billion, or 1.2%, and imports of goods and services increased US$10.3 billion, or 3%. The goods deficit increased from US$14.2 billion to US$109 billion while the services surplus rose US$600 million to US$24.6 billion.

- China: China continued to report a trade surplus, which surged to US$95.3 billion in October 2024 from US$56.1 billion in the same period a year earlier. It’s the largest trade surplus reported since June this year. Exports jumped ~13% YoY as manufacturers began front-loading orders in anticipation of further tariffs from the US and the EU. Imports slipped 2.3% YoY due to weak domestic demand.

- UK: The UK’s trade deficit widened to £3.46 billion in September from an upwardly revised £2.02 billion in August due to higher declines in exports than imports. Exports fell 5.8% MoM to a 28-month low of £68.20 billion while imports declined 3.7% MoM to a six-month low of £71.67 billion.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.